Perhaps the "serious beer-drinking session" is still in progress.Date of the tweet is December 2019.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Those who time it badly and miss out (i.e lose $$$) will keep quiet.

The same happens with people who sold too fast. Most of them won't tell us here. If not out of shame, then because they fear the HODL-police.

TheTalkingMule

Distributed Energy Enthusiast

As noted in their commentary, they feel SP is maxed out and 2Q profit is already baked in. They're specifically advising not to buy in advance of earnings.Why would anyone adjust a rating one day before quarterly results? Why don't they just wait until the results and they'll have a better picture to build their rating from?

Not a great position IMO, but understandable.

What's the share goal? Infinity for me....

I often think about the same thing ... $75,000 worth TSLA shares at $180= = 417 shares vs 2017 Model S ???Amen. And I curse myself every day for not having jumped in more deeply at the time. (We instead bought an X that month, which will likely turn out to have been the most expensive purchase of my life).

417 shares at yesterdays close ~ $684,500 .... however, i believe owning the model S allowed me to fully appreciate the value of TSLA and gave me the the confidence along with this thread to make purchases all last year ...it is very easy to to look back at the decision to accumulate TSLA shares now ... but for me there was a lot of uncertainty at the time .. i would still buy the Model S first

I think you are looking at this the wrong way. Back in the day, you took the decision based on information you had at the time. Dont forget that even Elon said they were seriously close to failing.

I could curse myself for not having purchased the lottery ticket number xxxxxxx after I knew it was the winner, but before the draw I didn't know which number was going to be the winner. I took the decision not to buy it based on information I had at the time. We cant guess what happens next. We can only make the best decisions we can with the info we have.

I often think about the same thing ... $75,000 worth TSLA shares at $180= = 417 shares vs 2017 Model S ???

417 shares at yesterdays close ~ $684,500 .... however, i believe owning the model S allowed me to fully appreciate the value of TSLA and gave me the the confidence along with this thread to make purchases all last year ...it is very easy to to look back at the decision to accumulate TSLA shares now ... but for me there was a lot of uncertainty at the time .. i would still buy the Model S firstyou need to understand first hand the products of the firm you are investing

Oh, absolutely. I don't *actually* shed tears for that decision. In reality, I am quite happy with my purchase as there's zero gasoline in our household, several family members and friends (and family members of friends) have bought Tesla cars after experiencing mine, I'm doing quite well with the TSLA I do have, etc.

Certainly having not invested more in the past is a first-world problem and not something I'm losing sleep over.

Having the products does make my decision to HODL much easier, just as having sold a portion back in the 500s makes HODLing more of my chairs now much easier even if on paper selling then was a mistake.

Hindsight is always 20/20 and all that, but there's life to be lived today, and not just in the future. People have differing life situations and goals. Stonks are a tool with more uses than simply 'accumulate as much as possible.'

Regardless of all this, I've never followed a more exciting company.

Carry on.

you have me thinking ... that i am thinking too small ...I'm already at twice my original goal and I still want more.

Artful Dodger

"Neko no me"

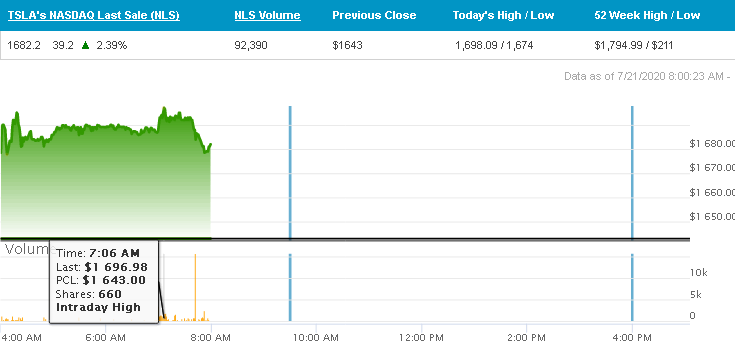

08:00 a.m. Whistle: Tue, 21 Jul 2020

Pre-Market High: $1,698.00 (07:07:37 AM)

Pre-Market Low : $1,678.20 (07:52:49 AM)

Comment: "Last Tuesday-Funday before da Big Badda-Boom"

Cheers!

- NASDAQ-100 Futures: +90.50 +0.83% 07:59:44

- TSLA share price: $1682.20 +39.20 +2.39%

- NASDAQ Pre-market Volume: 257,209 @ 08:00 ET (high volume)

Pre-Market High: $1,698.00 (07:07:37 AM)

Pre-Market Low : $1,678.20 (07:52:49 AM)

Comment: "Last Tuesday-Funday before da Big Badda-Boom"

Cheers!

If there are already concerns around water usage at GigaBerlin, how likely do you think it is that they will continue to expand there vs elsewhere in Europe?According to sources in Germany Tesla is expecting, in the long run, to produce 2 million vehicles in Germany in GF Berlin alone p.a. and assumes the BEV market in Europe will be 12 mio p.a.

That's a modest 16% market share.

https://twitter.com/alex_avoigt/status/1285498173918785536

jhm

Well-Known Member

It would nice to see the performance of the excluded 250 stocks. Tesla does appear to be the secret sauce.Some what surprised when I got to the bottom of this article and saw they are already holding TSLA. Many of the benchmarked funds (not index funds) may already be holding TSLA.

This index ETF is beating the S&P 500 by excluding ‘losers’

I guess TSLA is included because the focus is on the 500 largest companies. Not strictly the S & P 500.

Runarbt

Active Member

you have me thinking ... that i am thinking too small ...

THIS have been my problem.

I have had a LOT (for me) of options these past 10-months, but I have always closed 'em way to early.

Cashed in $100k but have left $500k or so on the table..

I need to think BIGGER! - Trying to now this ER, but its not easy, when gains are 50x on my options which expire in august

If there are already concerns around water usage at GigaBerlin, how likely do you think it is that they will continue to expand there vs elsewhere in Europe?

Despite all the chatter water is really not a problem. We have cities in Germany that get their water from 200km away. It's just a logistics task and not as painted from many a true issue.

dgodfrey

Member

Thanks, It was actually closer to 8 weeks, 5/19 to be exact. Based on your chart, I may want to have a kidney removed next. That should get us to $4k.Congratulations on your fantastic prognosis!! Wishing you continued health!

And....thank you for your service!

View attachment 567009

Jack6591

Active Member

Despite all the chatter water is really not a problem. We have cities in Germany that get their water from 200km away. It's just a logistics task and not as painted from many a true issue.

Much of the electrical power consumption in California is dedicated to moving water.

ByeByeJohnny

Active Member

Yeah it's not exactly in the middle of a desert like some other Tesla factory. Any water shortage in Berlin is solvable.Despite all the chatter water is really not a problem. We have cities in Germany that get their water from 200km away. It's just a logistics task and not as painted from many a true issue.

Sure seems that way. Cramer is on his soap box trying to say the market has gone "insane".Are they trying to tank pre market before the 9am guys come in?

Todd Burch

14-Year Member

Are they trying to tank pre market before the 9am guys come in?

They're the guy with the camera.

Blimey, missed yesterday's fun a bit as I was at a friend's having a serious beer-drinking session...

I wanted to buy a couple of weeklies at the beginning of the session, but decided it would gap up quickly, so spent my remaining cash on 10 trading shares at $1514 in pre-market. That turned out OK!

What's the plan from here, chaps, skip the 1700's altogether?

I agree, the 1700's are not a nice playground for TSLA. Last time it ventured there (last Monday, IIRC), it got kicked out pretty fast. So, I agree, this time we should just skip it altogether and jump straight into the 1800's or even 1900's.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M