Yes, I think Q2 sales (particularly deliveries) will be stronger than Q1. And Q3 stronger than Q2.

Sales sure, wondering more about profitability.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Yes, I think Q2 sales (particularly deliveries) will be stronger than Q1. And Q3 stronger than Q2.

Sales sure, wondering more about profitability.

The way you put it makes it seem like a false dichotomy to me. For example, the one in Australia uses Samsung batteries. IIRC, Tesla was contracted to build it. So they neither sold nor leased it, they made money through contracting.Can someone please explain how Tesla makes money from large battery installations, like the one in Australia?

Does Tesla sell them or lease them?

Why doesn't Tesla go after one of these FUDsters with a defamation lawsuit? Make an example of one of these lying "analysts" (not the word I wanted to use). Their FUD is now so provably wrong and has clearly done harm to the valuation of the company.He's a hired liar, which is worse than being stupid, he's vile, he should be on trial.

Why doesn't Tesla go after one of these FUDsters with a defamation lawsuit?

January 2018, for comparison:

Model 3 1875 (+347%)

Model S 800 (+9%)

Model X 700 (+36%)

The way you put it makes it seem like a false dichotomy to me. For example, the one in Australia uses Samsung batteries. IIRC, Tesla was contracted to build it. So they neither sold nor leased it, they made money through contracting.

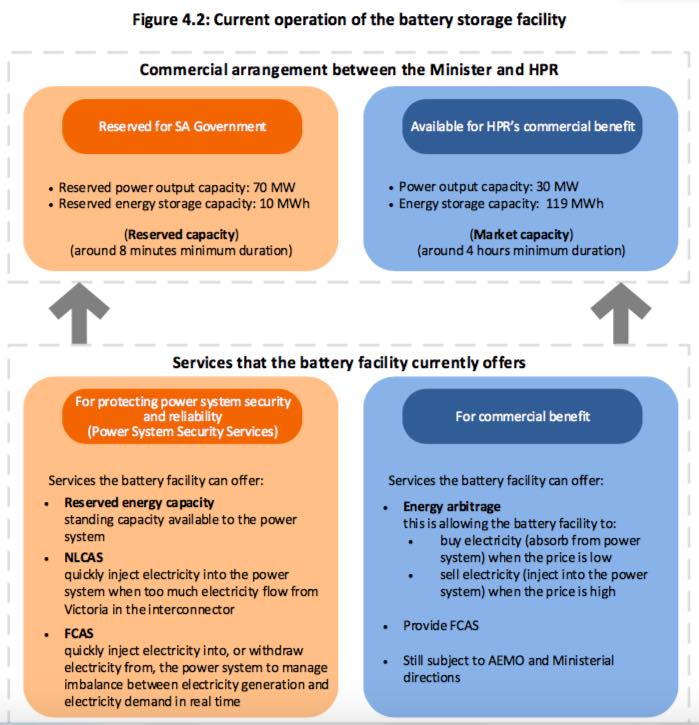

Mainly it seems by FCAS (Frequency Control & Ancillary Services), keeping the electrical grid up, running, stable, obviating the need of expensive peaker plants to keep it going since the moment you make electricity, you have to use or store itCan someone please explain how Tesla makes money from large battery installations, like the one in Australia?

Does Tesla sell them or lease them?

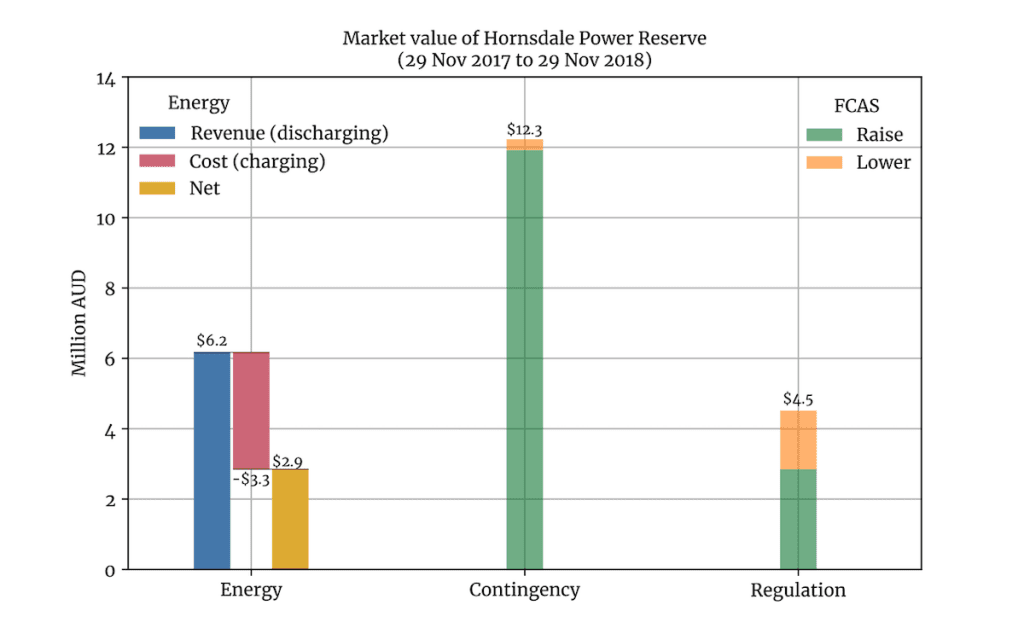

That is made up, as this graph above shows, of $2.86 million of net revenue from energy market trading (generation revenue minus charging costs), and another $16.75 million from FCAS market. Add in the $4 million a year it gets from the South Australia government for grid security services, that takes it close enough to $24 million.

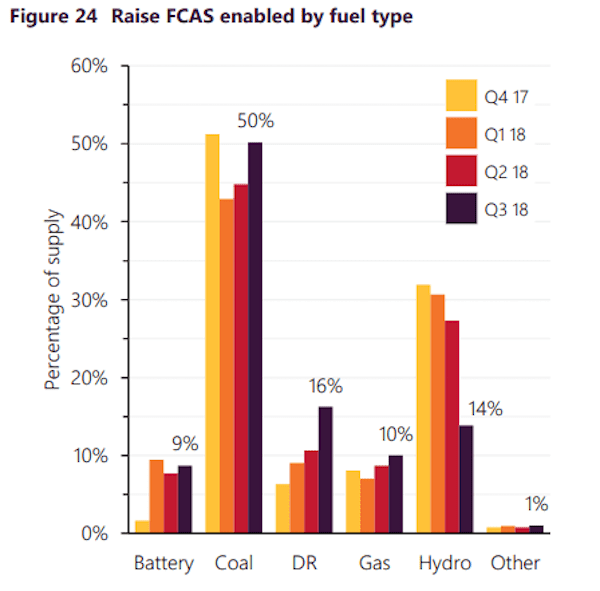

That is made up, as this graph above shows, of $2.86 million of net revenue from energy market trading (generation revenue minus charging costs), and another $16.75 million from FCAS market. Add in the $4 million a year it gets from the South Australia government for grid security services, that takes it close enough to $24 million. But no one is pretending they can. This graph above, published in the recent AEMO quarterly update and highlighted by McConnell, points to the influence even a relatively small battery can have.

But no one is pretending they can. This graph above, published in the recent AEMO quarterly update and highlighted by McConnell, points to the influence even a relatively small battery can have. More importantly, the success of the battery has paved the way for other installations. Another two batteries in Victoria – at the Gannawarra solar farm (Tesla) and the Ballarat network hub (Fluence)have nearly completed commissioning, and a third is soon to join at the Wattle Point wind farm in South Australia.

More importantly, the success of the battery has paved the way for other installations. Another two batteries in Victoria – at the Gannawarra solar farm (Tesla) and the Ballarat network hub (Fluence)have nearly completed commissioning, and a third is soon to join at the Wattle Point wind farm in South Australia.Can’t find the source. But I saw something on Twitter mentioning something about a weather holds. New estimated arrival date of Feb5

I don't know where you get that impression. Tesla supplied the system. The system consists of batteries, inverters, controllers, wiring, and I believe even the construction of the concrete base. Batteries are large things full of cells. The fact that Tesla bought the cells from Samsung doesn't mean that Tesla was only a middleman.The way you put it makes it seem like a false dichotomy to me. For example, the one in Australia uses Samsung batteries. IIRC, Tesla was contracted to build it. So they neither sold nor leased it, they made money through contracting.

Gaslighting - WikipediaThat's not gas lighting -- just cognitive bias or simple confusion.

Even saying "batteries" is a very poor simplification of what Tesla does. Those batteries even if they are from Samsung have to get assembled into battery pack modules. Samsung isn't doing any of that.I don't know where you get that impression. Tesla supplied the system. The system consists of batteries, inverters, controllers, wiring, and I believe even the construction of the concrete base. Batteries are large things full of cells. The fact that Tesla bought the cells from Samsung doesn't mean that Tesla was only a middleman.

Rear legroom is not just to fit people in, it’s to fit them comfortably even when they lay back and cross their legs.Certain part of China have different average height and some are taller. So I agree.

The suggestion by some here for the long wheelbase is the elderly are needing the longer leg room. I’m saying this is completely false as that generation is pretty short on average. Larger car equals luxury in their eyes so they want to pay less. And lastly which Chinese can resist a bargain?

And the rest of the quote:

Can't tell if just an idiot or trying to be deceitful.

Source (Yahoo): Analyst: 'Trump is going to come down on' Tesla

I am currently math challenged. A long time ago in a galaxy far away I was OK with math......and even in my current sorry math state I know you can't do what this "analyst" did and get a correct answer.The bigger problem isn't just that 91% of 93% isn't 84% but 84.6% (rounded to 85% if a decimal point is too difficult to print), but that in 2018 Tesla's workforce also grew by +30%, so the real growth number is 84.6% of 130%, which is 110%.

TL;DR: Tesla's workforce grew by +10% last year.