Artful Dodger

"Neko no me"

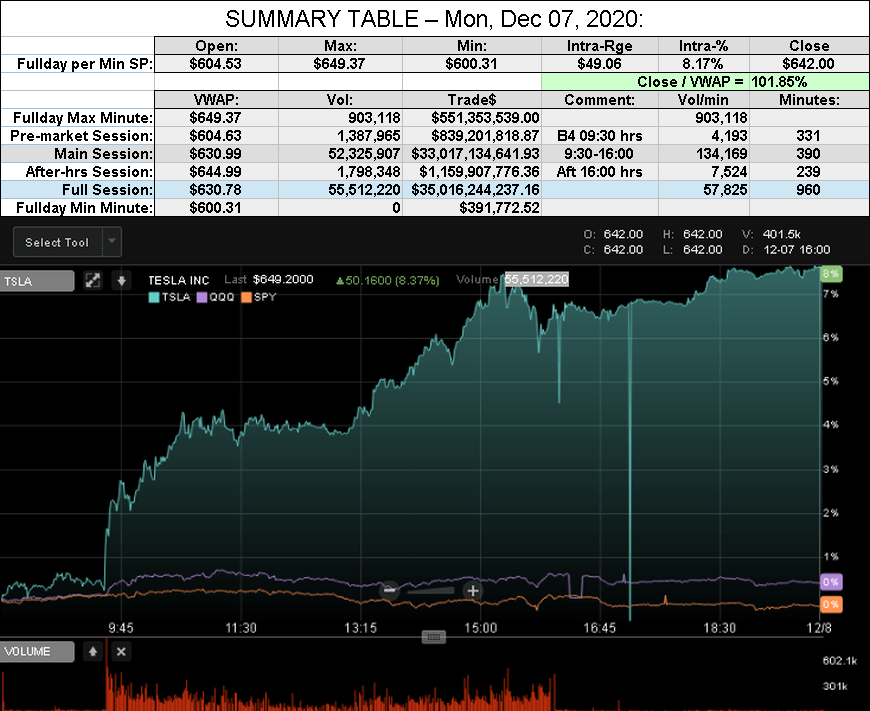

After-action Report: Mon, Dec 07, 2020: (Full Day's Trading)

Headline: "TSLA Tops $600B Mkt Cap"

QOTD: @Kruggerand "Mom says double"

Comment: "4 ATHs today, plus a nifty $649.45 After-hrs

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Tops $600B Mkt Cap"

Traded: $35,016,244,237.16 ($35.02B)

Volume: 55,512,220

VWAP: $630.78

Close: $641.76 / VWAP: 101.85%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $560 (+$10)

Mkt Cap: TSLA / TM $608.325B / $193.181B = 314.90%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

CEO Comp. Status:Volume: 55,512,220

VWAP: $630.78

Close: $641.76 / VWAP: 101.85%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $560 (+$10)

Mkt Cap: TSLA / TM $608.325B / $193.181B = 314.90%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

TSLA 30-day Closing Avg Market Cap: $482.79B

TSLA 6-mth Closing Avg Market Cap: $350.89B

Mkt Cap req'd for 6th tranche ($350B) reached today, Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche. Paging @The Accountant

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $350.89B

Mkt Cap req'd for 6th tranche ($350B) reached today, Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche. Paging @The Accountant

FINRA Volume / Total NASDAQ Vol = 52.8% (52nd Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 40.9% (46th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.45% of Short Volume (46th Percentile Rank)

FINRA Short / Total Volume = 40.9% (46th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.45% of Short Volume (46th Percentile Rank)

QOTD: @Kruggerand "Mom says double"

Comment: "4 ATHs today, plus a nifty $649.45 After-hrs

View all Lodger's After-Action Reports

Cheers!

Last edited: