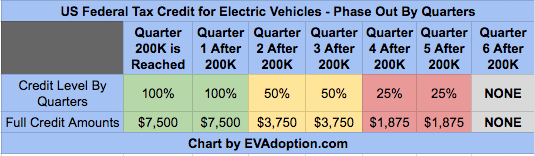

I'm hoping there will be a lot of very happy Canadians receiving their Model 3 in June. Surely there are enough Canada orders to fill Tesla's dance card for June. If they keep in under 200,000 that would give another whole quarter of US deliveries to get subsidized by taxpayers.

I don't think so. Seems most are putting off the order for AWD or the base model. I don't think there are that many in Canada anyways.