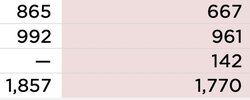

The numbers that jumped out for me was the 40,000 output weeks, but also in the 10,000 weekly out of Berlin and Austin each, sometime next year (aka Q4?). Obvious in the long term but perhaps can help align estimates….

So perhaps 250,000 quarterly run rate Berlin+Austin combined EoY 2023? 125,000 quarterly was when Shanghai really hit its stride

So perhaps 250,000 quarterly run rate Berlin+Austin combined EoY 2023? 125,000 quarterly was when Shanghai really hit its stride