JusRelax

Active Member

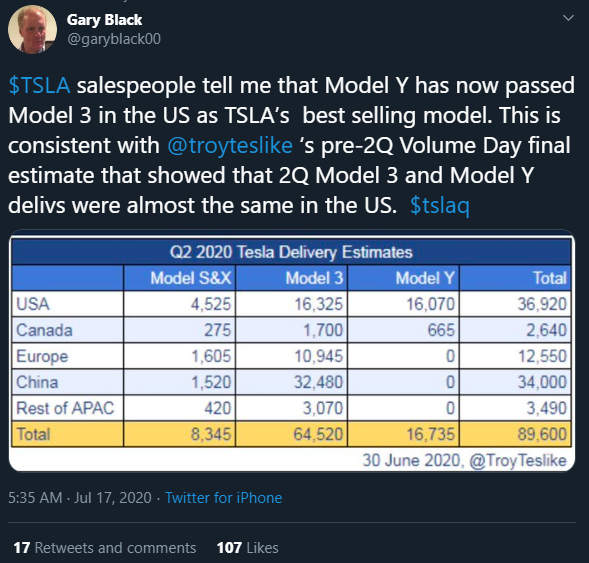

This looks great for profitability. More MY's sold = higher ASP, while costs will remain similar to M3 construction:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

So why did you use a non-existent ticker along with real stocks like TSLA, UBER, NFLX? You could have used "AAPL", like that big computer/phone company.Thanks!

Did a quick search for every use of "APPL" and all 13 of them are correct.

So why did you use a non-existent ticker along with real stocks like TSLA, UBER, NFLX? You could have used "AAPL", like that big computer/phone company.

Do you think that TSLA would have exploded the way it did if it was included in the index beginning of the year? Granted, the March sell off was major for all markets, but i think TSLA SP is better off this way IMHO.

Basic options question: when is the last date/time to sell to close a call option? For example 7/24. Thanks.

So why did you use a non-existent ticker along with real stocks like TSLA, UBER, NFLX? You could have used "AAPL", like that big computer/phone company.

Edit: I used to do serious work in standards organizations, it makes me a bit of a stickler for detail. It has saved my employer a lot of money a couple of times.

One second before the bell, AFAIK. Options can't be traded (at least not for us retail farties) outside main trading hours.

If it's out of the money then I tend to put an order for $0.05 15 minutes before close. If it's really far out of the money then usually $0.01 will be enough.

Lot of mutual fund owns Tesla stock, for example Ark Investment always have top holding Tesla but mutual fund rules go against truly holding TSLA for long term, they have to trim positions all the time, They are subject to selling out too early and buying at higher price just like individuals investors.

You do the 5cent play because if you do buy the contract, you can turn around and close it that quick (if it goes in the money)? Or execute automatically for shares?

Thanks!

Did a quick search for every use of "APPL" and all 13 of them are correct.

With so many people saying "Telsa" all the time, can you imagine if Tesla's stock ticker was TLSA? Unimaginable.

Congradulations TMC, you did it!Something odd about F*GMAN... should be TAGMAN.

Tesla, Apple, Google... MAN, and in that order. You're it!

Didn't Elon already give a thumbs down to this idea?Say

Excuse me for repeating this but I finally figured out how to link my question on 'Say' in case anyone wants to vote for it.

I really want to see Tesla make a variety of stainless steel vehicles after the cybertruck and I am hoping to see what their thoughts are on it.

You used to work for Adam Jonas and told him not to short TSLA anymore?So why did you use a non-existent ticker along with real stocks like TSLA, UBER, NFLX? You could have used "AAPL", like that big computer/phone company.

Edit: I used to do serious work in standards organizations, it makes me a bit of a stickler for detail. It has saved my employer a lot of money a couple of times.

Knightfall? went about it the wrong way but he did have some valid points. I've noticed that a lot (all?) of those saying he was wrong about a need to improve service have avoided to comment/mention the story yesterday about upcoming openings and immediate need for locations.

Tesla is looking for new locations 'immediately available' to expand service - Electrek

Interesting. This is kind of a reversion to the previous pricing structure that was based purely on a $/kWh that varied by state, but remained static regardless of array size.Correct. Only the Small 4.08 kW system had a price drop ($10,000 to $8,200). Otherwise they harmonized every system to a linear $2.01/watt no matter the size. You'll notice that 8.16 kW is now exactly twice as expensive as 4.08 kW, etc.

It does represent a small price increase for the larger systems, but it does simplify pricing and entices customers to check them out in the first place when the starting system is so affordable.

Interesting. This is kind of a reversion to the previous pricing structure that was based purely on a $/kWh that varied by state, but remained static regardless of array size.

My take on this is they realized there was value in the tiny system pricing as advertising at both the initial point if sale and referral. Putting in a 4kW system doesn't make a profit, but the follow-on business from that install won't necessarily be small systems.

Smart, simple moves. I like it. Paying minimal sales cost per install makes this kind of pricing possible. At the rate they're iterating, Tesla will own half of residential energy before long. With the other half being local installers.

Nice of Sunrun to buy Vivint so Tesla only has one massive bloated sales organization to put out if business.