hahaha, at first read that the wrong way. sorry ...He is swinging for the fences. In his mind he has nothing to lose. That tweet reads like a threat to the voting population. Tesla is holding up well in spite of the weak macros. I guess we needed something to wake up Tesla, it was sleep walking for the past few days lol.

I just sold a 375 PUT expiry Oct 23rd on that dip for 19.00. Also added a Oct 23rd 450 Call in my Roth IRA for 15.75. I like where IV is and I believe it will spike next week.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

Market should digest this very nicely by end of the week IMO, if the narrative and tone remains the same. Anything creating more post-election certainty is a good thing. This craziness makes it much less likely we'll see an outcome that could rationally be contested.

In the meantime, IV drifts even lower and so does SP....

Have a feeling the big boys are gonna show up next week and scoop up calls galore.

Edit: Where's the WTI reaction? I guess they think this is a headfake?

In the meantime, IV drifts even lower and so does SP....

Have a feeling the big boys are gonna show up next week and scoop up calls galore.

Edit: Where's the WTI reaction? I guess they think this is a headfake?

dc_h

Active Member

I was happy when we broke $300........................every stinking time..........We must have broke, lost it. then broke it again about 10 times......

I was not happy every time we broke 300 and someone would say, this is your last chance to buy at under 300. It would drop 10% faster then you can type under 300.

lafrisbee

Active Member

I will support the GoFundMe account to have you on the Mount.Lol!! Let me tell you about balls of steel... 100% of my life savings have been in TSLA since early 2012. In February this year, I borrowed an additional £40k and added 100% of it to my holding. It's now at a point where on particularly volatile days the value of my holding fluctuates by more than your entire ROTH!

And I'm as tranquil as the Money Calm Bull... (Google it, it's a British thing)

I think the reason I'm so calm is I treat my ownership of TSLA as if it was my own growing business. I feel I'm a part owner of one of the most transformative companies in the world today, with enormous potential. It's not just a shareholding to me.

Or maybe I'm just too stupid to realise how precarious my financial situation is by doing what I've done!

Unfortunately, Fred is like many (perhaps most) pseudo journalists in deciding what to post: if it bleeds, it leads...Eh

Fred always emphasizes every Tesla misstep or issue. I swear he scans non-stop for anyone having a bad Tesla experience. Just like you sometimes get a lemon with a car or a improperly installed regular roof from a contractor, there will be instances of bad experiences.

lafrisbee

Active Member

we both have to zip up our pants and take a seat to Favguy. he is 100% in and then borrowed to get even deeper....I think. Unless you are playing the margin game...but my point still is, In terms of size of investment it should be the percentage and not the amount of money determines who is the most Bullish/Ballish.Tenderfoot, don't even talk to me until you are over 97%.

Not only that, I've got your dollar amount beat multiple times. You have less now than I did before going "all-in" on March 19th at $373 ($74.60). Go ahead, do the math.

You still want me to get out the tape measure?

Mike Ambler

Member

Very Fiat 500L...ishIt seems that a new Chinese BEV will enter in Europe soon.

They contacted me via Facebook for a consumer survey (as I just bought a BEV) and asked me several questions about what I look for in a car, and perception about Chinese tech.

These are the pics that were in the survey.

Sold 10 Puts for 10/23 with 370SP for almost $11k a few minutes before close today. I also have 10 Puts for this Friday for 420 SP. Happy to make money on the premiums, or pick up more shares at a discount....

Dear S&P,

If there was ever a time!

Love,

lol

If there was ever a time!

Love,

lol

ZeApelido

Active Member

Official Polestar 2 EPA Range Rating Is Very Disappointing

"The official range rating for the 2021 Polestar 2 is 233 miles (375 km), using a 78 kWh battery, which is far below our expectations."

That's EPA range.

Is anyone talking about breaking up Apple? How did Steve Jobs skate past getting hit with a criminal indictment when he was actually caught repricing stock options, even though other CEOs got sent to jail for the same crime?

The answer is that the company and the person are/were too politically popular for the feds to tackle. As long as people love Teslas, I don't think Tesla has anything to worry about. In ten years, they'll have the best cars in most vehicle segments. Musk will be hailed as a national treasure for SpaceX. His military contracts will ensure the spooks will want to protect him, etc. I really don't see this as a problem. Of course, ten years is a long time for any crystal ball.

There may be a certain amount of gratitude that the leading EV maker in the world is based in the US...

Last edited:

bkp_duke

Well-Known Member

Funny that's how all my ex-girlfriends treated me!

Lucky you. I had a few clingy ones that were . . . hard to get rid of.

R

ReddyLeaf

Guest

Well, last night for grins and giggles, I put in a $408 buy and $425 sell for today. I was hoping that both would hit for a small profit. Now I’ve got to find some more cash for the settlement account. Damn, I hope this thing goes back over max pain before Friday so I can get some cash back. Otherwise, I’ll need to sell something.Now that was a buying moment. Now I have to hope things return for the sake of my trading account

insaneoctane

Well-Known Member

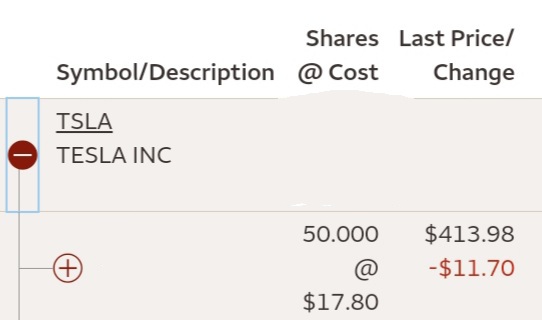

Nowhere near the winner here, but proud of my earliest lot:

I'm surprised at how many lots I actually have, as I haven't kept track of all the buys over the years! One thought.... Although advisors would HIGHLY recommend against it, diversified TSLA owners ALWAYS wish they had more TSLA. The steel balled >90% folks don't have that regret!

I'm surprised at how many lots I actually have, as I haven't kept track of all the buys over the years! One thought.... Although advisors would HIGHLY recommend against it, diversified TSLA owners ALWAYS wish they had more TSLA. The steel balled >90% folks don't have that regret!

ZachF

Active Member

Not one of oldest members here but still got in pretty early. Still haven’t sold a single share. No options, no leverage (unless you count taking out a loan for my P85+ instead of paying cash so I could invest more in TSLA). Used to joke I wasn’t selling until $4K (pre-split). Now I’m not planning to sell until $4K period. Buy and hold really works.

View attachment 595855

Respect.

gabeincal

Active Member

Not an entirely positive article, but still decent from seekingalpha:

https://seekingalpha.com/article/4377742-tesla-q3-numbers-spark-questions

This all gets me to perhaps my biggest prediction for the Q3 report, and that is that Tesla will report tremendous gross margins. With ASPs likely helped by dollar weakness along with significantly higher total production, I think lower credit sales will be offset here. My guess is that management was upset by the negative coverage of Q2 results being heavily overshadowed by credit sales, and that it wants to produce a GAAP profit without these sales in Q3. Tesla likely wants to give the S&P 500 committee something to think about, since it now has been passed over twice for inclusion. I'll have more on what I think a possible profit would look like as we get closer to the earnings report.

https://seekingalpha.com/article/4377742-tesla-q3-numbers-spark-questions

The only thing I’m worried about for Q3 ER is the potential impact of Elon’s compensation package.

IMO the street already knows this and should not come as a surprise. In fact the Piper analyst is already modeling this into the GAAP estimates.

I would be worried about any additional supply chain and manufacturing costs associated with the factory shutdowns, shipping costs etc more so than Elon’s compensation. That’s pretty much the only thing that can put a big dent in Q3 earnings.

MC3OZ

Active Member

Maybe it is just as simple as India has 1.4B people and if you want to decarbonize the global economy you have to be in India.

Tesla can start manufacturing Battery Energy Storage/Solar in India then move to vehicle manufacturing later.

India has high tariffs against Chinese Imports and may be going higher resulting from the military friction at the border. Manufacturing BES/Solar may be very profitable in India.

Yes, energy storage batteries are the "tip of the spear" in India.

After Battery Day we can conclude that it may be capex efficient to make energy storage batteries closer to their final destination.

In particular Australia, UK and India are 3 locations where energy storage battery factories might make sense.

All 3 are RHD countries and the next logical question is if it makes any sense to make RHD cars in a RHD country.

India is about halfway between Australia and the UK and at the centre of the Asia Pacific RHD market.

So the issue isn't so much the Indian market for a model, it is the total RHD market.

So eventually the lower priced cars in India may make sense.

Having factories in multiple countries/states give Tesla a might more negotiating power with governments and a bit more appeal with car buyers.

The keys to success in India are:-

- Negotiating the right deal with governments before starting.

- Building a strong and capable local team

- Having the right mix of products, and the right timing.

Yes, India is a big challenge, the first step in a big challenge is build a team that can do the job. There will be no shortage of highly motivated and capable locals keen for an opportunity to build Tesla in India.

The combination of electricity and the internet is transformative in developing countries, EVs allow them to avoid expensive oil imports and some of the associated health issues.

Access to electricity can change lives for the better.. solar and batteries work everywhere.

Green Pete

Active Member

Yes, energy storage batteries are the "tip of the spear" in India.

After Battery Day we can conclude that it may be capex efficient to make energy storage batteries closer to their final destination.

In particular Australia, UK and India are 3 locations where energy storage battery factories might make sense.

All 3 are RHD countries and the next logical question is if it makes any sense to make RHD cars in a RHD country.

India is about halfway between Australia and the UK and at the centre of the Asia Pacific RHD market.

So the issue isn't so much the Indian market for a model, it is the total RHD market.

I don't think it makes sense to make anything in the UK anymore? Brexit kinda makes the UK an ecnomic island. That's why Germany got the gigafactory. edit - more reasoning: I think it's easy enough to make 1 production section at a factory occasionally kick out RHD models rather than ships between India Australia and UK. One of the main factors for this was payment terms and selling the car before needing to pay the suppliers. Shipping from India to UK is like 20 days on the water. Even from India to Australia is 14 days. That would be a massive waste of capital tied up on the ocean in transit. It would almost be better to just not sell to the UK than to ship from India.

Last edited:

https://twitter.com/enn_nafnlaus/status/1313598616091734016?s=21

Gordo vs @KarenRei on Twitter. Knife to a gunfight. Result, Gordo resorts to blockage.

Gordo vs @KarenRei on Twitter. Knife to a gunfight. Result, Gordo resorts to blockage.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M