The SEC is likely more worried about maintaining very good relations with the Wall Street firms that will employ them after their stint with the SEC.Well, let’s just hope it’s been punishingly expensive for Market Makers who were abusing their ability to naked short and to all short sellers of Tesla.

If the SEC won’t curb such abuses, maybe heavy hitters like Tesla and Apple can help do so and maybe send a message to the SEC too.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

insaneoctane

Well-Known Member

Sounds very much like me....No higher than 10% IMO.

I'm getting close to the first target at which I planned to sell 10% but it's happened much sooner than I expected.

Now I have to be strong and stick to the plan...

While I share the sentiment with those of you who don't know where better to reinvest any locked in gains you might produce.... Doesn't it make sense to pick a number to sell 5%, or 10% to avoid being caught with tunnel vision? What number would that be for you?

I have some sell orders in at $600/$3,000. I would be trimming already if we didn't have so many significant positive catalysts lined up.

Tslynk67

Well-Known Member

It's weird...I am so much more wealthy than I thought imaginable at this point in time and yet I feel nothing. If I were to pull cash out I don't even know what I would do with it.

Lucky you, I'm going to give all mine to my wife...

While I share the sentiment with those of you who don't know where better to reinvest any locked in gains you might produce.... Doesn't it make sense to pick a number to sell 5%, or 10% to avoid being caught with tunnel vision? What number would that be for you?

At the same time, let's keep in mind income tax considerations, particularly regarding short vs. long term capital gains.

Saw stock price was 486.xx and had a flashback to when that was the CPU I was drooling over.

had an SX 25, dreamed of a DX2/66. Oh the days of Computer Shopper catalogs.

Whew, that's some serious flashback. That was the time I went from knowing how many cycles each basic instruction takes for some manual code optimization, to saying screw it, compiler is good enough. I had a DX2/66 overclocked to some ungodly frequency, and the darn thing proceeded to work reliably for the next 7 years.

In other (on-topic) news, Fidelity is still all messed up with how it displays position values. Especially options. TSLA up 10%, AAPL up 5%. Makes me feel a bit less concerned about today's 10% being swing trader amplified hot air. Still quite tempted to sell a little.

I have diversified slightly recently by buying ARKK, BPTRX, ESGV and HASI. They were all recommended here by others.So now I have way more TSLA in my portfolio than I like holding of one company (six figures). Any suggestions on what investments to buy if I sell a big chunk of my TSLA shares?

Edit: The total of these 4 funds is about 10% of my Roth IRA. The other 90% is TSLA shares and options.

Last edited:

It does seem rather incredible that so many established platforms could be experiencing trouble executing a rather mundane stock split. To me, it lends some credence to the naked short selling theory - these platforms have tried to reconcile the stock after the split and something weird probably turned up.

ive gone into detail in past about the difference between brokers and how they handle corp actions.

some brokers are more automated and more “pro trader”-focused than others

but all have had glitches, some major and some minor, based upon the reports here, news outlets, and downdetector.com

1) obviously the most important aspect is getting your account value inline with market value, as this reduces position exposure of the broker to the market. the broker doesn’t want to take on error positions due to a corporate action event, and be exposed to covering those positions in open market.

- for example, in my IB accts, i have the correct stock and option quantities, and can also trade them...how novel!

- while cost basis is updated correctly for all stk and options,

- my overall acct unrealized PnL is off due to using fridays options close prices.

- yet my individual position Unrealized PnL is correct

yet the brokerage system is using fridays option closing prices to calculate the overall acct unrealized PnL - weird as that is, its 2 different processes calculating

_____________

im not here to doubt or rule out that theres some serious shenanigans with shorts and covering

- but this post is more about how the process works, or is intended to work.

some of the reported behavior is explainable...

and is mainly more about how archaic or manually intensive their broker's process is.

(is it possible some of these brokers keep those processes manual for a reason, i guess, but some brokers just suck at corporate actions).

these two splits garner lots of attention, but the practices that brokers use to process corporate actions has been pretty standard for a long time.

ill tell you who doesnt suck at corporate actions - HFTs, MMs, prop shops etc - otherwise theyd be taking on undue PnL on a day like today

issues reported:

1) positions not updated in account

the simple explanation is that dtcc participants have not yet received the stock allocation from the split. this is common practice. it all depends on your brokers SOP for corporate actions processing

a) some brokers adjust all your positions based upon the corporate action on ex/effective date

b) some brokers leave your existing position intact and insert a placeholder, or equity freeze, in order to maintain neutrality to the market

obviously the first option is best. but even IB, who does option a) cant do that in all global markets. for example, in HK market, IB will insert a placeholder in your account in lieu of the actual stock. because HK market is fail intolerant, they cant risk the customers selling everything before they are issued the corporate action allocation (the shares resulting from the split), and thus failing to deliver to the street!

(speculation time)

...if US market was fail intolerant, we'd probably be looking at a whole different landscape right now!

but its not, so we can have periods of fail to delivery, which are supposed to fall inline with SEC rules for buy-ins

but some have circumvented this rule in the past, as pointed out by many, and cited recently by Zhelko and Mongo as being caught and fined.

as we have experienced in the past, the small fish are made example of (think of the poor sap from goldman or wherever that basically was the only one to be prosecuted for 2008 fin crisis - as if nobody else was culpable) so its not a stretch to think that those clowns prosecuted in 2013-14 for naked shorting were not alone in engaging in activity not within the spirit of the law - but tough to prove (end speculation)

c) in instances where theres a hop between entities, like a Candian or European broker that's a customer of a US broker or DTCC participant, they may have to wait an additional day or two to get the split shares -

well, of course. if your broker chooses option a, regardless of how removed they are from DTCC, then you should be fine. but if they choose option B customer treatment for corp actions, then you are delayed even further.

2) not allowed to trade options, or have to call to place trade

i have no idea why this happens, and it sucks. id try to find another broker, if thats even an option.

seriously, move to a better broker if they put you out of the market during a time like this. its just unacceptable (again, do you think prop shops, HFs, or pro-traders are locked out of a market, ever? no, they are not, unless 3) below happens, at which point theyd find a better executing broker, or pay to connect direct to exchange if they arent already)

3) trading unavailable or overloaded/disconnected, or slow

seems like this has happened a lot this year due to volume at all brokerages. some more than others. i think this has mre to do with the volume of aapl and tsla this morning, and less about how the split 'looks' in their customer's accounts

4) im sure theres other issues as well that people have reported, just forgetting them at moment

smorgasbord

Active Member

To those thinking of diworsifiying, I suggest watching these 2 video of Warren Buffett.

Yeah, Buffett doesn't "get" technology stocks at all, but his advice about owning what you understand and how infrequently truly great businesses come around is still relevant today:

Yeah, Buffett doesn't "get" technology stocks at all, but his advice about owning what you understand and how infrequently truly great businesses come around is still relevant today:

If you really know businesses, you shouldn’t own more than 6 of them. Very few people have gotten rich on their seventh best idea, but a lot of people have gotten rich on their best idea.

Volume is only modest. Very different from 2/4 (50M+) and 7/13 (38M). This looks like less traders are participating.

Wait Yahoo is showing 87M shares traded so far. How is this modest?

Wait Yahoo is showing 87M shares traded so far. How is this modest?

87 million shares post-split would be less than 18 million shares pre-split.

Last edited:

My portfolio is 100% Tesla and I still feel like I'm missing outWhat is this disease!

ZeApelido

Active Member

It's weird...I am so much more wealthy than I thought imaginable at this point in time and yet I feel nothing. If I were to pull cash out I don't even know what I would do with it.

Folks I accidentally also performed a 5 to 1 dividend split on my children, and now I have 10.

Having cash flow issues, plz help.

Driver Dave

Member

I feel like calling Vanguard and yelling at whoever picks up:

"JUST DIVIDE BY 5!!!"

"JUST DIVIDE BY 5!!!"

Looks like Desktop Metals is not public yet.https://twitter.com/chamath/status/1300463875402407937?s=21

Chamath likes industrial-scale 3D-printing (e.g., DesktopMetals).

View attachment 582809

ARK has a 3D printing fund... PRNT.

S

Sofie

Guest

If that happens, Maybe I could consider quitting ONE of mine hmmm...Not selling. Sept and oct will be huge. Into the $7xx’s! Still not selling. Might quit my job though at that point!

While I share the sentiment with those of you who don't know where better to reinvest any locked in gains you might produce.... Doesn't it make sense to pick a number to sell 5%, or 10% to avoid being caught with tunnel vision? What number would that be for you?

For what it's worth, I've been selling some here and there over the past couple weeks. I look back on the fact that I would have been a multi-Teslanaire with what I originally held back in 2012 had I never touched anything (Wise words from @StealthP3D) however my accounts have grown so much in the last 6 months that I sort of ran into a moral quandary where I needed some time to reflect and think about what I wanted to do, if anything.

I've been very fortunate this year and a lot of pieces of my life have finally fallen into place. My wife is writing her Royal College exam as I type this, and is now a practicing specialist Physician. We bought a beautiful new home in Vancouver and just received an acceptable offer for our old one in Edmonton. My work just announced a Special Dividend on Friday. With all of these things happening, I wanted to spend some time cleaning up finances in the form of minimizing tax burden, RESP funding for my son and just some general things for the house.

My wife has always been an adamant Tesla supporter and told me not to sell anything unless we needed to, but I have decided now is a good time to live a bit and enjoy things. The "mere" five figure daily account bumps have been nice, but as another member mentioned, I wasn't get any happier as the balances grew. My gains are anywhere between 400-900%. I'm nowhere close to retirement (Only 34) but for the first time in my life, I'm in a position where I can buy some time, and that's pretty amazing.

edit: I now hold more cash than I ever have in my life, but nothing interests me except TSLA and some of the ARK funds in terms of investment opportunity, so I sit and wait. I may miss out on more gainz, but I've at least harvested an amount that solves a lot of day to day issues.

While one point of view is that you write the calls with the intent to either pocket the premium or sell the shares at a price that's inconceivable at the time, it's still a bearish move, in that you profit most when the stock doesn't rise. Once I remembered this, and the anecdote about "picking up pennies in front of a steamroller", I stopped doing it, and I'm glad. "Full bull" is working well for me.Sooo....if one had say pre-split sold 2500 covered calls they didn't really want exercised, and it's now looking disturbingly like SP is gonna go over 500 post-split sooner than later... Is there any better strategy to avoid that than just buying them back and eating the loss?

(I suppose you could buy back then resell at higher strike to effectively roll em up and offset the loss somewhat on the premiums for that.... anything better?)

Volume is only modest. Very different from 2/4 (50M+) and 7/13 (38M). This looks like less traders are participating.

87 million shares post-split would be less than 18 million shares pre-split.

But the average volume only ~72M. So we are only part way through the day and we have surpassed the average trading volume already.

Last edited:

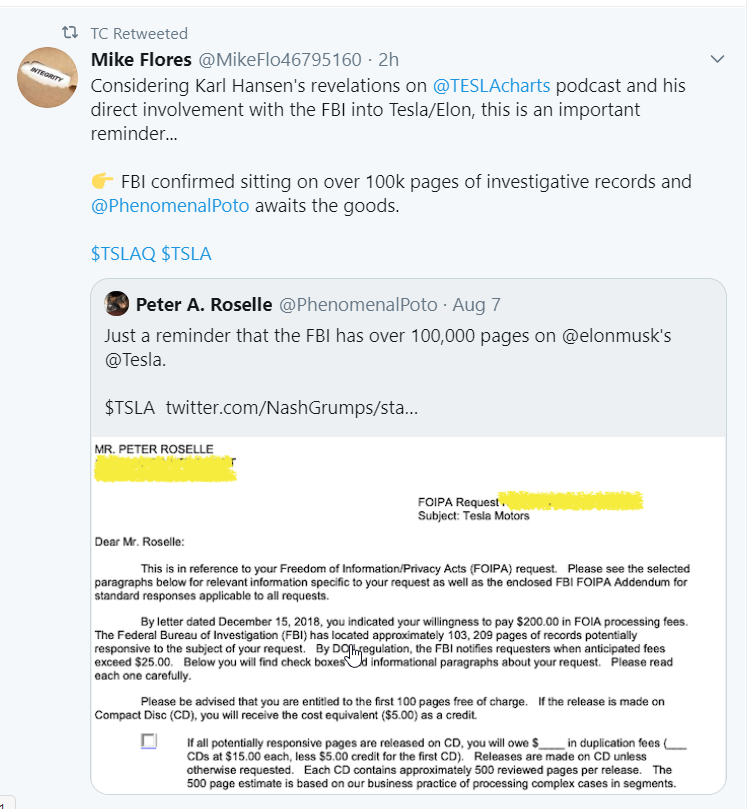

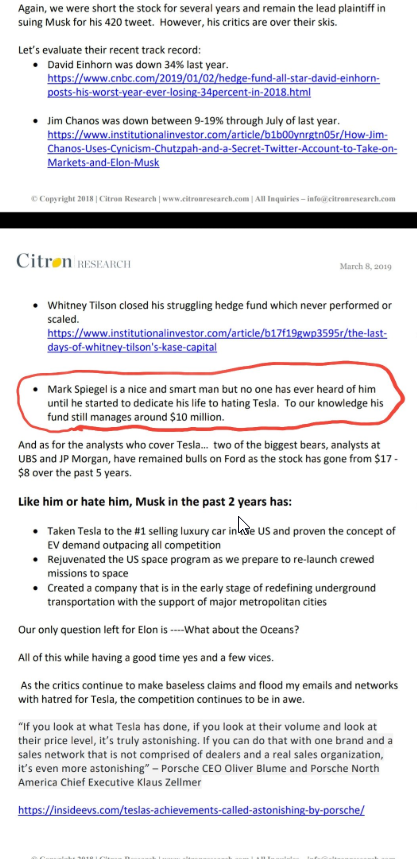

I checked in on TSLAQ. Considering this brain trust is our "competition", it's no wonder we are getting rich.

Bonus burn on smeagol from Citron at the bottom

Bonus burn on smeagol from Citron at the bottom

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K