Merry Christmas to you all!

Thank you Elon, thank you TMC for turning a terrible year into a positive one.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Is it just me, or is the Tesla app looking different this morning after summoning the car.....

View attachment 620963

They have zippers around the doors. When you load units on the trucks you hang your head out the window. Im not sure if these wraps are the same but most are some system close to thisHow do you load a wrapped up model Y for transport?

I was thinking these Y are not going to be shipped until later, so the covers are just protection while sitting around (storage vs transport).How do you load a wrapped up model Y for transport?

Many thanks for sharing @Blue horseshoe , highly interesting and helpful. One of my main fears (here's that word again) is that my core shares or LEAPS are getting called away and I'm not able to participate in the "unlimited" upside of both positions (FOMO!). This strategy seems to be a great answer to this challenge.

I don't know how that reviewer can claim the Mach-e is impressive and "stands tall" against the Model Y in "most competitive measures".

The most glaring deficiency is really basic. To get comparable range and AWD in the Mach-e it's necessary to get the Premium Model with the extended range battery which costs $54,700 before delivery charge. That's $4,700 MORE than the Model Y Long Range which has significantly more range (326 miles of EPA certified range vs. 270 miles of EPA targeted range for Ford). That's a whopping difference of 56 miles less range for $4,700 more money.

Because the Tesla is considerably more aerodynamic the range deficiency will almost certainly be greater than this in the real world where it matters most - on the freeway going 70-75 mph. These vehicles are not even in the same ball-park. And that's before we talk about the huge disparity in safety and convenience features. The Ford doesn't come with the Tesla Autopilot and the safety features will not match Tesla's. The Ford doesn't have crash safety ratings yet but they can't beat Tesla's (and I'm confident they won't even match them).

The Model Y has 14% more cu. ft. of cargo capacity with the rear seats folded forward. The Model Y is 500 lbs. lighter so I'm betting it feels more nimble and drives better. 500 lbs. is a lot of extra weight, the equivalent of having two very large men in the car at all times (in addition to the driver and whatever else is in there). I could go on and on but it baffles me how any reviewer could say it compares favorably with the Model in "most competitive measures". These differences in range and weight derive directly from Tesla's superior EV technology. When you have to put in a considerably larger battery to get less range, all kinds of bad effects compound including driving dynamics. It's a BIG deal. This also means the Fords electric bill will be quite a bit higher over the life of the vehicle.

No one can compete with Tesla on price for what you get. And that is Tesla's real advantage and it's likely to grow, not shrink because Tesla is just starting to optimize production. The Ford will find some buyers because there are always people out there that don't understand how handicapped the Mach-e is vs. the Model Y or maybe they like the way the Mach-e looks. But that's not what it means to compare favorably in "most competitive measures". A porky lower range car for thousands more simply won't entice that many buyers.

To wit:A big AGREE to this. Even though the numbers are out in the open; all the data about the production capacity of the factory, and the demand in China and the rest of Asia etc. it still seems like mostly everyone is severly underestimating the potential of this market. So many people are stuck in the past where "Made in China" ment poor quality. And a lot of smart people have no clue what at beast the Chinese economy is and how many new millionaires and affluent middle class people are being created over there every year.

How do you load a wrapped up model Y for transport?

Sorry for on topic.

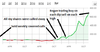

I was thinking about those S&P500 benchmarked funds and the affect of them buying and the following scenario crossed my mind: if a fund doesn't understand TSLA and doesn't want to buy it, but at the same time doesn't want to be left behind the BM, it could be a great strategy to buy every time it goes below $695 and sell every time it goes over. Sounds like a very logical trade to me and I started to think maybe to match it with my trades (even though I forgot where is the sell button). On the other side - it is hard to do when there are doezens of funds trying to implement the same strategy, they might overshoot quickly.

I’ve been following this and agree he needs our help. I just donated $1,000.Omar Qazi needs our help to defend himself against TeslaQ. Please consider donating or at least informing yourself about what’s going on by reading his blog. Link below.

Merry Christmas All.

Merry Christmas, and Thank You

Good video."New Model 3 Made in China SR+ Tesla Review" | Lara's new MiC LFP Model 3 for €33K is the least expensive Tesla now available in Europe:

Her car is one of the 1st shipment of 7K MiC Model 3s from Fall 2020. Excellent build quality with good range plus fast charging. Tesla will sell (more) boatloads of these cars.

Cheers!

Very carefully...How do you load a wrapped up model Y for transport?

7:45 here on the West Coast. Merry Christmas to all here on TMC. It's been a looooooong year!

I was thinking about those S&P500 benchmarked funds and the affect of them buying and the following scenario crossed my mind: if a fund doesn't understand TSLA and doesn't want to buy it, but at the same time doesn't want to be left behind the BM, it could be a great strategy to buy every time it goes below $695 and sell every time it goes over. Sounds like a very logical trade to me

While I can't afford $1k right now, I just gave $100. Good luck my friend!I’ve been following this and agree he needs our help. I just donated $1,000.