Kalani

Member

Diess always recognised Tesla's leadership in EV technology, but he shares the view that the future must be all-electric.To me, this makes VW look like a little child looking to his big brother for approval.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Diess always recognised Tesla's leadership in EV technology, but he shares the view that the future must be all-electric.To me, this makes VW look like a little child looking to his big brother for approval.

Elon: “How big battery does it have?”Diess to Elon: "This [ID.3] is a mainstream car. Not a race machine."

Since S&P can do whatever they want in terms of the terms of inclusion. Why not just announce Tesla now, but state the index funds have until next quarters rebalancing to acquire the necessary funds? I can't be the only one that's thought this is the route to go to please everyone

Gives them 3 months to buy at a much slower pace and ease a sharp spike in the share price. Seems to solve a lot of the issues.

the Trustee is required to adjust the composition of the Portfolio whenever there is a change in the identity of any Index Security (i.e., a substitution of one security for another) within three (3) Business Days before or after the day on which the change is scheduled to take effect.

S&P has no control whatsoever on the timeline for a given fund buying or selling stock regarding inclusion, other than date of incusion.

The rules of each fund govern the specifics otherwise..

One funds rules might give them 3 days before inclusion to prebuy, another 7 days, another at discretion of manager, etc.

Somebody else's perspective

The $400B Front Run with the Index Funds Holding the Bag – Part III | The Bear Traps Report Blog

Warning, this is naive musing regarding the S&P inclusion.

If the $5B offering has anything to do with inclusion (trying to "play nice" with the Committee) I think it is too small an amount to have a significant impact controlling the SP during the expected purchase rush. But, if the Committee establishes a new rule allowing the inclusion over a period of time, say 8.5% per month for a year, then it could.

Still doesn't change the dynamic I'm suggesting. Like you said, its up to each individual index fund as to when they buy. But no one can start buying anything until they announce inclusion. There's nothing stopping the S&P committee from announcing right now and stating the inclusion date is Dec 10th for example. Index funds then have a period of 3 months to chose when to buy.

Edit: Looks like @StarFoxisDown! has very similar question as well. I am thinking more about where they phase it in systematically - say 25% inclusion Sept 21 into the index, followed by 25% each over Oct, Nov, Dec. By Dec rebalancing, it is completely included in the index.

To be clear, that was something Buffett came up with as a hypothetical to reduce the inclusion problem, it is not a published in the rules method.Question regarding a speculation in here - something I have wondered as well

Can S&P500 transition in TSLA slowly over a period to time to avoid the sudden run up/spike in share price?

Following is a quote from the article:

"Option #2, S&P scales the entry in, say 10bps a month or quarter. To us, this is the MOST likely solution. The index funds don’t swallow Tesla in one bite but a dozen nibbles over 12-24 months."

I personally think 12-24 months is too long of a transitioning in period, but can imagine a scenario where TSLA is phased in over say a 3 month period - effectively allowing the index funds 3 months vs. a few days to buy the stock. This would prevent the sudden spiking, which in the long term won't be healthy for anyone.

Edit: Looks like @StarFoxisDown! has very similar question as well. I am thinking more about where they phase it in systematically - say 25% inclusion Sept 21 into the index, followed by 25% each over Oct, Nov, Dec. By Dec rebalancing, it is completely included in the index.

Since S&P can do whatever they want in terms of the terms of inclusion. Why not just announce Tesla now, but state the index funds have until next quarters rebalancing to acquire the necessary funds? I can't be the only one that's thought this is the route to go to please everyone

Gives them 3 months to buy at a much slower pace and ease a sharp spike in the share price. Seems to solve a lot of the issues.

Guys, don't hold your breath. It will come at a random time and during some random quarter. FB's announcement was 3qs after they qualified. Amazons was a full quarter after they qualified. I

She has mentioned him a few times...I don't think there is a Mr. Kruggerand...

You're right about her companion ggr, I was referring to our friendly board member... sorry, should have been clearer in my description, like "I don't think Kruggerand is a Mr." However, she may be feline...She has mentioned him a few times...

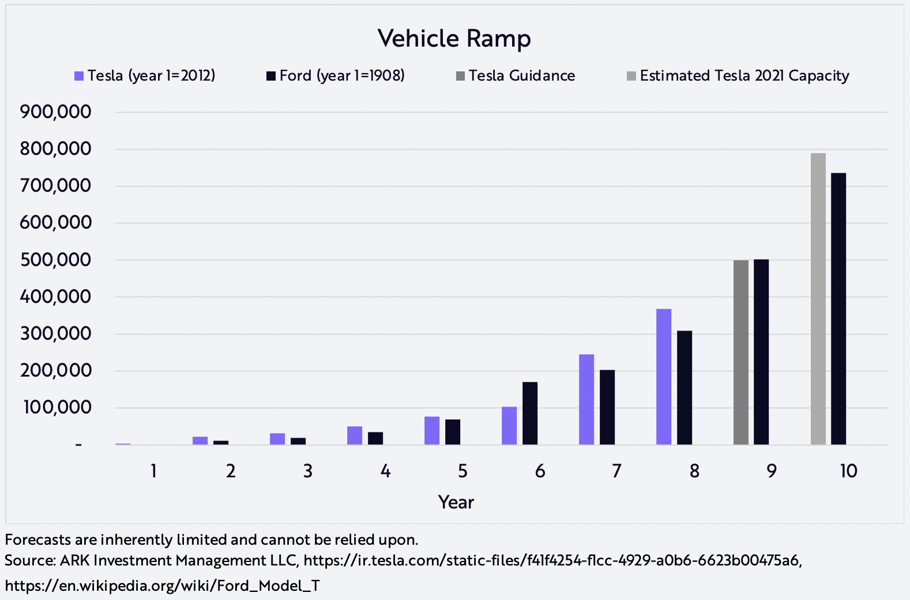

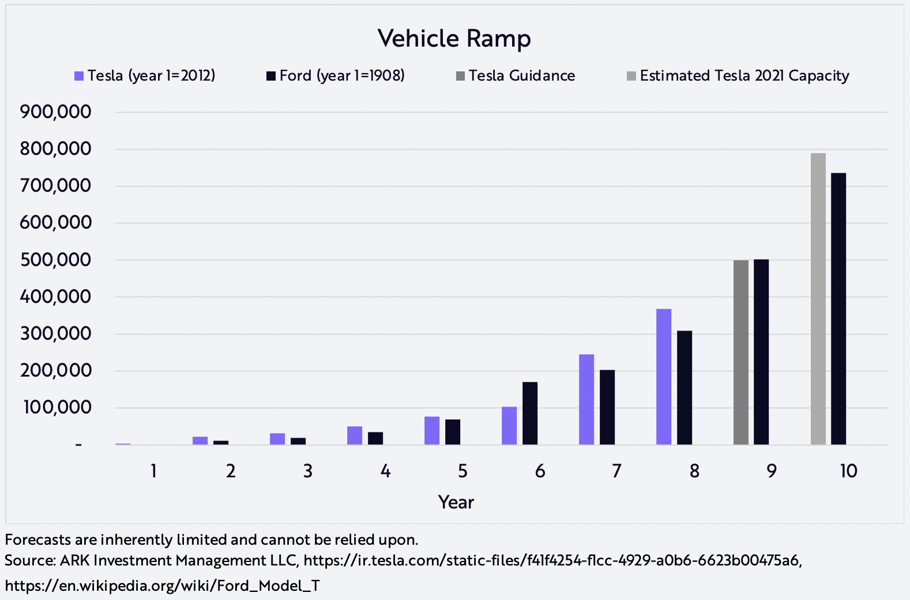

Ford really beat the hell out of Tesla in 1913.ARK Invest - today - ARK Disrupt 09.07.2020

Excerpt:

Is Tesla on Pace to Ramp Production Faster Than Ford Scaled the Model T?

By Sam Korus | @skorusARK

Analyst

Produced on the first moving assembly line in 1908, the Ford Model T is famous for the speed at which it scaled. Interestingly, in its first nine years of production, Tesla has ramped at the same pace as the Model T, as shown below. After learning lessons in “production hell”, Tesla now is preparing to ramp production even faster than Ford scaled the Model T, also shown below.

In China, Tesla broke ground for Model 3 production and hit a 200,000 annual run rate in just a year and a half, increasing its capacity by 33% to an annual run rate of roughly 800,000 in year 10, as shown by the gray bar above. Now with plenty of capital, Tesla has construction projects underway in both China and Berlin which, in only a year and a half, could add another 50%, or 400,000 units, to capacity.