The USD is weakening substantially. I'm not gonna pretend to be a currency expert but the current US monetary and fiscal policies probably have a thing or two to do with it.

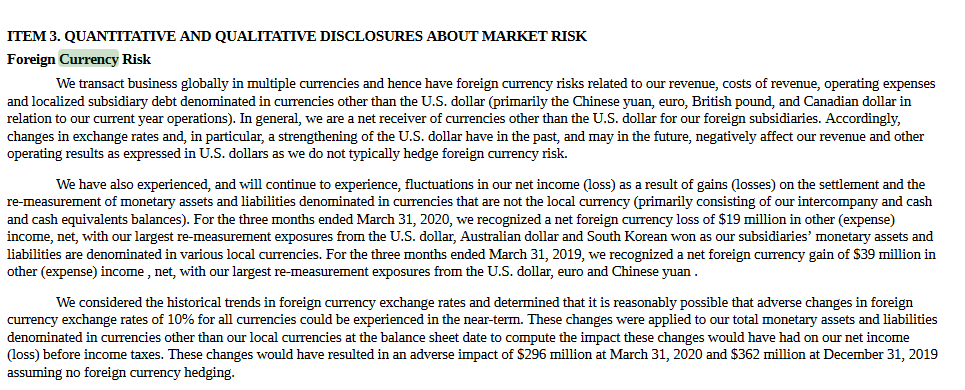

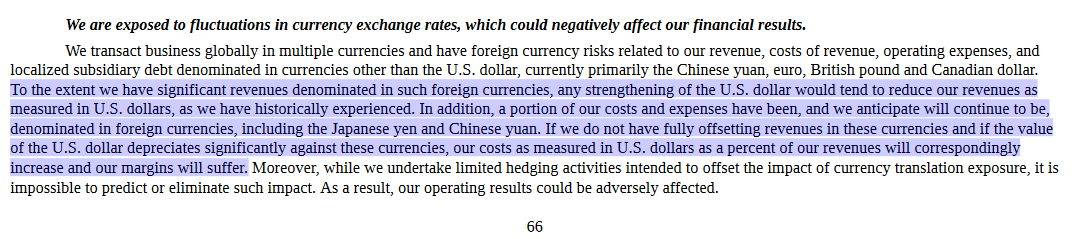

Tesla is exposed to currency fluctuations per their 10K and recent 10Q.

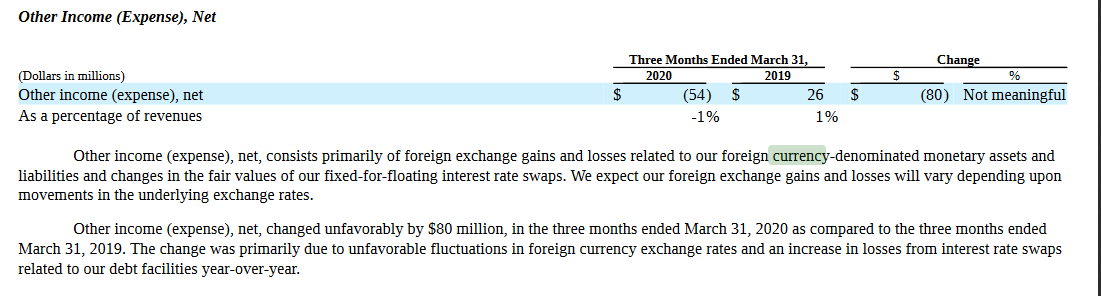

10Q from 2020 Q1:

Interest rate risk is negligible:

Worst case adverse move of 10% results in ~300m$ loss. I'm unsure whether this is computed as a simple 10% gain/weakening of the USD or as individual worst case moves of individual currencies that happen to be good/bad for income. Ie. 10% gain in a currency vs usd where tesla has a net debt and a 10% drop in a currency vs usd where tesla has a net inflow.

Maybe

@The Accountant can chime in?

The flipside of that should obv be that a favorable 10% move results in ~300m$ of income. So worth a glance.

it seems to me that on average tesla should gain positive income from dollar weakness unless the timing with EUR and CNY debt facilities has been bad. But we would expect bigger debts to be currency hedged, no?

While revenue streams are less likely to be hedged.

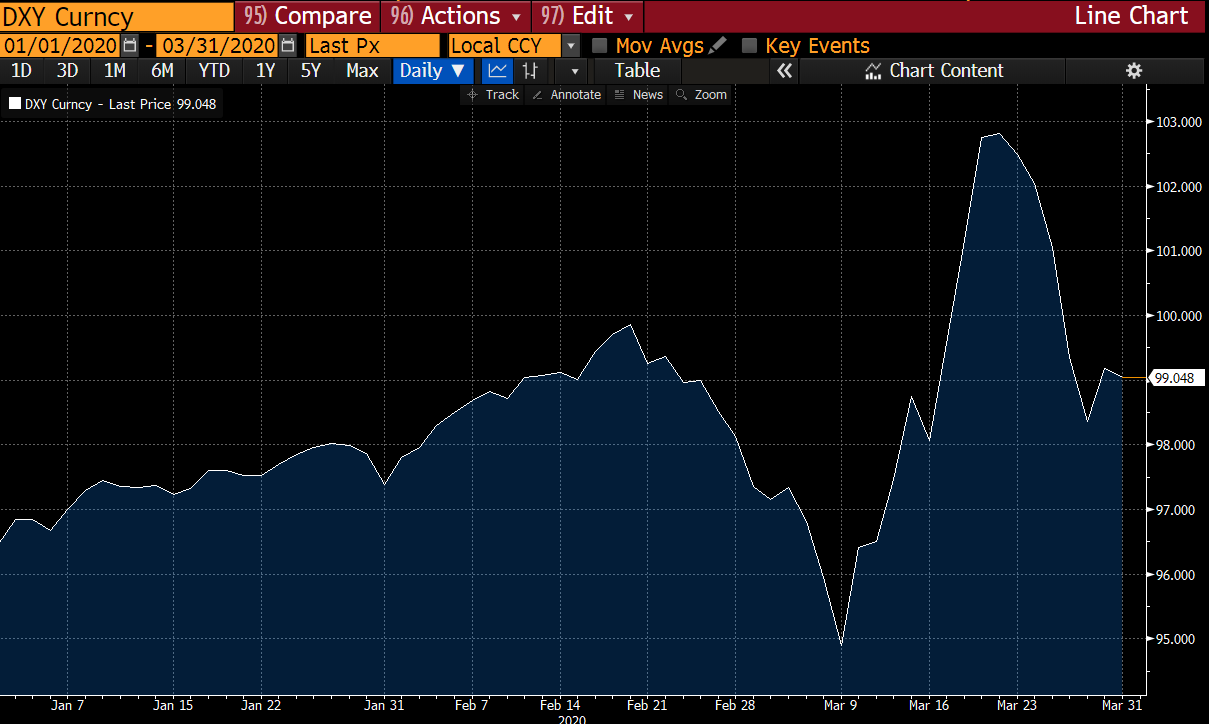

Dollar index DXY Q1 started 96.442 and ended 99,048. 2.7% strengthening.

In Q1 strengthening translated into a 54m$ loss.

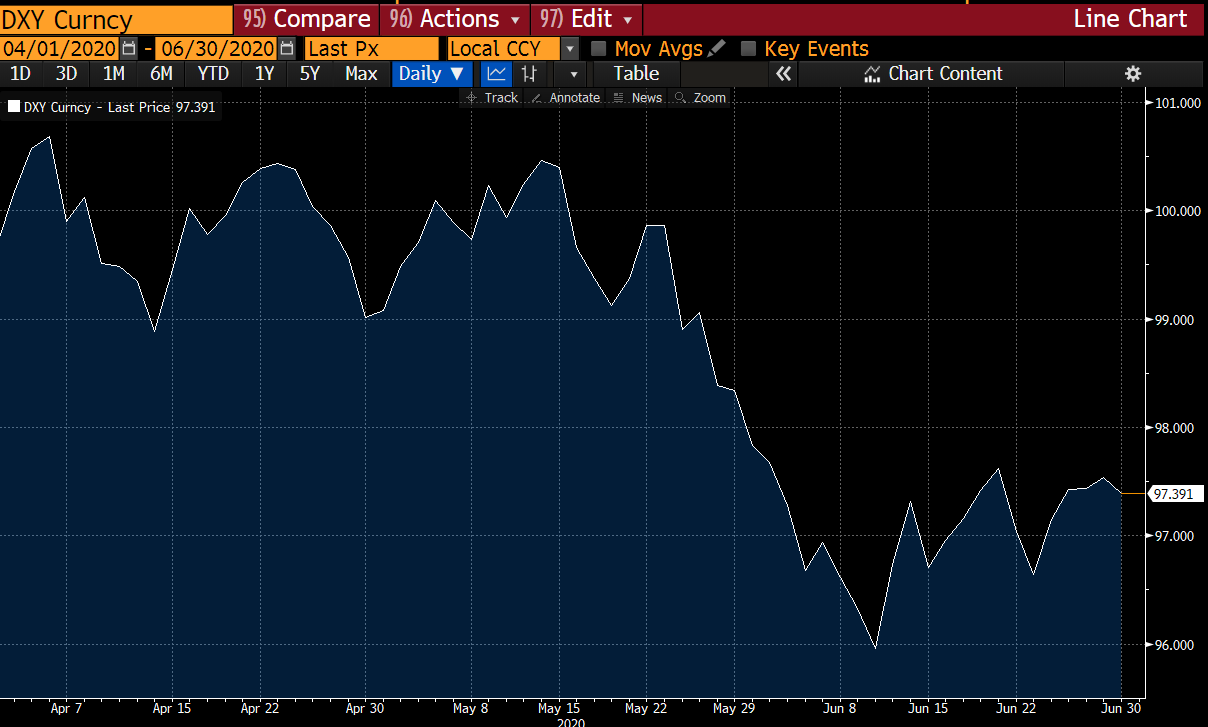

Dollar index, DXY started Q2 at 99.048 and ended at 97.391. 2.2% weakening.

Will have to wait for 10Q to confirm whether this weakening translates into an income gain. VERY simple prediction is that it should have translated into a ~45m$ gain.

I started trying to back out individual currency fluctuations in the quarter but ... you know... too much work.

So how is Q3 panning out?

Started at DXY 97.196 and currently sitting at 93.928. a 3.4% weakening.

So, with my r/wallstreetbets level of due diligence I'm predicting this translates into a ~80m$ gain if this level holds through the quarter.

Above is as close as we can come to a garbage in, garbage out analysis. But it's at least a framework that's useful for thinking about how USD movements affects Teslas Q3.