You may be right on growth, but this valuation metric is totally dumb.

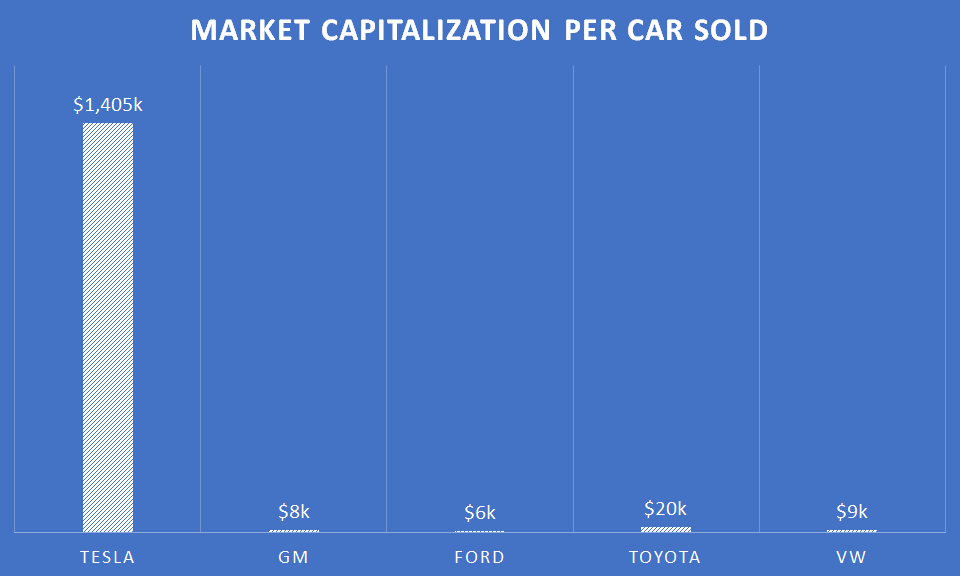

I just think it is a quick way to illustrate how much future growth is already built in to the current TSLA valuation.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

You may be right on growth, but this valuation metric is totally dumb.

I just think it is a quick way to illustrate how much future growth is already built in to the current TSLA valuation.

Say it with me three times: Tesla is not just a car company. Tesla is not just a car company. Tesla is not just a car company.

It seems like everything has to go right over the next 5 years to justify the current valuation. I love my car, love what TSLA does and I get that TSLA is well positioned for the "green" era with a lead on other companies for solar, battery, EV, and other tech but when I see charts like this I get nervous.

It seems like everything has to go right over the next 5 years to justify the current valuation. I love my car, love what TSLA does and I get that TSLA is well positioned for the "green" era with a lead on other companies for solar, battery, EV, and other tech but when I see charts like this I get nervous.

I just think it is a quick way to illustrate how much future growth is already built in to the current TSLA valuation.

I did read your post. Maybe I misunderstand you position. "Everything has to go right over the next 5 years to justify the current valuation". Let's assume they continue on the same path they've been on for many years - this is after all the most likely isn't it - in that case do you believe TSLA should trade at $800-900 in 5 years or should it trade at $800-900 now?

I’m saying that there is no way to justify the current valuation based on current sales for Tesla products, so there must be the assumption of tremendous growth built in to the current value.

That’s neither here nor there in regards to what you said to me though. The part you didn’t choose to keep in my quote clearly shows that I do not consider Tesla to just be a car company which is why I didn’t like your response.

It is probably my bad for commenting on the Tesla valuation in this particular thread to begin with... but it was in direct response to another poster considering dumping a bunch of cash into 3 stocks were Tesla was one of them so it’s not like I brought it up out of the blue. Either way, this thread is not the place for debates about Tesla valuation so I will leave it at that.

I agree this is not the right thread, so this will also be my last response. The way I see it of course future potential is baked in the stock price, which is why the chart you posted is so irrelevant because you are comparing Tesla to other companies who are currently only making money per car they produce and sell and only ever in the futre will make money from every car the produce and sell. So after reading you response I still don't understand why you found it relevant to post that chart at all - because basically you're saying it's a meaningless metric, and I also don't understand on what other basis (because you basically admit that the market cap per car sold metric is meaningsless) you think the current valuation is wrong. But hey that's what makes a market isn't it - different players estimating the fair value of a stock differently at any given time.

I am just some clown on the internet that trades in his spare time, so take this with a grain of salt, but what kind of short-medium term upside do you think TSLA has at this point? It seems like everything has to go right over the next 5 years to justify the current valuation. I love my car, love what TSLA does and I get that TSLA is well positioned for the "green" era with a lead on other companies for solar, battery, EV, and other tech but when I see charts like this I get nervous.

Full disclosure. I sold all but 1 of my TSLA shares at $875. I wanted to still be a shareholder so I had to keep one but I think that the stock can't keep growing at the kind of rate is has.

Anyone familiar with ATAO (Altair International)? Seems like another company getting into Lithium mining and battery recycling.

The interesting part is Pelosi's son is on the board.

Im in the same boat. About 20,000 shares. Really like ABML and TSLA but already have positions in both and considering SENS.

I prefer to take long term positions but not sure what we can realistically expect from SENS.

So, maybe like others on here, I'm a Patreon supporter of The Limiting Factor. Jordan has started releasing his vids to us before the general public and this most recent one was all about how he got into his channel and what's on the horizon content wise. It got me thinking, so I emailed him to see if he knew about ABML and he said it has definitely caught his attention and will mention it in the salt + clay video of his.

All good things!...In all good time ,

I recommend having a look at Lynas Rare Earths, which is the only major producer of refined rare earths outside of China. LYC on the ASX or LYSCF in the OTC market. I’ve been invested in this company since 2012.

I expect the share price to double within 12 months and 4-5x by 2025. Even higher multiples are possible in the event of a global supply shortage arising from exponential growth of EV sales, wind power deployment etc. AND/OR a trade war with China - who has repeatedly threatened to restrict REE exports to the US and others.

Lynas is profitable, well managed, and is growing together with the increasing global demand for REEs. Its share price has been suppressed for years due to sovereign risk relating to a hostile government in Malaysia, where their processing facility is located. This risk is abating for two reasons. First, there has been a change of government in Malaysia and operations are no longer threatened. Second, Lynas is building two new processing facilities in Australia and Texas. In fact, the US military will help to fund the plant in Texas, as announced last week.

Lynas is currently a penny stock, traded over the counter overseas. I expect that to change this year, as the share price has risen to $4/share in the US. It’s very likely to be uplisted to the Nasdaq when it reaches $5, greatly boosting its profile and widening the pool of potential investors.

Link to Lynas’ latest QR below.

https://hotcopper.com.au/threads/ann-quarterly-activities-report.5876905/?post_id=50524441

Cheers

I've sold MSFT, AMD, UBER, FACE and bought PLL, STLD, TSLA.

I'm all in.

MP Materials produces about 15% of the world's supply of rare earths.