My coworker could have a model 3 highland today. She is waiting because white interior is not available yet.I am now concerned the issues ramping the refresh are causing them to delay launching the Ludicrous

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Model 3 Highland Performance/Plaid Speculation [Car announced 04.23.2024]

- Thread starter Daniel L

- Start date

The huge Tesla devaluations were a perfect storm of global supply chain issues followed by a massive ramp of of production capacity AND a deliberate sacrifice of per-vehicle profit to increase volume as other competitors came on line.

Other new vehicles will experience part of that after successfully ramping (I.e. Rivians and Lucids). However, the major supply chain issues of 2021-2022, AND seeing a global auto manufacturer suddenly drop new prices by 20% and still stay in the black just to undercut competition, are once-in-a-generation phenomena. I do NOT expect it to happen again with Teslas.

It definitely was a perfect storm, bad for those that were caught up in it, but good for those that benefited from the "leveling out" afterwards. Such a crazy series of events for those that took a huge hit, but the salt to the wound was the rug pull from Tesla, regardless of the justification. A lot of people were left holding the bag and/or lost a huge chuck of value overnight.

I wonder if Tesla does decide to cash in on the M3L hype, if the close to $60K price tag would lift up some of the M3Ps in the used market some? This would be the best case scenario for those who survived the 21-22 storm.

It might return M3Ps to a more normal depreciation curve, retaining greater than the PCP Optional Final Payment value (of around 40% of new) at 3-4 years old. Mine had tanked to 50% at 1 year old and Tesla offered 45% of new against a Highland LR. None of this was helped by Tesla selling nearly new cars from inventory for 60% of their sticker price.I wonder if Tesla does decide to cash in on the M3L hype, if the close to $60K price tag would lift up some of the M3Ps in the used market some?

The M3L might be the best thing since sliced bread, but I'm not about to hand over another £33k for the pleasure of losing another £33k in 18 months!

Lets go Plaid

Member

They'd be foolish to get greedy and overprice this thing. 1st quarter numbers disappointed the market and this would only exacerbate the situation moving into thd 2nd quarter. Price it competitively, go for volume and they’ll do well.

FastLaneJB

Active Member

They might overprice it but then you know you'll take the depreciation hit once they've sold the initial early buyer wave. I mean Plaids used to cost a lot more but dropped once demand tailed off also.They'd be foolish to get greedy and overprice this thing. 1st quarter numbers disappointed the market and this would only exacerbate the situation moving into thd 2nd quarter. Price it competitively, go for volume and they’ll do well.

I feel like it should have the same gap from a Model Y Performance as the Model 3 Long Range does with a Model Y Long Range. That would be a realistic and not over inflated price.

Good points and yeah, no thanks to handling over even a cent more than they deserve. What's on my radar is a used '22+ Plaid.

I agree that Tesla must price this accordingly, but the question is will they?

They've already used up the "fool me once" card. The "fool me twice" card would be a huge risk, although they'd still catch the die hard fans set on the M3L. To be fair, I don't blame them. It'll be a great car.

I agree that Tesla must price this accordingly, but the question is will they?

They've already used up the "fool me once" card. The "fool me twice" card would be a huge risk, although they'd still catch the die hard fans set on the M3L. To be fair, I don't blame them. It'll be a great car.

They might overprice it but then you know you'll take the depreciation hit once they've sold the initial early buyer wave. I mean Plaids used to cost a lot more but dropped once demand tailed off also.

I feel like it should have the same gap from a Model Y Performance as the Model 3 Long Range does with a Model Y Long Range. That would be a realistic and not over inflated price.

The current delta between a MYLR ($49,990) to the MYP ($53,490) is $3,500.

However, there's a lot to consider here and I'm sure we can all see the obvious.

Between the new base M3 RWD ($38,990) and M3LR ($47,740) we're looking at $8,750.

Pricing the M3L in the mid 50s is possible, but I think they might peg it at $58,990 - $59,990 out of the gate for the initial wave.

It'll be interesting to see what the starting price will be, perhaps on the 20th or 23rd?

mpgxsvcd

Active Member

My Carvana offer for a 2022 Model 3 Performance increased from $29,400 to $33,200 in the last couple of months. Used prices seem to be stabilizing somewhat now.It definitely was a perfect storm, bad for those that were caught up in it, but good for those that benefited from the "leveling out" afterwards. Such a crazy series of events for those that took a huge hit, but the salt to the wound was the rug pull from Tesla, regardless of the justification. A lot of people were left holding the bag and/or lost a huge chuck of value overnight.

I wonder if Tesla does decide to cash in on the M3L hype, if the close to $60K price tag would lift up some of the M3Ps in the used market some? This would be the best case scenario for those who survived the 21-22 storm.

My primary problem with a $60K Model 3 is this is no longer the good old days of Teslas holding their value. Tesla's merciless price drops combined with the POS tax credits and the media trashing EVs means any new 3/Y purchase could very likely lose 40% value within 12 months. It's possible a credit-free 3L would fair a bit better, but it will always have the risk hanging over it of Tesla dramatically slashing prices or changing supply chains to reinstate the credit. Credit comes back? BOOM, your vehicle just lost $10K overnight. So yes, vehicles are depreciating assets but the rollercoaster of Tesla's values are now worse than most and this is how they apparently want it.

IMO, a low-spec or inventory discounted new Tesla makes reasonable financial sense due to low running costs and the like, but more expensive trims easily see depreciation offset most of the long term cost savings compared to ICE. So yes, a Highland M3L may compete with a G80 M3 and cost way less in fuel and maintenance, but that G80 is going to hold it's value to the point where there's not much in it. It's easy to say depreciation is not a factor if you're keeping the car long term, but I would say enthusiasts tend to swap vehicle more often than the average consumer, making it especially problematic for enthusiast-focused vehicles.

IMO, a low-spec or inventory discounted new Tesla makes reasonable financial sense due to low running costs and the like, but more expensive trims easily see depreciation offset most of the long term cost savings compared to ICE. So yes, a Highland M3L may compete with a G80 M3 and cost way less in fuel and maintenance, but that G80 is going to hold it's value to the point where there's not much in it. It's easy to say depreciation is not a factor if you're keeping the car long term, but I would say enthusiasts tend to swap vehicle more often than the average consumer, making it especially problematic for enthusiast-focused vehicles.

mpgxsvcd

Active Member

That is what leases are for. They automatically get the full $7,500 tax credit regardless of vehicle price or income. Plus you get to hand the vehicle back to them in 3 years and they take the depreciation hit.My primary problem with a $60K Model 3 is this is no longer the good old days of Teslas holding their value. Tesla's merciless price drops combined with the POS tax credits and the media trashing EVs means any new 3/Y purchase could very likely lose 40% value within 12 months. It's possible a credit-free 3L would fair a bit better, but it will always have the risk hanging over it of Tesla dramatically slashing prices or changing supply chains to reinstate the credit. Credit comes back? BOOM, your vehicle just lost $10K overnight. So yes, vehicles are depreciating assets but the rollercoaster of Tesla's values are now worse than most and this is how they apparently want it.

IMO, a low-spec or inventory discounted new Tesla makes reasonable financial sense due to low running costs and the like, but more expensive trims easily see depreciation offset most of the long term cost savings compared to ICE. So yes, a Highland M3L may compete with a G80 M3 and cost way less in fuel and maintenance, but that G80 is going to hold it's value to the point where there's not much in it. It's easy to say depreciation is not a factor if you're keeping the car long term, but I would say enthusiasts tend to swap vehicle more often than the average consumer, making it especially problematic for enthusiast-focused vehicles.

Sellout

Member

Well, you have literally paid for the depreciation when you hand them back the depreciated car at the end of a lease. The only way you’re winning in that sense is if you’ve somehow gotten away with paying for less depreciation than you caused.

No tax credit for purchase vs a $7,500 credit for a lease, at least some of which goes to lower your lease payments. Not everyone buys cars based on projected depreciation, otherwise we'd all be driving $800 shitboxes.Well, you have literally paid for the depreciation when you hand them back the depreciated car at the end of a lease. The only way you’re winning in that sense is if you’ve somehow gotten away with paying for less depreciation than you caused.

mpgxsvcd

Active Member

Yes, that is precisely what you are expecting to happen. The lease is setup with an expected depreciation but you are betting that the final depreciation will exceed that. As long as they keep reducing prices the final depreciation will exceed the initial predicted depreciation.Well, you have literally paid for the depreciation when you hand them back the depreciated car at the end of a lease. The only way you’re winning in that sense is if you’ve somehow gotten away with paying for less depreciation than you caused.

It still baffles me why people want to own a severely depreciating asset when they can just rent it for less.

Sellout

Member

I do generally agree with what you’re saying. I just don’t see the $7500 credit actually coming to anyone but Tesla with the way they’ve priced the lease payments.Yes, that is precisely what you are expecting to happen. The lease is setup with an expected depreciation but you are betting that the final depreciation will exceed that. As long as they keep reducing prices the final depreciation will exceed the initial predicted depreciation.

It still baffles me why people want to own a severely depreciating asset when they can just rent it for less.

Admittedly, I don’t have documented numbers from when I checked the lease payments estimated on the Tesla site before and after the credit became available at POS, but I was watching the prices with exactly this in mind.

mpgxsvcd

Active Member

Your point is valid. I did a deep dive into the purchase price at the 6.39% interest rate vs. the lease payment with zero down but the same money out of pocket as the loan. It turns out that they are actually giving you about $3,500 worth of benefit in the payment of the lease. They are capturing about half of the tax credit for themselves in the lease.I do generally agree with what you’re saying. I just don’t see the $7500 credit actually coming to anyone but Tesla with the way they’ve priced the lease payments.

Admittedly, I don’t have documented numbers from when I checked the lease payments estimated on the Tesla site before and after the credit became available at POS, but I was watching the prices with exactly this in mind.

If you qualify for the full tax credit on a vehicle with a purchase then even taking the severe depreciation into account the purchase is probably the better deal especially if you pay cash. If you qualify for $3,500 with the purchase and a loan but you get $7,500 with the lease then it is basically a wash. If you don't qualify for any tax credit with the purchase then the $7,500 that acts like a $3,500 tax credit in the lease will make it beneficial over the purchase with a loan.

Knightshade

Well-Known Member

Your point is valid. I did a deep dive into the purchase price at the 6.39% interest rate vs. the lease payment with zero down but the same money out of pocket as the loan. It turns out that they are actually giving you about $3,500 worth of benefit in the payment of the lease. They are capturing about half of the tax credit for themselves in the lease.

If you qualify for the full tax credit on a vehicle with a purchase then even taking the severe depreciation into account the purchase is probably the better deal especially if you pay cash. If you qualify for $3,500 with the purchase and a loan but you get $7,500 with the lease then it is basically a wash. If you don't qualify for any tax credit with the purchase then the $7,500 that acts like a $3,500 tax credit in the lease will make it beneficial over the purchase with a loan.

There's no such thing as "partial" credit on a purchase---- if you're below the income max you can take the full $7500 at point of sale.

That’s irrelevant to what they’re discussing (how much of the 7500 they’re passing onto you for leasing, which is also not subject to income limits)There's no such thing as "partial" credit on a purchase---- if you're below the income max you can take the full $7500 at point of sale.

The current pricing for Model Y trims are: 44,990...49,990...53,490The current delta between a MYLR ($49,990) to the MYP ($53,490) is $3,500.

However, there's a lot to consider here and I'm sure we can all see the obvious.

Between the new base M3 RWD ($38,990) and M3LR ($47,740) we're looking at $8,750.

Pricing the M3L in the mid 50s is possible, but I think they might peg it at $58,990 - $59,990 out of the gate for the initial wave.

It'll be interesting to see what the starting price will be, perhaps on the 20th or 23rd?

With tax credit the Model Y trims are: 37,490...42,490...45,990

The current pricing for Model 3 trims are: 38,990...47,740...xx,xxx

Here are my arguments for the M3L being priced at least below $55k:

- Tesla's mission statement is to accelerate the world's transition to sustainable energy.

- Their current BEV strategy is to drive more adoption with competitively priced mass-produced vehicles.

- Tesla is making a comfortable net profit on vehicles sold and is not risking losing their mission by lowering prices to increase adoption.

- Many big ticket items on the M3L BOM did not change from the M3P: front motor, battery, same chassis design (no NRE for implementing larger castings), brakes

- Many of the changes are already implemented and priced in to the RWD/LR: vented seats, laminated glass, suspension (adjustable shocks add minimal cost), HW4, interior features

- Front and rear body panels have different styling but still attach to the chassis in the same way (no vehicle assembly process/tooling changes)

- Equivalent trims for the Model Y have always had higher pricing-before-credits than Model 3.

- The last price for a new order M3P was 50,990 (lets assume it was that low to move 2023 inventory) with the level before that 53,240.

- Last applicable tax credit for M3P was 3,750.

- For a brief amount of time in 2024, M3P with tax credit was less cost than M3LR. This is probably not a big contributor but it also demonstrates Tesla has sold M3Ps for less consumer cost than M3LR and that situation is not completely out of the realm of possibilities

Knightshade

Well-Known Member

That’s irrelevant to what they’re discussing (how much of the 7500 they’re passing onto you for leasing, which is also not subject to income limits)

They literally discuss the exact thing I'm pointing out does not exist though so it's directly relevant. See bolded quote below.

If you qualify for the full tax credit on a vehicle with a purchase then even taking the severe depreciation into account the purchase is probably the better deal especially if you pay cash. If you qualify for $3,500 with the purchase and a loan but you get $7,500 with the lease then it is basically a wash. If you don't qualify for any tax credit with the purchase then the $7,500 that acts like a $3,500 tax credit in the lease will make it beneficial over the purchase with a loan.

That is not a thing. You can't qualify for only $3500 of the POS credit on a purchase. It's either $0 or $7500.

[*]Last applicable tax credit for M3P was 3,750.

No, it was not. It was $7500.

It STILL is if you could find a new P for sale.

Which kind of wrecks the math on all the rest of your post.

Last edited:

mpgxsvcd

Active Member

For everyone who is expecting a 2.9 0-60 mph with rollout subtracted, I did a 2.97 0-60 mph with rollout subtracted with my current Model 3 Performance. The only change was 23 lb 18" wheels. It had a full weight interior and a 200 lb driver. The new 20" Ludicrous wheels look substantially lighter than the 20" UberHeavy wheels. Just the change to lighter wheels alone in the Model 3 Ludicrous would give you a 2.9 0-60 mph with rollout subtracted without any power improvements at all.

Honestly, there is zero chance they are going to only take the 0-60 mph from 3.1 to 2.9. That isn't an improvement that would be worthy of the "Ludicrous" badge. The Model S Ludicrous did 2.5 0-60 mph with rollout subtracted. There are even P90D cars that did 2.6 with rollout subtracted on Dragy.

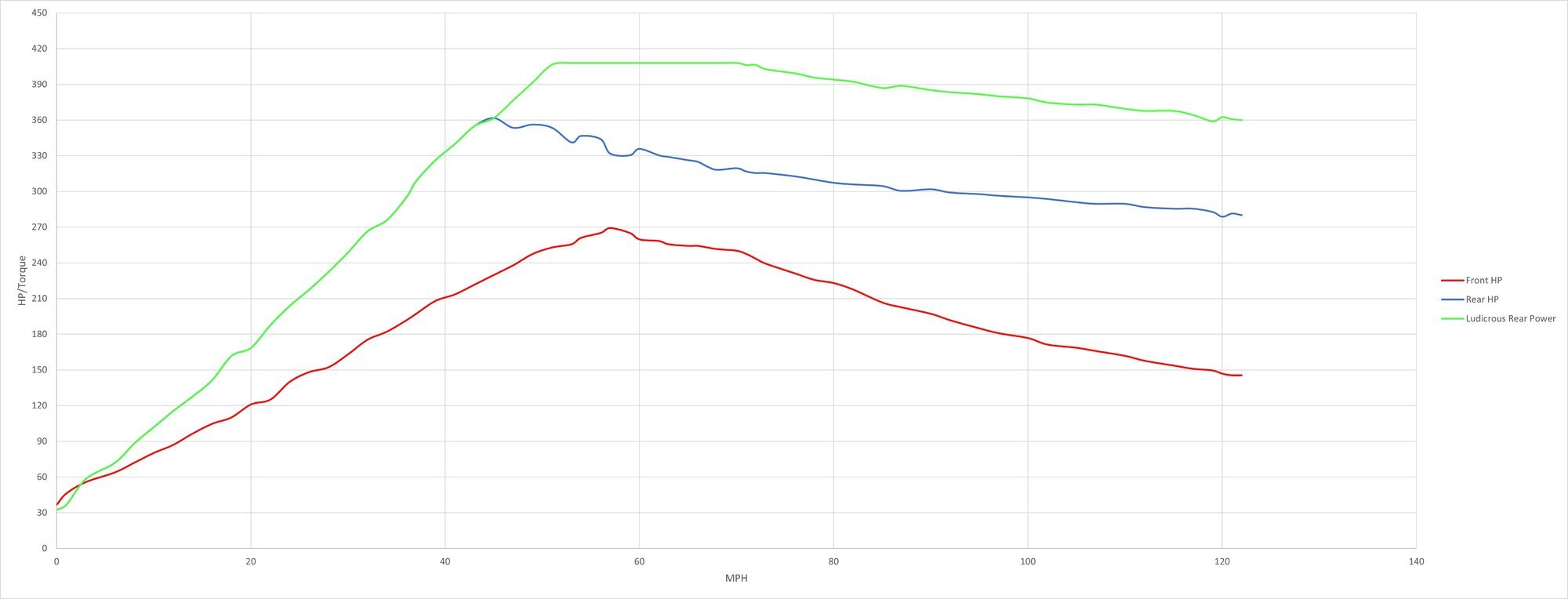

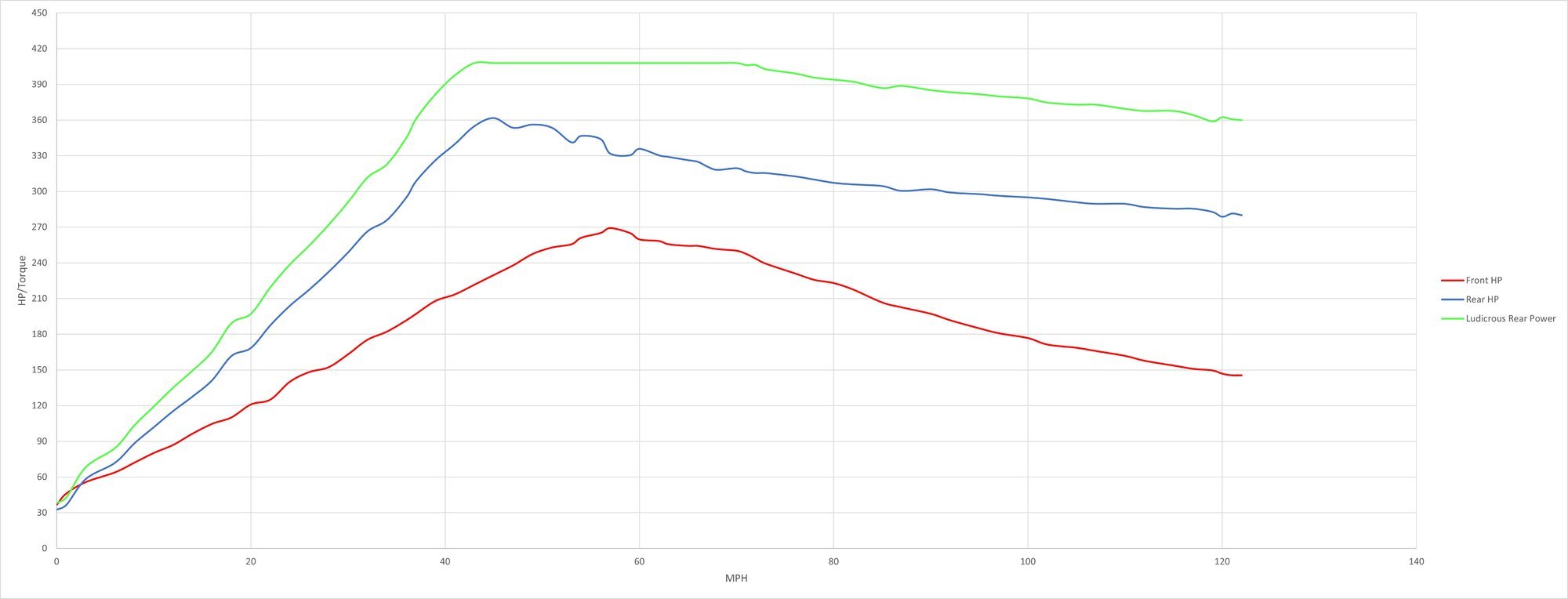

I took the liberty to create some more HP graphs of what the current Model 3 front and rear motors produce vs. what the Ludicrous rear HP graph could look like. I took @eivissa data from his 4/2/2024 post in this thread and assumed a max HP of 408 for the rear motor as opposed to 360 HP in the current Model 3 Performance rear motor. I assumed a peak HP speed of ~69 mph.

This first graph assumes zero improvement in torque for 0-60 mph but it holds that torque MUCH longer. You can see the area under the green(Ludicrous) rear motor HP line and above the Blue(Model 3 Performance) rear motor HP line is very significant. This car would be substantially quicker especially above 50 mph.

Then I created a graph where torque off the line is stronger to start and actually increases a bit as speed increases. I assumed that the wider tires and new larger rear wing will give the car more grip off the line and more downforce as speed increases. This graph would definitely be capable of a 2.5 0-60 mph with rollout subtracted and a mid 10s 1/4 mile.

Honestly, there is zero chance they are going to only take the 0-60 mph from 3.1 to 2.9. That isn't an improvement that would be worthy of the "Ludicrous" badge. The Model S Ludicrous did 2.5 0-60 mph with rollout subtracted. There are even P90D cars that did 2.6 with rollout subtracted on Dragy.

I took the liberty to create some more HP graphs of what the current Model 3 front and rear motors produce vs. what the Ludicrous rear HP graph could look like. I took @eivissa data from his 4/2/2024 post in this thread and assumed a max HP of 408 for the rear motor as opposed to 360 HP in the current Model 3 Performance rear motor. I assumed a peak HP speed of ~69 mph.

This first graph assumes zero improvement in torque for 0-60 mph but it holds that torque MUCH longer. You can see the area under the green(Ludicrous) rear motor HP line and above the Blue(Model 3 Performance) rear motor HP line is very significant. This car would be substantially quicker especially above 50 mph.

Then I created a graph where torque off the line is stronger to start and actually increases a bit as speed increases. I assumed that the wider tires and new larger rear wing will give the car more grip off the line and more downforce as speed increases. This graph would definitely be capable of a 2.5 0-60 mph with rollout subtracted and a mid 10s 1/4 mile.

Similar threads

- Replies

- 1

- Views

- 878

- Replies

- 10

- Views

- 3K

- Replies

- 74

- Views

- 12K

- Replies

- 23

- Views

- 2K