MODERATOR: ~~~And with that, we'd better zip it. All done!~~~

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

RobStark

Well-Known Member

About the part of "brand loyalty is a bit fickle", basically it says whoever bought an EV that's not a Tesla regrets deeply and will most likely "consider" Tesla next time.

Couldn't find the exact numbers but got some snippets from here:

I think the "900 points" bar is a typo though, since there is no car ranked above 800, Tesla models took all top ranks in premium segment with:

(even considering none-premium, only Kia Niro with 782 is close, others are all well below 750)

- Model S: 798

- Model 3: 790

- Model Y: 780

- Model X: 758

So to summarize the report:

Tesla owners satisfied, other EV owners regret, but none will go back to ICE.

So, where are all the posters that have called JD Power reports unscientific bovine feces in the past?

Captkerosene

Member

Can someone give me a webpage for consideration of Elon's Prize?[/QUOTE]

Too late, I'm claiming the prize. The best carbon capture technology is: no carbon capture technology. It was a trick question. Better to just let nature soak it up and enjoy the benefits (and suffer the costs) of a greener and warmer world.

Too late, I'm claiming the prize. The best carbon capture technology is: no carbon capture technology. It was a trick question. Better to just let nature soak it up and enjoy the benefits (and suffer the costs) of a greener and warmer world.

MC3OZ

Active Member

The U-curve was forecast by Tony Seba. He is well aware of the battery cost decline curve.

Translation: The U-curve already includes the effect of cheaper batteries in the future.

Tony has 15% per year in the 2020s. However batteries have been doing 20% price drops per year.

Battery Day has 54% cost reduction, but 7% is the structural battery. So say 49%.

Taking Tony's numbers over 3 years the cost is around 61%.

Assuming Tesla battery day tech takes 3 years we get to the same 61%.

However, I still, expect higher drops in the retail price of energy storage batteries, that is because a shortage of supply is helping to keep prices high and slowing the adoption curve.

Tesla is also switching chemistries for grid scale energy storage from Nickel to Iron for grid scale energy storage.

Tesla themselves talk about changing the curve.

Add in chemistry changes, higher production volumes, Tesla has an opportunity to grow market share while retaining margins.

Competitors have to respond, the amount of battery research at all stages of production is staggering. So what we can expect is the whole industry chasing reduced costs very aggressively. With lots of time, money and effort spent on the problem.

Tony is more often right than wrong but my hunch is 15% per year is conservative, especially for energy storage batteries.

The study finds that 95% of EV owners whose overall ownership satisfaction exceeds 900 points say they will purchase another EV. Nearly two-thirds (64%) of these owners say they “definitely will” repurchase the same brand.

64% for "definitely will" seems low, but it would make sense if one of the other choices is "likely will".

So, where are all the posters that have called JD Power reports unscientific bovine feces in the past?

Perhaps JD Power got tired of looking like idiots. Consumer Reports and all the other “unbiased” paid analysts and researchers should take a lesson.

They are too busy calling Munro unscientific bovine feces...well depending on the video..So, where are all the posters that have called JD Power reports unscientific bovine feces in the past?

FreqFlyer

Active Member

After watching the drone footages over the last few days I can’t help wondering how much more efficient Fremont would be if it were a Gigafactory instead of a lot of buildings cobbled together with lots of empty space between them. Too many people hanging/loitering around, a lot of storage in the open air, transport with forklifts and carriages, lines of cars waiting with drivers standing around.

The good thing: the more Gigafactories get built, the less Fremont will weigh on the average efficiency. And hopefully the high volume production (Model Y and 3) will eventually fully move to Gigafactories, leaving Fremont for lower volume products.

I bet that is the plan. The Bay area will always have a Tesla factory, but don't think for a second Elon has forgotten the little disagreement of last spring.

They are bad at making conclusions, good things for this report is, this is customer satisfaction survey, and it’s hard to tailor the survey to be biased to certain groups.So, where are all the posters that have called JD Power reports unscientific bovine feces in the past?

So raw data just makes Tesla shine, same as any other owner satisfaction survey.

Actually I am surprised the brand loyalty stats were not broken down to different brands, which is the most obvious analysis one should do.

That alone already tells what narrative they are trying to push there.

“Oh see, EV owners are not loyal, they switch in a snap when competition arrives” (sorry btw, Tesla owners don’t do that.)

I'm seeing down 0.19% AH, so not crying wolf just yet

LN1_Casey

Draco dormiens nunquam titillandus

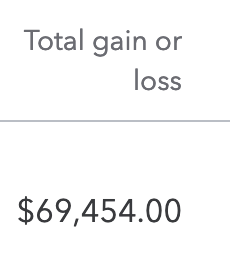

I'm starting to file my taxes and it shows my total realized gain from TSLA for the year and,

Does anyone know if I can I return $34??

Does anyone know if I can I return $34??

Safe to say this person flushed $320,000 down the toilet?Benzinga - 42 minutes ago: 10 Consumer Discretionary Stocks With Unusual Options Alerts In Today's Session

Excerpt:

Regarding TSLA (NASDAQ:TSLA), we observe a call option trade with bullish sentiment. It expires in 1 day(s) on January 22, 2021. A trader bought 400 contract(s) at a $850.00 strike. The trader or institution spent $320.0K on this trade with a price of $800.0 per contract. There were 7341 open contracts at this strike prior to today, and today 24961 contract(s) were bought and sold.

Sure seems like it to me.Safe to say this person flushed $320,000 down the toilet?

Bet TSLA

Active Member

Not at all. Could easily have been part of some more complex bet that made this person a pile of money. No way to tell.Safe to say this person flushed $320,000 down the toilet?

Maybe he bet a golf buddy $1M that TSLA would close below its all time high close today.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

It does rain in Fremont, but I think the lack of a roof is an indication of how much heat is produced by these gigapresses - so much that an overhead roof would cause heat issues with the surrounding structure.

The best roof is no roof

Tony has 15% per year in the 2020s. However batteries have been doing 20% price drops per year.

Battery Day has 54% cost reduction, but 7% is the structural battery. So say 49%.

Taking Tony's numbers over 3 years the cost is around 61%.

Assuming Tesla battery day tech takes 3 years we get to the same 61%.

However, I still, expect higher drops in the retail price of energy storage batteries, that is because a shortage of supply is helping to keep prices high and slowing the adoption curve.

Tesla is also switching chemistries for grid scale energy storage from Nickel to Iron for grid scale energy storage.

Tesla themselves talk about changing the curve.

Add in chemistry changes, higher production volumes, Tesla has an opportunity to grow market share while retaining margins.

Competitors have to respond, the amount of battery research at all stages of production is staggering. So what we can expect is the whole industry chasing reduced costs very aggressively. With lots of time, money and effort spent on the problem.

Tony is more often right than wrong but my hunch is 15% per year is conservative, especially for energy storage batteries.

From the Battery Day presentation slide on the cost curve, it didn’t look like they plan to achieve the full cost reduction until 2025.

Highly recommended weekend watching. VERY bullish from Tesla Bjorn

https://youtu.be/rQVEmVy9fQ8

edit; importantly, he’s very fair and balanced and reviews ALL EV’s, mainly in Norway, and has been critical in past reviews.

https://youtu.be/rQVEmVy9fQ8

edit; importantly, he’s very fair and balanced and reviews ALL EV’s, mainly in Norway, and has been critical in past reviews.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M