Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla BEV Competition Developments

- Thread starter uselesslogin

- Start date

-

- Tags

- TSLA

willow_hiller

Well-Known Member

Rivian Q1 P&D are out.

9,395 produced

7,946 delivered

.jpeg?auto=webp)

.jpeg?auto=webp) stories.rivian.com

stories.rivian.com

Can't find a consensus for a single quarter, but 50k expected for 2023. Might be achievable with Q1 being seasonally poor?

9,395 produced

7,946 delivered

.jpeg?auto=webp)

Q1 PRODUCTION AND DELIVERY NUMBERS ANNOUNCED, ON TRACK WITH 2023 ANNUAL PRODUCTION GUIDANCE - Rivian Stories

We reported our official Q1 production and delivery numbers this morning. Vehicles Factory Gated: 9,395Vehicles Delivered: 7,946Our Q1 production results are in line with our expectations and we believe we are on track to deliver on the 50,000 annual production guidance previously provided...

Can't find a consensus for a single quarter, but 50k expected for 2023. Might be achievable with Q1 being seasonally poor?

wws

Active Member

He forgot the "dotted line" from the Porsche bubble back up to the top of VW. The Porsche and Piech families are tied at the hip.

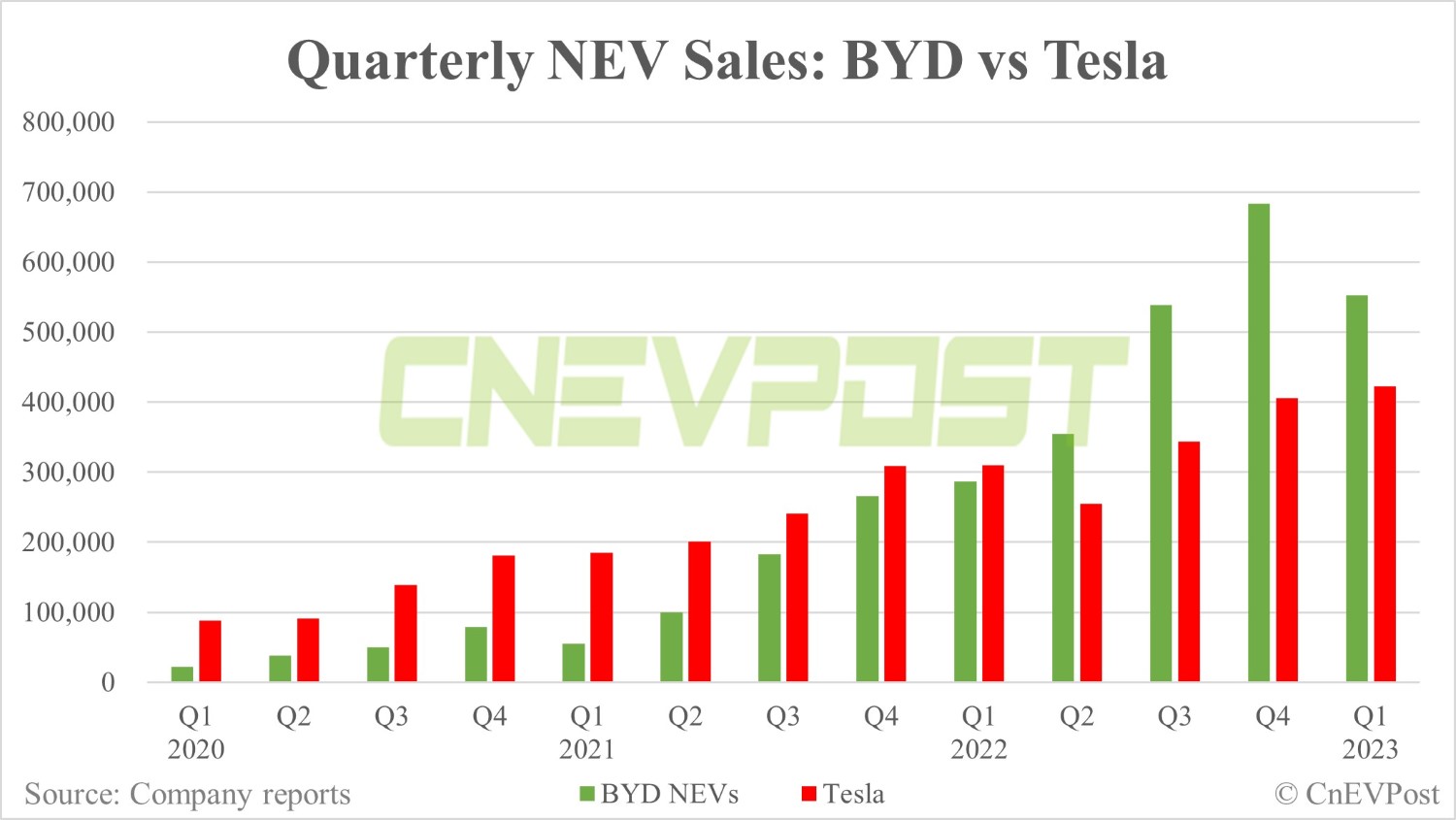

Q1 2023 BYD vs Tesla

(As usual, NEV includes hybrids see BYD Mar sales breakdown: Qin 40,850, Song 40,510 for model breakdown)

Tesla delivers record 422,875 vehicles globally in Q1

(As usual, NEV includes hybrids see BYD Mar sales breakdown: Qin 40,850, Song 40,510 for model breakdown)

Tesla delivers record 422,875 vehicles globally in Q1

RobStark

Well-Known Member

Rivian is back on the board of Top 25 Automakers by Market Cap.

GM,Ford and Stellantis have flipped vs a month ago.

GM, Ford, Stellantis now Stellantis, Ford, GM.

Ford says 4 of 6 EVs will drop to half credit April 18th. Lightning and Lincoln Aviator Grand Touring will keep $7,500 .

Ford says new rules will cut EV tax credit in half for most models

Ford says new rules will cut EV tax credit in half for most models

ID.4 recall due to doors that may self open (if water gets in door module)

Interesting review of the HiPhi Z made by Chinese brand Human Horizons. The Fully Charged Show reviewer claims it's the top of the tech tree for Chinese vehicles today. I think it looks like fun even though it is 50% LEDs.

Tesla Bjorn has thinks the Mercedes EQS 580 is the best overall large SUV on the market today, even if it is a bit thirsty. It should be pretty good for ~$200k.

RobStark

Well-Known Member

Tesla Bjorn has thinks the Mercedes EQS 580 is the best overall large SUV on the market today, even if it is a bit thirsty. It should be pretty good for ~$200k.

In the US the EQS SUV 580 starts at $126k. The EQS line starts at $104k.

RobStark

Well-Known Member

EQS 580SUV range is listed as 285 miles by Mercedes.

Tesla and Lucid run the 5 cycle EPA test and try to publish the biggest number they can.

Almost everyone else runs the much cheaper to do 2 cycle EPA test.

Most other OEMs post conservative EPA ranges and try to under promise and over deliver.

EV buyers from traditional OEMs will rate their BEVs very poorly in consumer surveys if real world range doesn't match rated range.

Tesla, Lucid and Rivian buyers seem to give their cars a pass in the same surveys regarding range.

Write up on the methods:Tesla and Lucid run the 5 cycle EPA test and try to publish the biggest number they can.

Almost everyone else runs the much cheaper to do 2 cycle EPA test.

Most other OEMs post conservative EPA ranges and try to under promise and over deliver.

EV buyers from traditional OEMs will rate their BEVs very poorly in consumer surveys if real world range doesn't match rated range.

Tesla, Lucid and Rivian buyers seem to give their cars a pass in the same surveys regarding range.

The Secret Adjustment Factor Tesla Uses to Get Its Big EPA Range Numbers

Here's a fun midsize electric pickup. It's pre-production for now but if it comes in at a decent price I could see a lot of them being sold outside North America. Unfortunately it appears the company will have a long road ahead of them, even if they do claim to be the California EV maker of the year.

You can buy their stock on their website for $18.50/share until the 18th of May.

Alpha Motor | StartEngine

You can buy their stock on their website for $18.50/share until the 18th of May.

Alpha Motor | StartEngine

petit_bateau

Active Member

Another UK Brexshit sh1tshow for the UK car industry

"Ineos, the company founded and run by the British billionaire Sir Jim Ratcliffe, will build an electric version of its new Grenadier off-road vehicle in Austria.

The electric version of the 4x4 will be developed with the Canadian car parts manufacturer Magna and production is scheduled to start in 2026. The decision means that the UK has missed out on building a second Ineos vehicle, after Ratcliffe, a vocal Brexit backer who is resident in Monaco for tax purposes, chose a French factory for the original Grenadier."

www.theguardian.com

www.theguardian.com

"Ineos, the company founded and run by the British billionaire Sir Jim Ratcliffe, will build an electric version of its new Grenadier off-road vehicle in Austria.

The electric version of the 4x4 will be developed with the Canadian car parts manufacturer Magna and production is scheduled to start in 2026. The decision means that the UK has missed out on building a second Ineos vehicle, after Ratcliffe, a vocal Brexit backer who is resident in Monaco for tax purposes, chose a French factory for the original Grenadier."

Brexit backer Jim Ratcliffe’s Ineos to build electric Grenadier in Austria

Britain misses out on building second Ineos vehicle, after company chose France for original model

RobStark

Well-Known Member

Ford F-150 Lightning Going Global, Coming To Norway In 2024

In response to "overwhelming public demand" from Norwegian consumers, the F-150 Lightning will reach Norway next year as a special Lariat Launch Edition model.

"In my 25 years at Ford, I've never seen anything like the passion and demand I'm seeing from drivers right now to get behind the wheel of our F-150 Lightning. I've had customers literally banging on my door and pleading for us to bring the electric pickup to Norway."

Per Gunnar Berg, managing director, Ford Norway

Here's a fun midsize electric pickup. It's pre-production for now but if it comes in at a decent price I could see a lot of them being sold outside North America. Unfortunately it appears the company will have a long road ahead of them, even if they do claim to be the California EV maker of the year.

View attachment 928587

You can buy their stock on their website for $18.50/share until the 18th of May.

Alpha Motor | StartEngine

The downside of owning an EV made by a now defunct company is probably considerably greater than with ICE. No computer in a Delorean.

I don't see how these small startups can spread their software developments costs over enough vehicles.

Even Rivian with a 12 billion IPO may not scale sufficiently to cover their overhead in their current form.

adiggs

Well-Known Member

I figure the next owner of the Rivian is getting the benefit of a fantastic amount of investor cash. They'll be able to buy that out of bankruptcy for pennies on the dollar.The downside of owning an EV made by a now defunct company is probably considerably greater than with ICE. No computer in a Delorean.

I don't see how these small startups can spread their software developments costs over enough vehicles.

Even Rivian with a 12 billion IPO may not scale sufficiently to cover their overhead in their current form.

And that is how I figure Rivian gets to the scale sufficient to cover their overhead - as a part of somebody else.

Similar threads

- Replies

- 10

- Views

- 959

- Replies

- 53

- Views

- 2K

- Replies

- 16

- Views

- 2K