Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

racer26

Active Member

how many $50 billion companies can you list that do not make profits and rely ***every year*** on $1b+ capital raises to continue to be solvent?

Also: Tesla does not rely on big capital raises to remain solvent. It relies on big capital raises to accelerate and maintain an already huge growth rate. Automaking is an industry where scale is critical to the longevity of a company. You simply can't build a profitable car company unless you make a lot of cars.

ValueAnalyst

Closed

FWIW - The number of shares available to short at one of my brokers doubled from 400k pre-market to ~1m now couple with a slight increase in fee rate.

Bugs me when TSLA does not keep pace with the market on big market up days. I get why: TSLA being uncoupled from the indexes is a double edged sword, we get to go up on down days but on big up days like this traders can go elsewhere for better action.

Bugs me when TSLA does not keep pace with the market on big market up days. I get why: TSLA being uncoupled from the indexes is a double edged sword, we get to go up on down days but on big up days like this traders can go elsewhere for better action.

Yeah, I thought we might have dodged that bullet today because the after-opening dip was weak and short-lived, but the money is indeed migrating elsewhere this morning. On the other hand, a SP of 305 to 310 is not a bad place to go into the ER next week.

Yeah, I thought we might have dodged that bullet today because the after-opening dip was weak and short-lived, but the money is indeed migrating elsewhere this morning. On the other hand, a SP of 305 to 310 is not a bad place to go into the ER next week.

I think this is just our standard mid-morning swoon and we will be back near 308 in the afternoon.

Of course Tesla may "flub" the M3. It also may have improved its generic quality improvement radically from the MX initiation. What is the ratio of non-flub/flub risk? Since I am statistically challenged I would put it somewhere in the multiple integer range. If I had dry powder I would buy now, even though our average cost of Tsla is just under $60.

TheTalkingMule

Distributed Energy Enthusiast

A lot of algos likely have TSLA tied to oil in some capacity. Oil is down quite a bit over the last week(and today).Bugs me when TSLA does not keep pace with the market on big market up days. I get why: TSLA being uncoupled from the indexes is a double edged sword, we get to go up on down days but on big up days like this traders can go elsewhere for better action.

Waiting4M3

Active Member

I know you like being a contrarian and come on this board to pop some bubbles. Have you considered how big of a bubble the 30 million shares shorted is?I'm sorry... but I'm 100% certain you didn't talk to the right shorts... and your sample data is irrelevant... why?... because there's 30 million shares shorted... and anyone you talked to represents under 1% of that... because nobody with billions in short position are going to talk to you about their "feelings" and let you post it on a message board.

the #1 reason to short this stock... grossly under appreciated RISK.

I know you like being a contrarian and come on this board to pop some bubbles. Have you considered how big of a bubble the 30 million shares shorted is?

I don't think there will be a major short squeeze before Tesla show a clear path to profits led by a very good M3 production and deliveries.

At best the short squeeze will happen current summer when we will have concrete numbers about M3 production, or mid to late 2018 when the M3 will definitely impact Tesla results.

Paracelsus

Active Member

I don't think there will be a major short squeeze before Tesla show a clear path to profits led by a very good M3 production and deliveries.

At best the short squeeze will happen current summer when we will have concrete numbers about M3 production, or mid to late 2018 when the M3 will definitely impact Tesla results.

That is one party I would not want to be late for. News & numbers could be provided at any time

It appears that at least some of the Tesla shorts demonstrate a type of mental dissonance, likely related to their world view and personality type. Despite mountains of evidence to the contrary, they just can't bring themselves to entertain the idea that Elon Musk could actually be motivated by something other than self enrichment as a primary motivator. That that overarching motivation is to help save the world is clearly a lie, anathema to them. Tesla is a scam; it must be. Having established that it is a scam, they feel compelled to find evidence of this truth, using whatever mental gymnastics are necessary to support their thesis. Logic and reason are the casualties of this mental position, leading to compromised decision making.

Mark Spiegel (like Chanos and perhaps Left) is a clear example of this. He rates and judges people based on his own deeply flawed belief system. His Twitter feed shows that he's in deep pain, but he just knows he must be right, that it just must be a scam, and all will come out in the wash. He uses his own moral failings as his infallible benchmark and places his bets accordingly.

This is a fascinating phenomena to watch play out in front of us.

Mark Spiegel (like Chanos and perhaps Left) is a clear example of this. He rates and judges people based on his own deeply flawed belief system. His Twitter feed shows that he's in deep pain, but he just knows he must be right, that it just must be a scam, and all will come out in the wash. He uses his own moral failings as his infallible benchmark and places his bets accordingly.

This is a fascinating phenomena to watch play out in front of us.

It appears that at least some of the Tesla shorts demonstrate a type of mental dissonance, likely related to their world view and personality type. Despite mountains of evidence to the contrary, they just can't bring themselves to entertain the idea that Elon Musk could actually be motivated by something other than self enrichment as a primary motivator. That that overarching motivation is to help save the world is clearly a lie, anathema to them. Tesla is a scam; it must be. Having established that it is a scam, they feel compelled to find evidence of this truth, using whatever mental gymnastics are necessary to support their thesis. Logic and reason are the casualties of this mental position, leading to compromised decision making.

Mark Spiegel (like Chanos and perhaps Left) is a clear example of this. He rates and judges people based on his own deeply flawed belief system. His Twitter feed shows that he's in deep pain, but he just knows he must be right, that it just must be a scam, and all will come out in the wash. He uses his own moral failings as his infallible benchmark and places his bets accordingly.

This is a fascinating phenomena to watch play out in front of us.

Probably insecure people that have had a bad upbringing. Not necessarily violent, but morally depressing (parents that constantly put them down, say they can't achieve anything...).

Probably insecure people that have had a bad upbringing. Not necessarily violent, but morally depressing (parents that constantly put them down, say they can't achieve anything...).

Hence they act stupidly, are uninformed, or own a lot of fossil fuel stocks. How many are there? Perhaps 43% of the voting population today, just to pick a number out of the air.

I think this is just our standard mid-morning swoon and we will be back near 308 in the afternoon.

You appear to know a thing or two about this stock

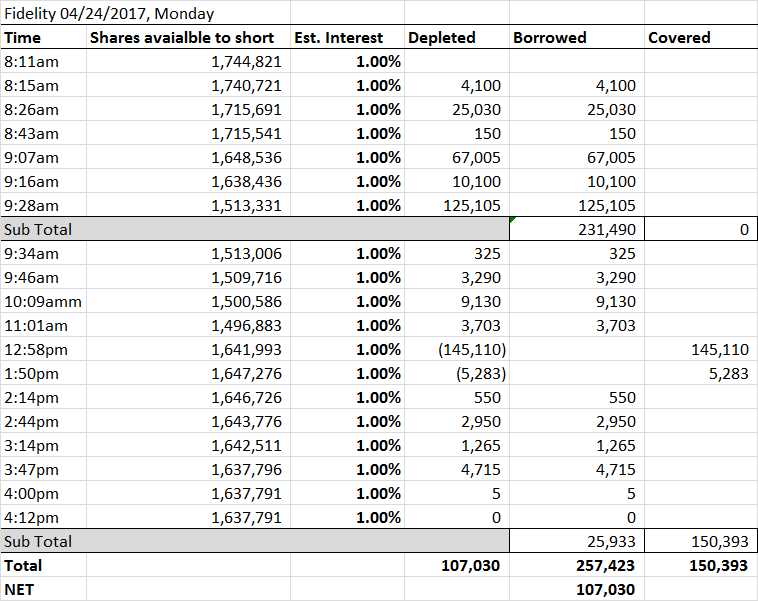

Today was again a net shorting day at Fidelity: about 257k shares borrowed, 150k shares covered, for a total net 107k shares covered. (Based on samples of the snap shots of the Fidelity trading screen shown below)

You appear to know a thing or two about this stock

Yeah I have been on a roll making accurate calls. I don't trade on it, but it amuses me.

erthquake

Active Member

Yeah I have been on a roll making accurate calls. I don't trade on it, but it amuses me.

Just let us know if you do decide to trade on it so we can be ready for the jinx

It appears that at least some of the Tesla shorts demonstrate a type of mental dissonance, likely related to their world view and personality type. Despite mountains of evidence to the contrary, they just can't bring themselves to entertain the idea that Elon Musk could actually be motivated by something other than self enrichment as a primary motivator. That that overarching motivation is to help save the world is clearly a lie, anathema to them. Tesla is a scam; it must be. Having established that it is a scam, they feel compelled to find evidence of this truth, using whatever mental gymnastics are necessary to support their thesis. Logic and reason are the casualties of this mental position, leading to compromised decision making.

Mark Spiegel (like Chanos and perhaps Left) is a clear example of this. He rates and judges people based on his own deeply flawed belief system. His Twitter feed shows that he's in deep pain, but he just knows he must be right, that it just must be a scam, and all will come out in the wash. He uses his own moral failings as his infallible benchmark and places his bets accordingly.

This is a fascinating phenomena to watch play out in front of us.

Back in November one among the cohort of mostly anonymous short sellers who regularly tweet to each other, tweeted that Curt Renz is a "dimwit" who has been giving horrific TSLA advice for years. With apparent sarcasm the tweeting short seller then recommended that Curt "double down" on TSLA. I did.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 872