Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RobStark

Well-Known Member

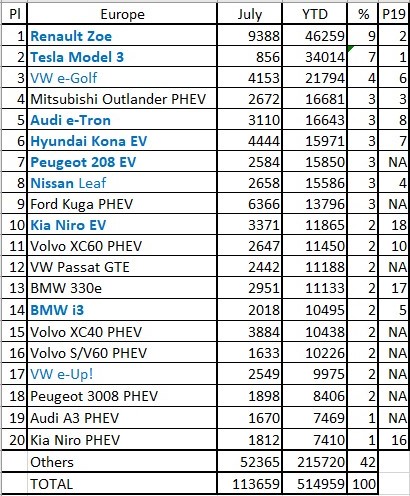

Tesla delivered 856 Model 3s and a handful of S/X in July in Europe. Renault YTD has 9% European PEV market share while Tesla has 8%. By end of September Tesla will be #1 and when 2020 totals come in Tesla should be #1 by a large margin.

Most of the Teslas ordered by Europeans in May/June/July are arriving on boats as we speak. This is typical Tesla lumpiness.

Same for Chinese deliveries. Even MiC Model 3s. China is as big geographically as the US and Tesla only has one factory in China. At the beginning of the quarter Tesla sends MiC Model 3s to customers farthest from Shanghai and delivers to Shanghai customers last.

FUDsters like to cherry pick monthly data. It means very little.

Doggydogworld

Active Member

Tesla will not be #1 in Europe this year. Model 3 should be the best selling single model and Tesla overall should beat Renault (excluding Kangoo panel van). But Tesla won't catch VW Group. I estimate Tesla Europe will end 2020 at 90-95k. VW should hit 150k BEVs plus maybe 50k PHEVs.By end of September Tesla will be #1 and when 2020 totals come in Tesla should be #1 by a large margin.

There's no need for this in China. Something like 95% of sales are within 1600 km of Shanghai, with the vast majority less than 1100 km. I'm sure they tweak deliveries the final week to reduce cars in transit, but Shanghai customers don't have to wait until EOQ like US west coasters.Same for Chinese deliveries. Even MiC Model 3s. China is as big geographically as the US and Tesla only has one factory in China. At the beginning of the quarter Tesla sends MiC Model 3s to customers farthest from Shanghai and delivers to Shanghai customers last.

RobStark

Well-Known Member

Tesla will not be #1 in Europe this year. Model 3 should be the best selling single model and Tesla overall should beat Renault (excluding Kangoo panel van). But Tesla won't catch VW Group. I estimate Tesla Europe will end 2020 at 90-95k. VW should hit 150k BEVs plus maybe 50k PHEVs.

There's no need for this in China. Something like 95% of sales are within 1600 km of Shanghai, with the vast majority less than 1100 km. I'm sure they tweak deliveries the final week to reduce cars in transit, but Shanghai customers don't have to wait until EOQ like US west coasters.

Tesla will be #1 in Europe this year.

We see lumpy deliveries in China that correspond to US deliveries. I see no other reason for it.

Doggydogworld

Active Member

Tesla will be #1 in Europe this year.

How? What is your full year estimate for Tesla in Europe?

Just a general question for those who have more expertise in this than me. If Europe is ahead of the US in adopting EVs, then is it reasonable look at trends there as a relevant indicator of future Tesla's EV market share in the US? More specifically, there are increasing numbers of relevant EV competitors in Europe that will be coming here in the next year or so. There's been a sense these competitors won't be serious competition because of range, software features, self driving, etc. However, in Europe, where Tesla was the main player previously, Tesla's market share has dropped precipitously as these newer models have become available. In addition, how long will these differences (e.g., range) really be a factor, so that there will be really competitive viable competitors?

adiggs

Well-Known Member

Just a general question for those who have more expertise in this than me. If Europe is ahead of the US in adopting EVs, then is it reasonable look at trends there as a relevant indicator of future Tesla's EV market share in the US? More specifically, there are increasing numbers of relevant EV competitors in Europe that will be coming here in the next year or so. There's been a sense these competitors won't be serious competition because of range, software features, self driving, etc. However, in Europe, where Tesla was the main player previously, Tesla's market share has dropped precipitously as these newer models have become available. In addition, how long will these differences (e.g., range) really be a factor, so that there will be really competitive viable competitors?

It's a reasonable hypothesis, but looking at Tesla specific trends in any geography are going to be warped by Tesla shipping different numbers of vehicles quarter to quarter (and year to year) to different geographies.

Those trends will be a better predictor once giga-Berlin is online, and more generally, the trends will be better predictors when we think Tesla is in the vicinity of satisfying current demand. If things continue as they've been, then it's like that EV trends = Tesla trends

The upcoming competitors, MHO, aren't actually competitors until it is clear that a given model is intended to be built in arbitrarily large numbers - enough to satisfy whatever demand people have for the vehicle AND it's got good enough features to be in the ballpark with Tesla. Building EV compliance cars, as everybody else is doing, makes those manufacturers into kids playing in the sandbox; they're not serious yet.

And they've got a serious problem in front of them - if they build a really good EV then they are most likely to be cannibalizing their ICE car sales, rather than taking share from Tesla. And that means they'll go through a period of declining revenue and profits as they destroy their ICE car business and are building their new EV car business. In a world where nobody has produced a serious competitive product (looking at all facets of the vehicle - not just the interior appointments, 0-60 times, Nurburgring times, etc..), building greater than compliance car volumes is the MINIMUM for anybody else to be serious.

I think that we can get an idea of what all markets can look like in the future from the markets that have the highest adoption %. Today I see that as Norway, maybe with a dose of California. That's a very future looking view though - not something that is particularly relevant to this quarter or next, and probably even next year / the year after.

Doggydogworld

Active Member

I recommend merging this thread with EU Market Situation and Outlook.Just a general question for those who have more expertise in this than me. If Europe is ahead of the US in adopting EVs, then is it reasonable look at trends there as a relevant indicator of future Tesla's EV market share in the US? More specifically, there are increasing numbers of relevant EV competitors in Europe that will be coming here in the next year or so. There's been a sense these competitors won't be serious competition because of range, software features, self driving, etc. However, in Europe, where Tesla was the main player previously, Tesla's market share has dropped precipitously as these newer models have become available. In addition, how long will these differences (e.g., range) really be a factor, so that there will be really competitive viable competitors?

My thoughts - EU growth is driven by mandates which create a completely different competitive situation than the US. Non-trivial mandates force legacy OEMs to develop EVs that people actually want to buy, and allow legacy OEMs to raise ICE prices and cross-subsidize those EVs as required to sell them. That makes life very difficult for Tesla, who cannot cross-subsidize (they get a partial cross-subsidy from FCA right now, but that's temporary).

Remember, legacy OEMs don't have to "take share from Tesla". All they have to do is prevent defections to Tesla. If they succeed at that then Tesla, which must grow rapidly via conquest sales, is screwed.

CARB states also have a mandate, but the volumes it requires are too low to justify full R&D programs. So legacy OEMs instead ripped ICEs out of econoboxes and threw batteries in the trunk. Or just bought ZEV credits from Tesla. GM/LG did full R&D for the Bolt, but that was a mistake. Might have been a different story had Hillary won, of course.

Will the Euro-OEMs invade the US now that they have real EV designs? Will Ford sell a bazillion Mach-Es here? Not really. Legacy OEMs will sell enough here to meet CARB rules, plus a few extra in non-CARB states for PR (especially VW). No more 95 mile compliance cars - yay!. But they can't cross-subsidize here, so there's no reason to scale up.

China mandates are closer to CARB-level, but with stronger incentives. That's a much more even playing field for Tesla, at least now that they avoid tariffs via local production. China tweaks their mandates constantly, though, so that market could become more EU-like.

Tesla wins if consumer demand races ahead of mandates. But it seems the opposite is true. Without strong mandates US and China are flat at ~2.25% and 4% respectively for three straight years now.

There is also a big difference in minimum range requirements and size of car between most of Europe and the US. Not to mention most high end cars are company cars here while not so much in the US.Just a general question for those who have more expertise in this than me. If Europe is ahead of the US in adopting EVs, then is it reasonable look at trends there as a relevant indicator of future Tesla's EV market share in the US? More specifically, there are increasing numbers of relevant EV competitors in Europe that will be coming here in the next year or so. There's been a sense these competitors won't be serious competition because of range, software features, self driving, etc. However, in Europe, where Tesla was the main player previously, Tesla's market share has dropped precipitously as these newer models have become available. In addition, how long will these differences (e.g., range) really be a factor, so that there will be really competitive viable competitors?

Not to mention Tesla needs a SUV option for those without lots of money or lots of kids, i.e. the Y. To be able to say anything about Tesla’s competitiveness.

RobStark

Well-Known Member

UK Q2 new registration numbers were published today. The generic model numbers are found here, and broken down by model variants here.

In Q2, Tesla delivered:

Model 3: 4029

Model S: 197

Model X: 254

Total: 4480

That represents a 2.64% market share, significantly higher than previously:

2019 Q2: 0.17%

2019 Q3: 1.01%

2019 Q4: 1.24%

2020 Q1: 1.18%

This is mostly accounted for by the pandemic-related lockdown, which meant that the showrooms were closed for about 2/3rds of the quarter, yet Tesla was able to partly carry on with online orders and contactless deliveries at new owners' homes.

The high-water mark for quarterly deliveries was set in Q3 2019, with 5974 units.

Q3 2020 looks weak in the monthly Y-o-Y comparison, and it would require a spectacular September delivery number (around 4500 units just this month, or similar to the whole of Q2) to match it*. We're expecting cars aboard at least 4 ships (3 already docked and unloaded, another one or two to arrive - but all have stopped at Zeebrugge before reaching Southampton or moving cars to other ships, so not all cars for the UK market) to contribute to September deliveries, so it's not completely outside the realm of possibilities, but some of those cars will likely spill over into early October due to late-September arrival. Based on comments on UK-specific threads, it seems deliveries are at full-throttle in the UK at the moment.

*Such a monthly delivery number would not be unprecedented, however. In March this year, Tesla delivered about 5000 cars in the UK.

In Q2, Tesla delivered:

Model 3: 4029

Model S: 197

Model X: 254

Total: 4480

That represents a 2.64% market share, significantly higher than previously:

2019 Q2: 0.17%

2019 Q3: 1.01%

2019 Q4: 1.24%

2020 Q1: 1.18%

This is mostly accounted for by the pandemic-related lockdown, which meant that the showrooms were closed for about 2/3rds of the quarter, yet Tesla was able to partly carry on with online orders and contactless deliveries at new owners' homes.

The high-water mark for quarterly deliveries was set in Q3 2019, with 5974 units.

Q3 2020 looks weak in the monthly Y-o-Y comparison, and it would require a spectacular September delivery number (around 4500 units just this month, or similar to the whole of Q2) to match it*. We're expecting cars aboard at least 4 ships (3 already docked and unloaded, another one or two to arrive - but all have stopped at Zeebrugge before reaching Southampton or moving cars to other ships, so not all cars for the UK market) to contribute to September deliveries, so it's not completely outside the realm of possibilities, but some of those cars will likely spill over into early October due to late-September arrival. Based on comments on UK-specific threads, it seems deliveries are at full-throttle in the UK at the moment.

*Such a monthly delivery number would not be unprecedented, however. In March this year, Tesla delivered about 5000 cars in the UK.

Last edited:

And we have Q2 numbers available:Hi everybody. We have the official registration numbers for the UK for Q1 2020. You can download the data HERE. This is the smaller file that shows the table you see below. If you want to see the trim levels too, you can download the larger file HERE.

Because the official numbers are released late, we use estimates in the meantime. The estimate we were using for Q1 2020 was 5,722 units. That's only 22 units off.

- 5,367 Model 3 (I assumed the 2 car listed as 'model missing' are Model 3)

- 155 Model S

- 178 Model X

- 5,700 in total

The UK releases only quarterly numbers instead of monthly. Therefore we use SMMT numbers (the same source we use for estimates) to split the quarterly numbers into monthly. This method is explained HERE in case you are interested. The numbers in orange show the monthly split that was calculated from the official quarterly numbers.

Total estimate was 4556, actuals are 4480, so we were off by 76 units. That's 1.7% off - kudos to @Troy for his formula! I have hidden lines that were empty for Tesla Q2 2020:

Totals per model are:

Model 3: 4029

Model S: 197

Model X: 254

Entering those numbers into the Google sheet for the monthly split:

RaezoR

Member

Yupp, we have a truckload of EVs & Hybrids here in Norway. What is interesting is the amount of vehicles and the fuels in the car pool. According to the Norwegian Statistics Bureau. At the end of 2019 100% Electric cars represented 9.31 %. Chargeable Hybrids 4.14 %. Hybrids 3.95 %. Petrol 36.83 % and DIRTY Diesel 45.75 % (0.02 % Other (Hydrogen etc). Pure electrics have around 55 % of all car sales now. The Norwegian governments politics towards them is slowly moving away from incentives such as; No purchase taxes, Very low (35 USD) "road tax" (they don't call it that any more, as it was almost never used for roads) No Tolls (roads or ferries), use of Bus/Taxi lanes in cities and free parking. There is NO DOUBT that all these incentives and high fuel costs drove many Norwegians to buy EVs and still does (Petrol here is around 6-7 USD per US gallon. Cars here are normally very expensive, but my 2020 Tesla Model 3 Performance cost 64.000 USD (exchange rate 9 NOK = 1 USD). Which is inexpensive compared to comparable midsize saloon. Denmark stopped all EV incentives in 2015 and EV sales sank like a brick in a swimming pool. All countries need to accelerate alternative fuel car sales to replace ICE vehicles. I believe that is Norway doesn't change the incentives the Norwegian Car Pool l believe that petrol / diesel car sales will fall to around 20 %. Norway is supposedly reviewing these incentives in 2025, but you know politics, they may start to mess with them before that.

The Model 3 was the most sold EV in Italy this september:

1. Tesla Model 3: 880

2. Renault Zoe: 676 (mine is here! ;-)

3. Smart fortwo 461

1. Tesla Model 3: 880

2. Renault Zoe: 676 (mine is here! ;-)

3. Smart fortwo 461

RobStark

Well-Known Member

So what happened in Norway this month? https://teslastats.no/.

I thought the story was that Tesla was suffering badly this year with market share because of all the new BEV competition. But they’re going to have the best month since March19 which was the initial rush of first deliveries. Have they now realised that M3 is the best choice after all or is there something else going on?

I thought the story was that Tesla was suffering badly this year with market share because of all the new BEV competition. But they’re going to have the best month since March19 which was the initial rush of first deliveries. Have they now realised that M3 is the best choice after all or is there something else going on?

Norway was starved of supply, with most cars going to other countries in the EU, and UK. Now with China Model 3 shipping to EU, Norway got supply again. There was never a demand problem in Norway.So what happened in Norway this month? https://teslastats.no/.

I thought the story was that Tesla was suffering badly this year with market share because of all the new BEV competition. But they’re going to have the best month since March19 which was the initial rush of first deliveries. Have they now realised that M3 is the best choice after all or is there something else going on?

Similar threads

- Replies

- 0

- Views

- 743

- Replies

- 9

- Views

- 711

- Replies

- 993

- Views

- 67K

- Article

- Replies

- 64

- Views

- 6K

- Replies

- 5K

- Views

- 561K