I have a 10X since Feb 7. Only "invested" $1000 so I cannot retire. Oh wait. I am already retired.Tired of bleeding out slowly. I should have listened to Elon and went all in on Dogecoin when he first tweeted about it, it's done a 20x since then. I could have had $50 million and retired.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

EVDRVN

Active Member

My 16 Tacoma is showing higher than what I bought it forChicago Tribune - 2.5 hours ago: Used car values skyrocket

Excerpt:

Used car values are skyrocketing as new car inventory dries up, creating robust demand for everything from well-traveled minivans to late-model pickup trucks. Edmunds said the average value for used vehicles traded in during the month of March hit an all-time high, climbing to $17,080, compared with $14,160 a year ago.

Thekiwi

Active Member

Look at this nonsense

A decline in Tesla's regulatory credit sales could be devastating to its future profitability, strategist says

"The loss of these regulatory credit revenues for Tesla is devastating and brings into question the future profitability of Tesla," Louis Navellier said.markets.businessinsider.com

Regulatory credits. lol. They are shortly to be made irrelevant to Tesla profits.

During 2021 Tesla should earn in the ballpark of $4 Billion in GAAP net income. Yes if reg credits declined quite a bit, then Tesla might earn closer to $3 billion net income probably in a worse case scenario where reg credits halve.

However, in 2022 full year Tesla is looking at net income far north of $10 Billion (I have $12 Billion net income in my crude first draft earnings model, which is fairly conservative). So beyond the next couple of quarters reg credits are going to reduce to a negligible amount in terms of net income.

Last edited:

Got ~50% more than I expected when I sold a car for a new Model Y recently. Nice surprise. Sold to CarMax and they said they couldn't keep a RAV4 on the lot - demand too high.Chicago Tribune - 2.5 hours ago: Used car values skyrocket

Excerpt:

Used car values are skyrocketing as new car inventory dries up, creating robust demand for everything from well-traveled minivans to late-model pickup trucks. Edmunds said the average value for used vehicles traded in during the month of March hit an all-time high, climbing to $17,080, compared with $14,160 a year ago.

CUVs in high demand. Model Y is a CUV...

ZeApelido

Active Member

Or could be the chip shortage causing legacy autos to raise new car prices/selling out while used cars are skyrocketing in prices. All of a sudden a Tesla is looking pretty cheap.

Genius car analyst thinks there's no surging demand for Tesla , just reduced production due to chip shortages.

Thekiwi

Active Member

Could be worse - my watchlist FWIW

View attachment 659959

Always surprises me that a TSLA investor would also invest in SPCE. I would have thought anyone familiar with SpaceX (most people on this forum I imagine) would realise how doomed SPCE is in the face of SpaceX.

I think one is the unfurled tweet from the forums software and the other is my snapshot.How did you manage to get the same tweet at 2 different dates?

View attachment 660054

Watch this video to understand how annoying datetime is in programming.

MC3OZ

Active Member

Rumors were that this was a SpaceX project. Sounds like the rumors were incorrect.

SpaceX is rumoured to be the other side of the highway... west of the main factory, Bobcat is east....

EVNow

Well-Known Member

True. Then I'll start selling callsAgreed, the only real risk is an early exercise...

As long as you have faith the stock will come back up (next month/next year ...), its all fine.

Ah, so internal memos at Tesla are lying to the employees who are building the cars..lol. Hopefully they wouldn't notice their assembly line is shut down.Genius car analyst thinks there's no surging demand for Tesla , just reduced production due to chip shortages.

EVNow

Well-Known Member

There are a LOT of us waiting. My order was automatically cancelled.Pulled the trigger again to replace my Model 3 with a Model Y, can’t let my wife drive the White Model Y and suffer from endless jealousy. YOLO.

the tesla rep told me they expect to receive them not until October, he said they don’t know what is going on, they have never seen so many orders, ever. The last month was crazier than ever for the number of reservations.

Wife drives less than 10 miles a week now - no point getting a new car until she actually starts commuting again.

EVNow

Well-Known Member

No wonder the genius limits who can see his tweets. Afterall he doesn't want people pointing out the employees know exactly how many cars they are building / scheduled to build.Genius car analyst thinks there's no surging demand for Tesla , just reduced production due to chip shortages.

Oveeus

Member

As a TSLA investor, I think one should always focus on the market leader of a new sector. I think SPCE is not a market leader, but barely a follower to SpaceX while targeting a specific niche (tourism). You need to look further than that. How their vision and progress is going to change a market... whatever that market is.Always surprises me that a TSLA investor would also invest in SPCE. I would have thought anyone familiar with SpaceX (most people on this forum I imagine) would realise how doomed SPCE is in the face of SpaceX.

For example, Robinhood, as controversial as it might be, it brought many new aspects to stock trading; where it used to be a more "elite" oriented (sorry for the lack of a better word). And now, given its business model, I can totally see it expanding into something much greater when it comes to investing.

They might not be the first to provide free trades, but certainly, the first one to make it popular. Everything has two side of story... some'd argue that they are a "casino" like Buffett. But if you look at the grand picture, why should investment be limited to elite investors/firms? After all, the idea of investing, at its simplest form is an idea of value. What something is worth is in the eye of beholders. Say GME, who Wall St. investors don't think there's value there. But if you go ask a gamer, or someone who has grown up with having Gamestop around, they will tell you it's still their go-to spot for trading video games. In such case, who's right or wrong? No one. Just disagreement on valuation.

Texas HB 4379

Relating to the ownership or operation of a motor vehicle dealership by a manufacturer or distributor of motor vehicles. Scheduled for public hearing on 5/11/2021.

Relating to the ownership or operation of a motor vehicle dealership by a manufacturer or distributor of motor vehicles. Scheduled for public hearing on 5/11/2021.

Thanks for your comment. You made my day.Tired of bleeding out slowly. I should have listened to Elon and went all in on Dogecoin when he first tweeted about it, it's done a 20x since then. I could have had $50 million and retired.

In February I was opening an account to buy bitcoins and was planning to buy some doge at 0.04$, however I ended up buying GBTC through my broker platform and didn’t complete my crypto trading account registration. I was proud my $15,000 in GBTC became $25,000. Now, it looks a bit pitiful knowing the same in Etherum would be $35,000 and the same in Doge would be worth $300,000

I don’t think I would have ever sold out my TSLA position like this YouTuber who went all in on Doge after making money in the TSLA 2019 stock surge.

however, after listening to his way of redditter reasoning, I think a lot of young millennials retail investors who made money recently with TSLA are now going all in on dogecoin. I don’t know if it has a significant volume on TSLA stock trading but t certainly has an effect on Doge volume.

Last edited:

Congrats!... the tesla rep told me they expect to receive them not until October, he said they don’t know what is going on, they have never seen so many orders, ever. The last month was crazier than ever for the number of reservations.

The SP is surely not following the same trend as reservations.

I have an inkling what is happening. It’s based on a cocktail party theory of mine which I think is actually true.

Whenever there is a major economic or societal disruption, fashions change—and they change for a reason:

Fashions are fitness markers in the evolutionary sense of the word. We humans use stuff to strut our stuff. That is, we display our goods to show we are fit mates and to maintain our status in the group.

After there is an upheaval, fashions change so that folks are required to spend on the new fashions if they want to show they are still fit. If you’re running around in last season‘s clothes or have that dated purse or car, your fitness comes into question.

If you think you’re immune, think again. A former neighbor who always has the best wines, the top of the line Model S, and the Model 3 performance for the academic hubby as well as recently buying a large power cruiser is quoted to have said to her kids "we don’t do status symbols" (pretty much gets a ”Whaaat?" and a laugh from anyone who knows her).

tl;dr: Pandemic drives change of fashion which plays into Tesla’s advantages ‘cause we are still primates.

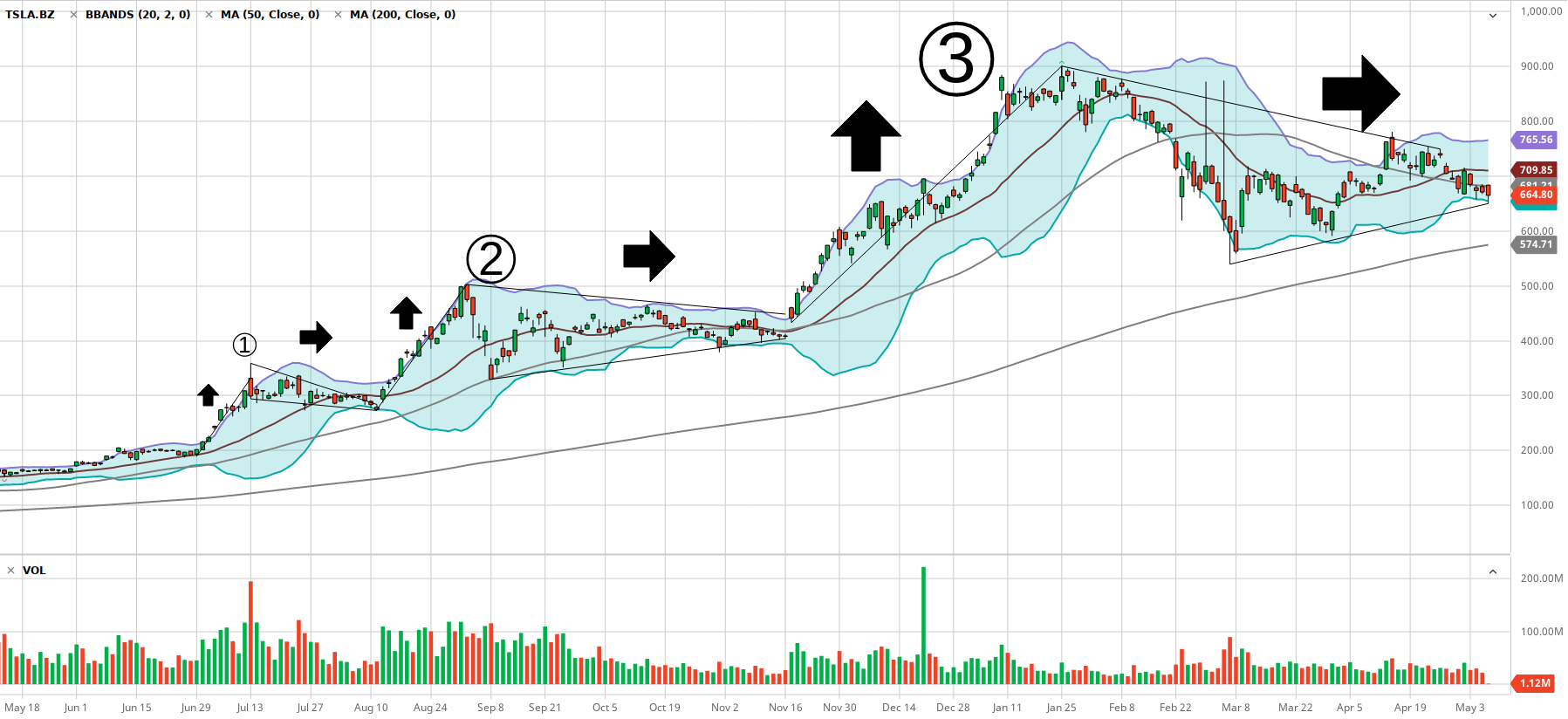

(not so pretty -- not enough colors / dragons / etc) picture time.

I see a pattern emerging on the 1 year chart.

1. breakout ~60% SP increase in 2 weeks => followed by 1 month consolidation

2. breakout ~80% SP increase in 3 weeks => followed by 2.5 months consolidation

3. breakout ~120% SP increase in 10 weeks => followed by ?? months consolidation

How long will be the current consolidation cycle ?

Does it scale like the breakout length ? That would be at least 8 months long.

How large will be the next breakout in terms of SP growth ? 180% ?

I see a pattern emerging on the 1 year chart.

1. breakout ~60% SP increase in 2 weeks => followed by 1 month consolidation

2. breakout ~80% SP increase in 3 weeks => followed by 2.5 months consolidation

3. breakout ~120% SP increase in 10 weeks => followed by ?? months consolidation

How long will be the current consolidation cycle ?

Does it scale like the breakout length ? That would be at least 8 months long.

How large will be the next breakout in terms of SP growth ? 180% ?

UnknownSoldier

Unknown Member

The consolidation (flatlining) could easily last until 2022. That's when we'll really see the jump in revenue and profit from the fully armed and operational battle stations Giga Berlin and Giga Texas.

My original plan was to retire next year anyways, so I guess it seems like that's what is going to happen. I was kind of hoping things could move faster and I could get out this year but since I didn't go all-in on Dogecoin in February it looks like that won't be happening.

My original plan was to retire next year anyways, so I guess it seems like that's what is going to happen. I was kind of hoping things could move faster and I could get out this year but since I didn't go all-in on Dogecoin in February it looks like that won't be happening.

Speaking of not doing status symbols, I just happened to notice this development in my gambols about the ‘net which I don’t recall seeing mentioned here:

robbreport.com

robbreport.com

"Michael Jost, head of group strategy product and CSO of the Volkswagen brand, says the current plan is to install up to six batteries per yacht and to enable 500 kW power for yachts around 50 feet plus. That will enable the vessel to cruise all night non-stop and also power the onboard amenities."

"The jointly declared goal of the three companies is to put the first solar-electric catamaran with MEB propulsion on the water in 2022. After four years, the plan is to produce at least 50 of the MEB-based Silent Yacht 50 per year, and more if required."

It is curious that VW is looking for more volume for their capacity for their EV platform.

Volkswagen Is Teaming Up With Silent Yachts to Create Futuristic Solar-Powered Catamarans

The new solar-electric catamarans will feature the same electric powertrains currently used in Volkswagen's ID.3 and ID.4.

"Michael Jost, head of group strategy product and CSO of the Volkswagen brand, says the current plan is to install up to six batteries per yacht and to enable 500 kW power for yachts around 50 feet plus. That will enable the vessel to cruise all night non-stop and also power the onboard amenities."

"The jointly declared goal of the three companies is to put the first solar-electric catamaran with MEB propulsion on the water in 2022. After four years, the plan is to produce at least 50 of the MEB-based Silent Yacht 50 per year, and more if required."

It is curious that VW is looking for more volume for their capacity for their EV platform.

Thekiwi

Active Member

I've got a little over $10 GAAP EPS for 2022 pencilled in at present, so todays price equates to a PE multiple of ~66x 2022 earnings.The consolidation (flatlining) could easily last until 2022. That's when we'll really see the jump in revenue and profit from the fully armed and operationalbattle stationsGiga Berlin and Giga Texas.

My original plan was to retire next year anyways, so I guess it seems like that's what is going to happen. I was kind of hoping things could move faster and I could get out this year but since I didn't go all-in on Dogecoin in February it looks like that won't be happening.

Thats a pretty reasonable price for a company growing as fast as Tesla (many here will regard that as an understatement)

I think it will be a shock to the market when the current Tesla price ($663) is no longer at a stratospheric PE multiple that is generally regarded as being so high its meaningless (like the current PE ratio of 663x TTM net income).

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M