colettimj

Member

Your daily Seeking Alpha Rundown:

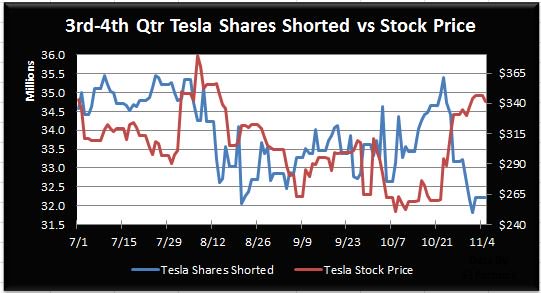

Here's How We Short Tesla And Still Sleep Soundly

Summary: Don't worry, we all know that Tesla is going down eventually. Buy calls to deal with the risk and then ignore the volatility. And the cognitive dissonance about the fact that you're also going long on Tesla.

Quote: "Because we agree with Jim Chanos and Mark Spiegel. Tesla could be one of those once-in-a-lifetime shorts. When we typically short, we are looking for a move down between 10 and 20 percent. Not so with Tesla, our largest short position. We expect to wake up one day with Tesla stock down $30, headed to down $150, and who knows from there."

Tesla, Dieselgate, And The Future

Summary: EVs are a government-promoted scam because you can sequester carbon more cheaply by other means, and I don't understand the concept that subsidies exist to kickstart an industry so it can sustain itself. Solar City was a fleecing fraud. Don't switch to clean energy, just go vegan. It'll fix any problems you have with your genitals as well, and yes, I'm actually talking about Viagra in a Seeking Alpha article.

Quote: "The absurd dream of an integrated renewable energy company is quickly coming to an end. From a societal standpoint, it was always more make-believe than real solution anyway"

That second quote almost got me a new laptop due to a spit take.