Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TN Mtn Man

Member

Yes...but since it's Cruise and not a Tesla-the MSM will ignore the story and we'll never know what happened.In other very real news, if Cruise didn't have LIDAR they couldn't have seen all the high resolution details of the cyclist before they plowed into him.

ZachF

Active Member

Buying Rivian might not be a bad bet for Apple if they really want to enter the EV scene.

dhanson865

Well-Known Member

Happened in July and was discussed back then, why mention it today?

B

betstarship

Guest

Happened in July and was discussed back then, why mention it today?

Maybe its getting the minor Tesla treatment of last month sales for a quarter, on ramping production, that's about to, hopefully, say they produce an increase in the number of vehicles from their production line?

Start the acquisition rumors!

"Out marketcap is more than 2x of all car companies combined by not being a car company...kind of tells me being a car company is a good way to return value to our shareholders!" ---said by no one at Apple.Buying Rivian might not be a bad bet for Apple if they really want to enter the EV scene.

TheTalkingMule

Distributed Energy Enthusiast

Totally fine with a flat TSLA / macro down day.......so long as oil & gas get hammered. Brent is down 3% and gas down 4.5%.

August CPI is a week from today and should provide the springboard to get us out of this. Then we have the Fed meeting 9/21, and Powell should have seen enough positive movement on inflation by then(if he hasn't already).

I remain focused on oil, as I assume Powell is. OPEC is pulling out all the stops to juice the markets.....and they're not responding. Production is already well below their target rate, so further threats are likely empty. I think Powell has succeeded in taking most of the "Putin premium" out of oil futures and they'll start trading with a more normal level of volatility.

August CPI is a week from today and should provide the springboard to get us out of this. Then we have the Fed meeting 9/21, and Powell should have seen enough positive movement on inflation by then(if he hasn't already).

I remain focused on oil, as I assume Powell is. OPEC is pulling out all the stops to juice the markets.....and they're not responding. Production is already well below their target rate, so further threats are likely empty. I think Powell has succeeded in taking most of the "Putin premium" out of oil futures and they'll start trading with a more normal level of volatility.

TN Mtn Man

Member

Not sure why all the drama about an "Apple Car". Apple doesn't even manufacture their phones, they just have Foxconn slap an Apple label on their products. They don't have the manufacturing or engineering experience to consider something as complex as auto manufacturing-at this time anyway. Of course they could buy Bolts from GM, stick their label on it and mark the price up 50% and we'd hear from the media how revolutionary and advanced it is, while the fanboys line up around the block to buy them. The thing they have going for them is very deep pockets should they actually decide to get into autos."Out marketcap is more than 2x of all car companies combined by not being a car company...kind of tells me being a car company is a good way to return value to our shareholders!" ---said by no one at Apple.

Buying Rivian might not be a bad bet for Apple if they really want to enter the EV scene.

Rivian is a money pit and will be even more. This might be too deep even for Apple. Finally, they 'only' have cars. It is all a big meh.Not sure why all the drama about an "Apple Car". Apple doesn't even manufacture their phones, they just have Foxconn slap an Apple label on their products. They don't have the manufacturing or engineering experience to consider something as complex as auto manufacturing-at this time anyway. Of course they could buy Bolts from GM, stick their label on it and mark the price up 50% and we'd hear from the media how revolutionary and advanced it is, while the fanboys line up around the block to buy them. The thing they have going for them is very deep pockets should they actually decide to get into autos.

Mod: 15 posts moved to China / Taiwan discussion --ggr

ZachF

Active Member

Rivian up over 6% based on @ZachF starting a rumor that Apple might buy Rivian.

View attachment 849505

Damn, I never knew I had such market power!

Sadly, this country (US) is a world of hurt if the Orange One gets elected again. His supporters cheer him on as he bashes an unnamed EV's, and, of course, there's no way to validate the story as it's always "a friend," and so very, very many here 100% believe his never ending string of lies.

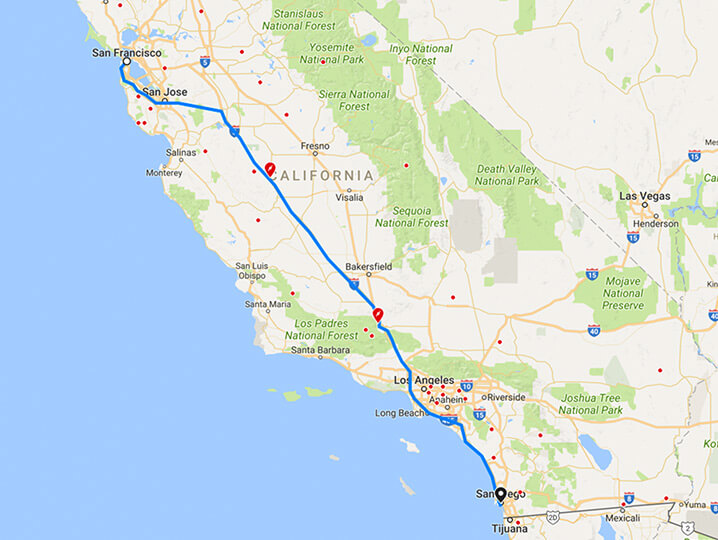

Just for fun, I used tesla.com/trips to generate a trip to match this supposed EV fiasco . . . and in a Tesla it appears to be a non-issue, but the facts DO NOT MATTER in the Trump and post-Trump era:

Go Anywhere | Tesla

Stay charged anywhere you go, with access to our global charging networks. Explore a route and we’ll find the best locations to keep you charged along the way and upon arrival.www.tesla.com

I'm optimistic. "If we don't stand for something, we'll fall for anything".

I think there are enough of us who stand for something.

Sorry, I'm running way behind with this thread...So, doesn't seem like Moody's is about to raise Teslas rating anytime soon. They just pretty much said they won't until Tesla puts out at least another model.

Is there competition between Moody's and S&P though? No idea. But if there is this would be the perfect time for S&P to raise their rating. Right now. While it's discussed in all kinds of media.

It'll be about a year until Moody's can do it with any type of credibility remaining so that would be a long time for them to look foolish alone if they want to look a little smarter than the competition..

Surely the issue with all of this isn't Moody's and S&P ratings - everyone knows they're BS and what Elon said is correct

For me, the thing that doesn't make sense is that many funds cannot invest in stock unless they are above a certain rating, this is where the system breaks. So you can have the very best companies on the planet, not paying the protection money to these agencies, and big funds cannot invest

We all know Wall Street is a basically a racket to steal money, but this seems all a bit too obvious

It's (at least part) CYA (cover your assets). If a fund buys a junk rated stock and loses money, they have more exposure from their investors than if they had purchased an investment rated stock that tanked.Sorry, I'm running way behind with this thread...

Surely the issue with all of this isn't Moody's and S&P ratings - everyone knows they're BS and what Elon said is correct

For me, the thing that doesn't make sense is that many funds cannot invest in stock unless they are above a certain rating, this is where the system breaks. So you can have the very best companies on the planet, not paying the protection money to these agencies, and big funds cannot invest

We all know Wall Street is a basically a racket to steal money, but this seems all a bit too obvious

Your arguments need not be faulty or refuted in order to oppose your conclusion. Presenting the bill to the oil companies for their share of the cost of protecting their interests would do just fine.Eliminating all subsidies would be great in my opinion, but no one will roll back the entire US navy fleet that effectively helps subsidize oil by ensuring freedom of the seas in certain geographic areas. Or any of the other machines in place to keep the subsidies going. *shrug*

And pigs also fly.

Apple car does not or will not exist. Apple in cars is their end goal. They want to slowly take over the entire software suite for car manufactures because they just want to see high margin software.Not sure why all the drama about an "Apple Car". Apple doesn't even manufacture their phones, they just have Foxconn slap an Apple label on their products. They don't have the manufacturing or engineering experience to consider something as complex as auto manufacturing-at this time anyway. Of course they could buy Bolts from GM, stick their label on it and mark the price up 50% and we'd hear from the media how revolutionary and advanced it is, while the fanboys line up around the block to buy them. The thing they have going for them is very deep pockets should they actually decide to get into autos.

The market got it wrong that when Apple hired car engineers, they thought they were going to make their own cars..lol not over their dead body.

Software advantages for Tesla will begin to shrink as Apple and Android fights to dominate that space for the car manufactures. This is why Elon believes their competitive advantage is in manufacturing only, as in they continue to make high margin Cara while the rest give away their margins to software companies in the era of electric cars.

Of course this is not exactly bullish news for Tesla. Apple believes they can use their ecosystem prowess to create sticky brand loyalty to Apple software cars. They will make music and apps seemless while Android does the same.

Last edited:

We have had a very considerable amount of clamor in this thread concerning - and repeating - the point that many funds cannot invest in the equities of companies w/o a bond investment grade rating.Sorry, I'm running way behind with this thread...

Surely the issue with all of this isn't Moody's and S&P ratings - everyone knows they're BS and what Elon said is correct

For me, the thing that doesn't make sense is that many funds cannot invest in stock unless they are above a certain rating, this is where the system breaks. So you can have the very best companies on the planet, not paying the protection money to these agencies, and big funds cannot invest

We all know Wall Street is a basically a racket to steal money, but this seems all a bit too obvious

It‘s time to ascertain the truth of that statement. From my experience, it might be minimal - I know I never encountered any such restrictions.

For example, just as I was writing this, another poster used the phrase ”junk rated stock”. There is no such creature.

larmor

Active Member

Many people are buying Tesla cars…Rivian up over 6% based on @ZachF starting a rumor that Apple might buy Rivian.

View attachment 849505

As faultlessly true as that is in 2022 and in prior years, looking forward, I would suggest that argument falls flat on its face, or condemns Tesla to be relegated to the rarefied atmosphere of the highly creditworthies.Anybody who looks at the surface of captives thinks they are great. They are, for dealers. They are, for F&I. The securitized assets are excellent for institutional investors.

For Tesla, there is no point. Above all, Tesla customers are highly creditworthy, so have no need for the F&I ‘get ‘em done’ practices.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M