intelligator

Active Member

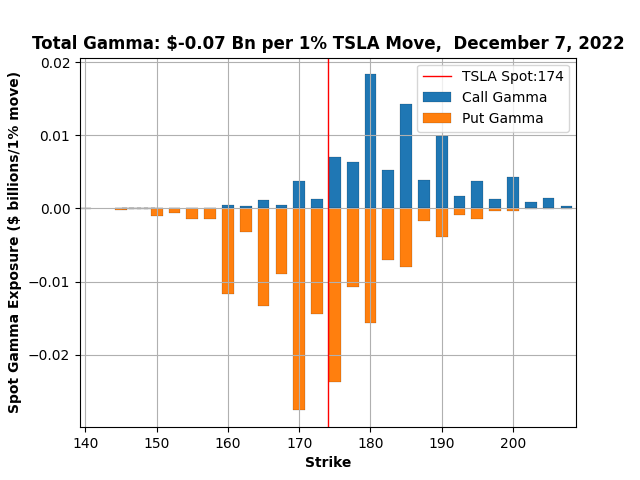

Yikes! For CC expiring sake, glad to see c190 trim some, c180 and c185 increased. The put interest shifted left by adding to p160-p175, trimmed some at p180 ... are the high 160's evident? 172 bottom, where are you ???

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

i've been noticing that TSLA is climbing just before end of day, so i checked...

TSLA Last 20 Minutes of Trading - Red or Green?

in the last 16 days, there is 94% probability of sp going up in the last 20 minutes

View attachment 882524

for Thanksgiving 11/25 half day, used 12:40pm to 1pm

Wow, looks like they’re dumping in the morning on open and then buying back end of day. Kills any chance to gain upward momentum.

Curious trading of Dec16th DITM puts today that makes no sense to me. Over 30,000 p300s traded, but only 3200 open interest.How is this even possible? Furthermore, these are so far out, there’s ZERO time value. See below graph for other similar high puts traded. Why would anyone BUY +p300s for $126 unless they think the SP will drop and want a guaranteed place to put shares? This would be a highly inefficient use of capital (unless MMs naked shorts). These cannot be SOLD -p300s because 1) there were 1/10 as many open and 2) they have no time value and would immediately be bought back (as we’ve seen for other DITM puts). I had to confirm the data directly on the Nasdaq site because I thought maybe the MaxPain site was erroneous. I posted some similar observations awhile back, so maybe this is a routine MO. Edit: found my previous 11/22 post: Here. Perhaps this is actually good news, since 11/22 was coincidentally the day the SP hit $166. Will we rally tomorrow because of naked short covering? @BornToFly @Yoona

@Chenkers @Max Plaid @OrthoSurg @dl003

So is this evidence of naked shorting or other shenanigans? @Artful Dodger @Papafox thoughts?

View attachment 882575

View attachment 882577

Curious trading of Dec16th DITM puts today that makes no sense to me. Over 30,000 p300s traded, but only 3200 open interest.How is this even possible? Furthermore, these are so far out, there’s ZERO time value. See below graph for other similar high puts traded. Why would anyone BUY +p300s for $126 unless they think the SP will drop and want a guaranteed place to put shares? This would be a highly inefficient use of capital (unless MMs naked shorts). These cannot be SOLD -p300s because 1) there were 1/10 as many open and 2) they have no time value and would immediately be bought back (as we’ve seen for other DITM puts). I had to confirm the data directly on the Nasdaq site because I thought maybe the MaxPain site was erroneous. I posted some similar observations awhile back, so maybe this is a routine MO. Edit: found my previous 11/22 post: Here. Perhaps this is actually good news, since 11/22 was coincidentally the day the SP hit $166. Will we rally tomorrow because of naked short covering? Calling all traders: @BornToFly @Yoona

@Chenkers @Max Plaid @OrthoSurg @dl003 @juanmedina @adiggs @Jim Holder

So is this evidence of naked shorting or other shenanigans? @Artful Dodger @Papafox thoughts?

View attachment 882575

View attachment 882577

It looks promising based on the data in the recent events. Do you have the data for the whole OpEx week performance Mon-Fri or Fri-Fri. Thanks in advance.for 12/16...

TSLA Triple-Witching OpEx (Day Of)

What is the stock price performance of TSLA on OpEx Friday? (Thur Close to Fri Close)

View attachment 882623

View attachment 882621

i have 2 wks before (ie 12/2-12/16) and 1 wk after (12/9-12/16) :It looks promising based on the data in the last 8 events. Do you have the data for the whole OpEx week performance Mon-Fri or Fri-Fri. Thanks in advance.

TSLA Triple-Witching OpEx (2 Weeks Before and 1 Week After)

What is the stock price growth of TSLA 2 weeks heading into OpEx (14 DTE blue) and 1 week after OpEx (green)?

For ex,

- OpEx is 2022-03-18

- (blue) TSLA is +8% from 2022-03-04 to 2022-03-18 (14 DTE) OpEx

- (green) TSLA is +11.62% from 2022-03-18 OpEx to 2022-03-25 (1 week later, Fri Close)

View attachment 881691

Until the bear market is overSelling CC's now is like going to Vegas and plunder all machines.

Of course this only work until it isn't, so I would stay careful.

Bloomberg repushing China FUD causing the PM dump from +0.5% to -2%

Pretty bad. I'll tell you what, they may be smart at engineering and manufacturing but they are dumb as bricks when it comes to investor relations. If the demand concerns are true and Q4 is a miss you may as well just sell premarket because nothing will save this stock from plumetting. O and Elon will probably pump it a bit during the earnings call then sell some more shares a week later.How are you guy feeling about Q4? There is no immediate Tesla catalyst at all other than P&D. Retail has run out of ammo and doesn't have the power to turn this ship around. If Q4 doesn't print we are royally screwed IMO. You can tell that many long time members in this forum are starting to panic including myself. I really want to see the Q4 result before I make any rash decisions. Just venting here. I sold a few $210's for next week yesterday.

I'm already of the mindset that we'll only get clear cut information on the next earnings call. If Q4 is as good as Elon thought it would be, a bottom for the stock should be formed by then.In the absence of communication by Tesla, many investors are going to assume the worst. Tesla could release a two sentence explanation that would reverse the 10% plunge this week. But we may have to wait until the next P&D report a month from now to get those answers.

I have $195 and $200 12/16 CC to either hold until expiration, or close by 12/12 to be out before the inflation report, and thinking to stay out for the holidays and through the 1/2 P&D. Have made double my CC income target in the past month, 8/1-12/7 almost even with rolls and DITM rescues, 1/1-7/1 was excellent. Just one data point.How are you guy feeling about Q4? There is no immediate Tesla catalyst at all other than P&D. Retail has run out of ammo and doesn't have the power to turn this ship around. If Q4 doesn't print we are royally screwed IMO. You can tell that many long time members in this forum are starting to panic including myself. I really want to see the Q4 result before I make any rash decisions. Just venting here. I sold a few $210's for next week yesterday.