I got that feeling too, volume and SP supports it, but, on the other hand, macro in play as well. I just hope we're not heading towards that $944-910 gap fillToday feels an awful lot like Elon selling again

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

TheTalkingMule

Distributed Energy Enthusiast

i never wait for 0 DTE before making decisions, especially on borderline strikes

- quick downhill means instant ITM (chance of early assignment, expensive to roll, may not have time or buyers to close, etc)

- SP may not go up again the rest of the day

- no extrinsic safe buffer

- position may still be good late afternoon, but a 3:59 steep pushdown will be a disaster

if 1 DTE (thursday) and i am still uncomfortable or position is 50-50, roll or close is guaranteed

Not to mention I believe options contracts actually expire on Saturday, so any Friday after-hours shenanigans can lead to unexpected execution.

Thanks!i never wait for 0 DTE before making decisions, especially on borderline strikes

- quick downhill means instant ITM (chance of early assignment, expensive to roll, may not have time or buyers to close, etc)

- SP may not go up again the rest of the day

- no extrinsic safe buffer

- position may still be good late afternoon, but a 3:59 steep pushdown will be a disaster

if 1 DTE (thursday) and i am still uncomfortable or position is 50-50, roll or close is guaranteed

Rolled to 990 940 for next week with a 3.50 credit.

Position looked great yesterday morning…. And then I was out for the rest of the day….

anyone opening 12/23 puts?

I started repeating my strategy of the last five days by rolling 20% of my position of p1025’s from 12/17 to 12/23. I got 5 x $12.00. My aim is to roll 20% each trading day. It worked well enough last week to try it again. It’s feels nice to be able to make a trade every day (and receive between $5k and $12k premium every day*) instead of having to sit on my hands for most of the week.

* This is astonishing and still sometimes gives me the feeling I’m doing something illegal.

bkp_duke

Well-Known Member

the 12/23 and 12/31 -p1000 prems are so tempting... someone stop meeeeeeeeeeeeeeeeee

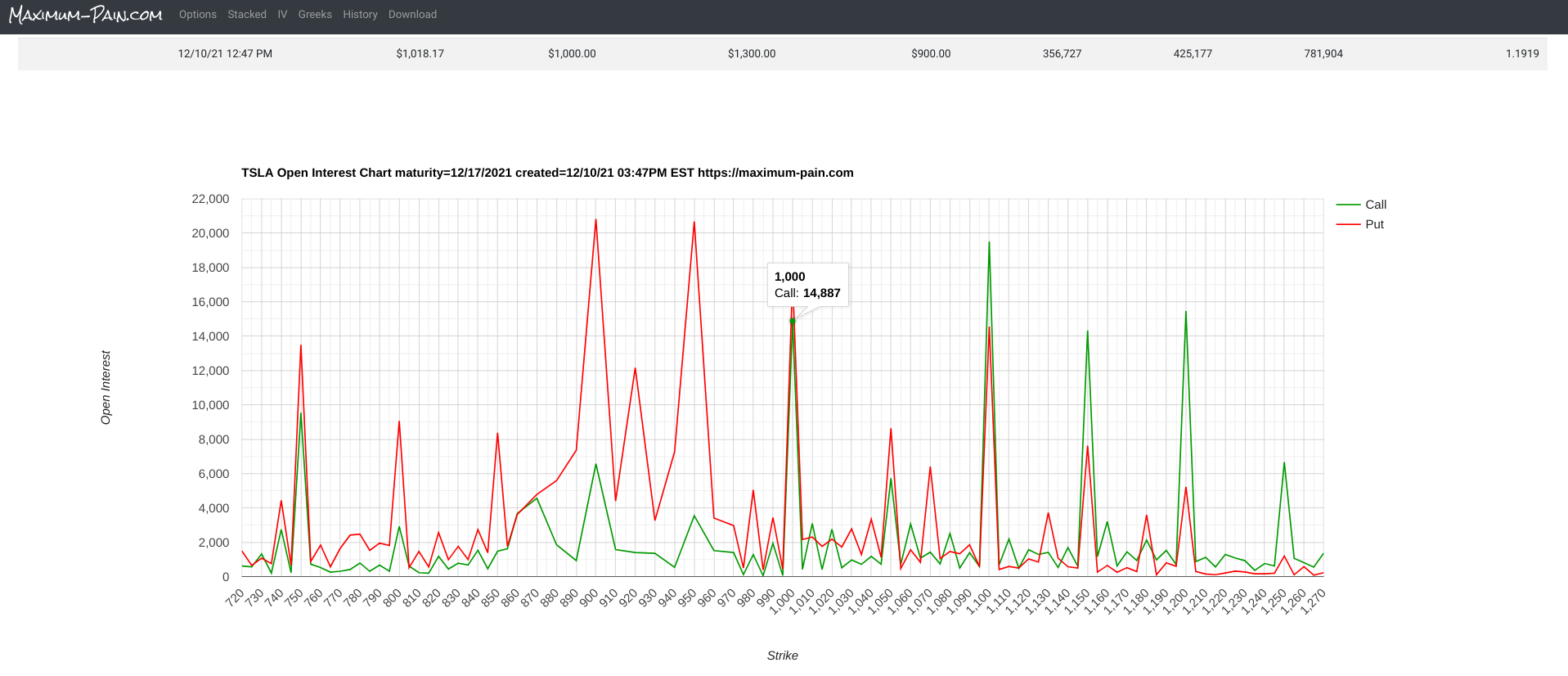

View attachment 742714

Won't be me. I'm eyeing them as well.

intelligator

Active Member

I started repeating my strategy of the last five days by rolling 20% of my position of p1025’s from 12/17 to 12/23. I got 5 x $12.00. My aim is to roll 20% each trading day. It worked well enough last week to try it again. It’s feels nice to be able to make a trade every day (and receive between $5k and $12k premium every day*) instead of having to sit on my hands for most of the week.

* This is astonishing and still sometimes gives me the feeling I’m doing something illegal.

Thinking the same, to roll 12/17 920/700 to 12/23 920/820 for 4.7 credit , seems worth the while to free up some margin as well.

It used to be the case that they expire on Saturday, but there was a rule change a few years ago, where they made it Friday evening expiry.Not to mention I believe options contracts actually expire on Saturday, so any Friday after-hours shenanigans can lead to unexpected execution.

chiller

Member

STO 880/970 Dec17 BPS for 5.41

BTC 880/970 Dec17 BPS for 1.84 less than three hours later.

BTC 880/970 Dec17 BPS for 1.84 less than three hours later.

Here is a 2 step process to figure if it makes sense to roll:Not advice from the experts - sitting on a 890/790 BPS that's down about 100%. We can roll it forward to 12/23 for a $5 credit. Is it worth doing this, or given we're still 10% from the sold put strike price, perhaps sit on it until next week? Said another way, do folks roll just to grab credit even if they feel their strikes aren't in danger of expiring ITM?

1. Setup a roll ticket on your app - Buy near option, sell farther option. Then look at the theta. If your theta is strongly positive, then its generally a no-brainer to roll.

2. If both contracts have roughly same theta, look at deltas. An OTM roll, especially if you are setting it up for the same strike adds more deltas. For instance by rolling your 890s to the week after, you get longer. So if your near term inclination is to not add more deltas to your position, stay put. If you do think rally is in the cards, better to roll early.

edit: some times I dont want to roll because theta is too high on the near dated short puts, and I am worried about stock shooting up. Then I just get some other deep itm calls or such, subject to available capacity in my account. Beware of this Texas hedge though. If your instinct is wrong, it cuts you twice. So this is done only in rare situations.

Last edited:

We have seen some good buying in the high 900s and even as we dipped below 1000 a few times in the past week, we didnt spend a whole lot of time there.

I am not ready to roll my 950s to 12/23 yet, but did roll up a third of my 950s to 985s next week.

Also if anyone is looking to roll to 12/23 and are feeling that the premiums are not enough, keep in mind that it is a 4 day week, and the premiums are probably commensurate with that.

I am not ready to roll my 950s to 12/23 yet, but did roll up a third of my 950s to 985s next week.

Also if anyone is looking to roll to 12/23 and are feeling that the premiums are not enough, keep in mind that it is a 4 day week, and the premiums are probably commensurate with that.

On one of the pops to 1020, added 1170/1220 BCS to all of my BPS for next week. 15% OTM, at upper-bb, behind the 1143 key resistance level (middle of prior wedge). It looked like a double top (turned out to be a quadruple top), so took my shot. A lot of resistance levels to regain, and I am thinking probabilities are that we see 910 before we see 1200 again. Though I don't think we'll be staying at those 900 levels for very long.Closed the BCS at 65%. Time to make some popcorn for after hours.

So, positions going in to next week:

- 150x 870/920 1170/1220 IC average @ 15.59 (BPS were a roll)

- 50x 850/900 1170/1220 IC average @ 14.3 (BPS were a roll)

- 50x 830/780 1170/1220 IC average @ 2.23

- 11x 1050 LCC expiring 12/17; hopefully close these at near full profit next week; I can then get back on track of selling weekly LCCs; this batch started in October and has been rolling for strike improvements since;

- 6x 805 CC expiring 12/17; these are in a non taxable account, so I'm not worried about tax implications of early assignment; but I plan to flip roll these either next week, or roll once more then flip roll;

- 6x 800 CC expiring 12/23; same as the 805s, will either flip roll or roll once more before flip rolling to a BPS, likely to 800/1200 06/2022 BPS;

Does ToS have this option?1. Setup a roll ticket on your app - Buy near option, sell farther option. Then look at the theta

LightngMcQueen

Aspirationally Rational

Also have the following to manage over the next couple weeks:

- 11x 1050 LCC expiring 12/17; hopefully close these at near full profit next week; I can then get back on track of selling weekly LCCs; this batch started in October and has been rolling for strike improvements since;

- 6x 805 CC expiring 12/17; these are in a non taxable account, so I'm not worried about tax implications of early assignment; but I plan to flip roll these either next week, or roll once more then flip roll;

- 6x 800 CC expiring 12/23; same as the 805s, will either flip roll or roll once more before flip rolling to a BPS, likely to 800/1200 06/2022 BPS;

Whats your opinion @st_lopes on the risk of frequent trading being classified as business income as opposed to capital gains for purpose of Canadian tax? This is an issue particularly for tax free (TFSA) accounts but may arise in taxable account as well, resulting in doubling of tax due.

There are few articles online discussing the risk in the context of TFSA but here is the more generic interpretation from KPMG:

The CRA generally recognizes that individual investors displaying one of the following characteristics will have to report their option-related gains or losses as business income:

- The transactions are that of a taxpayer who holds himself out to the public as a trader or dealer in securities;

- The transactions are made by a taxpayer using special information not available to the public to realize a quick profit;

- The transactions are part of the “whole course of conduct” of the taxpayer and are carried on in the same way as those of a trader or dealer in securities. Some of the factors to be considered in establishing whether the taxpayer’s course of conduct indicates the carrying on of a business are as follows:

- extensive buying and selling of securities;

- securities usually owned only for a short period of time;

- knowledge or experience of securities markets;

- security transactions form a part of a taxpayer’s ordinary business;

- a substantial part of the taxpayer’s time is spent studying the securities markets and investigating potential purchases;

- security purchases are financed primarily on margin or by some other form of debt; and

- the taxpayer has advertised or otherwise made it known that he is willing to purchase securities.

Day trading in a TFSA or RRSP | Investment Executive

There are several factors that must be taken into account when determining whether a taxpayer’s gains from securities constitute carrying on a business

Frequently trading stocks in your TFSA? The CRA may have questions - National | Globalnews.ca

Many young Canadians have started investing during the pandemic, often opening self-directed TFSAs. But too much trading inside a TFSA could trigger tax consequences.

As a precaution I have restricted myself to monthly or longer durations, I also spread my transactions across multiple entities (persons and corp) which lowers trading frequency.

Last edited:

Hi all!

After some weeks of testing the BPS strategy like described in this thread with good results I decided to go all cash and starting cash backed BPS.

At the moment I‘m in -920/+820 BPS for 12/17. Just curious if you have some hard rules I could learn from. I want to take profit at 50%, but still not sure if I‘ll already set the take profit order after entering the trade or if I‘ll just set an alarm and close it manually.

And do you have some hard adjustment rules? Like 100% loss = opening BCS, 200% loss = rolling out and down?

Happy as always about every input and thank you so much to share your trades and ideas!

After some weeks of testing the BPS strategy like described in this thread with good results I decided to go all cash and starting cash backed BPS.

At the moment I‘m in -920/+820 BPS for 12/17. Just curious if you have some hard rules I could learn from. I want to take profit at 50%, but still not sure if I‘ll already set the take profit order after entering the trade or if I‘ll just set an alarm and close it manually.

And do you have some hard adjustment rules? Like 100% loss = opening BCS, 200% loss = rolling out and down?

Happy as always about every input and thank you so much to share your trades and ideas!

yes, just posted on the main thread the same pic as a response.IV has utterly died this week... Monday morning it peaked around .9 and now is down to .58, with today just being a linear decline from about .68.

Missed mentioning, but this is another advantage of rolling early where you actually trade off some theta for larger Vega. So when IV drops the impact is typically much larger than what you get from theta on the near dated options. Balancing risk and reward with options is certainly not easy!

I'm sticking to STO BPS/puts when it dips. Not seeing juicy enough premiums with CC's or BCS.

I feel like big swings are still in our future until a few weeks after Q4 earnings.

For instance, what is going to happen next week with all these call walls? Feel like we could be in for some IV increases next week.

I feel like big swings are still in our future until a few weeks after Q4 earnings.

For instance, what is going to happen next week with all these call walls? Feel like we could be in for some IV increases next week.

Will respond in PM.Whats your opinion @st_lopes on the risk of frequent trading being classified as business income as opposed to capital gains for purpose of Canadian tax? This is an issue particularly for tax free (TFSA) accounts but may arise in taxable account as well, resulting in doubling of tax due.

There are few articles online discussing the risk in the context of TFSA but here is the more generic interpretation from KPMG:

The CRA generally recognizes that individual investors displaying one of the following characteristics will have to report their option-related gains or losses as business income:

Here are couple tax free account specific sources, in this case re-assessment is particularly painful ... from 0% tax to 50%:

- The transactions are that of a taxpayer who holds himself out to the public as a trader or dealer in securities;

- The transactions are made by a taxpayer using special information not available to the public to realize a quick profit;

- The transactions are part of the “whole course of conduct” of the taxpayer and are carried on in the same way as those of a trader or dealer in securities. Some of the factors to be considered in establishing whether the taxpayer’s course of conduct indicates the carrying on of a business are as follows:

- extensive buying and selling of securities;

- securities usually owned only for a short period of time;

- knowledge or experience of securities markets;

- security transactions form a part of a taxpayer’s ordinary business;

- a substantial part of the taxpayer’s time is spent studying the securities markets and investigating potential purchases;

- security purchases are financed primarily on margin or by some other form of debt; and

- the taxpayer has advertised or otherwise made it known that he is willing to purchase securities.

Day trading in a TFSA or RRSP | Investment Executive

There are several factors that must be taken into account when determining whether a taxpayer’s gains from securities constitute carrying on a businesswww.investmentexecutive.com

Frequently trading stocks in your TFSA? The CRA may have questions - National | Globalnews.ca

Many young Canadians have started investing during the pandemic, often opening self-directed TFSAs. But too much trading inside a TFSA could trigger tax consequences.globalnews.ca

As a precaution I have restricted myself to monthly or longer durations, I also spread my transactions across multiple entities (persons and corp) which lowers trading frequency.

Hi all!

After some weeks of testing the BPS strategy like described in this thread with good results I decided to go all cash and starting cash backed BPS.

At the moment I‘m in -920/+820 BPS for 12/17. Just curious if you have some hard rules I could learn from. I want to take profit at 50%, but still not sure if I‘ll already set the take profit order after entering the trade or if I‘ll just set an alarm and close it manually.

And do you have some hard adjustment rules? Like 100% loss = opening BCS, 200% loss = rolling out and down?

Happy as always about every input and thank you so much to share your trades and ideas!

#1 rule for me is - Don’t be greedy.

I avoid opening short positions too close to the share price. It’s often better to close positions at 50-80% profit than squeeze the last bit out. Best to take a small loss right away rather than *hope* things turn around and end up with a nightmare. Many folks here give helpful reminders about these guidelines

I break my rule too often

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K