Yep pretty dog friendly...only one surly cat around...but just keep a laser pointer in your pocket and you will be fine.Yeah man. I’m all in. Swimming in the miracle Kool-Aid.

My only fear was someone else has to have that avatar already. lol

PS: From one dog to another, is this place dog friendly? I’ve seen a lot of cats.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

VW plans to sell 500,000 ID.4 electric cars per year - Electrek

"In the interview, Brandstätter said that VW plans to sell 1.5 million electric cars per year by 2025, and they aim for ID.4 to account for ~500,000 of those sales:

Volkswagen wants to become the world market leader in e-mobility — but that won’t happen by itself. The Volkswagen brand is therefore investing around 11 billion euros by 2024. As a compact SUV, the ID.4 has, in our view, the best prerequisites for being successful in a large scale in all important markets. We therefore expect the Volkswagen brand to produce a total of 1.5 million e-cars per year by 2025. And the ID.4 is likely to account for around a third of this. The ID.4 will thus become the driving force behind our reorientation a hundred thousand times over."

What does a person around here have to do to get an interview? I’d like to make my own statement about VW ‘e-car’ production for 2025.

Knightshade

Well-Known Member

VW plans to sell 500,000 ID.4 electric cars per year - Electrek

"In the interview, Brandstätter said that VW plans to sell 1.5 million electric cars per year by 2025, and they aim for ID.4 to account for ~500,000 of those sales:

They were also planning to be #1 in EVs by 2018 a few years earlier...how'd that work out?

That said- there's 80 million cars sold a year... Tesla won't be making even 1/5th that many for another couple years minimum....we know EV demand is high for good cars (Kia/Hyundai makes a decent one and has said they could sell massively more if they could get enough batteries to make more for example)

So if VW (or anybody) is able to build 1.5 million (or even 500k- keep in mind stuff like the Mach E is limited to 50k production because again nobody has enough batteries)) worthwhile EVs, they'll easily sell em....

dc_h

Active Member

That whole area around GA4 and 4.5 is of interest. What is the pace of cars going in and out of GA4 and 4.5? I think there was changes on the other side of GA4 as well.

Thanks for the great videos @gabincal

ByeByeJohnny

Active Member

Are all the cars at Fremont coming out of the same port/door at the factory. If so we should pay @gabincal to fly his drone right there for maybe an hour per day a couple of times a week and we could probably get a very accurate production number.That whole area around GA4 and 4.5 is of interest. What is the pace of cars going in and out of GA4 and 4.5? I think there was changes on the other side of GA4 as well.

Thanks for the great videos @gabincal

MartinAustin

Active Member

Unless I am reading things wrongly, stock in Talga Resources (ASX:TLG) is up 21% so far today.

That's an Australian mining company that creates graphite anode material, discussed by Gordon Gesigy about a month ago.

Is it possible that Tesla derivative stocks might jump up or down, depending on leaks or announcements occurring around the Battery Day event?

That's an Australian mining company that creates graphite anode material, discussed by Gordon Gesigy about a month ago.

Is it possible that Tesla derivative stocks might jump up or down, depending on leaks or announcements occurring around the Battery Day event?

Yeah man. I’m all in. Swimming in the miracle Kool-Aid.

My only fear was someone else has to have that avatar already. lol

PS: From one dog to another, is this place dog friendly? I’ve seen a lot of cats.

boomer is dog, but loves all animals

(even the mean ones)

TheTalkingMule

Distributed Energy Enthusiast

Looked up call prices last night for Jan 2021 and thought to myself, "Hey these are almost reasonable, I'm gonna buy some tomorrow if we drop a bit."

Stone cold lock for a 6% pre-market followed by a +10% day. Going back to sitting on hands.

Stone cold lock for a 6% pre-market followed by a +10% day. Going back to sitting on hands.

Krugerrand

Meow

PS: From one dog to another, is this place dog friendly? I’ve seen a lot of cats.

Tolerated, the same way we tolerate birds.

ZachF

Active Member

Somebody is buying....But I ain't selling!

They must finally be realizing the implications from the battery leaks... The implications being ICE is a dead man walking.

Always worth posting Rob Maurer videos here just in case people don't religiously watch them. This is his battery day predictions. At the end of the video Rob says he left out one prediction which he believes more important than everything else he mentioned. My guess is the potential of Tesla Energy enabled by larger better battery supply. Tesla energy is going after a bigger market than auto. The reason very few have focussed on it is because thus far Tesla has not had enough batteries to go after energy as ambitiously as auto. In the Autonomy Day presentation there were clear figures showing how a robo taxi fleet would blow away the competition and be a huge profit generator. Batteries does the same thing when applied to the energy sector.

Last edited:

Krugerrand

Meow

They must finally be realizing the implications from the battery leaks... The implications being ICE is a dead man walking.

Or just getting a jump on controlling the SP and having it end up at $450 for the day.

I think the cost implications will be the main focus - but that could extrapolate out into energy markets and robotaxi economics. Rob loves a spreadsheet.Always worth posting Rob Maurer videos here just in case people don't religiously watch them. This is his battery day predictions. At the end of the video Rob says he left out one prediction which he believes more important than everything else he mentioned. My guess is the potential of Tesla Energy enabled by larger better battery supply. Tesla energy is going after a bigger market than auto. The reason very few have focussed on it is because thus far Tesla has not had enough batteries to go after energy as ambitiously as auto. In the Autonomy Day presentation there were clear figures showing how a robo taxi fleet would blow the competition and be a huge profit generator. Batteries does the same thing when applied to the energy sector.

ZachF

Active Member

Or just getting a jump on controlling the SP and having it end up at $450 for the day.

....Probably more likely TBH

I have to disagree

20M cars

40k ASP

25% gross margin

$200B gross profit

$20B SGA

We're easily looking at $100-150B net income from auto alone in 2030. A puny 20x multiplier gives it $2-3T valuation.

Exactly. Tesla is turning the conventional wisdom about auto business ( low margin, high volume) on its head. Through vertical integration, electrical architecture and business model innovation, it is turning a low margin, high volume business into high margin, high volume business and this is un heard off.

Artful Dodger

"Neko no me"

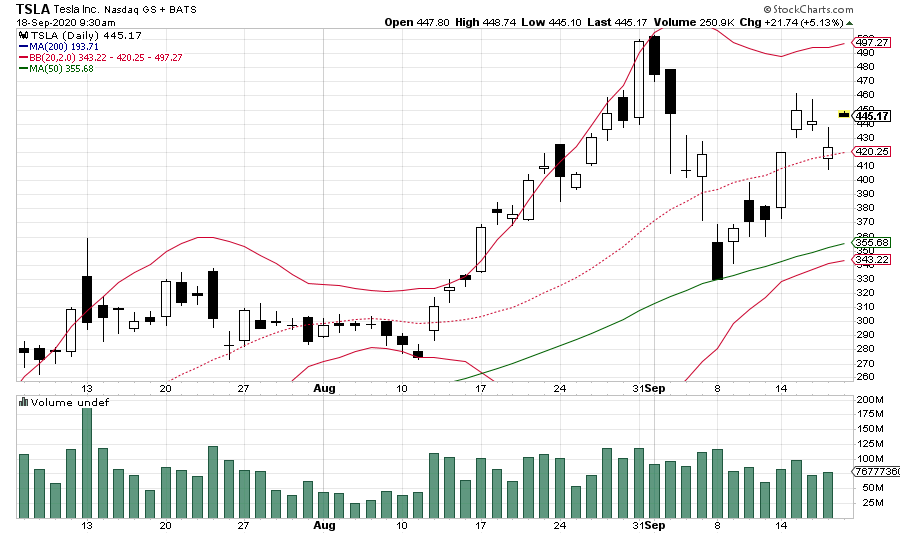

Here's today's Tech chart as of 09:30 AM

LN1_Casey

Draco dormiens nunquam titillandus

Love the Mid-band support level.

ZachF

Active Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M