I feel like something is brewing but it's not clear what it is yet

Just checked my Plaid+ reservation page and the car image is now missing. Anyone else seeing this? Maybe the Plaid+ will look different after all.

Last edited:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I feel like something is brewing but it's not clear what it is yet

Just checked my Plaid+ reservation page and the car image is now missing. Anyone else seeing this? Maybe the Plaid+ will look different after all.

View attachment 638384

Or he is signaling the legacy carmakers about now being last chance to get serious about BEV.Some important decision needs to be made soon? I wonder what it is and what Elon will decide.

Imagine how wonderful it would be if Tesla would announce on the Q1 earnings call that it was going to pay for the new India GF with the $1B in BTC profits, and that Tesla would reinvest the original $1.5B in Cathy Wood’s ARK funds.

Did you really mean this the way it sounds--give the money to a "Financial Advisor"? Might as well just leave it in your checking account.To me this suggests a belief that Tesla's cash is not best spent furthering its own business model, but better left to someone else to look after.

It came from this article: A Fork in the Road

Elon musk will fork a coin. He could fork Doge with big holders excluded. Or fork with a different mining algorithm.I feel like something is brewing but it's not clear what it is yet

What we do know about Tesla & Kirkhorn & Elon is they ALL know how close Tesla was from bottoming out during the Model 3 ramp. That was very recent and fresh in their minds. When I look at some analysts EPS estimates for Q4 2021 and onward, Tesla will be raking in the money.

There is no way anyone with clout @ the Tesla conference table would not only recommend the Bitcoin transaction, but also actually going through with it WITHOUT a clear roadmap to the financials that Tesla would need for this type of investment to be both in the best interest for the company but also a SAFE investment.

Where are you all looking for quarter to quarter EPS estimates for 2021? Tired of Gary, but the man does know financials. I would like more research ideas if anyone can recommend.

I am decent at looking at automotive deliveries/revenues and margins but as soon as EPS comes into play I’m still confused where these guys get their estimates without really diving into Tesla energy expenses/operating expenses with the factory builds. All of this which I don’t have any resources for.

hoping for a green Monday, hope you all have a nice weekend.

Seems pretty clear to me; FSD by the end of March. And I'm padding that big time. Probably by the end of this month.View attachment 638394

I wish we could move on from BTC and bickering to the really important stuff...

Like WTF does this mean?

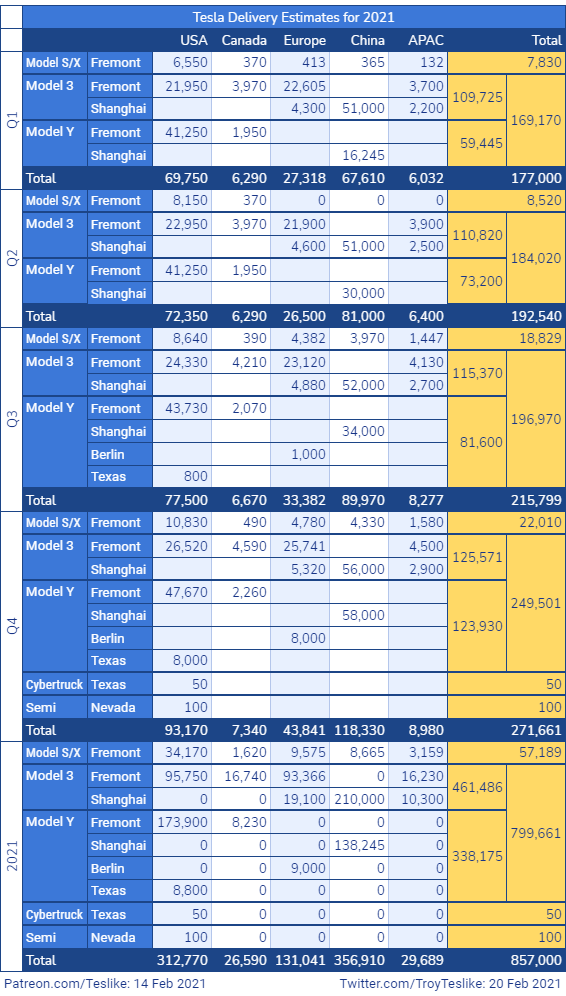

Troy's latest thoughts on Q1 and all of 2021:What we do know about Tesla & Kirkhorn & Elon is they ALL know how close Tesla was from bottoming out during the Model 3 ramp. That was very recent and fresh in their minds. When I look at some analysts EPS estimates for Q4 2021 and onward, Tesla will be raking in the money.

There is no way anyone with clout @ the Tesla conference table would not only recommend the Bitcoin transaction, but also actually going through with it WITHOUT a clear roadmap to the financials that Tesla would need for this type of investment to be both in the best interest for the company but also a SAFE investment.

Where are you all looking for quarter to quarter EPS estimates for 2021? Tired of Gary, but the man does know financials. I would like more research ideas if anyone can recommend.

I am decent at looking at automotive deliveries/revenues and margins but as soon as EPS comes into play I’m still confused where these guys get their estimates without really diving into Tesla energy expenses/operating expenses with the factory builds. All of this which I don’t have any resources for.

hoping for a green Monday, hope you all have a nice weekend.

...

Prove me wrong.

A fork in the road, is also known as a split, in the road.

When you come to a fork in the road, take it!

Interestingly IF you buy MMT and velocity of money's impact on inflation then the very act of taking bitcoin as a payment system would cause Tesla's investment in bitcoin to lose value. I suspect Tesla either knows this and has thought more chess moves ahead on this somehow, or doesn't believe in velocity of money and its effects on inflation - which strikes me as unlikely.

I don’t necessarily see those two as mutually exclusive when it comes to BTC and sustainability. I’ve worked with several BTC miners in setting up new facilities in locations with the most affordable, accessible, and fully renewable/sustainable energy sources available.

Tesla turning jurisdictions in to self sustaining, solar producing farms can just easily help turn BTC’s power consumption in to an opportunity for advancing the mission.

View attachment 638394

I wish we could move on from BTC and bickering to the really important stuff...

Like WTF does this mean?

Like Elon tweeted.What many are missing is that this BTC buy represents Tesla’s treasury function fulfilling its mandate of managing the company’s war chest. Most healthy Fortune 500 companies will carry more cash on hand than they need to fund their near and medium term operating requirements. That excess cash is meant to be used opportunistically or as reserves for black swan events. That cash will often be invested in T-bills or government bonds, many of which have carried near zero if not negative yield curves (especially when you consider that low interest rates would not even compensate for inflation). Treasury functions around the globe are looking for means of putting that unused cash to work and BTC is becoming the answer. It’s no longer a speculative bet. It’s a legitimately uncorrelated asset class that isn’t going to be subject to the same macro economic forces that currencies or equity markets will be. People trying to value it like other assets are just stuck in trying to compare apples to oranges.

The true unlock of value is when BTC suddenly becomes more than just an inflationary hedge. When customers and suppliers start accepting transactions in BTC, we are going to see an adoption velocity that people are going to be blind sided by. A genuine universal, frictionless, fully traceable currency. Not to say BTC is the right crypto asset to fulfill that need, but sometimes the first mover and recognizable brand wins that race, even against better use case competitors (Microsoft anyone...)?

Anyone that’s every worked with large businesses and has tried to move material sums of money between jurisdictions, particularly Asia or Latin America, can appreciate what removing that friction means to the working capital and treasury function of these businesses.

I’ll repeat... anyone liquidating their Tesla positions because of BTC are being distracted and short sighted as to where global finance and monetary policy is heading... and ultimately are forgetting that this is still the beginning of Tesla’s journey.