Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Someone from somewhere with significantly more capital and firepower probably called him and said: "Hey Pierre, remember the time i told you to buy XYZ stock and you made $$$$$ from it...well, it's time to repay that favor...downgrade $TSLA so we can buy in at a cheaper price before S&P...wink, wink"

Perhaps, but that may even more likely apply to the lowly ranked JPMorgan analyst who suddenly felt compelled to reiterate his TSLA sell rating today, and advise S&P 500 index or benchmarked funds to hold down their their spending on TSLA. Despite such help from apparent accomplices, the necessary buying of TSLA by those funds should be nearly impossible to keep a lid on.

Lot of people trade short term Tesla options, including me, it's a hit or miss thing, but sometime I think If I put equal amount of money to buy stock, in 5 years return would be better, some how making money fast is satisfying.

UnknownSoldier

Unknown Member

Well I mean in 5 years we might all be dead from COVID-24 so at this point you might as well YOLO.Lot of people trade short term Tesla options, including me, it's a hit or miss thing, but sometime I think If I put equal amount of money to buy stock, in 5 years return would be better, some how making money fast is satisfying.

You can't predict what will happen to you in 5 years, but you can predict that in about 1-2 weeks the biggest planned and anticipated single forced share buying event in the history of the S&P 500 is going to occur. In such a situation, it's downright rational to be playing some short term options right now because if it pays off it will pay off big and immediately.

Mo City

Active Member

Chuck Cook is an FSD beta tester in Orlando and has some interesting thoughts about Green's recent postings on AP Developer Controls https://twitter.com/greentheonly/status/1336467014727110656. He says the settings that give weights to the various rules AP NNs use to make decisions may not be identical across all beta testers. Interesting thought.

I doubt it but maybe this is why Brandon's experiences with FSD beta in Sacramento seem so different than others.

Mods, this post is not intended to cause a drawn-out FSD discussion. Just thought it was worth a brief FYI in this thread.

I doubt it but maybe this is why Brandon's experiences with FSD beta in Sacramento seem so different than others.

Mods, this post is not intended to cause a drawn-out FSD discussion. Just thought it was worth a brief FYI in this thread.

May be we should start a Tslaholics anonymous.

I thought this group here was Tslaholics anonymous? Are you saying this is not? We are all hooked on TSLA and come here for the daily fix . Don’t know what I would do without this support group

Support group for sure, though AA helps you stay sober. Oh well..I thought this group here was Tslaholics anonymous? Are you saying this is not? We are all hooked on TSLA and come here for the daily fix . Don’t know what I would do without this support group

Criscmt

Member

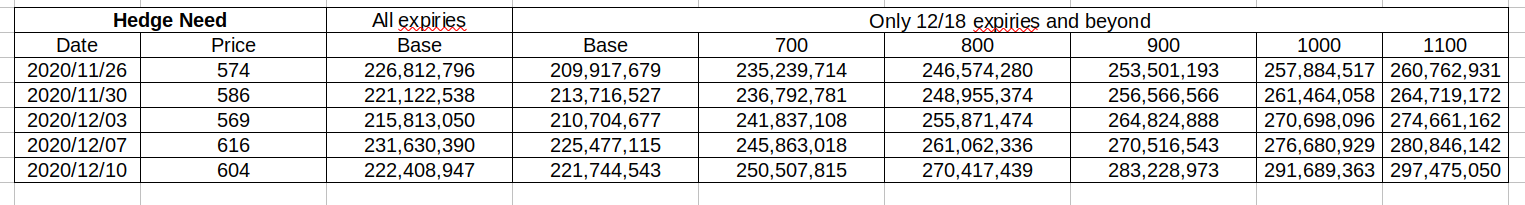

What The Tesla Options Market Is Predicting Regarding S&P Inclusion

Summary:

For 12/11, and primarily 12/18, significantly large bets on the call side, all the way to $900 strikes.

Today, even when stock went down ~7%, the call prices went up, as many were buying them heavily.

Buyers must be expecting a large gamma squeeze or strikes turning ITM.

Not much OI on the puts.

Red or Flat day expected for 12/10.

Summary:

For 12/11, and primarily 12/18, significantly large bets on the call side, all the way to $900 strikes.

Today, even when stock went down ~7%, the call prices went up, as many were buying them heavily.

Buyers must be expecting a large gamma squeeze or strikes turning ITM.

Not much OI on the puts.

Red or Flat day expected for 12/10.

mltv

Member

It is a shame that my previous post of the Quantumscape was removed from this thread from being informed about the competitive landscape that Tesla is in. But whatever. I normally read more than I post. Note I own 0 QSFor information on Quantumscape compared to Tesla watch these videos:-

Short answer Quantumscape definitely has some R&D breakthroughs that probably make commercial solid-state batteries viable.

However, Tesla's Battery Day tech is very competitive, Quantumscape now has to clear a much higher bar.

It isn't clear whether Tesla or Quantumscape will have better cheaper batteries in 5-10 years time, it is clear Quantumscape not have a significant impact for at least 5 years.

Todd Burch

14-Year Member

My thoughts are that this is a big attempt at shaking the tree.

Knowing what we know about the upcoming forced buying, they are trying to shake shares from weak hands.

Think about it. The big boys know what we know. Does it REALLY make sense to unload TSLA now? Now? Why not close to the 21st?

No, this is a bear trap. And it feels coordinated and just as “random” as the big upgrade from Morgan Stanley.

I believe it is wise to hold here. This is the opening act to the main event.

Knowing what we know about the upcoming forced buying, they are trying to shake shares from weak hands.

Think about it. The big boys know what we know. Does it REALLY make sense to unload TSLA now? Now? Why not close to the 21st?

No, this is a bear trap. And it feels coordinated and just as “random” as the big upgrade from Morgan Stanley.

I believe it is wise to hold here. This is the opening act to the main event.

It is a shame that my previous post of the Quantumscape was removed from this thread from being informed about the competitive landscape that Tesla is in. But whatever. I normally read more than I post. Note I own 0 QS

I want to talk more about QS so let's do it in this thread please All discussion of QuantumScape QS

See a bit of acceleration in options bought. Nothing surprising if you have been tracking the jump in IV.

*To clarify any confusion, reference price is before the market opens except for 12/7 which was after open. In this view it's not that important or relevant in any case.

*To clarify any confusion, reference price is before the market opens except for 12/7 which was after open. In this view it's not that important or relevant in any case.

Tslynk67

Well-Known Member

579$ in frankfurt and futures slightly in the red.

Just jumped to ~$600... Heavy volume for this exchange...

Is that by close this Friday, or Monday, Curt?

Artful Dodger

"Neko no me"

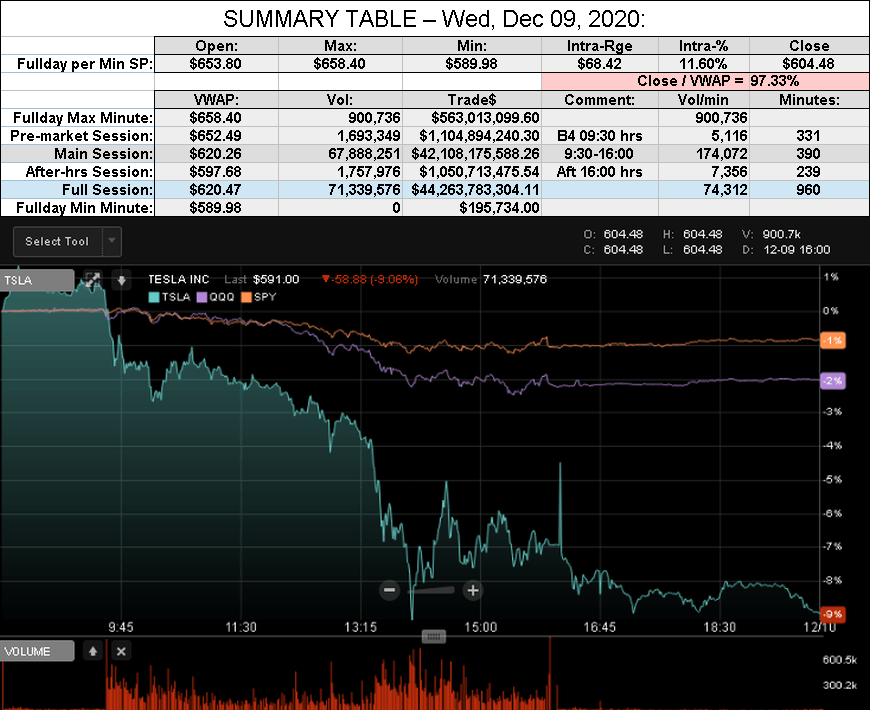

After-action Report: Wed, Dec 09, 2020: (Full Day's Trading)

Headline: "Market Tosses Witcher to the Curb"

Comment: "SP drops -9.52% narrowly avoiding Uptick Rule"

QOTD: @Krugerrand "If you listened to Elon, it really didn’t matter"

View all Lodger's After-Action Reports

Cheers!

Headline: "Market Tosses Witcher to the Curb"

Traded: $44,263,783,304.11 ($44.26B)

Volume: 71,339,576

VWAP: $620.47

Close: $604.48 / VWAP: 97.33%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $600 (+$10)

Mkt Cap: TSLA / TM $572.987B / $196.555B = 291.51%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

CEO Comp. Status:Volume: 71,339,576

VWAP: $620.47

Close: $604.48 / VWAP: 97.33%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $600 (+$10)

Mkt Cap: TSLA / TM $572.987B / $196.555B = 291.51%

Note: Yahoo Finance updated TSLA Mkt Cap for shares issued Sep 9th (per 10-Q)

TSLA 30-day Closing Avg Market Cap: $497.41B

TSLA 6-mth Closing Avg Market Cap: $357.44B

Mkt Cap req'd for 6th tranche ($350B) reached Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche.

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $357.44B

Mkt Cap req'd for 6th tranche ($350B) reached Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche.

FINRA Volume / Total NASDAQ Vol = 50.1% (49th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 38.8% (45th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.75% of Short Volume (48th Percentile Rank)

FINRA Short / Total Volume = 38.8% (45th Percentile rank Shorting)

FINRA Short Exempt Volume ratio was 0.75% of Short Volume (48th Percentile Rank)

Comment: "SP drops -9.52% narrowly avoiding Uptick Rule"

QOTD: @Krugerrand "If you listened to Elon, it really didn’t matter"

View all Lodger's After-Action Reports

Cheers!

cyclingthealps

Member

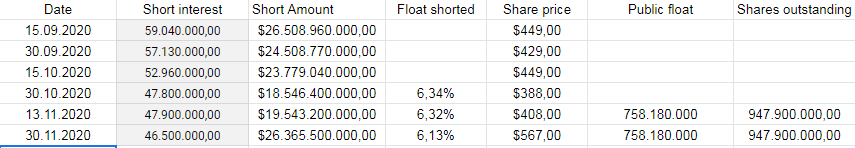

Short interest decreased in the period from 11/13/2020 (share price $408) to 11/30/2020 (share price $567,50)

The short amount increased massively, due to the rise in share price!

My view on the numbers, not so many shorts covered in this time period, and the money needed to cover increased big time.

Overview of the short interest from the last few months:

The short amount increased massively, due to the rise in share price!

- Shares shorted from 47.800.000 to 46.500.000

- Float shorted from 6,32% to 6,13%

- Amount shorted from $19.543.200.000,00 to $26.365.500.000,00

- Shares shorted from 47.900.000 to 48.260.000

- Float shorted from 6,32% to 6,36%

- Amount shorted from $19.543.200.000,00to $27.411.680.000,00

My view on the numbers, not so many shorts covered in this time period, and the money needed to cover increased big time.

Overview of the short interest from the last few months:

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Short interest decreased in the period from 11/13/2020 (share price $408) to 11/30/2020 (share price $567,50)

The short amount increased massively, due to the rise in share price!

According to Ihor https://twitter.com/ihors3/status/1333490594635767811

- Shares shorted from 47.800.000 to 46.500.000

- Float shorted from 6,32% to 6,13%

- Amount shorted from $19.543.200.000,00 to $26.365.500.000,00

My view on Ihor's numbers, I get the feeling he is just guessing.

- Shares shorted from 47.900.000 to 48.260.000

- Float shorted from 6,32% to 6,36%

- Amount shorted from $19.543.200.000,00to $27.411.680.000,00

My view on the numbers, not so many shorts covered in this time period, and the money needed to cover increased big time.

Overview of the short interest from the last few months:

View attachment 616243

I'm assuming the first data set you are referring to the official NASDAQ figures for the period? (Tesla, Inc. Common Stock (TSLA) Short Interest).

cyclingthealps

Member

YesI'm assuming the first data set you are referring to the official NASDAQ figures for the period? (Tesla, Inc. Common Stock (TSLA) Short Interest).

Artful Dodger

"Neko no me"

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M