Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

We had price reduction for the 3 in particular for the Performance Model. This is true for many EU countries.

But overall prices for Model 3 went up by about €1000 to €1500. I believe that happened in August. Tesla probably did this to compensate for the deteriorating dollar-euro exchange rate.

larmor

Active Member

There is a very good effort to keep gas prices in check in Texas. For example the latest “drone” incident/pseudo oil shortages had very little effect on local gas prices around dallas. I’m almost certain that was not the same thing happening in Southern California, there would have been some story about how that was seriously it would alter gas prices there.Not only are electricity rates in TX less than half that in CA, gasoline prices and natural gas prices in TX are also less than half those in CA.

Maybe some people in TX view gas prices cheap enough to forgo going electric as of now?

Fact Checking

Well-Known Member

Nice to see the phase 2 battery building rising.

BTW., in one of the videos it was referred to as "Phase 1.5" - i.e. probably still part of "Phase 1".

RobStark

Well-Known Member

Manufacturers Are Emphasizing Efficiency More Than Ever

So why is it that the latest cars from established manufacturers can’t come close to the efficiency of the Silicon Valley start-up’s aging models? It comes down to inefficiency, both in the cars and in the corporate culture. I should point out that the Model S has become better than 25 percent more efficient over its eight model years, climbing from 89 MPGe to 111. The latest upgrades include revisions to tires and air suspension, changing from an induction-type front motor to a more efficient permanent-magnet design, and revised wheel bearings.

Yes, even wheel bearings count. These have slightly less drag than the car’s already-efficient bearings. The new part is more expensive to manufacture, but Tesla’s engineering teams don’t speak just in terms of dollars, they talk of Battery Bucks—a measure of how much cost can be saved on batteries for every efficiency gain made.

The exchange rate between Battery Bucks and Bearing Dollars must be favorable, because the new bearings made it into production. Rather than shrink the battery, though, Tesla took advantage of the increased range: the new parts are responsible for up to an additional 15 miles compared with traditional bearings. Fifteen miles is more than a quarter of the range of that microscopic Smart Fortwo, and I bet those bearings cost much less than a fourth of the Fortwo’s battery.

Thinking in terms of Battery Bucks allows the company’s departments to work together, rather than in isolated silos as at traditional automakers. There, one imagines braking guys might fantasize about four-piston, monobloc calipers, but their budget would never allow that luxury. At Tesla, the brake guys looked at their Battery Bucks and realized that it cost less overall to use expensive Brembos. Because they can be made to retract the pads from the spinning rotors faster and more reliably than sliding calipers, monoblocs reduce friction—enough to provide up to 20 miles of increased range. The Brembos were easily paid for using Battery Bucks. The additional stopping power, credibility, and better pedal feel are just added bonuses.

So why is it that the latest cars from established manufacturers can’t come close to the efficiency of the Silicon Valley start-up’s aging models? It comes down to inefficiency, both in the cars and in the corporate culture. I should point out that the Model S has become better than 25 percent more efficient over its eight model years, climbing from 89 MPGe to 111. The latest upgrades include revisions to tires and air suspension, changing from an induction-type front motor to a more efficient permanent-magnet design, and revised wheel bearings.

Yes, even wheel bearings count. These have slightly less drag than the car’s already-efficient bearings. The new part is more expensive to manufacture, but Tesla’s engineering teams don’t speak just in terms of dollars, they talk of Battery Bucks—a measure of how much cost can be saved on batteries for every efficiency gain made.

The exchange rate between Battery Bucks and Bearing Dollars must be favorable, because the new bearings made it into production. Rather than shrink the battery, though, Tesla took advantage of the increased range: the new parts are responsible for up to an additional 15 miles compared with traditional bearings. Fifteen miles is more than a quarter of the range of that microscopic Smart Fortwo, and I bet those bearings cost much less than a fourth of the Fortwo’s battery.

Thinking in terms of Battery Bucks allows the company’s departments to work together, rather than in isolated silos as at traditional automakers. There, one imagines braking guys might fantasize about four-piston, monobloc calipers, but their budget would never allow that luxury. At Tesla, the brake guys looked at their Battery Bucks and realized that it cost less overall to use expensive Brembos. Because they can be made to retract the pads from the spinning rotors faster and more reliably than sliding calipers, monoblocs reduce friction—enough to provide up to 20 miles of increased range. The Brembos were easily paid for using Battery Bucks. The additional stopping power, credibility, and better pedal feel are just added bonuses.

Fact Checking

Well-Known Member

There is a very good effort to keep gas prices in check in Texas. For example the latest “drone” incident/pseudo oil shortages had very little effect on local gas prices around dallas.

That is because 95%+ of U.S. gasoline production is using U.S., Canadian and Venezuelan crude oil - so the reduction in Saudi oil exports has only a limited effect on supply.

I’m almost certain that was not the same thing happening in Southern California, there would have been some story about how that was seriously it would alter gas prices there.

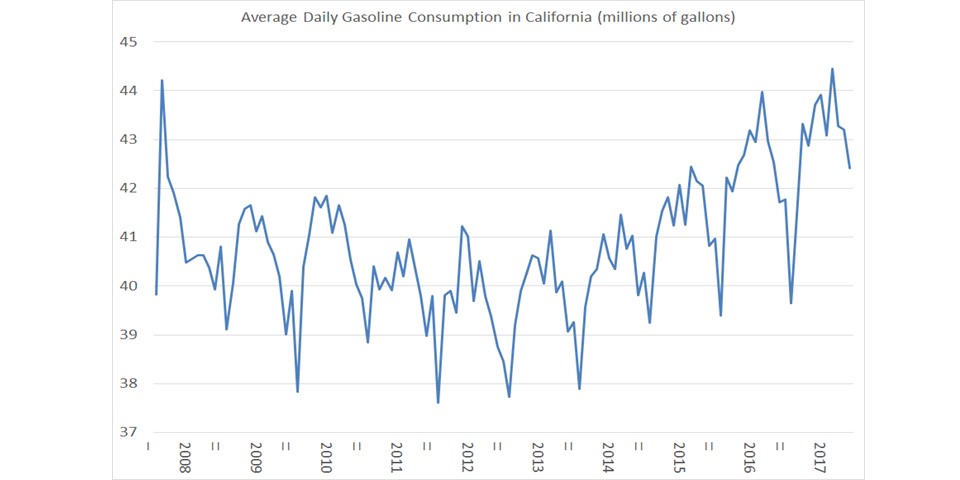

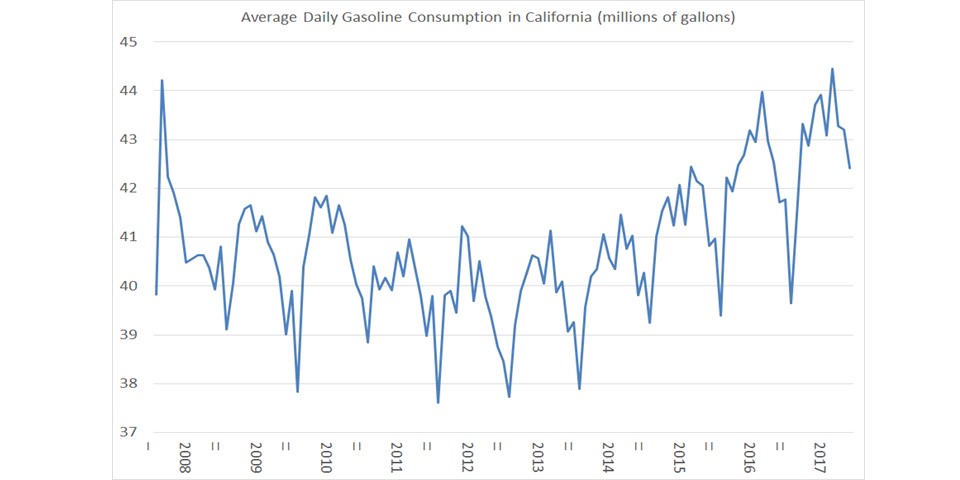

I believe there's various price cartel and monopoly supply shenanigans in California that are unconnected to the price of crude oil: refineries go down for "maintenance" with suspicious timing, and refinery capacity is limited to begin with. All this goes hand in hand with rising gasoline consumption in California:

(Graph ends early 2018 - does anyone have the 2019 data perhaps? Do EVs make a dent in gasoline consumption already?)

So it's a classic "limited supply, rising demand, inelastic consumers" situation that results in natural rise in prices with quite a bit of opportunistic price gauging on top.

IMO eventually the spreading of EVs will free up gasoline supply and this will put a natural floor on any rise in gasoline prices (those who can will buy an EV, those who cannot will drive less), before a price crash, which will be followed by a global oil industry crash.

Last edited:

Sean Wagner

Member

The used market is getting flooded with German luxury cars people are trading in to buy their Tesla. So not only is Tesla stealing their sales, they're also making it harder for them to sell new cars by effectively lowering the price of used models.

{{ngMeta.title}}

'The data shows exactly how rough the recent road has been for the once-dominant luxury marques. In the first six months of 2019 alone, a 2018 BMW 320i lost nearly 20% of its value, dropping from $37,700 to $30,700.* While it’s true that newer vehicles typically depreciate at a steeper rate, it’s not usually that steep. But again, The Tesla Effect is changing the norm. At three years old, a 2016 Mercedes B-Class would ordinarily depreciate at a slower rate. For the same time period as the BMW above, though, the B-Class dropped from $18,500 to $13,250, nearly 30%.'

This is exactly what Tony Seba has been going on about for quite a while now (read years).

When it hits the middle of the market and Toyota and Volkswagen feel the pinch, things will get truly interesting.*

You can bet your bottom dollar boardrooms will be fixating on this conundrum and become ever less bored rooms.

Spare a thought for one Dr. Diess, he very probably is already thinking about this on a daily basis.

Change is gradual until it seeps into the collective consciousness. Will it even be five more years until the world's biggest industry is upended and demand for anything but ultra-cheap ICEs just breaks away? **

Regarding the ASP of Model 3's in Europe (yes, prices havfe [ugh, covfefe] been adjusted), I'll gladly repost the following again:

Model 3 Performance - 59'990 Swiss Francs

BMW 330e - from 62'800 Swiss Francs [base content is higher than in adjoining countries]

Oh, and this video was so great to watch I'll post the link too:

[*] Edit: sometimes I think Elon's insistence on creating a truly unique, sci-fi pickup is meant to give the onetime big three one last chance to grasp the present future.

[**] Who will own the most battery cell production capacity then?

Last edited:

larmor

Active Member

And at the time of the oil industry collapse, if enough people have gotten an EV, then they are unlikely to get rid of their car-- because it still works and in good working condition-- and the number of consumers left to purchase gas will have significantly decreased.That is because 95%+ of U.S. gasoline production is using U.S., Canadian and Venezuelan crude oil - so the reduction in Saudi oil exports has only a limited effect on supply.

I believe there's various price cartel and monopoly supply shenanigans in California that are unconnected to the price of crude oil: refineries go down for "maintenance" with suspicious timing, and refinery capacity is limited to begin with. All this goes hand in hand with rising gasoline consumption in California:

(Graph ends early 2018 - does anyone have the 2019 data perhaps? Do EVs make a dent in gasoline consumption already?)

So it's a classic "limited supply, rising demand, inelastic consumers" situation that results in natural rise in prices with quite a bit of opportunistic price gauging on top.

IMO eventually the spreading of EVs will free up gasoline supply and this will put a natural floor on any rise in gasoline prices (those who can will buy an EV, those who cannot will drive less), before a price crash, which will be followed by a global oil industry crash.

Maybe that is why there is intense market scrutiny and "pressure" (FUD) on tesla, not because of tesla but because they can show EVs can be done. In part Porsche has actually helped the EV transition, and will be interesting to see reviews of the taycan, will the reviews be critical on range, etc....

Krugerrand

Meow

This is exactly what Tony Seba has been going on about for quite a while now (read years).

When it hits the middle of the market and Toyota and Volkswagen feel the pinch, things will get truly interesting.*

You can bet your bottom dollar boardrooms will be fixating on this conundrum and become ever less bored rooms.

Spare a thought for one Dr. Diess, he very probably is already thinking about this on a daily basis.

Change is gradual until it seeps into the collective consciousness. Will it even be five more years until the world's biggest industry is upended and demand for anything but ultra-cheap ICEs just breaks away? **

Regarding the ASP of Model 3's in Europe (yes, prices havfe [ugh, covfefe] been adjusted), I'll gladly repost the following again:

Model 3 Performance - 59'990 Swiss Francs

BMW 330e - from 62'800 Swiss Francs [base content is higher than in adjoining countries]

Oh, and this video was so great to watch I'll post the link too:

[*] Edit: sometimes I think Elon's insistence on creating a truly unique, sci-fi pickup is meant to give the onetime big three one last chance to grasp the present future.

[**] Who will own the most battery cell production capacity then?

[*] Nah. Elon just likes to do ‘fun’ things while doing ‘serious’ things. That’s called living to the fullest.

Yeah... probably so. In which case the placement may be less deliberate and more about who they can get to partner with them.EA is all in with WalMart, so their charger distribution is heavily influenced by WalMart locations.

Yeah... probably so. In which case the placement may be less deliberate and more about who they can get to partner with them.

BTW since this subject came back up: a brand new Supercharger site just opened in Texas last night (Henrietta, e.g. Wichita Falls). So add one more station, 12 stalls, and 6 chargers to the list

Although I'm more interested that Glendive, MT just went into construction. The North Dakota-Montana gap is closing quickly. I look forward to being able to drop the caveat from the sentence where I tell people, "You can drive anywhere in the continental US easily in a Tesla! ....excepting North Dakota and eastern Montana, but surely that will change at some point soon...."

Would be nice to fill in some of the smaller gaps too, however; I guess that'll be what I'll be cheering on next as far as US development goes

Last edited:

MartinAustin

Active Member

I do just that. (Well, Ride|Austin and Wingz to be exact.) My car has averaged 96miles/day, every day, since the day I got it. And I only pay $1/day for the electricity, courtesy of Austin Energy's EV360 program. A pretty good deal for a large four-door luxury fastback that would invariably be getting 20mpg of Premium gasoline if it was ICE.Would be useful for Uber/Lyft drivers.

StealthP3D

Well-Known Member

Jack is the main reason why I wish that you could increase Youtube playback speeds to greater than 2x

He's the only one I watch on 2X. Any faster than this and I might have trouble understanding his guest if he has one. I am surprised that Youtube doesn't offer an option to compress long spaces more than the rest of the track. Maybe it would cost too much in terms of processing/electricity.

In this video, Rickards said the point of measuring the exact efficiency of a charge/recharge cycle was to determine exactly what point a battery was in its lifecycle in terms of degradation. He said this more than once. However, it was my previous understanding that the entire point of this precision measurement exercise was to determine how much degradation each charge/discharge cycle would cause in a particular battery. In this way, the expected lifetime of a new battery "recipe" could be approximated without going through accelerated lifecycle testing. These seem to be two different things.

Now I'm confused.

Given that the state government has done everything in it’s power to block Tesla, it’s really better than expected.Texas, with it's 30 million residents, comes in far behind Washington with it's 8 million residents?

That looks pretty shabby to me.

Some “people” may but not the utilities because almost all the planned new power generating facilities are solar. They are cheaper to build, quicker to build, and much easier to get approval.Not only are electricity rates in TX less than half that in CA, gasoline prices and natural gas prices in TX are also less than half those in CA.

Maybe some people in TX view gas prices cheap enough to forgo going electric as of now?

StealthP3D

Well-Known Member

Although I'm more interested that Glendive, MT just went into construction. The North Dakota-Montana gap is closing quickly. I look forward to being able to drop the caveat from the sentence where I tell people, "You can drive anywhere in the continental US easily in a Tesla! ....excepting North Dakota and eastern Montana, but surely that will change at some point soon...."

I think you could probably easily drive anywhere in the Continental U.S. right now...the problem is getting back.

Would be nice to fill in some of the smaller gaps too, however; I guess that'll be what I'll be cheering on next as far as US development goes

For sure. A few weeks ago I took a 1300 mile trip from Seattle area to Whitefish, MT to visit family. I wanted to stay two nights in Kalispell in the Flathead Valley which has a complete lack of SC's and a dearth of destination charging. To do the trip without destination chargers would have required a longer detour through Missoula on boring Interstates and "ugly" state highways and I would have missed my favorite route through beautiful river canyons and remote grain fields. This is in Western Montana which also has a giant "hole" in the SC network. The net result is I chose to stay in a hotel I never would have chosen simply because they were the only hotel in the desired location that had destination charging. While I like to support hotels with destination charging I recommend avoiding Red Lion in Kalispel. They had 2 Level 2 chargers and they were at maximum capacity due to the dearth of other chargers in the area. The real problem though was the hotel was dated and worn with an obvious lack of capital improvements over the last 5-10 years, totally out of keeping with the over $500 I had to pay for a two-night stay.

The point is, even though there is a large population of potential Tesla customers in the Flathead Valley, the lack of charging infrastructure is currently a huge disincentive to becoming a Tesla owner. This is going on in many other areas of the country. To maximize sales of Tesla in the US, it is still necessary to significantly increase the SC density. It's not enough that you can easily "drive anywhere" because people want to drive on the roads they want to drive on and they don't want to, nor should they have to, take route detours to hit SC'ers. These rural "holes" present a huge opportunity for Tesla because these rural populations tend to spend a large percentage of their income on gasoline due to the large distances they regularly drive. The release of the Tesla pickup will be even more successful if these holes are well-filled because it will allow those with limited income to buy the standard range model.

StealthP3D

Well-Known Member

There is a very good effort to keep gas prices in check in Texas. For example the latest “drone” incident/pseudo oil shortages had very little effect on local gas prices around dallas. I’m almost certain that was not the same thing happening in Southern California, there would have been some story about how that was seriously it would alter gas prices there.

There is a political element to gas pricing strategy around the US. Oil companies price gasoline less in more rural, more conservative areas in order to keep the people's conservative support. In cities and liberal areas they "stick it to them" because the people are already going to elect anti-gas/oil representatives anyway.

It's like a bribe of cheap gasoline to maintain the status quo. This is very real (and it works).

Spotted at GF3: A Model 3 at a small test track:

Looks to be newly made (papers in the windscreen), not some employee vehicle:

At first I wasn't sure if it was a test track or loading area... but looking at the flow, I'm pretty sure it's a test track:

My interpretation:

Cars enter the track from the factory (top right); head south along the outside left of the track; drive back north across what looks like some strips of bumps (second from the right), do a tight left turn; head back south (second from the left); back north along the right side past what look like stop signs; back out to the road; then down to lot south of the factory for loading.

Looks to be newly made (papers in the windscreen), not some employee vehicle:

At first I wasn't sure if it was a test track or loading area... but looking at the flow, I'm pretty sure it's a test track:

My interpretation:

Cars enter the track from the factory (top right); head south along the outside left of the track; drive back north across what looks like some strips of bumps (second from the right), do a tight left turn; head back south (second from the left); back north along the right side past what look like stop signs; back out to the road; then down to lot south of the factory for loading.

Last edited:

Fact Checking

Well-Known Member

He's the only one I watch on 2X. Any faster than this and I might have trouble understanding his guest if he has one. I am surprised that Youtube doesn't offer an option to compress long spaces more than the rest of the track. Maybe it would cost too much in terms of processing/electricity.

In this video, Rickards said the point of measuring the exact efficiency of a charge/recharge cycle was to determine exactly what point a battery was in its lifecycle in terms of degradation. He said this more than once. However, it was my previous understanding that the entire point of this precision measurement exercise was to determine how much degradation each charge/discharge cycle would cause in a particular battery. In this way, the expected lifetime of a new battery "recipe" could be approximated without going through accelerated lifecycle testing. These seem to be two different things.

Now I'm confused.

I don't think there's any contradiction: Jack Rickard was characterizing the work of Jeffrey Dahn, Tesla's battery research specialist (starting at around 13:00 in the video), who was doing two things:

- "cycle testing": measure the longevity of a cell by doing thousands of charging/discharging sessions,

- "degradation prediction": to predict where a given cell is in its expected life cycle by doing a single charging/discharging session

Testing 3,000 cycles would take 4+ months, making any iterative testing of new chemistries take a prohibitively long time.

So Dahn invented a precision instrument to do only a few cycles and extrapolate the probable characteristics of a new chemistry or other variations to the cell's architecture - vastly speeding up R&D time.

My guess is that if the long term degradation curve is always convex, it's possible to measure the rate of degradation of a newly made cell based on a few iterations alone, as long as you are very precisely controlling the environment (temperature) of the charge/discharge cycle, and are measuring the energy flow very precisely as well.

At least that's how I understood it.

Last edited:

StealthP3D

Well-Known Member

Someone (with the patience of a sloth on vacation) please take one for the team and summarize what he’s on about.

1) Rickards knows a lot about battery chemistry.

2) Rickards has been knowledgable about this and EV's in general longer than most anyone else.

3) FSD is a long way in the future.

4) Tesla is screwed up but they build the best car in the world (Model 3).

5) Residential solar (in general) is a screwed up mess in terms of having integrated, easy to deploy solutions.

6) Tariffs increase the price of quality affordable Chinese made inverters and other solar equipment.

7) Government and utilities are screwed up

8) Trump is good.

9) Tesla will make a lot of money.

10) Basic summon is improved, skeptical of advanced summon.

11) The electricity in OK is cheap.

12) You didn't miss much.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M