I’m with Schwab and the margin on 1 put is 1.4x of share price. Depends on who you are with?Just want to note that 1:10 assumption is not true. Just checked, my broker removes $48k margin for 1 $1150 put.

So, if I sell 100-wide bps, I can sell ~5 instead of 1 put. Further, b/c of higher risk/exposure we go more OTM and collect less commission per contract.

If we remove most of volatility, I’d say $3/contract was around average for the relatively safe $100 spread; weekly puts that are just a bit OTM were around $10/week.

So, I’d say bps gives you 50% more income with much less chance of needing to roll and missing some of the income(in case of straight out).

Now with all the volatility we’re seeing higher numbers for commissions, but I’d think it’s about the same math.

Of course you can take a lot more risk on with spreads and make a whole lot more money or you can lose it all too.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Finished closing out everything for this week on the pop this morning. Waiting for a dip to set up next week's BPS. In the last few weeks, every time i've done this the stock has then dropped 30 points and i had to spend the next 2 days looking at -200% on my spreads. Trying to be a bit more patient on my re-entry this time. Will see how that works out. (I'm sure it means the stock just goes straight up from here the next few days)

I don't know about put spreads for 12/3. My 1000-1050 keep going down in value today, regardless of the stock price gyrations. They're close to closing on an 80% gain order (I only opened them yesterday). Maybe 12/10 ones are doing better?

Closed out my BPS for this week. The 1050s closed at 85% (of $22 - pretty awesome). The 1120s closed at 2/3rds of my collected premium (net profit over the last 2 weeks, with last week being a loss rolled to this week). Sitting out new BPS for the moment - the question before me is whether the $1150 share price is a low price for the next week and a half....

Trying something out with the long calls for lcc - bought some Jan '22 900s. Just under 2 months to expiration with very little time value to pay for. The idea for me is to test out shorter dated calls with medium dated and long dated (2 months, 6 months, 24 months). Guess of the moment - those Jan '22s will roll out to April '22s (first month of the quarter) so they're lined up close to earnings.

These also give me more leverage than I'd get with June '22s or something further out.

Then I goofed and bought them in the wrong account, but they're affordable - so buy more in the right account (and keep the oopsies).

Trying something out with the long calls for lcc - bought some Jan '22 900s. Just under 2 months to expiration with very little time value to pay for. The idea for me is to test out shorter dated calls with medium dated and long dated (2 months, 6 months, 24 months). Guess of the moment - those Jan '22s will roll out to April '22s (first month of the quarter) so they're lined up close to earnings.

These also give me more leverage than I'd get with June '22s or something further out.

Then I goofed and bought them in the wrong account, but they're affordable - so buy more in the right account (and keep the oopsies).

juanmedina

Active Member

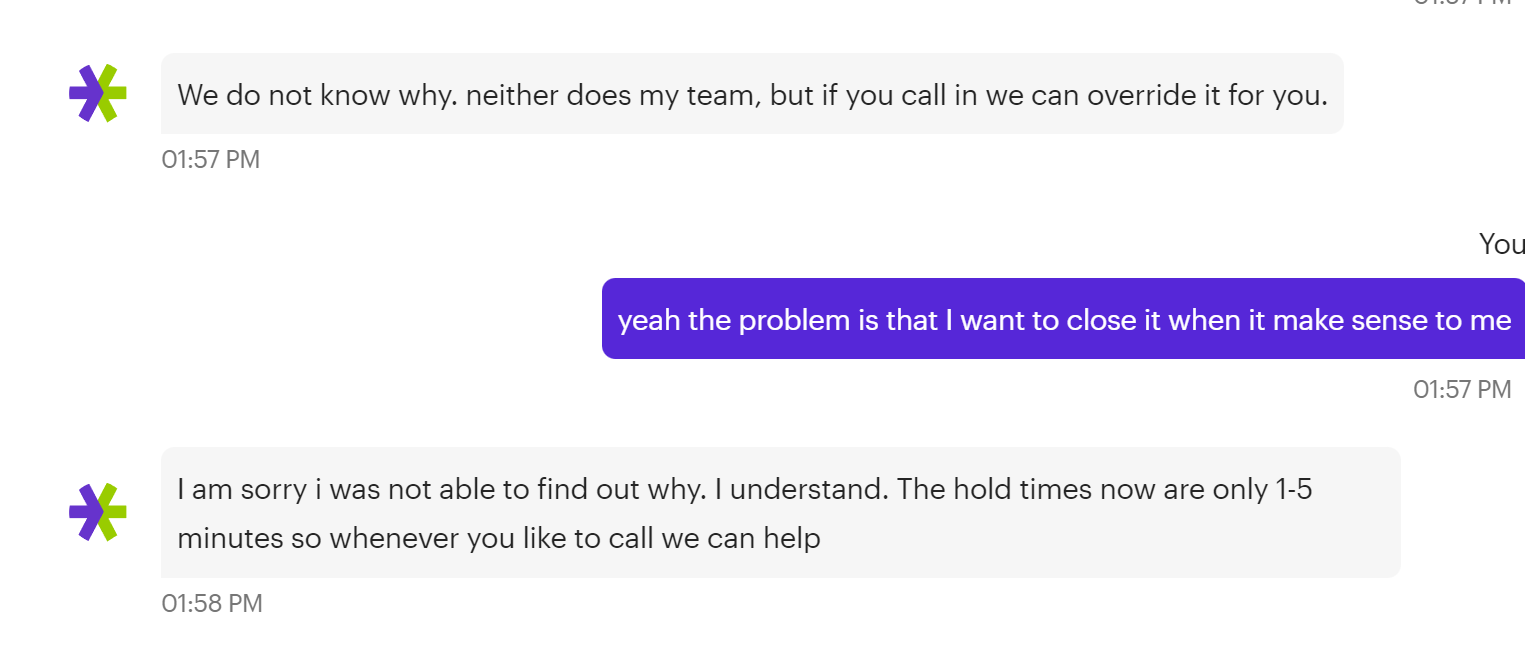

So I have an issue with E-trade with two covered calls that I wanted to close and for some reason their system say that I don't have no enough funds to close the trade but I do. I contacted them and this is what they say:

That's kind of scary.

That's kind of scary.

With the modest share price drop I went looking at new BPS. I considered 1100s for this week at $11 and 1050s for next week at $22 (both $300 wide spreads).Closed out my BPS for this week. The 1050s closed at 85% (of $22 - pretty awesome). The 1120s closed at 2/3rds of my collected premium (net profit over the last 2 weeks, with last week being a loss rolled to this week). Sitting out new BPS for the moment - the question before me is whether the $1150 share price is a low price for the next week and a half....

Trying something out with the long calls for lcc - bought some Jan '22 900s. Just under 2 months to expiration with very little time value to pay for. The idea for me is to test out shorter dated calls with medium dated and long dated (2 months, 6 months, 24 months). Guess of the moment - those Jan '22s will roll out to April '22s (first month of the quarter) so they're lined up close to earnings.

These also give me more leverage than I'd get with June '22s or something further out.

Then I goofed and bought them in the wrong account, but they're affordable - so buy more in the right account (and keep the oopsies).

I decided on next week and entered orders for $22. They took a little while to fill, but have done so when shares were down roughly $15.

Back in for next week with 1050s - now looking for a cc entry.

Knightshade

Well-Known Member

So I have an issue with E-trade with two covered calls that I wanted to close and for some reason their system say that I don't have no enough funds to close the trade but I do. I contacted them and this is what they say:

View attachment 739456

That's kind of scary.

FWIW I had a similar issue with ML this week... went to close some CCs- when trying to close all at once the system told me I couldn't, would cause a maintenance margin call... which made no sense as the $ required to do so a couple 0s less than available margin.

Contacted online support- they told me issue was:

ML rep said:the short calls are paired off with the equal number of long calls which are leaps. When closing the short leg of the call, the system is expecting the short leg to be replaced by a call

contract of the same maturity of the long calls being leaps which may have a higher requirement. The system sees the account as being unable to fully cover the anticipated leg

I do apologize for the experience but I do understand this is something we're working to fix and avoid in future updates.

But to further summarize, it's because the long leg of the spread is a long exp/leap contract and how system views the short leg being closed individually within that spread

This made no damn sense to me... (nor was any of this opened as spreads in the first place- and I have enough outright shares in there to cover all the short calls too if they've got to pair them up seems those ought come first).

But I found if I split up the BTCs into smaller #s of contracts I'd get a different warning.... that the trade might cause a Reg T violation for buying power.... but it WOULD let me hit submit.

So I did. Not only did it work, my available margin jumped significantly. So I repeated the smaller BTC until they were all closed.

No idea what the issue was, but not the first time ML told me their system was doing something wrong and they couldn't do anything about it but hoped it'd get fixed in some future update.

Already moved my IRA out of there to Fidelity (where they'll let me do spreads when ML won't)- really wanna move my cash account too but it's a bit more complicated to do so for option and tax reasons.

Artful Dodger

"Neko no me"

So I don’t think Elon could have completed selling yet.

Come back again 48 hrs after Elon's tweet about 'pool friends'. Then we'll be able to draw inferences about the Forms 4.

This played out quite well.

100x 1120/1220 are now 50x 860/960 1200/1300 IC 12/03... total cost to roll 0.25 dr x 100 contracts.

Also entered some new BPS on this weakness ... 50x 860/910 11/26 and 100x 800/850 12/03... will pair up the 12/3 with some BCS on the next up cycle.

Have now closed the 50x 860/960 BPS at 95%. 50x 1200/1300 BCS is my last remaining position for this week and looking like it's going to expire worthless. Would be an elegant, if I do say so myself, end to the saga of what started as a batch of 100x 1100/1150 BCS that went against me a couple weeks ago.

Loving how the new IC is looking.

Ending the day with more premium decaying, consuming less margin, with some nice clipped gains. This has been a good day. I'm done for this week absent some of these legs going to 80% profit this week (unlikely).

- Closed the 50x 11/26 860/910 at 75%.

- Moved the 50x 12/3 800/850 BPS to 50x 12/3 800/900 instead (widened for a credit). Paired that with 50x 1350/1450 BCS to form the IC. Total credit at 5.56 on these.

- Also entered 50x 795/845 1400/1450 IC at 1.91 cr.

Will need to manage DITM 12/3 CCs next week. Either flip rolling those to BPS or naked puts or continuing the trek of rolling for minor strike improvements.

Closing below the 20MA is bearish. I was half expecting the rally to get us back over that line. We shall see what rest of this short week brings, but my guess would be we chop around between 1050 - 1150.

Have now closed all my ICs for the week at 85-95% gains on the various legs. Again last remaining position is 50x 1200/1300 BCS.

I have also initiated 150x 12/10 900/950 1350/1400 @ 3.95 average credit (the BCS leg is already at 50%, so that will likely be an early close). Will likely add more to either the same strikes (will revisit the pricing when that time comes) once I close my remaining BCS. I have no intention of holding these through next week's "event". So, will look to close them all on 12/8 and reposition on 12/10 for the week after.

I also rolled the 12/3 DITM CCs for more strike improvement. One batch is now 12/17 another is 12/23. Have not yet ripped off the bandaid of flip rolling those, but that time will come in December. Both to crystalize any remaining loss for tax purposes, but also to digest whatever information comes out over next couple weeks (China November numbers, the event, end of Elon selling).

BrownOuttaSpec

Active Member

Got some 12/10 800/900 @ $4.01. I was waiting for this dip to reload for next week. I had thought that Elon would be selling today but it looks like we are just following macros, either way it worked out for my plan to get in today for next week.

Well, i'm good at predicting where I will not do well at least. I opened 850-950 BPS for 12/10 during the dip today, starting at 1140ish and opening the rest at 1120. And of course we almost immediately dropped into the 110x range.  I'm down between 15-40% currently - should definitely have been more patient (as i said i should be above). Still, nice premiums for the week and as long as we have any sort of recovery should be in good shape for next week.

I'm down between 15-40% currently - should definitely have been more patient (as i said i should be above). Still, nice premiums for the week and as long as we have any sort of recovery should be in good shape for next week.

corduroy

Active Member

I finished building out my full BPS 850/750 position for next week. I have no sense of what TSLA will do in this market next week. I wouldn't be surprised to see either $900 or $1300 (or both!).

I hit my profit target, so I'm not taking on any more risk and happy this conservative position.

I hit my profit target, so I'm not taking on any more risk and happy this conservative position.

scubastevo80

Member

Sold a late in the day 12/10 BPS at 940/840 at $7 - will close if we get rebound tomorrow. Still sitting on my 12/10 BPS at 900/820. Loving the premiums on these.

me too, I am already -35% on the 10x 17/12 -p990 I sold when I got back from work. Didn’t expect a total market collapse at the end of the day.Sold BPS too early again. Sigh.

I was positioning myself for a run up for the 9/12 buying the rumour. Let’s see if it rebound tomorrow or if these are going to be my first Puts I will be rolling.

Did something I was not expecting to do - as the market moved down sharply towards the end of the day, I reverse rolled a bunch of my ~950 short puts (part of BPS) for next week, to ~1030 this week. It does sound counter intuitive even to me, but the risk seemed to be manageable. The idea being, with 2 days of trading left, there might be a bit of support from options with max pain hovering at ~1100. Max pain is bound to drop 20-30 points tomorrow.

The idea being, these premiums are good with 2 days to expiry and I can always roll them down and out. Or open new positions next week. Theoretically, if max pain provides some support towards end of the week, that should result in a bit of relative weakness Monday. Will see how this experiment goes.

The idea being, these premiums are good with 2 days to expiry and I can always roll them down and out. Or open new positions next week. Theoretically, if max pain provides some support towards end of the week, that should result in a bit of relative weakness Monday. Will see how this experiment goes.

Clipped the 1350/1400 BCS 12/10 leg at 50% for a single day trade.Have now closed the 50x 860/960 BPS at 95%. 50x 1200/1300 BCS is my last remaining position for this week and looking like it's going to expire worthless. Would be an elegant, if I do say so myself, end to the saga of what started as a batch of 100x 1100/1150 BCS that went against me a couple weeks ago.

Have now closed all my ICs for the week at 85-95% gains on the various legs. Again last remaining position is 50x 1200/1300 BCS.

I have also initiated 150x 12/10 900/950 1350/1400 @ 3.95 average credit (the BCS leg is already at 50%, so that will likely be an early close). Will likely add more to either the same strikes (will revisit the pricing when that time comes) once I close my remaining BCS. I have no intention of holding these through next week's "event". So, will look to close them all on 12/8 and reposition on 12/10 for the week after.

I also rolled the 12/3 DITM CCs for more strike improvement. One batch is now 12/17 another is 12/23. Have not yet ripped off the bandaid of flip rolling those, but that time will come in December. Both to crystalize any remaining loss for tax purposes, but also to digest whatever information comes out over next couple weeks (China November numbers, the event, end of Elon selling).

Still waiting on 1200/1300 12/3 BCS and now have 950/900 BPS, which with today's very weak close, maybe we do revisit the 900s to fill those gaps! Next week should be fun.

Bonjour, mes amis! (Hello, my friends!) I shut down my 12/3 IC's BPS... $1M in 2 weeks - do you like it, boys?

The BCS i am closing on Fri.

In other news... Today is my 1-year anniversary doing options! I lived to tell the tale! I survived one full year of wins and losses (some were really, really, really painful). Can you imagine my first BPS had a width of 5??? I think -p600/+p595

THANK YOU SO MUCH

THANK YOU SO MUCH

THANK YOU SO MUCH

... to this thread and to everyone for your postings, comments, not advices, corrections, support, messages, help, trades that i copied, etc. I truly appreciate every single thing. I read all postings. This thread is my fave nighttime reading after i finish playing online games. In the morning, it's the TSLA ticker (of course), then maxpain, then Papafox, then this thread again. Always in that order. Some postings i print. Some i am still reading again up to now and STILL don't get it (ie LEAPS and timing it). I finally understand theta now... still working on what in the world has a strike price's vega got to do with anything.

If i have to give an anniversary speech and not be a drama queen, here's the #1 lesson i learned the most from experience: DO. NOT. BE. GREEDY. But what does it mean exactly?

When opening a position, don't let the credit determine if it's a go. The first priority is to make sure the strategy/position will give a very high probability of success. Then, get the credit, whatever amount it is. Too low? Suck it up. Does it matter? It pays the bills and you're doing this the next 30 years anyway. Nobody wants a loss... to avoid it, don't chase better premiums coz they come with higher risks. Slow and steady cash building up week after week is the key to surviving one year. Ask me, i know!

THAT IS ADVICE! YES! FOR REAL! (sorry for yelling)

The BCS i am closing on Fri.

In other news... Today is my 1-year anniversary doing options! I lived to tell the tale! I survived one full year of wins and losses (some were really, really, really painful). Can you imagine my first BPS had a width of 5??? I think -p600/+p595

THANK YOU SO MUCH

THANK YOU SO MUCH

THANK YOU SO MUCH

... to this thread and to everyone for your postings, comments, not advices, corrections, support, messages, help, trades that i copied, etc. I truly appreciate every single thing. I read all postings. This thread is my fave nighttime reading after i finish playing online games. In the morning, it's the TSLA ticker (of course), then maxpain, then Papafox, then this thread again. Always in that order. Some postings i print. Some i am still reading again up to now and STILL don't get it (ie LEAPS and timing it). I finally understand theta now... still working on what in the world has a strike price's vega got to do with anything.

If i have to give an anniversary speech and not be a drama queen, here's the #1 lesson i learned the most from experience: DO. NOT. BE. GREEDY. But what does it mean exactly?

When opening a position, don't let the credit determine if it's a go. The first priority is to make sure the strategy/position will give a very high probability of success. Then, get the credit, whatever amount it is. Too low? Suck it up. Does it matter? It pays the bills and you're doing this the next 30 years anyway. Nobody wants a loss... to avoid it, don't chase better premiums coz they come with higher risks. Slow and steady cash building up week after week is the key to surviving one year. Ask me, i know!

THAT IS ADVICE! YES! FOR REAL! (sorry for yelling)

50% profit in 2 weeks on the capital put at risk, that is darn good....I shut down my 12/3 IC's BPS... $1M in 2 weeks - do you like it, boys?

I just opened SP 860 and SP 910 (all 12/10) in the US morning time (HK is 13 hours earlier than US) after closing SP 850 with 80% gain

Although after opening the positions (short side), the best action maybe is to wait, I still cant stay up to watch the market - it is the tricky part of the time zone difference

I received premium of $11.53 but now the current prices are $22,6, sigh.

Although after opening the positions (short side), the best action maybe is to wait, I still cant stay up to watch the market - it is the tricky part of the time zone difference

I received premium of $11.53 but now the current prices are $22,6, sigh.

Bonjour, mes amis! (Hello, my friends!) I shut down my 12/3 IC's BPS... $1M in 2 weeks - do you like it, boys?

View attachment 739446

The BCS i am closing on Fri.

In other news... Today is my 1-year anniversary doing options! I lived to tell the tale! I survived one full year of wins and losses (some were really, really, really painful). Can you imagine my first BPS had a width of 5??? I think -p600/+p595

THANK YOU SO MUCH

THANK YOU SO MUCH

THANK YOU SO MUCH

... to this thread and to everyone for your postings, comments, not advices, corrections, support, messages, help, trades that i copied, etc. I truly appreciate every single thing. I read all postings. This thread is my fave nighttime reading after i finish playing online games. In the morning, it's the TSLA ticker (of course), then maxpain, then Papafox, then this thread again. Always in that order. Some postings i print. Some i am still reading again up to now and STILL don't get it (ie LEAPS and timing it). I finally understand theta now... still working on what in the world has a strike price's vega got to do with anything.

If i have to give an anniversary speech and not be a drama queen, here's the #1 lesson i learned the most from experience: DO. NOT. BE. GREEDY. But what does it mean exactly?

When opening a position, don't let the credit determine if it's a go. The first priority is to make sure the strategy/position will give a very high probability of success. Then, get the credit, whatever amount it is. Too low? Suck it up. Does it matter? It pays the bills and you're doing this the next 30 years anyway. Nobody wants a loss... to avoid it, don't chase better premiums coz they come with higher risks. Slow and steady cash building up week after week is the key to surviving one year. Ask me, i know!

THAT IS ADVICE! YES! FOR REAL! (sorry for yelling)

Congratulations! That is very inspiring!!

Would you mind sharing in % how much your account grew in this first year of trading spreads?

Also, it seems like you are not following @adiggs and @BornToFly methods of using super large spreads. I have found that when rolling I like being able to increase the spread when I get in trouble, and that is difficult to do when you start with a large spread. Is that why you use $50 spreads?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K