Great work. you'd have been bang on target without the BTC sale, though there certainly have been a few offsetting items that couldn't have been predicted accuratelyThere are many variances to my Q1 estimate but here are the big ticket items:

View attachment 657253

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Probably Leaf/Bolt owners upgrading.I really liked this too, and thought about it a bit more and legitimately wondered if the "EV" slice is existing owners upgrading to new Teslas? The graph doesn't indicate if this is the case and with the share price runup, it can't be a trivial number of owners upgrading.

2daMoon

Mostly Harmless

I thought it was the ball bearings ...I think best chance of a SP rocket from here is Elon giving battery guidance on call. If he says the ramp is going great or better than expected that could be a real trigger for a blast.

Speaking of which, what is up with those batteries? Is all about the batteries, right?

corduroy

Active Member

I assumed that was those unfortunate souls who paid their dues driving a Leaf/Bolt.I really liked this too, and thought about it a bit more and legitimately wondered if the "EV" slice is existing owners upgrading to new Teslas?

The Accountant

Active Member

Auto Margins (Excluding Reg Credits):

Q4 2020 - 20.7%

Q1 2021 - 22.0%

Huge improvement and will only get better as volume increases in Shanghai.

Q4 2020 - 20.7%

Q1 2021 - 22.0%

Huge improvement and will only get better as volume increases in Shanghai.

Bobbyducati

Member

HG Wells

Martian Embassy

Your forgetting the credit card fee's for those who do it as an add on.What is the take rate on FSD where marginal profit is 100% on a $10k sale?

So 99.2%

thx1139

Active Member

Not to mention when higher margin cars start selling again in Q2.Auto Margins (Excluding Reg Credits):

Q4 2020 - 20.7%

Q1 2021 - 22.0%

Huge improvement and will only get better as volume increases in Shanghai.

LiveLong&Profit

Member

Normally I would agree. But, given overall inflation, crypto hedging kind of makes sense. And yes, don't overdo trading. On the other hand, I guess Tesla in general and Zach specifically has the bandwidth to set a probable range for crypto, and buy/sell minor portions when the range is exceeded to either side.The one thing that stands out to me as a question mark is the Bitcoin sale.

OK, we made a 100 Million. Great.

Is TSLA a trading house now? I understand the hedging and really thought the idea was to HODL to counteract effects of fiat devaluation. But now they are selling for profit. OK, Why? Are there allocations they are sticking to? This would be OK... but otherwise what? It went high so we sold? And if it goes low again we will buy? And isn't that how allocations work?

Would rather not become a crypto trading house, but if you must, then go whole hog and set up the TESLA CRYPTO EXCHANGE. Yeah, baby! Bitcoin Billionaire!

No, not really. Want to stick to the mission.

Your avatar a real-time image of you?Auto Margins (Excluding Reg Credits):

Q4 2020 - 20.7%

Q1 2021 - 22.0%

Huge improvement and will only get better as volume increases in Shanghai.

Fishy Fish

Member

Maybe a shortage of chips for the 10 teraflop entertainment systemGratifying to see them ramp up capital expenditures (the source of future growth) while keeping the ship steady.

Model X/Model S is still a mystery. Was this a failure to execute or rather was it expected?

The Accountant

Active Member

Great work. you'd have been bang on target without the BTC sale, though there certainly have been a few offsetting items that couldn't have been predicted accurately

Thanks - and I only post my work publicaly for my TMC team here (no twitter, Youtube, etc). I've benefited more than you could imagine from all of you that I feel an obligation to contribute in some way.

zach_

Member

Complete guess, but I do wonder if Model S/X delays could have something to do with this:Gratifying to see them ramp up capital expenditures (the source of future growth) while keeping the ship steady.

Model X/Model S is still a mystery. Was this a failure to execute or rather was it expected?

In Q1, we were able to navigate through global chip supply shortage issues in part by pivoting extremely quickly to new microcontrollers, while simultaneously developing firmware for new chips made by new suppliers.

ByeByeJohnny

Active Member

Didn't they make $272 million? That's what proceeds from sales of digital assets says. Is there anything but bitcoin there? This is a new line in the report so should all be bitcoin.The one thing that stands out to me as a question mark is the Bitcoin sale.

OK, we made a 100 Million. Great.

Is TSLA a trading house now? I understand the hedging and really thought the idea was to HODL to counteract effects of fiat devaluation. But now they are selling for profit. OK, Why? Are there allocations they are sticking to? This would be OK... but otherwise what? It went high so we sold? And if it goes low again we will buy? And isn't that how allocations work?

Would rather not become a crypto trading house, but if you must, then go whole hog and set up the TESLA CRYPTO EXCHANGE. Yeah, baby! Bitcoin Billionaire!

No, not really. Want to stick to the mission.

Or does it mean they sold for $272 million out of which $101 million was profit?

Depending on when they sold I would say the got between 52k-58k. Bitcoin has lost roughly 2% since ER came out.

Krugerrand

Meow

100% in my household. Actually, 100% in my circle. I’m happy to work for free and hard sell those I’m willing to interact with. There’d be more FSD sales if I actually liked people.What is the take rate on FSD where marginal profit is 100% on a $10k sale?

The Accountant

Active Member

That's Ben Affleck from the movie The Accountant but my features are not that far off.Your avatar a real-time image of you?

J

jbcarioca

Guest

Thank you very much for your invaluable contributions. Your insights and perspectives are a huge benefit to us all.There are many variances to my Q1 estimate but here are the big ticket items:

View attachment 657253

Maybe you should hang on to this question for a while and ask it AFTER the product is released !?What is the take rate on FSD where marginal profit is 100% on a $10k sale?

People do not often calculate take-rate on future products that have not been released yet, ... just sayin'

agastya

Member

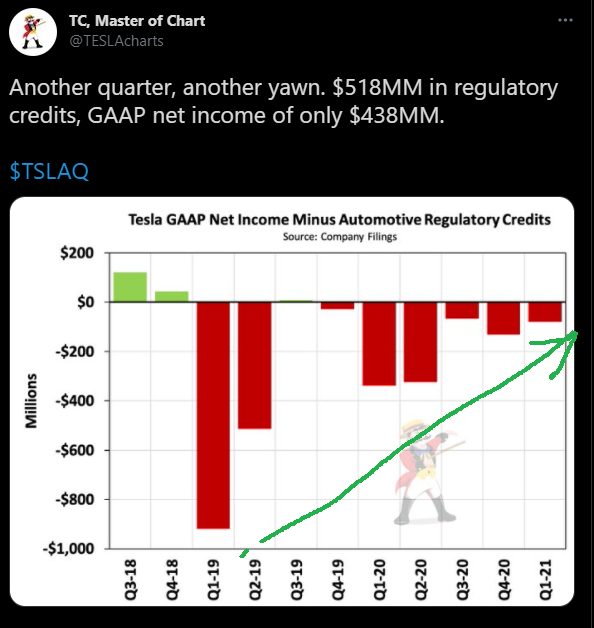

Even if you give TSLAQ the benefit of doubt re: regulatory credits, the dumdums can't figure out a trend when it's screaming at you.

How are these lemmings so up their own backside to not realize it will flip over as soon as revenues eek out from the capacity expansions in the next 9-12 months?

How are these lemmings so up their own backside to not realize it will flip over as soon as revenues eek out from the capacity expansions in the next 9-12 months?

They spent c.$1.2b on BTC, made a profit of c.$100m and ended the quarter at c.$1.3b (without being allowed to reval upwards) - That implies that they were paid in BTC for vehicles to the order of c.$300m (assuming the $100m difference in cash paid and EoQ balance, plus 100% gain on sold BTC). Not much out of $9b total revenue, but still a nice little earner.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M