Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

From Barclay's research: Why oil investors may suffer the ‘black swan’ potential of Elon Musk in 2017:

"Go ahead and count Elon Musk on that list of potential risks. The analysts say that the timely delivery of Tesla’s Model 3 could shake up the energy sector.

“Markets have a tendency to price in future developments and this development or a battery technology breakthrough that pushes prices far below current levels could turn the tide on how the market perceives EVs’ medium-term effect on oil demand,” the report said. "

"Go ahead and count Elon Musk on that list of potential risks. The analysts say that the timely delivery of Tesla’s Model 3 could shake up the energy sector.

“Markets have a tendency to price in future developments and this development or a battery technology breakthrough that pushes prices far below current levels could turn the tide on how the market perceives EVs’ medium-term effect on oil demand,” the report said. "

Mike Smith

Active Member

These small fluctuations up and down, about 50 cents below the green looks suspiciously like shorts trying to keep TSLA from going green this afternoon. Any other suggestions of why we're meeting resistance at this point are welcome.

There's a lot of weight on TSLA from the other autos being so low today so any reasonable point (like breakeven) should be expected give resistance.

racer26

Active Member

Maximum Pain for tomorrow sits at 220. Should be interesting to see what happens.

MitchJi

Trying to learn kindness, patience & forgiveness

I made a nice gain on a few Jan6 220's that I purchased based on one of your posts and @AlMc 's comments.PS: I'm rolling some calls forward today and the flirting between green and red has been working in my favor for selling in the green and buying in the red.

I'm really positive about the Q4 ER and intend to do something similar. In that case I minimized time value costs by waiting until about 10 days before and I got lucky betting on the numbers and the Gigafactory event.

One thing that helped me make a decision was @AlMc saying that he got a good deal on some calls. He paid a lot less for better calls than I bought.

I'd really appreciate it if you or Al , or anyone else posts if they see any calls that look like a good deal between now and the ER. I'm leaning towards Feb17's.

geneclean55

Active Member

TSLA has had good volume this week. Hopefully too much for max pain pin tmrw.Maximum Pain for tomorrow sits at 220. Should be interesting to see what happens.

N5329K

Active Member

Build out of the Model 3 fleet will have about the same effect on global oil prices as bringing in Bakken shale oil: it will drive down the price and cause producers to shut in expensive wells, and at sub-$50/barrel, that's a lot of wells.From Barclay's research: Why oil investors may suffer the ‘black swan’ potential of Elon Musk in 2017:

"Go ahead and count Elon Musk on that list of potential risks. The analysts say that the timely delivery of Tesla’s Model 3 could shake up the energy sector.

“Markets have a tendency to price in future developments and this development or a battery technology breakthrough that pushes prices far below current levels could turn the tide on how the market perceives EVs’ medium-term effect on oil demand,” the report said. "

That's one Black Swan I'm looking forward to.

Robin

Which speaks to some of my incredulity with the current Tesla analysts, including Brian Johnson of Barclay's, who just came out with a note mocking Elon's affinity for twitter and predicted Zero Model 3 production for 2017 and 75k for 2018. (Don't get run over by Elon Musk and Tesla stock bulls).From Barclay's research: Why oil investors may suffer the ‘black swan’ potential of Elon Musk in 2017:

"Go ahead and count Elon Musk on that list of potential risks. The analysts say that the timely delivery of Tesla’s Model 3 could shake up the energy sector.

“Markets have a tendency to price in future developments and this development or a battery technology breakthrough that pushes prices far below current levels could turn the tide on how the market perceives EVs’ medium-term effect on oil demand,” the report said. "

So on one hand, you have Barclay's energy analysts saying Model 3 could be 'black swan' disruptive, while their "expert" expects a fart in church and a mandatory capital raise. I know there is supposed to be a "Chinese wall" between the analysts and traders, but are any of these clowns going to reach out beyond their CPA/CFA training and Discounted Cash Flow models and talk to industry experts about what is actually happening in the disruption of markets - i.e. Tesla taking over and crowding out competition in the large luxury segment? Tesla disrupting energy markets. Tesla leading machine learning, big data and AI necessary for autonomous driving...(as the King of Siam would say...".etc., etc., etc.".

3Victoria

Active Member

Th

That article is a joke, and the clip re tweets is insulting. Maybe they can depress the SP, so I can buy more stock.Which speaks to some of my incredulity with the current Tesla analysts, including Brian Johnson of Barclay's, who just came out with a note mocking Elon's affinity for twitter and predicted Zero Model 3 production for 2017 and 75k for 2018. (Don't get run over by Elon Musk and Tesla stock bulls).

TSLA has had good volume this week. Hopefully too much for max pain pin tmrw.

And it's only a weekly, so tractor beam power is not as strong.

Which speaks to some of my incredulity with the current Tesla analysts, including Brian Johnson of Barclay's, who just came out with a note mocking Elon's affinity for twitter and predicted Zero Model 3 production for 2017 and 75k for 2018. (Don't get run over by Elon Musk and Tesla stock bulls).

So on one hand, you have Barclay's energy analysts saying Model 3 could be 'black swan' disruptive, while their "expert" expects a fart in church and a mandatory capital raise. I know there is supposed to be a "Chinese wall" between the analysts and traders, but are any of these clowns going to reach out beyond their CPA/CFA training and Discounted Cash Flow models and talk to industry experts about what is actually happening in the disruption of markets - i.e. Tesla taking over and crowding out competition in the large luxury segment? Tesla disrupting energy markets. Tesla leading machine learning, big data and AI necessary for autonomous driving...(as the King of Siam would say...".etc., etc., etc.".

Exactly! This was the reason I posted this, but did not have time to elaborate.

Having it both (negative!) ways. Very British.

Sector pullback?

Ford -2.5%

GM -1.7%

TM-.4%

tsla-1.6%

Ford -3.0%

GM -1.9%

TM-0.6%

tsla-0.1%

Not bad.

I made a nice gain on a few Jan6 220's that I purchased based on one of your posts and @AlMc 's comments.

I'm really positive about the Q4 ER and intend to do something similar. In that case I minimized time value costs by waiting until about 10 days before and I got lucky betting on the numbers and the Gigafactory event.

One thing that helped me make a decision was @AlMc saying that he got a good deal on some calls. He paid a lot less for better calls than I bought.

I'd really appreciate it if you or Al , or anyone else posts if they see any calls that look like a good deal between now and the ER. I'm leaning towards Feb17's.

My Jan17 190s and 200s did very well, too. They're sold now and I'm actually rolling my Mar17 180s forward to Jun17 180s in order to cover the Q1 delivery numbers and ER. The price difference isn't really great right now but that would change if TSLA took a sizeable dip. The current interest in Feb and Mar calls makes this an opportune time to sell them and move to my next strategy. One certainly can do well with other options, but I like mostly conservative calls that give me multiple positive catalysts before expiration. Glad the Jan17s worked well for you! Maybe ITM calls such as Jun 180s aren't your thing, but take a look. My strategy is focused now on being well-established in shares and calls so that if a short squeeze happens this year (and I think it is probable if Model 3 stays on track) I'm positioned to take advantage of that event. I also appreciate the volatility of this stock and only go shorter-term when it's painfully obvious that it is going to work.

I still appreciate the TMC member who mentioned that Jan19 150s were selling for little over $50 several weeks ago. I picked up a few and they've already done very well. Sharing good ideas is one of the values of this forum.

In regard to today's trading, the deep dips on opening looked suspiciously like short-seller induced dips, but with greater than 5 million shares traded today and a positive analyst upgrade during the day, the dip didn't hold, which furthers my belief that the old strategies of the short-sellers are failing more times than they are succeeding these days. That wasn't the case before mid-November, that's for sure.

Last edited:

I'm saying this because ferocity of TSLA move today reminds me of FB in its best days. Here is to '17 and hope this really is the case. And rdalcanto, be careful! I'm expecting us to touch 235 this week, but no idea where we close. Pure guess, $232, just to get back in the cadence of $10 move up per week

Haha, thanks Zhelko! I was feeling pretty smart a few hours after opening today when TSLA was down. Not too smart at close. We will see what happens next week. I only put 300 shares on the line, so if I have to sell them, it is no big deal. We made a lot of gains the last month, and my gut feeling is that we pull back below 226 next week, and then start climbing going to ER. But if I'm wrong, I hope to make money selling puts just below or above the SP, so I make a lot on the puts, and then hopefully get back in without paying too much more.

Jonathan Hewitt

Active Member

I still appreciate the TMC member who mentioned that Jan19 150s were selling for little over $50 several weeks ago. I picked up a few and they've already done very well. Sharing good ideas is one of the values of this forum.

Thanks for the appreciation! Glad you're doing well from your decision so far.November 2019 options opened up today. For one example, you can get a bright and shiny Jan19 150 call for ~$50. That means you won't lose any money as long as TSLA is above $200 in 2019.

I made a nice gain on a few Jan6 220's that I purchased based on one of your posts and @AlMc 's comments.

I'm really positive about the Q4 ER and intend to do something similar. In that case I minimized time value costs by waiting until about 10 days before and I got lucky betting on the numbers and the Gigafactory event.

One thing that helped me make a decision was @AlMc saying that he got a good deal on some calls. He paid a lot less for better calls than I bought.

I'd really appreciate it if you or Al , or anyone else posts if they see any calls that look like a good deal between now and the ER. I'm leaning towards Feb17's.

Thanks for the appreciation! Glad you're doing well from your decision so far.

You are way better off listening to J. Hewitt but I am glad you made some $ on the Jan calls we discussed a couple weeks ago!

to make this more market actionable; I did buy 40 J13 240s for an average of 65 cents. (edit: Bought on 1/5/17 on the dip)

Last edited:

Which speaks to some of my incredulity with the current Tesla analysts, including Brian Johnson of Barclay's, who just came out with a note mocking Elon's affinity for twitter and predicted Zero Model 3 production for 2017 and 75k for 2018. (Don't get run over by Elon Musk and Tesla stock bulls).

So on one hand, you have Barclay's energy analysts saying Model 3 could be 'black swan' disruptive, while their "expert" expects a fart in church and a mandatory capital raise. I know there is supposed to be a "Chinese wall" between the analysts and traders, but are any of these clowns going to reach out beyond their CPA/CFA training and Discounted Cash Flow models and talk to industry experts about what is actually happening in the disruption of markets - i.e. Tesla taking over and crowding out competition in the large luxury segment? Tesla disrupting energy markets. Tesla leading machine learning, big data and AI necessary for autonomous driving...(as the King of Siam would say...".etc., etc., etc.".

Indeed, you see the problems that financial firms have analyzing Tesla. Those firms have auto industry analysts and energy industry analysts. Tesla is the lone company in both industries. Either a firm's auto and energy analyst have to analyze Tesla jointly, or an an auto-energy analyst would have to be hired. But the latter would only follow one company.

Meanwhile, an analyst usually has to justify his conclusions to his boss using the same language of valuation they both learned in college. Those algorithms may work somewhat well when analyzing established companies in stable industries. But for an innovative young company disrupting its industry with long term goals, an analyst has dig deeper, see further into the future, and have really good intuition to boot. Such an analyst would be rare and well worth a top salary. Meanwhile, some of the participants here at Tesla Motors Club are at or near that standard, although without the benefit of an assured salary. They have to hope their bets placed in the stock market are winners more often than not.

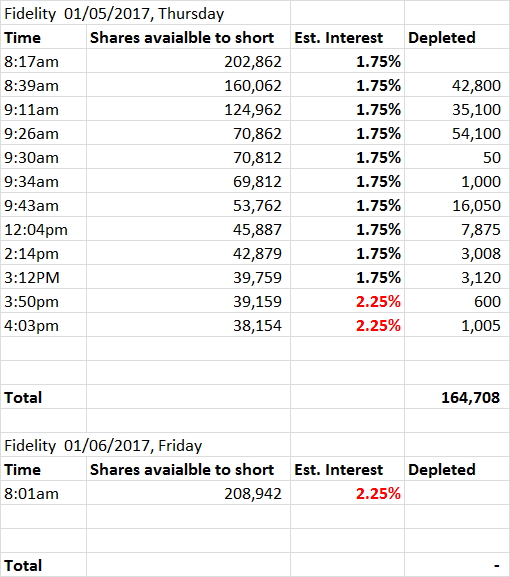

208k of shares available for shorting at Fidelity this morning, but interest went up yesterday from 1.75% to 2.25%.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 870