For me Model X is not a small size SUV, so remove those from the comparison. Not sure what is midsize, but for me that is 5 seats but large. Model X is also a performance cars, some of those cars are sold with pretty bad acceleration options, remove them also. What cars are then left?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Lucky_Man

Member

Never tho't I'd think this but I'm actually considering shorting the likes of XOM and MRO. Am I nuts?Good Vid on Pending EV Disruption.

brian45011

Active Member

Per broker:So, what rate is Tesla paying ?

Issuer: Tesla Auto Lease Trust 2018-B--(issued using Rule 144A)

Class A Notes, Assigned (P)Aaa (sf)--3.7% matures April 2021

Class B Notes, Assigned (P)Aa2 (sf)--4.1% matures June 2021

Class C Notes, Assigned (P)A2 (sf)--4.4% matures July 2021

Class D Notes, Assigned (P)Baa2 (sf)--5.29% matures July 2021

Class E Notes, Assigned (P)Ba3 (sf)--8.0% matures June 2022

Lucky_Man

Member

Aren't you guys missing the complication of the fossil fuel refining processes, specifically, all those hazardous by-products?Correct. However the quick release of previously stored fossil fuels by using petroleum products dumps huge amounts of CO2 into the atmosphere which has been out of circulation for millions of years. Burning biomass which would decay and release CO2 anyway is a different matter. Simple example: Grown corn in the summer, which absorbs CO2, burn it in the winter, releasing CO2, grow it again next summer, absorbing CO2, etc.

RobStark

Well-Known Member

For me Model X is not a small size SUV, so remove those from the comparison. Not sure what is midsize, but for me that is 5 seats but large. Model X is also a performance cars, some of those cars are sold with pretty bad acceleration options, remove them also. What cars are then left?

The link provided has three list. Luxury Subcompact SUVs, Luxury Compact SUVs and Luxury Midsize SUVs.

In America, Model X is a luxury midsize crossover. Which places it in Luxury Midsize SUV sales charts. Cadillac Escalade,Mercedes GLS, and Lincoln Navigator are full size luxury SUVs.

Yes, being electric, Model X has better acceleration and more interior room. But is not dominating its class in sales like Model 3 and Model S.

Model X is the same exterior size as BMW X5 Mercedes GLE etc

Last edited:

RobStark

Well-Known Member

Never tho't I'd think this but I'm actually considering shorting the likes of XOM and MRO. Am I nuts?

You might've missed the boat on that thought: https://teslamotorsclub.com/tmc/threads/shorting-oil-hedging-tesla

Plus it seems that the oil companies are well aware of their impending demise, and some are trying to pivot into "energy" companies. I'm short via the ProShares fund: SCO

RobStark

Well-Known Member

neroden

Model S Owner and Frustrated Tesla Fan

Bleh, securitization tranches... I hate those things. What's not obvious is how much of each type there is; we probably won't find out.Per broker:

Issuer: Tesla Auto Lease Trust 2018-B--(issued using Rule 144A)

Class A Notes, Assigned (P)Aaa (sf)--3.7% matures April 2021

Class B Notes, Assigned (P)Aa2 (sf)--4.1% matures June 2021

Class C Notes, Assigned (P)A2 (sf)--4.4% matures July 2021

Class D Notes, Assigned (P)Baa2 (sf)--5.29% matures July 2021

Class E Notes, Assigned (P)Ba3 (sf)--8.0% matures June 2022

Ask and ye shall receive. Here it is from the Moody's pre-sale.Bleh, securitization tranches... I hate those things. What's not obvious is how much of each type there is; we probably won't find out.

Dig deeper

Member

You might've missed the boat on that thought: https://teslamotorsclub.com/tmc/threads/shorting-oil-hedging-tesla

Plus it seems that the oil companies are well aware of their impending demise, and some are trying to pivot into "energy" companies. I'm short via the ProShares fund: SCO

I recently read the article by Neroden about oils demise and got to thinking. What is the best way to be short oil (perhaps this conversation is better had in that thread). Unfortunately, by the time i begin to fully understand these companies (eg. Exxon) balance sheets and capital structure (doesn't help that i am still a noob) they would probably already be bankrupt. So I started considering a more broad approach.

I dont have the stomach to short, nor the means to do so thankfully.

SCO piqued my interest, but from what i understand, leveraged etf's such as this lose some value due something a kin to theta. I also dont understand if there are any effects that I might not be considering when looking at options on something like this. Although I have much DD left to do, I think ill start at least building a small position myself (kind of feel pressed for time here). Momentum looks to be well behind SCO as well.

Would appreciate any thoughts you might have holding it.

Why China’s electric-car industry is leaving Detroit, Japan, and Germany in the dust

The above linked article does a brief analysis of the Chinese electric car industry versus, essentially, the rest of the world. The gist is China is the dominant force in the EV market and no one else is close. Astonishingly, there is no mention of Tesla outside of an infographic that shows EV sales in 2018, with Tesla on top...

I'm stunned to see Tesla left out of the discussion. I actually did a ctrl+f to make sure I wasn't crazy. How this article can be written without mentioning the company and its dominance in the industry is, frankly, insane. That said, I should know better. Tesla is a lumbering giant that is still somehow invisible to much of the public even though it's in plain sight for everyone to see. If demand for Teslas flags at all, a few well placed ads would easily cure the problem. Somehow, this company just doesn't come up on peoples radar. Good for investors who are buying in now. Great for investors who bought in years ago.

The above linked article does a brief analysis of the Chinese electric car industry versus, essentially, the rest of the world. The gist is China is the dominant force in the EV market and no one else is close. Astonishingly, there is no mention of Tesla outside of an infographic that shows EV sales in 2018, with Tesla on top...

I'm stunned to see Tesla left out of the discussion. I actually did a ctrl+f to make sure I wasn't crazy. How this article can be written without mentioning the company and its dominance in the industry is, frankly, insane. That said, I should know better. Tesla is a lumbering giant that is still somehow invisible to much of the public even though it's in plain sight for everyone to see. If demand for Teslas flags at all, a few well placed ads would easily cure the problem. Somehow, this company just doesn't come up on peoples radar. Good for investors who are buying in now. Great for investors who bought in years ago.

Why China’s electric-car industry is leaving Detroit, Japan, and Germany in the dust

The above linked article does a brief analysis of the Chinese electric car industry versus, essentially, the rest of the world. The gist is China is the dominant force in the EV market and no one else is close. Astonishingly, there is no mention of Tesla outside of an infographic that shows EV sales in 2018, with Tesla on top...

I'm stunned to see Tesla left out of the discussion. I actually did a ctrl+f to make sure I wasn't crazy. How this article can be written without mentioning the company and its dominance in the industry is, frankly, insane. That said, I should know better. Tesla is a lumbering giant that is still somehow invisible to much of the public even though it's in plain sight for everyone to see. If demand for Teslas flags at all, a few well placed ads would easily cure the problem. Somehow, this company just doesn't come up on peoples radar. Good for investors who are buying in now. Great for investors who bought in years ago.

According to the title, California was not a topic of discussion...

Which makes sense since China is not leaving Tesla in the dust.

/pedantic

dc_h

Active Member

The MIT review group has some animus for Tesla. Don’t think they’ve ever found anything positive to say.Why China’s electric-car industry is leaving Detroit, Japan, and Germany in the dust

The above linked article does a brief analysis of the Chinese electric car industry versus, essentially, the rest of the world. The gist is China is the dominant force in the EV market and no one else is close. Astonishingly, there is no mention of Tesla outside of an infographic that shows EV sales in 2018, with Tesla on top...

I'm stunned to see Tesla left out of the discussion. I actually did a ctrl+f to make sure I wasn't crazy. How this article can be written without mentioning the company and its dominance in the industry is, frankly, insane. That said, I should know better. Tesla is a lumbering giant that is still somehow invisible to much of the public even though it's in plain sight for everyone to see. If demand for Teslas flags at all, a few well placed ads would easily cure the problem. Somehow, this company just doesn't come up on peoples radar. Good for investors who are buying in now. Great for investors who bought in years ago.

neroden

Model S Owner and Frustrated Tesla Fan

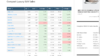

So, very much front-loaded into the lowest interest rate tranche. Nearly 3/4 of it is at 3.7%. I guess Deepak thinks interest rates are going up, since that's slightly higher than the variable-rate Warehouse Agreement, which was 3.5% last time we checked. Makes sense.Ask and ye shall receive. Here it is from the Moody's pre-sale.

View attachment 361705

Just a tad higher than the previous automotive asset-backed notes, as you would expect from the rise in interest rates which already happened.

I recently read the article by Neroden about oils demise and got to thinking. What is the best way to be short oil (perhaps this conversation is better had in that thread). Unfortunately, by the time i begin to fully understand these companies (eg. Exxon) balance sheets and capital structure (doesn't help that i am still a noob) they would probably already be bankrupt. So I started considering a more broad approach.

I dont have the stomach to short, nor the means to do so thankfully.

SCO piqued my interest, but from what i understand, leveraged etf's such as this lose some value due something a kin to theta. I also dont understand if there are any effects that I might not be considering when looking at options on something like this. Although I have much DD left to do, I think ill start at least building a small position myself (kind of feel pressed for time here). Momentum looks to be well behind SCO as well.

Would appreciate any thoughts you might have holding it.

Yeah, it's tied to the price of crude and not the oil companies themselves, and it's definitely for trading and not holding. As crude prices drop (and SCO price goes up), demand increases (or supply drops) to swing the price in the opposite direction. At least that's how I've been playing it.

Shell had the winning bid for one of the three blocks of off shore wind farm development, $135 million or so...Yeah, it's tied to the price of crude and not the oil companies themselves, and it's definitely for trading and not holding. As crude prices drop (and SCO price goes up), demand increases (or supply drops) to swing the price in the opposite direction. At least that's how I've been playing it.

For me Model X seems much closer to X6 than X5. X6 and X are CUVs, X5 is an SUV. Sure my statement is a bit open to interpretation and I guess you could claim that the Model X is a car and thus competes with all cars or that Model X is a perfomance car and thus competes with ferraris etc. Semantics schemantics.The link provided has three list. Luxury Subcompact SUVs, Luxury Compact SUVs and Luxury Midsize SUVs.

In America, Model X is a luxury midsize crossover. Which places it in Luxury Midsize SUV sales charts. Cadillac Escalade,Mercedes GLS, and Lincoln Navigator are full size luxury SUVs.

Yes, being electric, Model X has better acceleration and more interior room. But is not dominating its class in sales like Model 3 and Model S.

Model X is the same exterior size as BMW X5 Mercedes GLE etc

View attachment 361648

RobStark

Well-Known Member

For me Model X seems much closer to X6 than X5. X6 and X are CUVs, X5 is an SUV. Sure my statement is a bit open to interpretation and I guess you could claim that the Model X is a car and thus competes with all cars or that Model X is a perfomance car and thus competes with ferraris etc. Semantics schemantics.

It isn't semantics.

It isn't where I want to put the Model X but where the automobile industry puts Model X.

You want to create a microniche class, then put the Model X into that Class, then claim it dominates its class? LOL Crossover high performance coupe ?

Roadster competes with Ferraris.Ferrari makes sports cars. Specifically in the "supercar" and "hypercar" class.

"Performance Cars" can be anything from Golf GTI to Mustang to Ferrari.

Correct. This is pretty standard for a new issuer. You should see the A notes become a larger percentage of the total over the next few years.So, very much front-loaded into the lowest interest rate tranche. Nearly 3/4 of it is at 3.7%. I guess Deepak thinks interest rates are going up, since that's slightly higher than the variable-rate Warehouse Agreement, which was 3.5% last time we checked. Makes sense.

Just a tad higher than the previous automotive asset-backed notes, as you would expect from the rise in interest rates which already happened.

If you sign up to Moody's you can download their pre-sale report for free.

One of the more interesting points in it is that Moody's applies a very heavy penalty to the RV of the leases because of the short performance history of both Tesla and EVs in general. This is the main driver of the low % of A notes.

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 738

- Locked

- Replies

- 0

- Views

- 3K

- Article

- Replies

- 29

- Views

- 6K