Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

RobStark

Well-Known Member

Mike Smith

Active Member

.I thought 777.77 is the new 420.69 that will get you to buy a bunch of shares if you get one every time that target is hit. We'll see, seems might be just worth 3 shares.

Is that the bottom of the S or the top?

Both... bottom in 2021, and top in 2068 when a youthful looking Starship Fleet Admiral Musk is on hand to open GF#888 (Europa)

RobStark

Well-Known Member

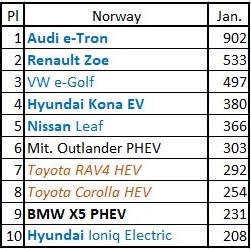

Nissan Market Cap has fallen below Subaru even though unit sales are 4x Subaru.

Mike Smith

Active Member

This equity raise destroys the 'FOMO retail' narrative. This is $2.3B of institutional money validating the current price.

Fact Checking

Well-Known Member

And Nissan's former CEO also warned that the company could go bankrupt in the next 2 years:

But it's Tesla's corporate debt that is rated by both Moody's and S&P as "junk debt" (B3/B-), while Nissan's corporate debt is rated as "investment grade" NINE full notches higher at A3/A-:

Hello Moody's and S&P credit rating staff, ... tap, tap ... is this thing on?

In case you missed this interview on Wed, Feb 5 during the -$150 'naked shorting' drama:

Big Short's Steve Eisman Says He Covered Tesla Short `A While Ago' | Bloomberg Markets and Finance - YouTube

Just one data point here but is it possible that making billions betting correctly on the suffering of millions makes you a miserable person?

And Nissan's former CEO also warned that the company could go bankrupt in the next 2 years:

But it's Tesla's corporate debt that is rated by both Moody's and S&P as "junk debt" (B3/B-), while Nissan's corporate debt is rated as "investment grade" NINE full notches higher at A3/A-:

Hello Moody's and S&P credit rating staff, ... tap, tap ... is this thing on?

one consequence of the capital raise is that it should make corporate debt less risky, and so improve their credit rating.

On the offering and the price, i’d Suggest going to Tesla IR, sign up for alerts.

On options, if looking for advice, ideas, understanding, I’d suggest getting and reading options book by mcmillan.

On options, if looking for advice, ideas, understanding, I’d suggest getting and reading options book by mcmillan.

RobStark

Well-Known Member

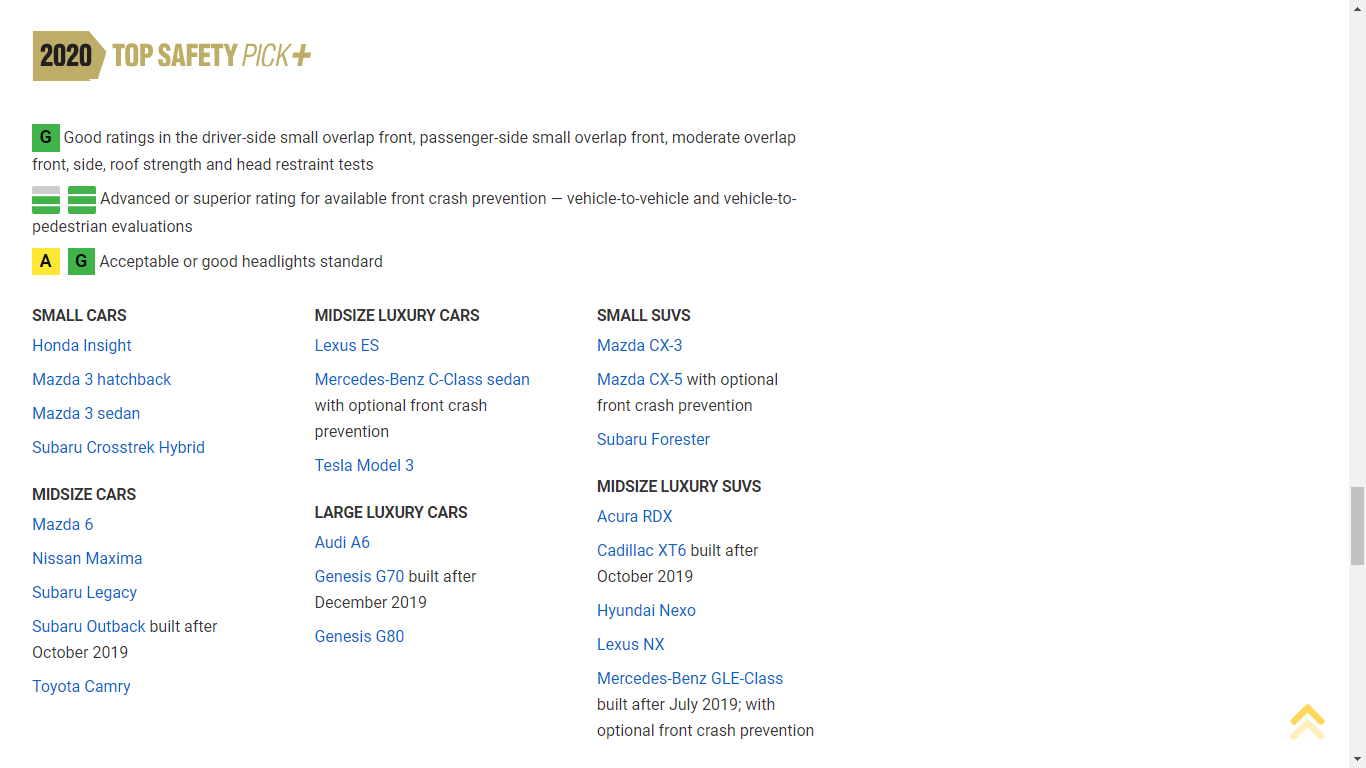

Model 3 qualified for 2020 IIHS Top Safety Pick Plus.

Model S/X did not qualify for either Top Safety Pick nor Plus because of headlight performance and one of the crash test, probably needs a re-engineered unibody for that.

64 vehicles earn 2020 IIHS awards, thanks to state-of-the-art safety

Model S/X did not qualify for either Top Safety Pick nor Plus because of headlight performance and one of the crash test, probably needs a re-engineered unibody for that.

64 vehicles earn 2020 IIHS awards, thanks to state-of-the-art safety

Mike Smith

Active Member

Model 3 qualified for 2020 IIHS Top Safety Pick Plus.

Model S/X did not qualify for either Top Safety Pick nor Plus because of headlight performance and one of the crash test, probably needs a re-engineered unibody for that.

64 vehicles earn 2020 IIHS awards, thanks to state-of-the-art safety

View attachment 511037

IIHS represents the insurance industry, which doesn't include Tesla Insurance, so they they can't be trusted to evaluate Tesla. NHTSA ratings is all that matters.

Pezpunk

Active Member

jschwefel

Tesla fan/TSLA, Model Y and Cybertruck owner.

And probably you’ll still be wrong.I predict between 10 and 500k deliveries.

Fact Checking

Well-Known Member

In theory, to sell 32 covered calls you'd need 3200 shares, or uncovered 32x strike price in margin or capital. Right?

I only have around $160k to play with in my trading account, so I can do one, two calls/puts max. I'm not going to use margin, there lies madness.

No, with @KarenRei's spreads the written higher price call is protected by the lower price lower leg call, so they are self-covered (no need for shares or cash backing), and capital requirements are basically the worst-case loss times the number of calls.

So for example, if you buy a $1,000 strike 2021/01/15 for $110 and sell a $1,200 strike (same expiry) for $75 to create a leveraged bullish spread, then the worst-case loss is the difference between the two premiums: $65 × 100 = $6,500 if TSLA closes below $1,200 on 2021/01/15.

With $160k of capital you can buy 24 such contracts.

With narrower spreads - for example a $1,100 upper leg for $90 your worst-case loss is $20, and your $160k cash will finance up to 80 such spreads, without using margin.

Note that if you start trading call spreads it's highly recommended you look up buy limit and sell limit orders and post your buy and sell orders at around the mid-price, the bid-ask price-spreads are rather substantial for the 2021 expiries that Karen is using, and will eat up a lot of the gains if you just buy/sell naively.

It's also recommended to put your limit orders in well in advance and wait for the market come to you, with occasional adjustments as new events come in and the price develops, i.e. do not try to react to price spikes (there's exceptions though) - you are just not fast enough for that and it's also stressful and emotional.

Another warning: on most retail trading platforms it's dreadfully easy to accidentally write naked puts or naked calls. You might want to ask your broker whether that can be enforced, i.e. let your account be downgraded to not allow naked options at all - only covered options and spreads. Not having margin enabled (i.e. a cash-only options trading account) is a solution.

If not then try to find some procedure that keeps you safe, for example by always double checking the balance of your spreads - and also be careful about always starting with the lower leg: if you write the upper leg first you will for a short amount of time own a naked call. If some huge event comes in or should you lose Internet connectivity at just the wrong moment and the price crashes, your losses with a naked call are almost unlimited. I.e. think through the consequences and try to be worst-case transaction-safe in multi-options strategies.

Same applies to closing and rolling a spread: always have at least as many long calls as short calls. No exceptions allowed: if you are trading in a personal retail account then your brokerage agreement makes you liable for any trading losses without limits, including all your personal and joint wealth, including your car, your home, all other bank accounts and more. Brokerages routinely go after retail clients that blew out with huge negative account balances, if the client doesn't pay they will sue and win, and if the client still doesn't pay the debt is sold to a debt collection agency.

Many platforms will allow you to safely enter into and exit from spreads, but rolling them as @KarenRei does is usually manual work.

Not advice and double check my calculations!

Last edited:

RobStark

Well-Known Member

IIHS represents the insurance industry, which doesn't include Tesla Insurance, so they they can't be trusted to evaluate Tesla. NHTSA ratings is all that matters.

If there is an anti Tesla conspiracy why give the large volume Model 3 a Top Safety Pick Plus rating?

Gen II is simply older designs with older design

MODERATOR EDITED TO REMOVE OBSCENE LANGUAGE. POSTER PLACED ON A ZERO-TOLERANCE LEASH

Last edited by a moderator:

Just throwing this thought out there.

Is it possible that somebody with first dibs on a cap raise like this, knew this was coming a week ago, and thus decided to heavily short the stock @ $960, knowing they'd be able to get the shares back from the capital raise at a lower price? Any chance that somebody close to Goldman Sachs / Morgan Stanley or they themselves pulled this off?

Not sure if this is possible, but it'd almost be the perfect crime:

Good Q4 ER -> Stock goes up -> TSLA Management decides over the weekend to go ahead with cap raise -> By Tuesday GS & MS know it's coming -> They short the stock -> Details get worked out -> Cap raise announced yesterday -> GS & MS get to cover for lower price.

Maybe this is too far out there, but I'm interested in what others think.

Is it possible that somebody with first dibs on a cap raise like this, knew this was coming a week ago, and thus decided to heavily short the stock @ $960, knowing they'd be able to get the shares back from the capital raise at a lower price? Any chance that somebody close to Goldman Sachs / Morgan Stanley or they themselves pulled this off?

Not sure if this is possible, but it'd almost be the perfect crime:

Good Q4 ER -> Stock goes up -> TSLA Management decides over the weekend to go ahead with cap raise -> By Tuesday GS & MS know it's coming -> They short the stock -> Details get worked out -> Cap raise announced yesterday -> GS & MS get to cover for lower price.

Maybe this is too far out there, but I'm interested in what others think.

Fact Checking

Well-Known Member

If there is an anti Tesla conspiracy why give the large volume Model 3 a Top Safety Pick Plus rating?

Gen II is simply older designs. ~~~Deleted trashbtalk~~~~~~,y.

There's no proven conspiracy, but these are facts:

- The IIHS is funded by U.S. car insurance companies.

- The "small overlap frontal collision test" was added when the Model S was tested first by the IIHS, and this was not known to Tesla in advance, and it's a worst-case collision pattern that hits the Model S at exactly the right spot to cause some lower leg forces to be over the allowed threshold. If we look at actual accident data from Tesla, they are excellent, including the IIHS data which is best-of-class in many areas.

- The headlight test criteria were made more strict after the fact as well, to the detriment of Tesla.

- AFAIK all other car companies give their cars for free to the IIHS, but they have to buy Teslas themselves. This asks the question to what extent the IIHS is a pay-to-play crash testing agency.

- Tesla is earning top scores at every other crash test agency, with excellent results in both side and frontal collisions.

Exciting rumor!

According to Jay in Shanghai, there appear to be at least 100,000 MIC Model 3 reservations based on vins. Jay in Shanghai on Twitter

If true, Tesla should have no problem delivering 500k vehicles in 2020.

I wouldn't be surprised. It'd be pretty amazing for demand, especially because not a single MiC M3 is on the road yet. Imagine the kind of demand they'll see after these 100k M3s convince friends and colleagues of their owners to also put in an order.

Tesla's problem in China is definitely not demand, but fulfilling the demand.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M