I sold a -p185 11/18 yesterday to leg into strangle offsetting my -c200 for the same expiration. My plan was to use the put premium to help pay for a debit roll on the call side if necessary. An hour later, we had the market sell-off and now I'm debating whether to roll the put or take assignment if the SP continues falling.Sold my first put in a while, P176.67 for Friday. I apologize in advance for the global market crash.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

corduroy

Active Member

from my limited experience, daytrading on SPY is better but the problem is

therefore, income is less on SPY for the same capital/strategy

- stock is 2x as expensive than TSLA

- options prems are cheaper than TSLA

the one thing going for TSLA is the "guaranteed" MMD, which means high probability of a daily dip and chance to buy low

so far, my strategy is

- just be happy with $1-2/day and be done with it; overtrading introduces risk

- go to a fib line or supp/res and wait there for the algos to arrive; then trade the reverse if it looks confirmed

- withdraw profits right away to another account; this gives me sense of small victories throughout the week... and because i see money coming in, there is less pressure to make risky options bets (ie now i can do 20% OTM instead of 10%)

- i am exploring the idea of daytrading on Fri afternoons and be extra active on the lookout... retail is tired and maybe out of money, but i think this is the time where institutions are positioning for next week - see if they are loading (yay!) or dumping prior to weekend

- i am currently backtesting 5/13 EMA on the 1st hr of TSLA - does it give good indication of dip where i can buy low?

Just to add my .02. I've been trading SPY for a little while, mostly 0-2 DTE ICs. According to my trusty tracking spreadsheet 70/70 successful trades so far. For me there are 2 big benefits:Agreed, I have a set of friends whose SPY strategy is to play inverse ICs and bet that it is volatile. They win when SPY goes up or down ~>1%, lose when SPY is stable. Typically it takes 10 wins to outweigh 1 loss, but they've ended up winning like 20:1 but the premiums are lower, like you mention, and it ends up being a job (4 to 6 hours a day job).

So I stick with TSLA options

1. No Elon selling, key man risk eliminated

2. The 5 day per week expirations allow for a huge expansion of possible trades and roll options.

I'm still trading TSLA tentatively, but not making any big moves these days.

70/70!Just to add my .02. I've been trading SPY for a little while, mostly 0-2 DTE ICs. According to my trusty tracking spreadsheet 70/70 successful trades so far. For me there are 2 big benefits:

1. No Elon selling, key man risk eliminated

2. The 5 day per week expirations allow for a huge expansion of possible trades and roll options.

I'm still trading TSLA tentatively, but not making any big moves these days.

can you share a sample trade PLS

p.s. i am cooking pork chops and at the same time waiting for you

Could you give some trade examples?Just to add my .02. I've been trading SPY for a little while, mostly 0-2 DTE ICs. According to my trusty tracking spreadsheet 70/70 successful trades so far. For me there are 2 big benefits:

1. No Elon selling, key man risk eliminated

2. The 5 day per week expirations allow for a huge expansion of possible trades and roll options.

I'm still trading TSLA tentatively, but not making any big moves these days.

Edit: Ninja'd by @Yoona

Same, closed -207.50CC at $0.41 for a 79% profit in 5 days from $1.98.I closed my -210CCs too fast yesterday when I saw 50% profit in 2 days. I didn’t expect a WW3 overhang with a missile in Poland. Hope we are not heading for power high and lower low already because of that.

Net ROI of 0.82% (>50% annualized) for first tranche of new strategy selling biweekly CC +10% OTM.

R

ReddyLeaf

Guest

Used the 2nd pivot point trader’s cheat sheet and today’s Fibonacci series guesses to buy back this week’s 195&200 CCs as well as 15 shares in the 187s. Waiting on a bounce to roll out and up $5. Still holding-p190s so may pick up more shares or roll tomorrow.

Really love that the cheat sheet summaries all the various TA levels for today. Very useful for trading day trading or to find a target level.

TSLA - Tesla Stock Trader's Cheat Sheet - Barchart.com

Really love that the cheat sheet summaries all the various TA levels for today. Very useful for trading day trading or to find a target level.

TSLA - Tesla Stock Trader's Cheat Sheet - Barchart.com

i amThat looks like a rising wedge to me, which is a bearish technical pattern. The expectation would be a quick drop from $196 to $188 near the apex of the wedge.

A 4% drop is like nbd for TSLA.. just something to look out for

you are

corduroy

Active Member

70/70!

can you share a sample trade PLS

p.s. i am cooking pork chops and at the same time waiting for you

I posted some a couple months ago: Wiki - Selling TSLA Options - Be the House

I'm still doing basically the same thing. These are high frequency, low risk trades - no big bets. $10 spreads on each wing, looking for .60-.70 credit per contract with around .10-.15 delta on the short legs. 1-2 DTE seems to be the sweet spot. The key is the entry. Usually the best time is the first half hour of trading. Always trying to hit the high or low for the day to STO. These decay fast so if you get the open right, you can sometimes close the same day. Like yesterday I sold -389/379/-410/420 for .65, got out a couple hours later at .15

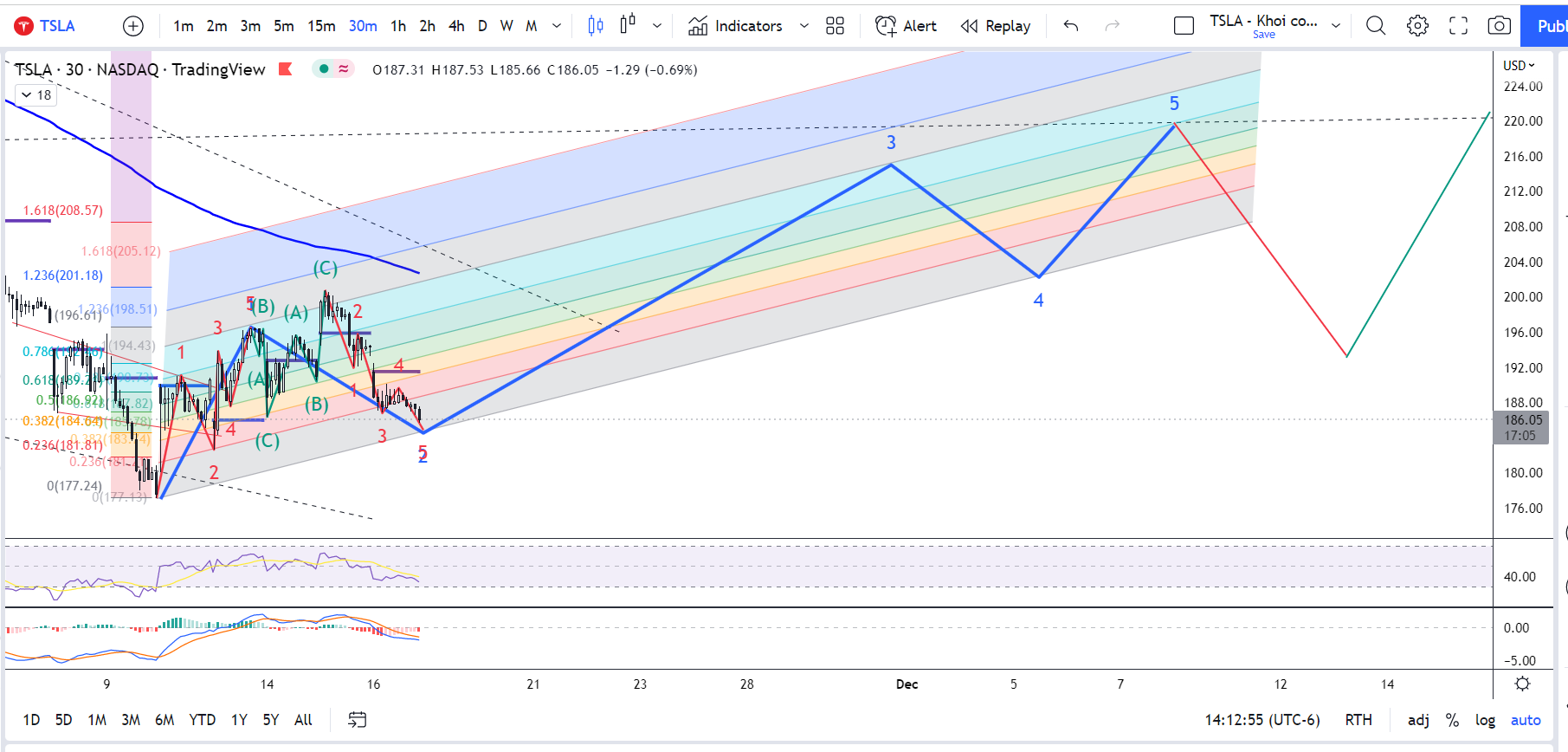

I THINK WE ARE CLOSE TO A BOTTOM FOR WAVE 2/B. MAY GO DOWN FURTHER, IDK. BUT DOUBLE BULLISH DIVERGENCE CAN BE SEEN ON THE 30M TIMEFRAME. THAT'S GOOD ENOUGH FOR ME CONSIDERING WAVE 1/A AND 2/B ARE SUPER SHORT. ASSUMING THE ENTIRE 5 WAVE SEQUENCE PLAYS OUT, WE'RE PROBABLY LOOKING AT 218 AS THE TOP. NOW, THIS WHOLE THING (BLUE SEQUENCE) CAN EITHER BE A DECENT SIZE WAVE 1 OF SOMETHING MUCH BIGGER, OR THAT'S IT, THAT'S THE WHOLE DEAD CAT.

I'M CLOSING 50% OF MY WEEKLY CCS HERE, ALREADY 60% PROFITABLE. MONTHLIES AND LEAPS I WILL KEEP FOR WHEN WE CORRECT FROM 218.

THIS SCHEDULE SUGGESTS WE WILL CORRECT INTO P&D INSTEAD OF RALLYING.

I'M CLOSING 50% OF MY WEEKLY CCS HERE, ALREADY 60% PROFITABLE. MONTHLIES AND LEAPS I WILL KEEP FOR WHEN WE CORRECT FROM 218.

THIS SCHEDULE SUGGESTS WE WILL CORRECT INTO P&D INSTEAD OF RALLYING.

Aside from being ICs, low risk SPY trades remind me of Karen "The Supertrader." It's a blast from the past. Everyone questioned her #s as she claimed to significantly outperform the market trading 3 StDev 5 delta short puts. She was trading with other's monies, lost big in the end, and had a lawsuit. I haven't heard much about her lately. Tastytrade still touts her as a success but reports say she carried her losses forward thereby inflating profits.

R

ReddyLeaf

Guest

^^ Thanks. Bought 2x c190s at $2.62 for Friday. Hoping for a small bounce tomorrow. Maybe score some beer money for the weekend.

I hope you're right. Dan Shapiro called the action perfectly today with a break at 190.5. He is hoping for a market gap up tomorrow at the open to play the downside again. He thinks if TSLA breaks 185 it is going to 182 or lower. He thinks the markets were up too much too fast from CPI and needed a rest. Could rest again tomorrow before climbing next week.I THINK WE ARE CLOSE TO A BOTTOM FOR WAVE 2/B. MAY GO DOWN FURTHER, IDK. BUT DOUBLE BULLISH DIVERGENCE CAN BE SEEN ON THE 30M TIMEFRAME. THAT'S GOOD ENOUGH FOR ME CONSIDERING WAVE 1/A AND 2/B ARE SUPER SHORT. ASSUMING THE ENTIRE 5 WAVE SEQUENCE PLAYS OUT, WE'RE PROBABLY LOOKING AT 218 AS THE TOP. NOW, THIS WHOLE THING (BLUE SEQUENCE) CAN EITHER BE A DECENT SIZE WAVE 1 OF SOMETHING MUCH BIGGER, OR THAT'S IT, THAT'S THE WHOLE DEAD CAT.

I'M CLOSING 50% OF MY WEEKLY CCS HERE, ALREADY 60% PROFITABLE. MONTHLIES AND LEAPS I WILL KEEP FOR WHEN WE CORRECT FROM 218.

THIS SCHEDULE SUGGESTS WE WILL CORRECT INTO P&D INSTEAD OF RALLYING.

View attachment 875254

The 10 year yield is way down since last Wednesday’s CPI. We were at 4.15 and now it’s down to 3.7.

Last time it was around here was Oct 5 when TSLA was at 240. Seems like that should be a tailwind.

Sold some pennies in front of the steamroller to move my -p195s for this week to -p190s. Holding 4x -c195 and 8x -c200 against 10x next week’s +c200.

Last time it was around here was Oct 5 when TSLA was at 240. Seems like that should be a tailwind.

Sold some pennies in front of the steamroller to move my -p195s for this week to -p190s. Holding 4x -c195 and 8x -c200 against 10x next week’s +c200.

Closed out my 175p bps for this week, finally, for a net of about .15 (.95 in, .80 out). Had a 2/3rds gain yesterday but didn't take it looking for an extra penny. Woke up today to an excellent opportunity for opening a new bps. Thankfully the old was still modestly profitable. Yes - I'm still disappointed in myself for not closing out / opening positions when I decide to open / close them, and instead go fishing after a few extra pennies. In this particular instance it cost me .50+; the number of fishing for pennies I have to get right to balance that out is like a quarter or more of trading. Its fun when it works, but in my own trading pattern / strategy its works badly for me overall.

Opened new 175/155 bps for next week - in for 2.20 or so. That's an 11% credit against a $20 wide spread; very high for me.

Also closed the 200 strike cc for this week - about 60% gain on those.

Opened new 175/155 bps for next week - in for 2.20 or so. That's an 11% credit against a $20 wide spread; very high for me.

Also closed the 200 strike cc for this week - about 60% gain on those.

EVNow

Well-Known Member

Anyone done anything (like incorporating an S corp for trading etc) to reduce taxes on options ?

intelligator

Active Member

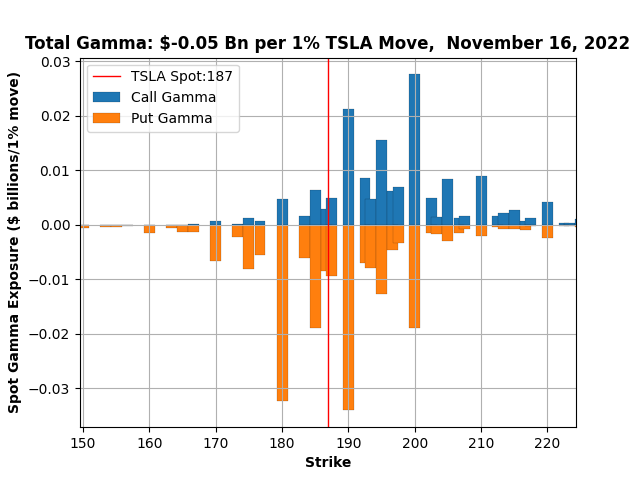

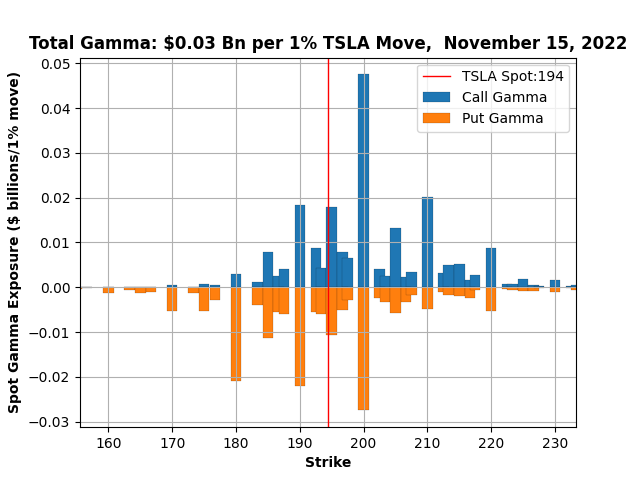

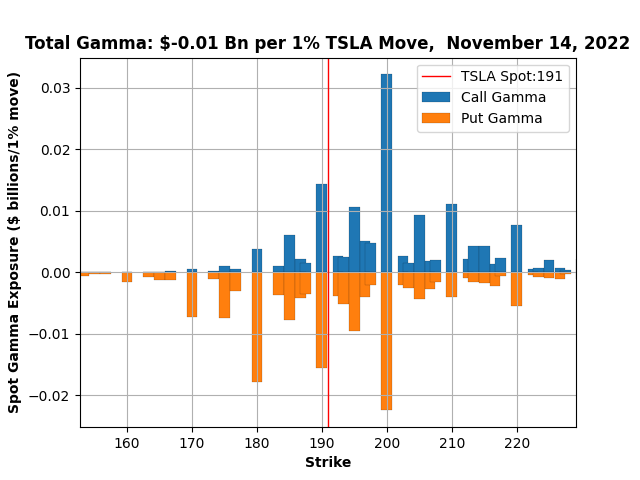

Gamma M- , T+ , W- , very much reflected in call spike Tuesday. The put side hasn't really changed much, less call exposure. All tapped out to write new CSPs, tomorrow would have been a good trade opportunity for this or next week. The share assignment last week hit margin, I had to reneg a whopping 10.575% down to 9.25%; With price this low, I don't really want to sell shares but can't readily buy either, without tapping margin. The few BPS left I've adjusted to safe levels, but those too can't be bought back. If we do tag 182 I'll sell the Protective Puts left on the long side of the assigned BPS ... live to fight another day, they say

P.S. Who thinks we stay under 200 Friday? I'm tempted to reel in Jan '24 -C550 to Nov 18 -C200 for minimal credit. I rolled these to safety when DITM and didn't want to have the shares called away. The purpose is to free the shares to write weekly CC 10% out. Quote this part if you have another idea.

P.S. Who thinks we stay under 200 Friday? I'm tempted to reel in Jan '24 -C550 to Nov 18 -C200 for minimal credit. I rolled these to safety when DITM and didn't want to have the shares called away. The purpose is to free the shares to write weekly CC 10% out. Quote this part if you have another idea.

Last edited:

I had though about selling shares in pre-market this morning, but chickened out. @Yoona, do you know how often the low of the day is below Pre-market low?

Yesterday, I should not have bought back my CC for Friday hoping for another leg in today. I need to learn how often you can buy back positions the next day for more than you closed the day before. I'm guessing that with extrinsic burn, it doesn't happen too often unless the SP gaps up significantly.

Yesterday, I should not have bought back my CC for Friday hoping for another leg in today. I need to learn how often you can buy back positions the next day for more than you closed the day before. I'm guessing that with extrinsic burn, it doesn't happen too often unless the SP gaps up significantly.

JSML

Member

When you say you close out 50% of your weekly CCs, do you mean Nov 18 at 210 and 215 strikes that you sold earlier? Is the rationale that you will sell more CCs before Friday?I THINK WE ARE CLOSE TO A BOTTOM FOR WAVE 2/B. MAY GO DOWN FURTHER, IDK. BUT DOUBLE BULLISH DIVERGENCE CAN BE SEEN ON THE 30M TIMEFRAME. THAT'S GOOD ENOUGH FOR ME CONSIDERING WAVE 1/A AND 2/B ARE SUPER SHORT. ASSUMING THE ENTIRE 5 WAVE SEQUENCE PLAYS OUT, WE'RE PROBABLY LOOKING AT 218 AS THE TOP. NOW, THIS WHOLE THING (BLUE SEQUENCE) CAN EITHER BE A DECENT SIZE WAVE 1 OF SOMETHING MUCH BIGGER, OR THAT'S IT, THAT'S THE WHOLE DEAD CAT.

I'M CLOSING 50% OF MY WEEKLY CCS HERE, ALREADY 60% PROFITABLE. MONTHLIES AND LEAPS I WILL KEEP FOR WHEN WE CORRECT FROM 218.

THIS SCHEDULE SUGGESTS WE WILL CORRECT INTO P&D INSTEAD OF RALLYING.

View attachment 875254

bkp_duke

Well-Known Member

Anyone done anything (like incorporating an S corp for trading etc) to reduce taxes on options ?

Taxes flow through an S-corp direct to the owners. I have an S-corp, doesn't help.

You can become a registered/verified trader (don't remember the exact term), but there are drawbacks to that.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K