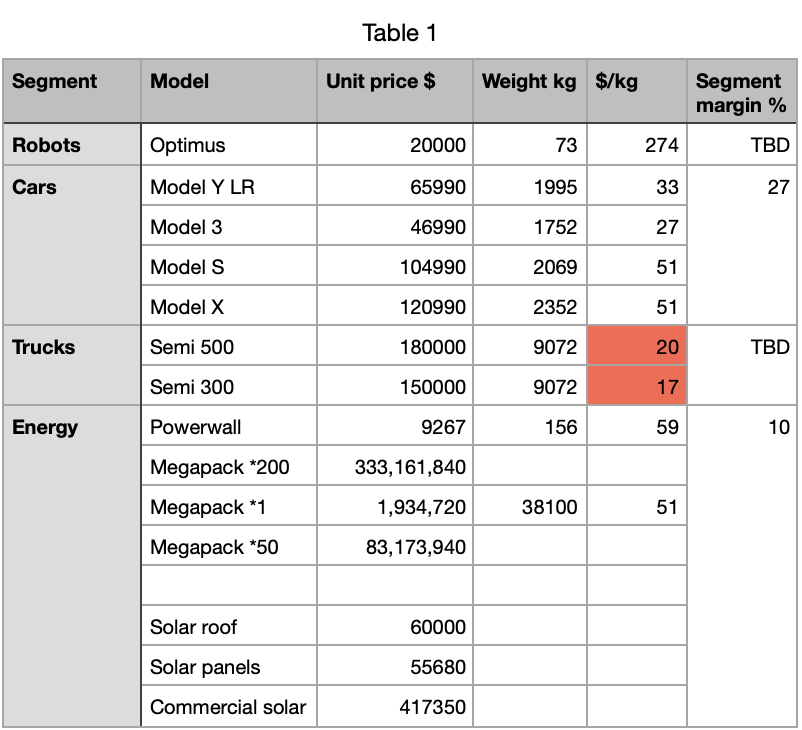

This pretty well highlights how Tesla needs to spend more engineering effort on reducing the cost of the Powerwall. Of course, as a relatively low cost product compared to the rest of their products, there is less room for optimization.Energy is low margin compared to cars and thus got lower priority. Semi is lower yet. Since we are hearing that Tesla is not cell constrained, I instead looked at $/kg. Take a look at the red cells in this table. How does this fit in with a high margin strategy? Or has Tesla now reached the point where the present day mission fulfillment takes priority over growth?

Given that cells should be well under $100 / kWh at this point, if Tesla's margins are only 10% on the Powerwall (so < $1500 for cells), they have a lot of room for packaging and manufacturing optimization there. I would guess that the other big cost is in the AC/DC power electronics.

With 1 MWh of cells in the 500 mi Semi, that's around $100,000 for the cells - at ~$200k for the truck I bet they're able to put that pack into the rest of the truck for $50k and still get around 25% margins.

Anyway - I have no issue with Tesla working on all these things as they're all needed - but I still would like to see a Powerwall V3 that further brings the cost down - probably using LFP cells vs the NCA? cells it uses now.