Gigapress

Trying to be less wrong

“Excess capacity” is also a meaningless concept, just as much as “Tesla sells every car they produce” has always been meaningless. In a market economy, surpluses and shortages exist only very temporarily and the main reason is usually sticky prices. In the short term, supply and demand imbalances always return to equilibrium primarily via price adjustments. For a market with inelastic supply in the short run and very elastic demand, such as the automotive manufacturing market, price is by far the main determining factor that balances it all out.Where did you get that idea? Do you have evidence?

In a more nuanced look at the game theory, psychology, and friction of pricing adjustments, there are many reasons why prices can be sticky, but in general major surpluses and shortages are transient and short-lived. Car companies have high fixed costs and make it up it volume, and they also have unions and supply chain agreements based around keeping production steady. Ramping production up and down also adds operational inefficiency compared to steady output. This is why they tend to cut prices and sacrifice margins instead of cutting quantity when demand weakens. (I’m counting discounted fleet sales as an effective form of price cutting.) Inventory buffers also help, because cars conveniently have a very long shelf life without material loss of value and can simply be parked outside somewhere until someone wants to buy them, which can’t be said of many other types of goods.

This is economics 101 and it’s shocking how many investors don’t understand this.

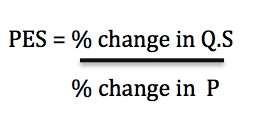

Inelastic supply - Economics Help

Definition, explanation, causes and diagrams. Supply is price inelastic if a change in price causes a smaller % change in supply.

www.economicshelp.org

www.economicshelp.org

Last edited: