This isn't true. You can still make money selling options (or lose money buying) even when the stock price is heading toward your strike due to IV contraction.IV is much less important than the underlying stock price.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

jeewee3000

Active Member

Haven't got a lot of time for trading or TMC lately but just an update for those interested. (And typing this out really helps me to analyse my own situation, as if I'm discussing someone else's trades).

The brutal stock price movements these last few trading days are weirdly not making me stressed out. Maybe it's because I don't have a lot of time to trade or because I forfeited the idea of making a lot of money on options the coming months.

Either way, below are my trades and or positions as of right now:

1) The yolo 1/28 1200 calls that I bought last Friday (1/21) for $2.5 were sold yesterday halfway during the day for $1.2 average. 50% loss but I figured 1200 by friday was now really out of the question and whatever value I could recover was value recovered. (And this engraved the lesson AGAIN to never buy short term calls. I get screwed every single time. It's really @TheTalkingMule 's fault for making it seem so cool (/joking of course, I take full responsability and then some).)

2) I sold 100 TSLA shares around $880 and with the proceeds I bought 4x JAN2024 1450c's @200 each. Yes, I too prefer ITM LEAPS (600's or 800's) generally but I believe this dip or market correction or whatever you call the current market turmoil will not extend to 2024 AND that TSLA will easily surpass $1450 in the coming two years. I probably paid too much for these calls, and will suffer IV crush come Thursday, but these calls are meant to be held for a long time and IV will rise again (when we return to ATH ). My goal with these is simple: ride the return to ATH (or slightly higher) with greater returns than holding stock, whilst selling short term 1450 ccs against them for a buck or two. Let's just hope we don't stay below $1200 for a year since then this will have been a very dumb move. But hey, it's just a part of my portfolio and I have conviction in TSLA reaching ATH within 6 months from here.

). My goal with these is simple: ride the return to ATH (or slightly higher) with greater returns than holding stock, whilst selling short term 1450 ccs against them for a buck or two. Let's just hope we don't stay below $1200 for a year since then this will have been a very dumb move. But hey, it's just a part of my portfolio and I have conviction in TSLA reaching ATH within 6 months from here.

3) Otherwise I did nothing. Simply nothing. My many BPS are in deep doodoo but I want to see what happens to the stock price on Thursday before managing any of them.

My current BPS for those interested:

1/28 expiration

-1025p/+875p

-950p/+900p

2/4 expiration

-1050p/+650p

-1000p/+850p

-900p/+800p

-1120p/+920p

3/18 expiration

-1050p/+900p

-1150p/+1000p

I do not plan on touching/rolling the 2/4 or 3/18 expirations this week, unless golden opportunities arise.

The 1/28 expiration BPS are not that hard to manage if the stock price were to go above $950, which I deem very possible.

If not, I can always widen the spread and roll.

My main conclusion after investigating my positions is that I'm not worried since I see multiple "outs" and I'm not of the mindset that I "have to" receive weekly income/premiums from my positions. As I mentioned before, this doesn't make me the most capital efficient (sometimes taking the loss and rebuilding is a faster way to grow capital) but my peace of mind is quite high given the abysmal market circumstances. I am happy I am only trading with my own capital though, instead of managing other people's money. Then I would not be feeling good right now .

.

Good luck to all. Stay calm. Stay rational. TSLA is worth more than it's current valuation. (Oh yeah, IMO now is a very bad time to sell cc's. When this thing turns around, things can go very fast).

The brutal stock price movements these last few trading days are weirdly not making me stressed out. Maybe it's because I don't have a lot of time to trade or because I forfeited the idea of making a lot of money on options the coming months.

Either way, below are my trades and or positions as of right now:

1) The yolo 1/28 1200 calls that I bought last Friday (1/21) for $2.5 were sold yesterday halfway during the day for $1.2 average. 50% loss but I figured 1200 by friday was now really out of the question and whatever value I could recover was value recovered. (And this engraved the lesson AGAIN to never buy short term calls. I get screwed every single time. It's really @TheTalkingMule 's fault for making it seem so cool (/joking of course, I take full responsability and then some).)

2) I sold 100 TSLA shares around $880 and with the proceeds I bought 4x JAN2024 1450c's @200 each. Yes, I too prefer ITM LEAPS (600's or 800's) generally but I believe this dip or market correction or whatever you call the current market turmoil will not extend to 2024 AND that TSLA will easily surpass $1450 in the coming two years. I probably paid too much for these calls, and will suffer IV crush come Thursday, but these calls are meant to be held for a long time and IV will rise again (when we return to ATH

3) Otherwise I did nothing. Simply nothing. My many BPS are in deep doodoo but I want to see what happens to the stock price on Thursday before managing any of them.

My current BPS for those interested:

1/28 expiration

-1025p/+875p

-950p/+900p

2/4 expiration

-1050p/+650p

-1000p/+850p

-900p/+800p

-1120p/+920p

3/18 expiration

-1050p/+900p

-1150p/+1000p

I do not plan on touching/rolling the 2/4 or 3/18 expirations this week, unless golden opportunities arise.

The 1/28 expiration BPS are not that hard to manage if the stock price were to go above $950, which I deem very possible.

If not, I can always widen the spread and roll.

My main conclusion after investigating my positions is that I'm not worried since I see multiple "outs" and I'm not of the mindset that I "have to" receive weekly income/premiums from my positions. As I mentioned before, this doesn't make me the most capital efficient (sometimes taking the loss and rebuilding is a faster way to grow capital) but my peace of mind is quite high given the abysmal market circumstances. I am happy I am only trading with my own capital though, instead of managing other people's money. Then I would not be feeling good right now

Good luck to all. Stay calm. Stay rational. TSLA is worth more than it's current valuation. (Oh yeah, IMO now is a very bad time to sell cc's. When this thing turns around, things can go very fast).

TheTalkingMule

Distributed Energy Enthusiast

You're only supposed to buy cheap YOLOs. And then certainly don't give up on them! I'll record a podcast on this at some point. I accept 49% responsibility.Haven't got a lot of time for trading or TMC lately but just an update for those interested. (And typing this out really helps me to analyse my own situation, as if I'm discussing someone else's trades).

The brutal stock price movements these last few trading days are weirdly not making me stressed out. Maybe it's because I don't have a lot of time to trade or because I forfeited the idea of making a lot of money on options the coming months.

Either way, below are my trades and or positions as of right now:

1) The yolo 1/28 1200 calls that I bought last Friday (1/21) for $2.5 were sold yesterday halfway during the day for $1.2 average. 50% loss but I figured 1200 by friday was now really out of the question and whatever value I could recover was value recovered. (And this engraved the lesson AGAIN to never buy short term calls. I get screwed every single time. It's really @TheTalkingMule 's fault for making it seem so cool (/joking of course, I take full responsability and then some).)

2) I sold 100 TSLA shares around $880 and with the proceeds I bought 4x JAN2024 1450c's @200 each. Yes, I too prefer ITM LEAPS (600's or 800's) generally but I believe this dip or market correction or whatever you call the current market turmoil will not extend to 2024 AND that TSLA will easily surpass $1450 in the coming two years. I probably paid too much for these calls, and will suffer IV crush come Thursday, but these calls are meant to be held for a long time and IV will rise again (when we return to ATH). My goal with these is simple: ride the return to ATH (or slightly higher) with greater returns than holding stock, whilst selling short term 1450 ccs against them for a buck or two. Let's just hope we don't stay below $1200 for a year since then this will have been a very dumb move. But hey, it's just a part of my portfolio and I have conviction in TSLA reaching ATH within 6 months from here.

3) Otherwise I did nothing. Simply nothing. My many BPS are in deep doodoo but I want to see what happens to the stock price on Thursday before managing any of them.

My current BPS for those interested:

1/28 expiration

-1025p/+875p

-950p/+900p

2/4 expiration

-1050p/+650p

-1000p/+850p

-900p/+800p

-1120p/+920p

3/18 expiration

-1050p/+900p

-1150p/+1000p

I do not plan on touching/rolling the 2/4 or 3/18 expirations this week, unless golden opportunities arise.

The 1/28 expiration BPS are not that hard to manage if the stock price were to go above $950, which I deem very possible.

If not, I can always widen the spread and roll.

My main conclusion after investigating my positions is that I'm not worried since I see multiple "outs" and I'm not of the mindset that I "have to" receive weekly income/premiums from my positions. As I mentioned before, this doesn't make me the most capital efficient (sometimes taking the loss and rebuilding is a faster way to grow capital) but my peace of mind is quite high given the abysmal market circumstances. I am happy I am only trading with my own capital though, instead of managing other people's money. Then I would not be feeling good right now.

Good luck to all. Stay calm. Stay rational. TSLA is worth more than it's current valuation. (Oh yeah, IMO now is a very bad time to sell cc's. When this thing turns around, things can go very fast).

Interested in how "rolling and widening" will work for BPS maintenance. I have some $1060/$960 for 2/4 that I'm not too worried about, but I also have a bit of cash leftover from converting shares to LEAPs. Perhaps this IRA cash would be best deployed as margin for wider BPS rolls. Moving to more conservative positions holds a lot of value with me right now!

I have no problem with rolling these BPS from 2/4 for multiple weeks waiting for the SP to catch up. Even all the way thru March if needed. Assuming widening the spread just gives me more flexibility to roll each week/month as the bought leg is more likely to be OTM. Gonna fiddle around today and keep a few scenarios at the ready in case I can't close next week.

Thanks for the update!

P.S. 2/4 $1100c should dip below $10 today, maybe $8-9 tomorrow..........just sayin'.

TheTalkingMule

Distributed Energy Enthusiast

Thought of putting this in the "noob thread", but a lot of folks may need it this week.

Looked into rolling and widening the lower strike of a fully ITM BPS. In this instance 2/4 $1060/$960 BPS. Seems that by rolling from 2/4 to 2/11 and widening the lower strike from $960 down to either $900 or $860, you would get credited about half the incremental margin required to widen the spread.

So rolling 2/4 $1060/$960 BPS to 2/11 $1060/$860 BPS "costs" me and additional $10k in cash margin within my IRA and obviously increases potential loss by as much. But the credit on the roll was $5k per contract. Rolling from $1060/$960 to $1060/$900 was a credit around $3k per contract with $6k more cash margin.

Can we think of that as the general rule for rolling and widening fully ITM BPS? That widening hands you back half the margin via roll credit? This appeals to me as a BPS holder willing to add moderately more risk to buy a lot of time. That new spread is also more flexible moving forward for any additional rolls.

I'm sure this is elementary to the experienced, but going thru the motions is the only way I'm gonna get comfortable. Understanding maintenance is 70% of the game it seems. Anyone have preferences on widening in another fashion? Perhaps moving the higher strike up a hair in certain instances?

Looked into rolling and widening the lower strike of a fully ITM BPS. In this instance 2/4 $1060/$960 BPS. Seems that by rolling from 2/4 to 2/11 and widening the lower strike from $960 down to either $900 or $860, you would get credited about half the incremental margin required to widen the spread.

So rolling 2/4 $1060/$960 BPS to 2/11 $1060/$860 BPS "costs" me and additional $10k in cash margin within my IRA and obviously increases potential loss by as much. But the credit on the roll was $5k per contract. Rolling from $1060/$960 to $1060/$900 was a credit around $3k per contract with $6k more cash margin.

Can we think of that as the general rule for rolling and widening fully ITM BPS? That widening hands you back half the margin via roll credit? This appeals to me as a BPS holder willing to add moderately more risk to buy a lot of time. That new spread is also more flexible moving forward for any additional rolls.

I'm sure this is elementary to the experienced, but going thru the motions is the only way I'm gonna get comfortable. Understanding maintenance is 70% of the game it seems. Anyone have preferences on widening in another fashion? Perhaps moving the higher strike up a hair in certain instances?

bkp_duke

Well-Known Member

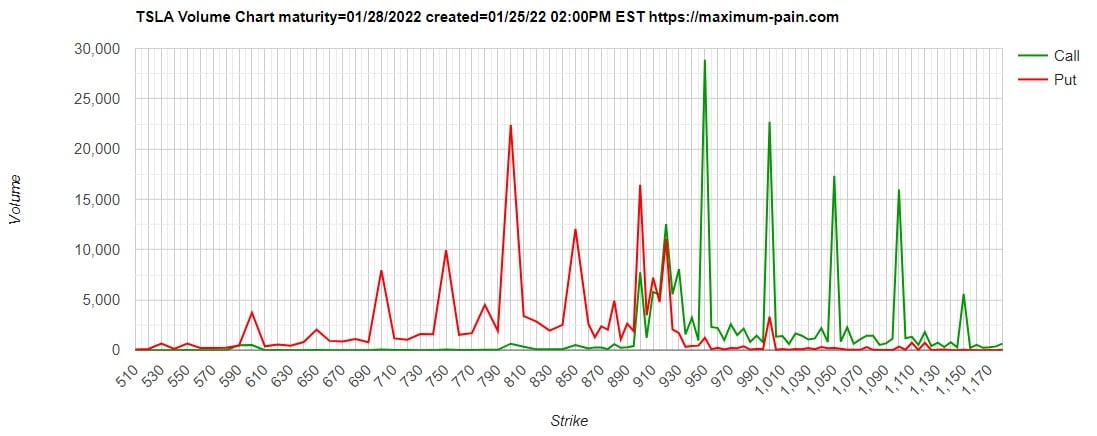

Anyone else notice the spring getting wound tighter and tighter today?

Look at call volumes at 950, 1000, 1050, and 1100.

Look at call volumes at 950, 1000, 1050, and 1100.

Yes and no. There is volume moving around 950, maar puts and calls are 10K each at 1000.Anyone else notice the spring getting wound tighter and tighter today?

Look at call volumes at 950, 1000, 1050, and 1100.

View attachment 760069

Selling calls at 1000 is like expecting the SP not to reach that point.

samppa

Active Member

As we started to climb a few minutes ago, we had ~14 minutes of green 1 minute candles that took us to $947. So am I understanding this correctly that we are most likely seeing buying due to calls going ITM? Regardless, it looked like buying due to options. Thoughts?Anyone else notice the spring getting wound tighter and tighter today?

Look at call volumes at 950, 1000, 1050, and 1100.

View attachment 760069

LightngMcQueen

Aspirationally Rational

Quick warning based on my experience today:

My "safe naked puts" backfired today because as an account went into margin call my room to manoeuvre shrunk quickly:

- This broker usually gives 2 days to cover, today I got few hours. I was less than -2% of on my equity and had their "premium/hnw" customer designation for couple years ... yet I was told no exception today because of "volatility".

- I was not able to reduce margin requirement through purchase protective PUTs, using my accounts postitive cash balance, and I was also not able to convert -PUTs into BPS for net credit AND margin improvement. Because I've entered margin call pariah status, broker's system just played Seinfeld's Soup Nazi spiting out "no orders for you" for anything other than plain sell order . Classic catch 22 .

.

- So I had to sell some stuff to add liquidity, for the most part I was able to use this as an opportunity for tax selling in this account and simultaneously repurchase same/or correlated stocks/etfs in the accounts with lower tax rates/longer time horizons. That was mostly ok, as luckily it was the account with highest tax rate.

- Towards the end of this scramble I was still short by a hair and I had to sell one ITM 2023 Call so I lost like 90+ deltas. I will have to pay tax 1 year earlier then I otherwise would.

- Once I was in plus I could buy protective PUTs and I am 'ok' now (for another week maybe?? )

It was probably first time I realized how quickly walls close on you as you become illiquid.

My "safe naked puts" backfired today because as an account went into margin call my room to manoeuvre shrunk quickly:

- This broker usually gives 2 days to cover, today I got few hours. I was less than -2% of on my equity and had their "premium/hnw" customer designation for couple years ... yet I was told no exception today because of "volatility".

- I was not able to reduce margin requirement through purchase protective PUTs, using my accounts postitive cash balance, and I was also not able to convert -PUTs into BPS for net credit AND margin improvement. Because I've entered margin call pariah status, broker's system just played Seinfeld's Soup Nazi spiting out "no orders for you" for anything other than plain sell order . Classic catch 22

- So I had to sell some stuff to add liquidity, for the most part I was able to use this as an opportunity for tax selling in this account and simultaneously repurchase same/or correlated stocks/etfs in the accounts with lower tax rates/longer time horizons. That was mostly ok, as luckily it was the account with highest tax rate.

- Towards the end of this scramble I was still short by a hair and I had to sell one ITM 2023 Call so I lost like 90+ deltas. I will have to pay tax 1 year earlier then I otherwise would.

- Once I was in plus I could buy protective PUTs and I am 'ok' now (for another week maybe?? )

It was probably first time I realized how quickly walls close on you as you become illiquid.

Last edited:

Quick warning based on my experience today:

My "safe naked puts" backfired today because as an account went into margin call my room to manoeuvre shrunk quickly:

- This broker usually gives 2 days to cover, today I got few hours. I was less than -2% of on my equity and had their "premium/hnw" customer designation for couple years ... yet I was told no exception today because of "volatility".

- I was not able to reduce margin requirement through purchase protective PUTs, using my accounts postitive cash balance, and I was also not able to convert -PUTs into BPS for net credit AND margin improvement. Because I've entered margin call pariah status, broker's system just played Seinfeld's Soup Nazi spiting out "no orders for you" for anything other than plain sell order . Classic catch 22.

- So I had to sell some stuff to add liquidity, for the most part I was able to use this as an opportunity for tax selling in this account and simultaneously repurchase same/or correlated stocks/etfs in the accounts with lower tax rates/longer time horizons. That was mostly ok, as luckily it was the account with highest tax rate.

- Towards the end of this scramble I was still short by a hair and I had to sell one ITM 2023 Call so I lost like 90+ deltas. I will have to pay tax 1 year earlier then I otherwise would.

- Once I was in plus I could buy protective PUTs and I am 'ok' now (for another week maybe?? )

It was probably first time I realized how quickly walls close on you as you become illiquid.

Playing safe and not for big/quick returns

Sold some Jun 22 600 Puts for 30$ on margin

last week had sold Jun 720 Puts on margin for same amount, thought they were safe bets, but past few days they had gone up to $65+

Hoping the IV shrink after earnings will allow for closing these puppies

Sold bunch of longer TSLA CC's, and went shopping buying shares of AAPL, MSFT, SHOP, TDOC etc as well.... hoping for overall macro reversal

jeewee3000

Active Member

A last escape for desperate times (for those with time on their hands and not willing to eat a loss) with BPS is to roll the entire spread out and up.Thought of putting this in the "noob thread", but a lot of folks may need it this week.

Looked into rolling and widening the lower strike of a fully ITM BPS. In this instance 2/4 $1060/$960 BPS. Seems that by rolling from 2/4 to 2/11 and widening the lower strike from $960 down to either $900 or $860, you would get credited about half the incremental margin required to widen the spread.

So rolling 2/4 $1060/$960 BPS to 2/11 $1060/$860 BPS "costs" me and additional $10k in cash margin within my IRA and obviously increases potential loss by as much. But the credit on the roll was $5k per contract. Rolling from $1060/$960 to $1060/$900 was a credit around $3k per contract with $6k more cash margin.

Can we think of that as the general rule for rolling and widening fully ITM BPS? That widening hands you back half the margin via roll credit? This appeals to me as a BPS holder willing to add moderately more risk to buy a lot of time. That new spread is also more flexible moving forward for any additional rolls.

I'm sure this is elementary to the experienced, but going thru the motions is the only way I'm gonna get comfortable. Understanding maintenance is 70% of the game it seems. Anyone have preferences on widening in another fashion? Perhaps moving the higher strike up a hair in certain instances?

For example, a 1/28 -1000p/+900p could be rolled to a -1100p/+1000p at a (preferably) much later date of expiration.

This would net you a credit and keep max loss at the same level. Just be sure to move it out far enough for the SP to be able to catch up.

NOT-ADVICEI'm feeling better about holding until Thursday. My gut feeling (hopefully not the Tofu) is that the Fed meeting tomorrow will actually cause a relief rally in the Nasdaq in the afternoon regardless of what they say. Then with an earnings beat we jump an additional 10% AH on Wednesday. After that, I don't know if the SP will hold or drift down next week.

This is exactly how I have been thinking the week would go for the last 2 weeks. I decided to bail on Monday as I had also expected to be at least $1000 share price around now, so a relief / earning rally would get to $1050+.

Between the share price being well below that on Monday plus realizing that time decay was about to bite hard on the remaining value in the spread ($20 out of $150 on Monday for me), I decided that waiting for Thursday trading and/or that relief rally on Wednesday at the expense of the remaining value in the spread was too high of a risk. It felt entirely too much like I had dice in my hand at the craps table, and that feeling is not consistent with a dividend / income point of view.

The problem as I see it is that there are 2 big events, both arriving on Wednesday, but 1 arriving after hours on Wednesday. For each event there are 2 wildcards. The first is the event itself - is it positive or negative? I.e. - is Tesla's earnings report really as big of a blowout as many of us believe it will be? Will the Feds have the right things to say, and the right changes in their plans, that it sounds like they've got this under control?

The bigger wildcard in both cases is what the overall investor universe thinks about the events and how do the react? I.e. I could be right about the Tesla earnings results - blowout goodness, new product updates that are very positive, ramping new factories - and investors still decide that good news is all priced in, and they can get out of their Tesla positions quick while others are buying in.

Or the Fed says all the right things, whatever exactly those are, and there are still enough investors thinking they aren't going far enough. Or going too far. And the market sells off anyway on the Fed announcement. Admittedly it seems like every Fed announcement for a year + is associated with a draw down ahead of time and a relief rally afterwards. That's not graven in stone result though.

Behind both of these events in my mind is the thought that for the share price to go up there needs to be buyers. Not just buyers at $900, 930, or 950. There need to be people that want the shares at $1000. And then 1050, 1100, ... Without those buyers the shares will be flat at best. I see nothing from the company to suggest that now is a good time to sell, but the macro environment is the suck.

Back when Covid first started happening my reaction to the early mask mandates and social distancing, while we were still getting a handle on things, so that the real economy and the stock market were getting so disconnected that they had to reconnect. And it would be the stock market coming back - not the economy catching up to the stock market. Now the easy money is pretty clearly starting to go away with the details the only real question. How does that all play out in practice?

I dunno.

I know that one of the thoughts I had back then was the Great Depression as well as the 07/09ish drop. The DOW worked its way from 381 down to 41 over 3 years (big 50% drop up front; relief rally that recovered 1/2 of that drop. Then sustained drop to 41 after that). Stock market down 90% over 3 years. That is an aggregate view - clearly not every company was down 90%. Many were down more (bankrupt); some were down less (well capitalized companies that didn't need debt to function was, I suspect, an important indicator

The thing I learned in our more recent experience is that in a big enough downturn, everything comes down. Some less than others but it all comes down. An article I read back then stuck with me. The observation there was that when you're getting repetitive margin calls, eventually the good stuff also has to go. After all - where will the positions closes come from to satisfy the margin calls? The stuff that is borderline worthless or the stuff that is holding its value? That is when I got an 11% dividend paying company at 1/2 price, with that dividend being both the focus of the company as well as the safest thing I'd ever seen (more than 1/2 of annual revenues with multi-year contracts already in place).

I post this only as another point of view into the current state of affairs (mine) and what I've done with it.

LightngMcQueen

Aspirationally Rational

Following the same line of thinking I'd sold some 2023 ITM PUTs during pre xmas deep dive ... IV was high, share price was low as well.Playing safe and not for big/quick returns

Sold some Jun 22 600 Puts for 30$ on margin

last week had sold Jun 720 Puts on margin for same amount, thought they were safe bets, but past few days they had gone up to $65+

Hoping the IV shrink after earnings will allow for closing these puppies

Sold bunch of longer TSLA CC's, and went shopping buying shares of AAPL, MSFT, SHOP, TDOC etc as well.... hoping for overall macro reversal

Month later I am in red on those LEAPS ... apparently SP can always go lower

I hope your timing is right though.

NOT-ADVICE

This is exactly how I have been thinking the week would go for the last 2 weeks. I decided to bail on Monday as I had also expected to be at least $1000 share price around now, so a relief / earning rally would get to $1050+.

Between the share price being well below that on Monday plus realizing that time decay was about to bite hard on the remaining value in the spread ($20 out of $150 on Monday for me), I decided that waiting for Thursday trading and/or that relief rally on Wednesday at the expense of the remaining value in the spread was too high of a risk. It felt entirely too much like I had dice in my hand at the craps table, and that feeling is not consistent with a dividend / income point of view.

The problem as I see it is that there are 2 big events, both arriving on Wednesday, but 1 arriving after hours on Wednesday. For each event there are 2 wildcards. The first is the event itself - is it positive or negative? I.e. - is Tesla's earnings report really as big of a blowout as many of us believe it will be? Will the Feds have the right things to say, and the right changes in their plans, that it sounds like they've got this under control?

The bigger wildcard in both cases is what the overall investor universe thinks about the events and how do the react? I.e. I could be right about the Tesla earnings results - blowout goodness, new product updates that are very positive, ramping new factories - and investors still decide that good news is all priced in, and they can get out of their Tesla positions quick while others are buying in.

Or the Fed says all the right things, whatever exactly those are, and there are still enough investors thinking they aren't going far enough. Or going too far. And the market sells off anyway on the Fed announcement. Admittedly it seems like every Fed announcement for a year + is associated with a draw down ahead of time and a relief rally afterwards. That's not graven in stone result though.

Behind both of these events in my mind is the thought that for the share price to go up there needs to be buyers. Not just buyers at $900, 930, or 950. There need to be people that want the shares at $1000. And then 1050, 1100, ... Without those buyers the shares will be flat at best. I see nothing from the company to suggest that now is a good time to sell, but the macro environment is the suck.

Back when Covid first started happening my reaction to the early mask mandates and social distancing, while we were still getting a handle on things, so that the real economy and the stock market were getting so disconnected that they had to reconnect. And it would be the stock market coming back - not the economy catching up to the stock market. Now the easy money is pretty clearly starting to go away with the details the only real question. How does that all play out in practice?

I dunno.

I know that one of the thoughts I had back then was the Great Depression as well as the 07/09ish drop. The DOW worked its way from 381 down to 41 over 3 years (big 50% drop up front; relief rally that recovered 1/2 of that drop. Then sustained drop to 41 after that). Stock market down 90% over 3 years. That is an aggregate view - clearly not every company was down 90%. Many were down more (bankrupt); some were down less (well capitalized companies that didn't need debt to function was, I suspect, an important indicator). I don't really think the pandemic is that scale of bad, but 1/2 instead of 9/10ths doesn't sound out of line.

The thing I learned in our more recent experience is that in a big enough downturn, everything comes down. Some less than others but it all comes down. An article I read back then stuck with me. The observation there was that when you're getting repetitive margin calls, eventually the good stuff also has to go. After all - where will the positions closes come from to satisfy the margin calls? The stuff that is borderline worthless or the stuff that is holding its value? That is when I got an 11% dividend paying company at 1/2 price, with that dividend being both the focus of the company as well as the safest thing I'd ever seen (more than 1/2 of annual revenues with multi-year contracts already in place).

I post this only as another point of view into the current state of affairs (mine) and what I've done with it.

Im playing it safe too. I took the opportunity today to close some of my ITM BPS and Puts. I only have these positions open for now:

6X -945/800 BPS(had 10X closed some for a loss)

Opened 10X 805/700 BPS, I hope these are safe lol

5X Feb 18 920(these are green so will continue to hold with a break even of 845).

I day traded a lot today to find opportunities to close some BPS, open the 805/700 BPS, closed some puts and I think I have de-risked enough going into tomorrow. I might further trim the above positions tomorrow and then wait.

I’m happy with the small losses which actually feel like wins, don’t want to be in a position where this month defines the rest of the year for me. Still have cash/margin available in regular and IRA accounts.

Last edited:

Was going to be away 1-4pm, so booked limit orders at 12:50pm, and for once picked the good prices -- all just cleared during the afternoon spike:

We'll see if the possible IV crush after tomorrow's ER presents an opportunity

- Buy-Write $974 (1/21): sto 012822C975 at $30

- 40% of Core Shares: sto 020422C1075 at $20, now 17%/$157 OTM

We'll see if the possible IV crush after tomorrow's ER presents an opportunity

Great post... Has your view on the profitability and risks of selling credit spread changed after these past few weeks?NOT-ADVICE

This is exactly how I have been thinking the week would go for the last 2 weeks. I decided to bail on Monday as I had also expected to be at least $1000 share price around now, so a relief / earning rally would get to $1050+.

Between the share price being well below that on Monday plus realizing that time decay was about to bite hard on the remaining value in the spread ($20 out of $150 on Monday for me), I decided that waiting for Thursday trading and/or that relief rally on Wednesday at the expense of the remaining value in the spread was too high of a risk. It felt entirely too much like I had dice in my hand at the craps table, and that feeling is not consistent with a dividend / income point of view.

The problem as I see it is that there are 2 big events, both arriving on Wednesday, but 1 arriving after hours on Wednesday. For each event there are 2 wildcards. The first is the event itself - is it positive or negative? I.e. - is Tesla's earnings report really as big of a blowout as many of us believe it will be? Will the Feds have the right things to say, and the right changes in their plans, that it sounds like they've got this under control?

The bigger wildcard in both cases is what the overall investor universe thinks about the events and how do the react? I.e. I could be right about the Tesla earnings results - blowout goodness, new product updates that are very positive, ramping new factories - and investors still decide that good news is all priced in, and they can get out of their Tesla positions quick while others are buying in.

Or the Fed says all the right things, whatever exactly those are, and there are still enough investors thinking they aren't going far enough. Or going too far. And the market sells off anyway on the Fed announcement. Admittedly it seems like every Fed announcement for a year + is associated with a draw down ahead of time and a relief rally afterwards. That's not graven in stone result though.

Behind both of these events in my mind is the thought that for the share price to go up there needs to be buyers. Not just buyers at $900, 930, or 950. There need to be people that want the shares at $1000. And then 1050, 1100, ... Without those buyers the shares will be flat at best. I see nothing from the company to suggest that now is a good time to sell, but the macro environment is the suck.

Back when Covid first started happening my reaction to the early mask mandates and social distancing, while we were still getting a handle on things, so that the real economy and the stock market were getting so disconnected that they had to reconnect. And it would be the stock market coming back - not the economy catching up to the stock market. Now the easy money is pretty clearly starting to go away with the details the only real question. How does that all play out in practice?

I dunno.

I know that one of the thoughts I had back then was the Great Depression as well as the 07/09ish drop. The DOW worked its way from 381 down to 41 over 3 years (big 50% drop up front; relief rally that recovered 1/2 of that drop. Then sustained drop to 41 after that). Stock market down 90% over 3 years. That is an aggregate view - clearly not every company was down 90%. Many were down more (bankrupt); some were down less (well capitalized companies that didn't need debt to function was, I suspect, an important indicator). I don't really think the pandemic is that scale of bad, but 1/2 instead of 9/10ths doesn't sound out of line.

The thing I learned in our more recent experience is that in a big enough downturn, everything comes down. Some less than others but it all comes down. An article I read back then stuck with me. The observation there was that when you're getting repetitive margin calls, eventually the good stuff also has to go. After all - where will the positions closes come from to satisfy the margin calls? The stuff that is borderline worthless or the stuff that is holding its value? That is when I got an 11% dividend paying company at 1/2 price, with that dividend being both the focus of the company as well as the safest thing I'd ever seen (more than 1/2 of annual revenues with multi-year contracts already in place).

I post this only as another point of view into the current state of affairs (mine) and what I've done with it.

Just to clarify, if there isn't a relief rally of the entire market tomorrow after the Fed meeting, I will roll at least half my BPS (and maybe all of them) to December tomorrow. If there is a rally, then I will probably wait until Thursday after earnings. A agree with Adiggs that if the market is bad, it will take TSLA down with it. That is why I don't want to roll up and out short term. I think it digs a bigger hole. Rolling my 850/1050 to December and widening a little bit seems to generate a decent credit - 850/1100. Less credit but still a credit to keep short leg at 1050 and just widen to 800. Of course this is with number generated with SP @ 918. If it is lower tomorrow afternoon it will be less favorable, but if the SP is higher it will be more favorable.

Oh, what a week, and it is only Tuesday!

Monday saw another margin call, this time requiring BPS roll outward and upward (I know, bad collie) 2/4 970/770 to 2/11 990/790 @9.9, this gave me some margin for another day. I decided using TSLA stock as margin for TSLA options trading was a bad idea so...

Tuesday sold about 10% of my TSLA at 913 (bad collie, very bad collie). Above my basis, but still painful. Now no more margin worries.

For this week I still have a few 1/28 BPS 950/650 I hope to close on an ER bump.

Next week will deal with the remaining 2/4 BPS 970/770.

Monday saw another margin call, this time requiring BPS roll outward and upward (I know, bad collie) 2/4 970/770 to 2/11 990/790 @9.9, this gave me some margin for another day. I decided using TSLA stock as margin for TSLA options trading was a bad idea so...

Tuesday sold about 10% of my TSLA at 913 (bad collie, very bad collie). Above my basis, but still painful. Now no more margin worries.

For this week I still have a few 1/28 BPS 950/650 I hope to close on an ER bump.

Next week will deal with the remaining 2/4 BPS 970/770.

At some point last year I was thinking converting 100% TSLA by moving my financial advisor value stocks portfolio full of Warren Buffet picks that has been doing 4-5% annually for 5 years now. I was waiting to roll from one company to another to do so. Switched accountant at my financial firm, took a while to get an appointment, took more time than expected. Little did I know that was going to be that very same boring portfolio that was going to come save my margin requirement today by adding a 20% cushion to the 50% I already had. Sometimes good’ol value stocks act as cash and come back to help you when you think your Revolutionary EV world changing CEO company is going to +30% but instead it -30%. I’m starting to read a lot articles about second bear raids, 4-6 months of bear market, I come back here every time for a safe haven but if we don’t have a nice rebound tomorrow, I will start believing it and start mentally preparing to roll out positions.NOT-ADVICE

This is exactly how I have been thinking the week would go for the last 2 weeks. I decided to bail on Monday as I had also expected to be at least $1000 share price around now, so a relief / earning rally would get to $1050+.

Between the share price being well below that on Monday plus realizing that time decay was about to bite hard on the remaining value in the spread ($20 out of $150 on Monday for me), I decided that waiting for Thursday trading and/or that relief rally on Wednesday at the expense of the remaining value in the spread was too high of a risk. It felt entirely too much like I had dice in my hand at the craps table, and that feeling is not consistent with a dividend / income point of view.

The problem as I see it is that there are 2 big events, both arriving on Wednesday, but 1 arriving after hours on Wednesday. For each event there are 2 wildcards. The first is the event itself - is it positive or negative? I.e. - is Tesla's earnings report really as big of a blowout as many of us believe it will be? Will the Feds have the right things to say, and the right changes in their plans, that it sounds like they've got this under control?

The bigger wildcard in both cases is what the overall investor universe thinks about the events and how do the react? I.e. I could be right about the Tesla earnings results - blowout goodness, new product updates that are very positive, ramping new factories - and investors still decide that good news is all priced in, and they can get out of their Tesla positions quick while others are buying in.

Or the Fed says all the right things, whatever exactly those are, and there are still enough investors thinking they aren't going far enough. Or going too far. And the market sells off anyway on the Fed announcement. Admittedly it seems like every Fed announcement for a year + is associated with a draw down ahead of time and a relief rally afterwards. That's not graven in stone result though.

Behind both of these events in my mind is the thought that for the share price to go up there needs to be buyers. Not just buyers at $900, 930, or 950. There need to be people that want the shares at $1000. And then 1050, 1100, ... Without those buyers the shares will be flat at best. I see nothing from the company to suggest that now is a good time to sell, but the macro environment is the suck.

Back when Covid first started happening my reaction to the early mask mandates and social distancing, while we were still getting a handle on things, so that the real economy and the stock market were getting so disconnected that they had to reconnect. And it would be the stock market coming back - not the economy catching up to the stock market. Now the easy money is pretty clearly starting to go away with the details the only real question. How does that all play out in practice?

I dunno.

I know that one of the thoughts I had back then was the Great Depression as well as the 07/09ish drop. The DOW worked its way from 381 down to 41 over 3 years (big 50% drop up front; relief rally that recovered 1/2 of that drop. Then sustained drop to 41 after that). Stock market down 90% over 3 years. That is an aggregate view - clearly not every company was down 90%. Many were down more (bankrupt); some were down less (well capitalized companies that didn't need debt to function was, I suspect, an important indicator). I don't really think the pandemic is that scale of bad, but 1/2 instead of 9/10ths doesn't sound out of line.

The thing I learned in our more recent experience is that in a big enough downturn, everything comes down. Some less than others but it all comes down. An article I read back then stuck with me. The observation there was that when you're getting repetitive margin calls, eventually the good stuff also has to go. After all - where will the positions closes come from to satisfy the margin calls? The stuff that is borderline worthless or the stuff that is holding its value? That is when I got an 11% dividend paying company at 1/2 price, with that dividend being both the focus of the company as well as the safest thing I'd ever seen (more than 1/2 of annual revenues with multi-year contracts already in place).

I post this only as another point of view into the current state of affairs (mine) and what I've done with it.

Listened to a lot of Dave Lee. Tesla execution should be great. Macros may suck this year. Having flashbacks of trading sideways.

I'm thinking of selling to open some cash covered puts Jan 23 1,300 at $50k each. Tesla will hopefully overperform, but it seems a decent return (62% max of effective at risk) for low effort. Worst case is equivalent to buying shares at $800. Vanguard IRA so no tax issues, but rolls, spreads, and such are not supported.

Crazy? Weak? Reasonable? Better strike/expiry to use?

I'm thinking of selling to open some cash covered puts Jan 23 1,300 at $50k each. Tesla will hopefully overperform, but it seems a decent return (62% max of effective at risk) for low effort. Worst case is equivalent to buying shares at $800. Vanguard IRA so no tax issues, but rolls, spreads, and such are not supported.

Crazy? Weak? Reasonable? Better strike/expiry to use?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K