Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

1101011

Proud TSLA/SCTY shareholder since 2013.

Put it in Ohio please!!!!

Second that motion.

Mike Smith

Active Member

When Tesla announced Giga Berlin TSLA soared because it showed Tesla is confident about future demand. This news about yet another new factory is very positive for TSLA. Analysts are expecting around 15% annual growth over the next ten years, but this doesn't line up at all with how fast they're adding new factories. This news specifically confirms massive Model Y and Cybertruck demand, which analysts were unsure about.

So no payroll taxes for employer and employees through end of year and maybe permanent...new proposal considered. Really? How large is our deficit?

Trump pitched 0% payroll tax rate for the rest of the year, White House official says

The US deficit is Bigger than it was yesterday and smaller than it will be tomorrow. So - average?

OK ok. I've seen plenty of entertaining slants on this. But this will be an extremely effective ad to the two recognized target consumer groups. And both of those are in the majority as to one attribute. They BOTH never drove a Tesla.

The one is lexus owners. It reinforce their choice to drive a Lexus by dismissing the upstart. And the other group is those that have neither driven a tesla or a lexus but are going to buy one or the other.

It is NOT an ad designed to influence the tesla owner.

Ummm, those flyers were left on tesla owner's vehicles. It very much was targeted at tesla owners. That's what makes their marketing campaign so bone-headedly funny. There are dumb people everywhere!

Fact Checking

Well-Known Member

I guess the silver lining of Biden wining Michigan is the market should be through the roof tomorrow. Grab up those Wall Street, healthcare, and insurance stocks!

This outcome was already priced in after Super Tuesday I'm afraid, and the Michigan polls were predicting Sanders a bleak future as well. It's "surprise" that moves markets.

Meanwhile most Asian markets are deep red, US futures are down sharply, and Trump is too personally wounded to entertain even the illusion to negotiate with Democrats over stimulus measures:

Trump's solution is to ... bail out oil billionaires (yes, really):

Just in case anyone is wondering what the policy influence of the fossil energy industry is in the U.S., versus renewables:

Tuesday night owls: Dirty energy got 12 times as many meetings at Interior Dept. as renewables did

"Executives from the oil, gas, electricity, coal and mining industries held 12 times as many meetings with the U.S. Department of the Interior’s top two officials over about two years as with conservation and renewable energy interests, a new report by Public Citizen and Documented Investigations finds."

"Executives from the oil, gas, electricity, coal and mining industries held 12 times as many meetings with the U.S. Department of the Interior’s top two officials over about two years as with conservation and renewable energy interests, a new report by Public Citizen and Documented Investigations finds."

I'm almost speechless. While China and most of Asia is handling it well, this crisis is escalating faster in the U.S. than I thought, in a weird way that superimposes articles from "The Onion" with scenes from "28 Days Later"...

Buckle up, not advice.

Last edited:

DOW futures are down over 600.I guess the silver lining of Biden wining Michigan is the market should be through the roof tomorrow. Grab up those Wall Street, healthcare, and insurance stocks!

tinm

2020 Model S LR+ Owner

So has anyone been monitoring Elon’s jet’s flight plans lately? If he’s checking out Cyber Giga locations, where has he landed lately?

It's called the power of negotiation and the possibility of a GF in the state would provide a huge amount of leverage in allowing the Tesla model of car sales within the state. Would also be a bit ironic in a state known for it's ties to the petroleum industry....Yes, but I doubt he wants to build a factory there when Texas doesn't allow car sales.

Well he is making music now days too...TechCrunch says Elon is scouting Nashville

Tesla is eyeing Nashville for Cybertruck gigafactory — TechCrunch

edit: Appears to be mostly speculation

Quote “Musk didn't provide further information in the tweets. However, a source with knowledge of the talks said Nashville is on a short list of contenders.”

You know turnabout is fair play... it would be great for a local Tesla group to compose a similar message describing the fun and other many advantages of owning a Tesla and slip them on as many Lexus windshields as they can find. The publicity would be quite entertaining!Ummm, those flyers were left on tesla owner's vehicles. It very much was targeted at tesla owners. That's what makes their marketing campaign so bone-headedly funny. There are dumb people everywhere!

Pras

Member

No point building in mid west. Weather and labor union issues. Central US is fine.As far as Giga's location goes, I agree that Elon is shopping around and sending pressure to Texas.

However, I don't think that's the main idea. Giga locations are usually very logistic focused. If Giga Buffalo will start producing cells, I'd put my money on anything that has a manageable (time) direct HWY access to Giga Buffalo... namely PA, and OH. (NY could be one, but I doubt much more incentive with Giga Buffalo already in place) Because by going down further, it just adds on logistic costs for cells.

Of course, given Elon has said this is a CT Giga, they can just produce the needed cell right there. But then it still needs to consider logistic costs of the final product to their consumers. So, take OH for example, LG Chem/GM is going to build their Giga there. I wouldn't be surprised to have Tesla Giga in OH too for the sake of talent pool access and also bargain power with the state as it could team up with LGChem/GM to lobby.

Artful Dodger

"Neko no me"

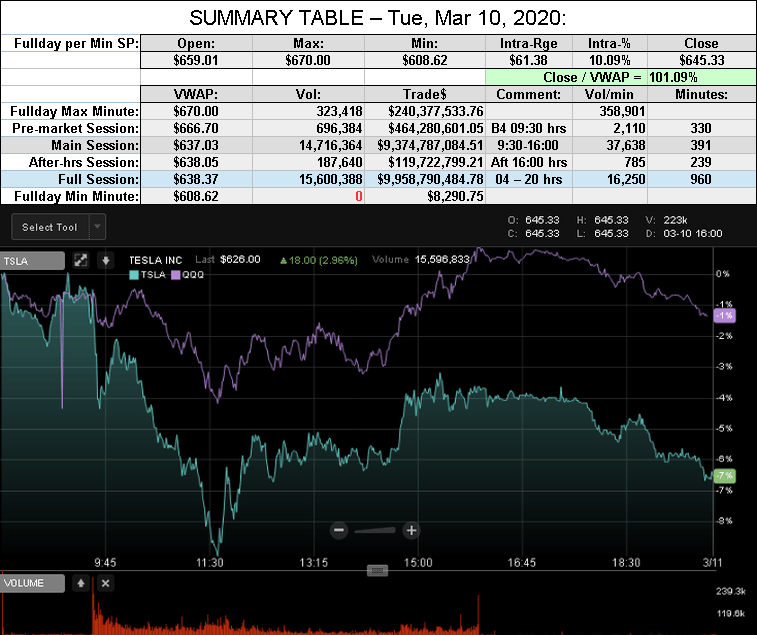

After-action Report: Tue, Mar 10, 2020: (Full-Day's Trading)

Comment: "1st min madness; then make it stick"

VWAP: $638.37

Volume: 15,600,388

Traded: $9,958,790,484.78 ($9.96 B)

Closing SP / VWAP: 101.09%

(TSLA closed ABOVE today's Avg SP)

Volume: 15,600,388

Traded: $9,958,790,484.78 ($9.96 B)

Closing SP / VWAP: 101.09%

(TSLA closed ABOVE today's Avg SP)

Comment: "1st min madness; then make it stick"

Buckminster

Well-Known Member

What states is Elon referring to when he says Central US? Central timezone includes mid west.No point building in mid west. Weather and labor union issues. Central US is fine.

MC3OZ

Active Member

So has anyone been monitoring Elon’s jet’s flight plans lately? If he’s checking out Cyber Giga locations, where has he landed lately?

Mars..

Fact Checking

Well-Known Member

What states is Elon referring to when he says Central US? Central timezone includes mid west.

IMO it means Tesla is negotiating with individual states for the GF5 location, and is trying to include as many states as possible in the list of offers, to get the best conditions.

Artful Dodger

"Neko no me"

As I suspected would occur again today on this 2nd day with the "Uptick Rule" in effect, an significantly large amount of naked short selling occurred.After-action Report: Tue, Mar 10, 2020: (Full-Day's Trading)

Comment: "1st min madness; then make it stick"

View attachment 520496

FINRA reported "Short Exempt Volume" was 6.59% of "Short Volume", a.k.a. naked short selling. Here is a chart showing recent history the FINRA short selling reports:

Notice that the volume of naked short selling today reached the 142nd Percentile. To get a feeling for how rare this should be (if it were to have occurred only by chance), we'd expect this deviation from the averages only once in 142 trading sessions.

This is the 4th time it has happened in the last 12 sessions. This is not happening by chance. One or more parties are taking advantage of their status as Market Makers to circumvent the "Uptick Rule", and conduct large volumes of naked short selling, likely to advantage their own proprietary trading positions. This is illegal.

Only Market Makers have this priviledge, but it is illegal to use it for anything except legitimate market making. MMs are barred specifically from using their "Short selling exemption" to support their own proprietary trading. The big drop that happened immediately at the Open on Tue, Mar 10, 2020 smacks of naked short selling by MMs. TSLA followed macros (NASDAQ-100) for the entire rest of the session, but the loss relative to the rest of the market was made to stick throughout the day.

IMHO, this is illegal market manipulation by certain unethical Market Makers, whose conduct should be investigated.

#SEC #DOYOURJOB

What states is Elon referring to when he says Central US? Central timezone includes mid west.

As usual he’s left that open to interpretation for maximum froth, free viral marketing, prolonged media exposure, and maximum leverage of state incentives. The midst of an economic crisis (even if imagined) puts Tesla in a pretty good bargaining position...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M