J

jbcarioca

Guest

But we won't. We'll be dead.Today's reminder:

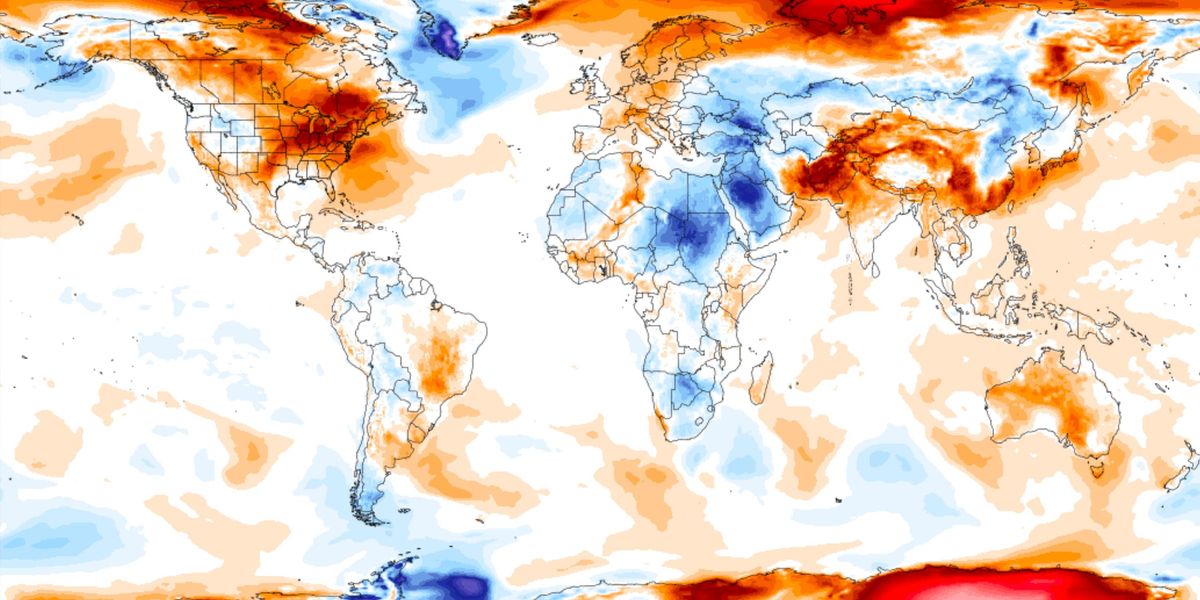

'Unthinkable': Scientists Shocked as Polar Temperatures Soar 50 to 90 Degrees Above Normal | Common Dreams

"With everything going on in the world right now, the dual polar climate disasters of 2022 should be the top story," says Eliot Jacobson.www.commondreams.org

The Earth has given us many, many warnings about what we are doing and why we should stop. If we eventually make our planet uninhabitable by our species, we will have only ourselves to blame.