Mike Smith

Active Member

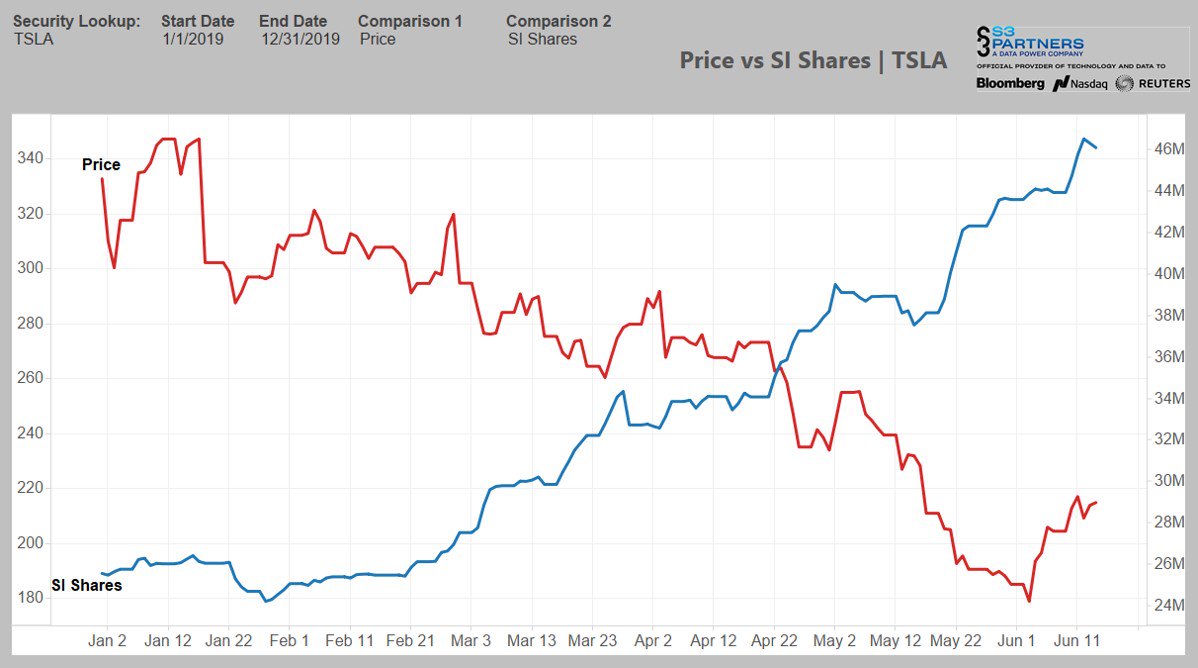

Those rates are set daily, if shares shorted are running low (indicating high demand) why aren't the rates going up? Is it normal for such high short interest to barely move the interest needle?

I'd ask @ihors3 myself, but no twitter and all that...

There are a bunch of competing brokers lending shares, so without an actual supply shortage there's no power to raise rates. But as soon as there's the slightest sign of tightness in supply the rate can go up really fast.