Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

RobStark

Well-Known Member

I can't decide if the target of this Ford ad is SpaceX or Model Y or just a jab at Elon. Maybe its supposed to be all three, but then hey Ford show me your rockets.

Wasn't that an Oldsmobile thing? Laughing my Fords as Olds: LMFAO

So Ford is worried now about the future of their Explorers? Wait til next month when the F-150 killer debuts. Looking forward to that ad... "The Wrong Stuff"?

I don't think that ad has anything to do with Elon, SpaceX or Tesla.

I think you have to live and breathe Tesla to see that in this ad.

RobStark

Well-Known Member

I've seen some claims/speculation (I don't know their accuracy) that Tesla's potential revenue from the FCA deal is limited by Tesla's total number of vehicle deliveries in Europe. Anyone have any more insight into this?

This is pretty easy to google.

FCA buys US ZEV credits from Tesla on an ad hoc basis.

The deal to pool credits is for the European Union.

It is limited to the number of Tesla vehicles delivered to the EU plus Norway since Norway opted into this CO2 limitation program. I have not read of Iceland or Switzerland opting in.

Fact Checking

Well-Known Member

I've seen some claims/speculation (I don't know their accuracy) that Tesla's potential revenue from the FCA deal is limited by Tesla's total number of vehicle deliveries in Europe. Anyone have any more insight into this?

Correct - the EU ZEV credits only count for EU (plus Norway, Switzerland?) deliveries.

The measurement of CO2 emissions begins in January 2020, the first CO2 penalties are due in 2021 (based on 2020 emissions averages).

But neither FCA nor Tesla operates in a vacuum: their deal might involve U.S. credits as well. Once FCA buys ZEV credits for one market they might as well use the same source for other markets as well? FCA needs the credits, Tesla has plenty of them and has some geographic imbalance between quarterly deliveries, so it would be advantageous to both of them to have a wider deal than just the EU.

But I don't think we know for sure, very little of this has been disclosed AFAIK.

This is pretty easy to google.

FCA buys US ZEV credits from Tesla on an ad hoc basis.

The deal to pool credits is for the European Union.

It is limited to the number of Tesla vehicles delivered to the EU plus Norway since Norway opted into this CO2 limitation program. I have not read of Iceland or Switzerland opting in.

Yes, but what's the limiting factor - FCA's demand or Tesla's supply?

Fact Checking

Well-Known Member

Correct me if I’m wrong, but I thought the FactSet expectations were non-GAAP. So we all (well, almost all) have similar expectations for the third quarter results. Maybe some analysts have a somewhat higher revenue number, but that’s probably because they didn’t realise the leasing percentage went up. No biggie.

I think comments about Q4, and beyond, are much more important than exactly what the Q3 EPS comes out to be.

No, you are right, I confused GAAP and non-GAAP estimates. Here's @KarenRei's current snapshot of FactSet estimates:

FactSet breakdown in more detail, posted last night by Tesla Daily:

Tesla Daily on Twitter

Revenue: $6.425B

GAAP EPS: -$1.61

Non-GAAP EPS: -$0.46

Free Cash Flow: +$32M

Gross Margin: 15.83%

I think that's a fairly reasonable middle-of-the-road revenue estimate, although I know most people here think it's too high. $75M over Q2. Assuming $90M lower automotive revenue (due to leasing) and maybe $50M more in service, this means that a beat roughly equals:

Energy Growth + Credit Growth + FSD Recognition - Lower-ASP Revenue Declines > ~$115M

One could also factor in an increase in post-purchase FSD upgrades in the (couple) days after the flood of Smart Summon videos - that would be, what... $20-ish million per percentage point of the total preexisting fleet that upgrades?

- I expect meaningful energy growth, and wouldn't be surprised with as much as +$100M or so over Q2 (which was $368,2M). Q3 is generally a strong solar quarter, and the storage market has been showing solid growth, as well as there being a number of announced completions of sizeable projects recently. I could of course be wrong - that said, I'd be surprised if energy growth is minimal, and very surprised if it's down.

- I expect credit growth (credits in Q1 boosted margins a lot more than in Q2, more vehicles delivered, etc), but you never know.

- I think expectations for FSD recognition for Smart Summon here have ranged in the ballpark of $50-100M, if I remember right? Of course, Tesla decides entirely what if any to recognize.

- Guidance for ASP is roughly even "within a few percentage points". We had a small price cut (I forget, US-only or global?), but upsell was supposed to make up for it, and FSD was $1k more this quarter than last. S/X were also a much higher Raven fraction this quarter. Overall, each percentage point of lower ASP might cost $60M or so.

If there is a meaningful revenue miss, I'm going to immediately suspect a significant ASP miss from guidance. That said, while I wouldn't be surprised with a bit of ASP decline, I'm going into this expecting it to be minor. Guess we'll see.

Margin looks far too low, unless credits are a no-show this quarter. I'd have to run the numbers on the others.

I'm trying to remember here... I know that EPS is net income divided by outstanding shares, which for Tesla (179,13M) would imply:

GAAP income: -$288,4

Non-GAAP income: -$82,4M

(That seems quite low, undoubtedly due to those margin estimates). But I seem to recall that there can be some nuance in that calculation... is there something I'm forgetting - something that adjusts outstanding shares, perhaps?

We of course never know what "one time charges" (which seem to hit like clockwork) there are. Also, consensus for Q4 at present is pretty middling, so anything that affects Q4 guidance will be important for the company's valuation.

RobStark

Well-Known Member

Yes, but what's the limiting factor - FCA's demand or Tesla's supply?

Tesla's supply.

FCA can make use of about ~200k Tesla EU deliveries for 2020 to reduce EU fines to zero if FCA BEVs and PHEV sales don't increase.

OEMs need for credits only increase in subsequent years.

FCA hopes to sell enough BEVs and long range PHEVs to not need to buy Tesla credits in or around 2023-2025.

So next year assuming GF1 can make 400k+ vehicles and none are shipped to China we could potentially see a decent portion of the limit being used.Tesla's supply.

FCA can make use of about ~200k Tesla EU deliveries for 2020 to reduce EU fines to zero if FCA BEVs and PHEV sales don't increase.

OEMs need for credits only increase in subsequent years.

FCA hopes to sell enough BEVs and long range PHEVs to not need to buy Tesla credits in or around 2023-2025.

Do you know the fee per vehicle from FCA to Tesla? Do you think it is high enough for Tesla to prioritise deliveries to EU over US to extract additional revenue from each vehicle?

Tesla's supply.

If that's correct then Tesla's huge EU scaleup in Q3 - which looks to continue and maybe even accelerate in Q4, based on how heavily they're focusing on European exports - is extremely positive for credit income growth.

Fact Checking

Well-Known Member

Yes, but what's the limiting factor - FCA's demand or Tesla's supply?

For U.S. ZEV credits I'm pretty sure the limit is FCA's (and GM's) demand.

For the EU, I don't think Tesla can deliver enough: first ~37k units are worth about €21,000 EUR (!):

I deleted an earlier reply to this post because I decided I didn't like the assumptions I was using. Here's the update.

My interpretation of the 2020 statement is that FCA thinks they can reduce their fleet average CO2 emissions from 120 g/km (2017 value) to 114 (20% of the way to their target of 91) using some kind of "ICE Tech". In order to get the rest of the way to compliance, they would need 190,000 ZEVs in the pool. (This assumes FCA fleet size of 912,000).

The first 37,000 ZEVs would be very valuable, since the Supercredit rules let you count each car x2. Each of these would be worth about 20,000€ in penalty reduction. Beyond that, each ZEV would be worth about 10,000€. So the total of 190,000 ZEVs would have a penalty reduction value of ~2B€

We're going to need a bigger boat.

ZEVs beyond the first 37,000 are worth €10,500 per unit.

FCA needs 190,000 units to reach their goal - assuming their "20% reduction via ICE technologies" doesn't include software hacks, it appears EU regulators have wised up to those techniques meanwhile...

If we assume FCA and Tesla are splitting the ZEV advantages 50%/50% the ZEV income to Tesla is €10,500 for the first 37,000 units and €5,250 per unit for the rest, in 2020.

It's unclear to me how the payments by FCA are timed: the credits are earned in 2020, but the penalties begin in 2021. I assume the payments begin in 2020 - but this is not a certainty.

That's almost 45,000 vehicles in the EU alone per quarter, twice the current rate, with very healthy margins ...

Singer3000

Member

Finally caught up after about a week. The battery / nickel discussion a couple of days ago was great.

Some further thoughts. Indonesia's unexpectedly accelerated ban on the export of raw nickel ore has been causing a lot of ructions in the market.

Miners welcome Indonesian export ore ban, plan smelting expansion

The China domestic premium inverted for the first time, the forward curve went into a quite unusual period of very volatile backwardation and there has been an unprecedented withdrawal of physical stock from the LME exchange. One assumes that spot prices might continue to rise.

LME Starts Inquiry Into Nickel Trading as Inventories Plunge

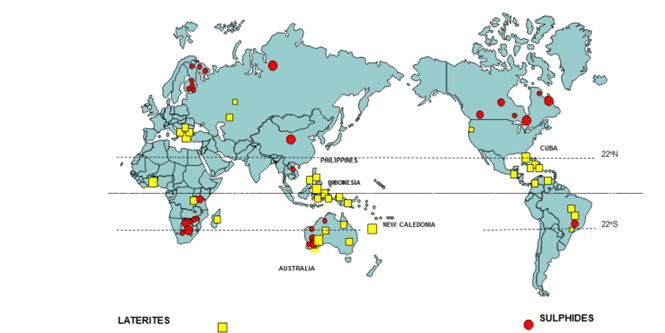

Further, there's some good high level discussion on nickel laterites in this slightly-aged prezzo:

https://www.metsengineering.com/wp-...-Processing-and-The-Rise-of-Laterites_JBM.pdf

While others have laid out a good case for Tesla moving all the way upstream, it should also be acknowledged that this would not come without quite significant additional risks beyond the finance risks mentioned by others.

Building an integrated mining/smelting capability helps build reliability of supply and takes away volatility in both the index price, as well as treatment & refining charges, which can be quite volatile itself. But looking at the geographic distribution of deposits, it is also highly likely to add material country, environmental and social risks on top.

Building such capacity in emerging markets is not for the fainthearted, increases the risk that Tesla (quite perversely) becomes the target of environmental protection groups and almost inevitably makes them susceptible to workforce industrialization in a way they have so far managed to avoid.

Elon is from South Africa so I guess he knows how dirty commodities production can be (and I don't just mean environmentally). I have every faith he's hired some excellent mining and metals consultants or will do so shortly. They will need to be world class if they are to pull this off. I do have to wonder just how many globally embedded businesses Elon has the headspace to disrupt. I've no doubt if he turned his attention to mining he'd tear it up but he'd no doubt learn some painful lessons first and he only has so many hours in the day.

It's also going to take A LOT of capital. Since Elon seems quite reluctant to materially dilute his shareholding, it's tricky to see how they simultaneously pull off upstream vertical integration and rapid expansion to the 1-2 TWh level. That is, without first Elon being in a position to substantially lever up against SpaceX (post Starlink perhaps?) or Tesla having cracked FSD and becoming a printing press. I'm fascinated to see what they're going to say at the Battery Day, they're far smarter than me so no doubt they have a plan they think will work.

Australia by the way seems a no-brainer candidate for a stationary storage Gigafactory, especially so if Mike Cannon-Brooks mega solar project in between Darwin and Alice Springs comes together.

Some further thoughts. Indonesia's unexpectedly accelerated ban on the export of raw nickel ore has been causing a lot of ructions in the market.

Miners welcome Indonesian export ore ban, plan smelting expansion

The China domestic premium inverted for the first time, the forward curve went into a quite unusual period of very volatile backwardation and there has been an unprecedented withdrawal of physical stock from the LME exchange. One assumes that spot prices might continue to rise.

LME Starts Inquiry Into Nickel Trading as Inventories Plunge

Further, there's some good high level discussion on nickel laterites in this slightly-aged prezzo:

https://www.metsengineering.com/wp-...-Processing-and-The-Rise-of-Laterites_JBM.pdf

While others have laid out a good case for Tesla moving all the way upstream, it should also be acknowledged that this would not come without quite significant additional risks beyond the finance risks mentioned by others.

Building an integrated mining/smelting capability helps build reliability of supply and takes away volatility in both the index price, as well as treatment & refining charges, which can be quite volatile itself. But looking at the geographic distribution of deposits, it is also highly likely to add material country, environmental and social risks on top.

Building such capacity in emerging markets is not for the fainthearted, increases the risk that Tesla (quite perversely) becomes the target of environmental protection groups and almost inevitably makes them susceptible to workforce industrialization in a way they have so far managed to avoid.

Elon is from South Africa so I guess he knows how dirty commodities production can be (and I don't just mean environmentally). I have every faith he's hired some excellent mining and metals consultants or will do so shortly. They will need to be world class if they are to pull this off. I do have to wonder just how many globally embedded businesses Elon has the headspace to disrupt. I've no doubt if he turned his attention to mining he'd tear it up but he'd no doubt learn some painful lessons first and he only has so many hours in the day.

It's also going to take A LOT of capital. Since Elon seems quite reluctant to materially dilute his shareholding, it's tricky to see how they simultaneously pull off upstream vertical integration and rapid expansion to the 1-2 TWh level. That is, without first Elon being in a position to substantially lever up against SpaceX (post Starlink perhaps?) or Tesla having cracked FSD and becoming a printing press. I'm fascinated to see what they're going to say at the Battery Day, they're far smarter than me so no doubt they have a plan they think will work.

Australia by the way seems a no-brainer candidate for a stationary storage Gigafactory, especially so if Mike Cannon-Brooks mega solar project in between Darwin and Alice Springs comes together.

Australia by the way seems a no-brainer candidate for a stationary storage Gigafactory, especially so if Mike Cannon-Brooks mega solar project in between Darwin and Alice Springs comes together.

View attachment 469070

Yeah - Australia is a hard sell for a vehicle Gigafactory, but whenever they want a dedicated energy Gigafactory for southeast Asia, it's a total no-brainer. If Australia creates the demand, a local Gigafactory will surely follow.

Tslynk67

Well-Known Member

Old Berty is a senile old man. Look everyone, I’m a bot! Entertaining as f...

View attachment 468947

View attachment 468948

How come you can even Tweet the idiot - I've been blocked for over two years now. Are you also on the $TSLAQ block list?

For the Model X, it's called losing flexibility as you and your friends age.I can see this happening.

But it's not called "discriminating", it's called "insecure".

Todd Burch

14-Year Member

How come you can even Tweet the idiot - I've been blocked for over two years now. Are you also on the $TSLAQ block list?

Yes I’m on the TSLAQ block list. I was surprised I wasn’t blocked too.

The exchange continued until he asked for my full name (uh, hello?), address, etc...at which point he turned into a genuine creeper and I moved on, lol.

Todd Burch on Twitter

Last edited:

Dan Detweiler

Active Member

That basket has become the forbidden fruit. Stay away...it's nothing but rotten apples.I'm wondering at what point they are going to find a good apple among all the UAW bad apples.

Dan

RobStark

Well-Known Member

First Mazda BEV/PHEV for 2021.

35.5 kWh pack for 125 miles of range and 50 kW charging.

Optional rotary wankel engine serving as a range extender.

This would have been so cool.

In 2011.

Pezpunk

Active Member

First Mazda BEV/PHEV for 2021.

35.5 kWh pack for 125 miles of range and 50 kW charging.

Optional rotary wankel engine serving as a range extender.

This would have been so cool.

In 2011.

jeez they just ..... don’t get it, do they?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M