Paracelsus

Active Member

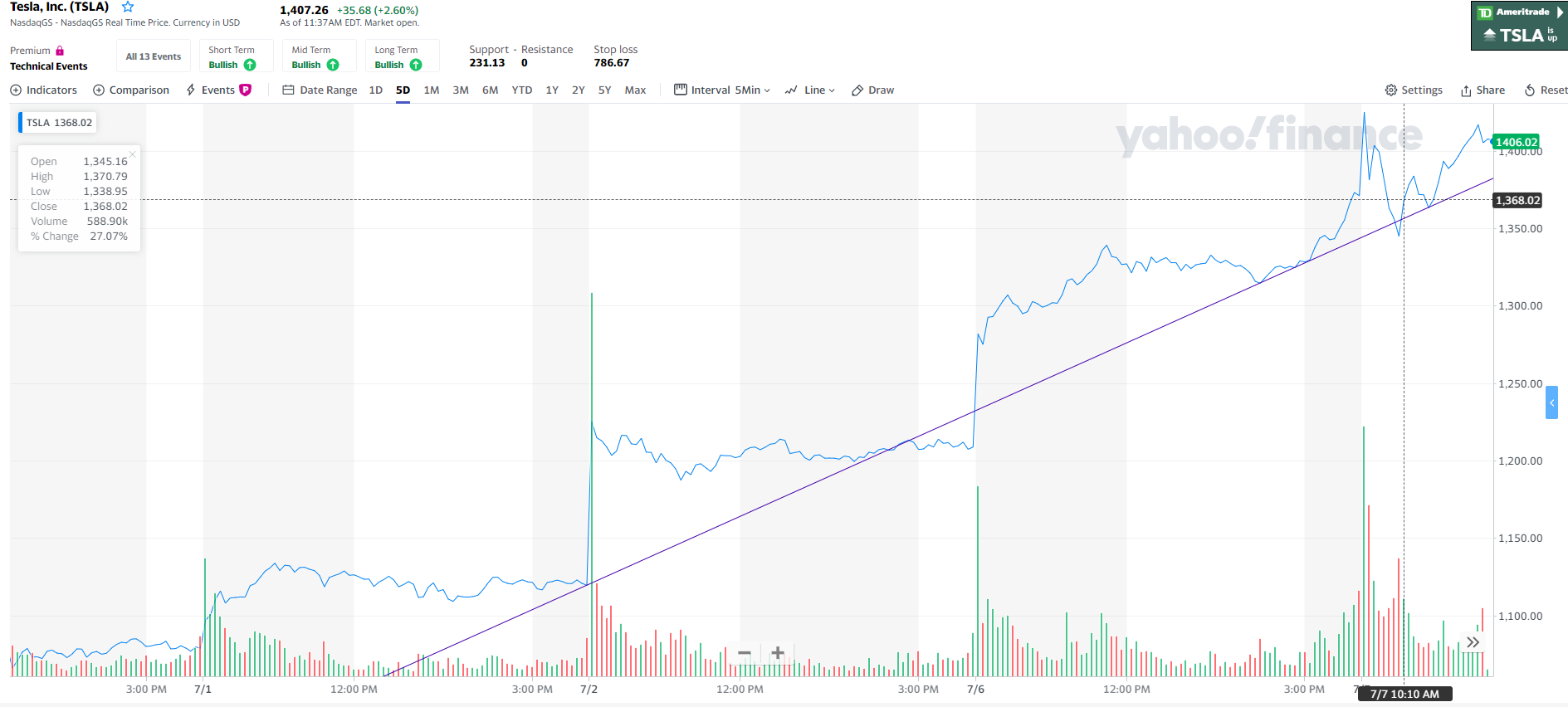

Is the ever-elusive 'Stairway to Heaven' pattern finally forming?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Agree with your post...I would add that the Cap Raise was important to the extent that it took away a base argument of the shorts that TSLA would run out of cash. Plus, that well-timed raise made the Covid crisis much less risky for investors and has contributed to the significant run we have just seen.

I take what you have posted to heart. Not because of just the source, but on some uncertain levels concerning energy I have thought WTF is really going on here. I haven't seen how energy is bought or sold or created really. All I know about the energy business is that I pay whatever they tell me I owe. After that it looks like I don't know what.I don't have a strong opinion on that except to say the action (volume and volatility) doesn't send any obvious messages to me other than normal volatility and price discovery of a stock like Tesla. There is a huge range of perspectives out there on how much is Tesla is worth going forward but many of them come from a position of ignorance. So it's not surprising the price bounces around a lot and I'm completely comfortable with $100 or $200 dollar price swings.

For what it's worth, I think the average TSLA prospects as put forth by this forum puts the financial industry's analysis of Tesla's future to shame. If anything, I think this board might be too conservative when it comes to projecting Tesla's likely achievements over the next several years (and not by a small amount). This forum (myself included) seems too focused on the auto side of Tesla's business. I get that it's difficult to project energy and solar with so little to go on at this stage but it's a bet on Musk doing what he said he would do. I think you have to throw in some value for that even though it's not very well defined.

As to manipulation, I'm not too worried about that. All stocks have some manipulation around the edges and yet, people can still buy or sell the stock if they they think it's under/over valued. In the end it doesn't matter much to a long-term investor. I would be more incensed if I were an active trader because it gives the "boys in the club" at an advantage. Wherever there is money at stake, people will try to scalp it.

Market has been open for 26 minutes

Bear are arguing from disbelief now. It's the only argument they have left. Profitability is coming, and that right soon.

"Tesla's future comes down to profitability, says Wedbush's Dan Ives"

Cheers!

Do you have another stop loss set now?

I strongly recommend against stop losses unless your particular situation has unique requirements and demands it. They are a recipe for having your shares stolen on the cheap!

On paper. It's odd but I keep seeing the number across my accounts and it doesn't register as real. I suppose that's a good thing.

Seeing seven figures in my account is so surreal that I've taken screenshots of it as it first breached the million dollar mark and at various points along the climb toward what I hope and believe will soon be "multi" status. It's all on paper, so I really don't feel any different.

Tesla (TSLA) gets $2,070 bullish price target after Monday rally

Tesla has officially received a bullish $2,070 valuation estimate from Morgan Stanley after the automaker’s stock rose 13.48%, or $162.92, on July 6.

Morgan Stanley analysts called the Monday rally “extraordinary” in a letter to investors. The financial firm’s previous price target for TSLA stock was $1,200.

The reveal will be on battery day. Where you looking at just solar panels? Nothing new there except revenue producing rooftops and California 2020 laws that mandate solar on all new homes.I take what you have posted to heart. Not because of just the source, but on some uncertain levels concerning energy I have thought WTF is really going on here. I haven't seen how energy is bought or sold or created really. All I know about the energy business is that I pay whatever they tell me I owe. After that it looks like I don't know what.

But if you say elon thinks better than you then he thinks better than me, so the intelligent thing for me to do is not concern myself with it. I'll just keep thinking of TSLA in terms of cars.

(I actually see the energy side as a money pit. THAT is how little I understand)

Does 1,000,000.1 count as 8 figures?Seven figures is indeed sweet. But eight figures.... that's my milestone.

Global auto market is worth 4 trillion. Global energy business is worth 8 trillion.I take what you have posted to heart. Not because of just the source, but on some uncertain levels concerning energy I have thought WTF is really going on here. I haven't seen how energy is bought or sold or created really. All I know about the energy business is that I pay whatever they tell me I owe. After that it looks like I don't know what.

But if you say elon thinks better than you then he thinks better than me, so the intelligent thing for me to do is not concern myself with it. I'll just keep thinking of TSLA in terms of cars.

(I actually see the energy side as a money pit. THAT is how little I understand)

Seven figures is indeed sweet. But eight figures.... that's my milestone.

Think of it this way, the vast majority of obscene wealth generated over the last 150 years is from energy. In that era it was hoarded fossil fuels. Putin is worth about $400B, the Saudi royal family, perhaps $1T. Rockefeller, etc...I'll just keep thinking of TSLA in terms of cars.

(I actually see the energy side as a money pit. THAT is how little I understand)

Seeing seven figures in my account is so surreal that I've taken screenshots of it as it first breached the million dollar mark and at various points along the climb toward what I hope and believe will soon be "multi" status. It's all on paper, so I really don't feel any different.

We continue to forecast a Model 3 launch at the very end of 2018 (more than 1 year later than company target) with 60k units in 2019 and 130k units in 2020.

I am a buyer at $2.I think the floor is $10-$15 SP