LOL! I didn't say you'd have a hose, or that you'd be close by (drive through car washes in the area where there is shopping).....but I can see you like to cause trouble, and I appreciated the laugh. I'm am now picturing you as a giant animated monkey wrecking havoc along the freeways. Thanks!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short-Term TSLA Price Movements - 2013

- Thread starter Robert.Boston

- Start date

- Status

- Not open for further replies.

Norbert

TSLA will win

But we already have battery chemistry that requires less management, LiFePO4 and Lithium titanate, they just don't have the energy density and low cost, though LiFePO4 in volume production should actually be cheaper than the cells Tesla is currently using. I'd even argue that Nissan's chemistry needs less temperature management, though they took it too far by using none.

We do have battery chemistries which don't require thermal management (or less of it), but when you use the word "already", it suggests that future battery techs will in general require less thermal management. However it may be that for a very long time, a trade-off with other features will remain. Those chemistries, without that requirement, are not necessarily the exclusive path to the future.

So for as long as Tesla has better thermal management, Tesla may also often (or even always) be able to use battery technologies which have better features otherwise. The point being, that we are not necessarily moving from one to the other. (And certainly not any time soon.)

ShortSlaver

Member

That is actually an interesting idea. If Tesla owners had car washes at Supercharging stations, that's one more thing they could do to "kill time" while charging. There's only so much coffee and In-and-Out burgers one can eat before feeling sick!

Swap the battery while getting a car wash would be pretty rad, even if not practical.

The president really seems to be hyping up the economics speech tomorrow. I know it can be akin to reading tea leaves to prognosticate what that can mean for the stock market in general, much less the impact on TSLA, but does anyone have any insight on past economics speeches by sitting presidents? Particularly when the president is excited about giving it? Is it insignificant in the obstructionist Congress era? Or will there be meaningful policy changes/reform that Obama can enact through executive order?

deonb

Active Member

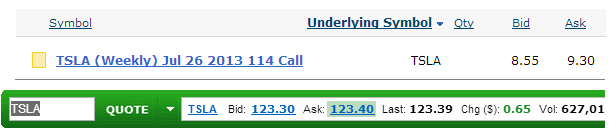

Are the arbitrage computers asleep at the wheel today? That $9.30 ask is me - how did this not get sold? Groan.

CyberDutchie

Active Member

toastypasta

Member

DonPedro

Member

Testing 120 level again, what's happening?

Recent price levels likely brought in weak longs who set tight stop loss limits. When a hedge fund initiates a quick short selling program, it triggers a cascade through all of those limits. The fund can then cover leisurely during the rest of the day and reap a profit.

Short interest will be reported after the market close today. It should be interesting.

sleepyhead

Active Member

I am getting slaughtered today.... MU, SOL, SPWR and TSLA all down big....

I took advantage of it and bought some more SOL at $4.12. Already back up above $4.25

These are the opportunities you need to take advantage of as an investor. SOL just ran up 100% in a month. It has corrected almost 20% since yesterday morning, and since my investment thesis on SOL has not changed I quickly scooped up a few thousand more shares. People will take profits after a 100% run up in a stock. Doesn't mean that the rally is over. If the stock goes below $4, I will buy even more.

toastypasta

Member

Just bought more August 150 calls.

Lowered my average buy and basically gambling.

Any good news or good earnings and i'll make a killing or lose it all.

Lowered my average buy and basically gambling.

Any good news or good earnings and i'll make a killing or lose it all.

sleepyhead

Active Member

Just bought more August 150 calls.

Lowered my average buy and basically gambling.

Any good news or good earnings and i'll make a killing or lose it all.

Good move Pasta, I own a few of those myself.

sleepyhead

Active Member

I hear you sleepy on grabbing more. I couldnt because i am saving my last chunk of investment money to put on TSLA for earnings, which i am still un-easy about. you never know how the street will take anything in a earning report.

Sorry to go off topic here again, but I didn't have any cash either. So I sold some SPWR (about 1% - 2% down) and some SCTY (about break even) and bought some SOL that was down 8%. Quick reshuffling of the portfolio to take advantage of irrational price swings.

With a long range goal of accumulating shares and options for the earnings, I've been riding this volatility - especially at market open.

Picked up some Sept $150 calls when they bottomed out this morning at $3.50

Having buy limit orders in for options that I would be happy keeping for the next month or so at a bargain is how I'm accumulating.

Picked up some Sept $150 calls when they bottomed out this morning at $3.50

Having buy limit orders in for options that I would be happy keeping for the next month or so at a bargain is how I'm accumulating.

Just bought more August 150 calls.

Lowered my average buy and basically gambling.

Any good news or good earnings and i'll make a killing or lose it all.

I've got a few of those right now, picked up some Sept 150's too and some Aug 190 lottery tickets (Only a couple hundred bucks worth though) For some reason, I'm nervous as I have no idea how good or bad news will be received leading up to and after the ER.

ongba

Member

Does anyone have a portfolio made up exclusively of TSLA options? If so, what strikes and expiration do you have? I currently have 100% in Tsla Sept 115s bought awhile back for around 10.65. Contemplating whether it would be prudent to hold through earnings or roll prior to earnings to jan 14 or jan 15. Any thoughts would be appreciated! Thanks.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 226

- Locked

- Replies

- 0

- Views

- 4K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 21

- Views

- 6K