AustinEV Q4 ER Megapost

1. Long term TM outlook

2. General market background

3. Specific Q4 earnings content guesses and ramifications

4. Differences from Q3.

5. Bear case, such as it is

6. Investment setup

1) Long term outlook:

I have never been more bullish on the long term outlook.

If you haven't watched it, check out this lengthy video of a talk given by Marc Tarpenning posted by TD1

here. Skip to 52:00 to see him comment on why the big automakers will not be threatening Tesla any time soon. Yes, TSLA has 1/2 of the market cap as GM, but this makes me think that GM is hugely overvalued.

He says in that video, that most of the functions of GM (or other large auto makers) has been subcontracted out, including the electronics. They essentially kept the engine part in house because that is "where the value is", in making good engines that run for 100k miles for not a lot of money, and the electronics and even some of the design and manufacturing is done by subcontractors. Maybe you all knew this already, but wow, they are in a terrible position to pivot and change in a major way.

He basically insinuates that 20 years ago you couldn't have started a new car company at all, because all of that subcontractor space didn't exist and now it does so they can leverage it. So basically, a brash silicon valley team could have probably succeeded in just making a good car of any sort (ICE) with a small in-house team, lots of vertical integration, top in-house design capability and a direct sales model. Whereas GM would be incapable of much more than making last year's car an inch longer.

That Tesla-as-a-new-ICE-car-maker thought experiment is valuable. That company alone would be quite exciting. Strong team, strong CEO, vertical integration, cheap factories, local tax incentives, market ripe for a new entry for a US made car. I would probably be investing like crazy in that company. Now add on the fact that they make better cars than anyone in the world, and have a multi-year plan to expand like crazy and a plausible explanation for being demand constrained for many years.

Now add in the new innovative drive train. Simple, with a low cost and a path to become very low cost. Ultimately the EV drive train should be much less than ICE which is fully cost-reduced after 100 years.

2) General market background:

It is a fortunate time in the general market, with Congress coming to their senses and the general market indexes on a roll. The last year has shown some periodicity of the SPY hitting or threatening the 50 day MA, but we just came out of our latest freak-out, strongly rebounded and we are not due for another for a few weeks, giving us a tailwind:

(SPX in green, blue lines are my market downturns)

3) Specific Q4 earnings guesses:

I am not a leading prognosticator on numbers, and I don't have an entrant into the guessing game. In this case I don't think the numbers will matter that much, other than the 6900 cars which has already mattered. Generally companies who pre-announce good news have other good news in their pocket. That seems reasonable, given that there are many such potential sources of good news and I would suggest relatively few things that could be lurking as bad news.

Potential Good News Menu:

- China reservations or uptake at a high rate. High reservation reserves of cash.

- China government incentives/anything.

- Improving Gross margin, at least over 25%. Guidance to 30% in 2014 possible, if they choose to say it.

- NHTSA clearance, probably not going to come out this week and probably 2/3 priced in.

- 2014 full year guidance. They should guide, and they should guide to 35k. I think 40k would be a headline and very positive.

- The Elon factor: For Q3 he practically warned us when he made bearish comments about the stock. For Q4 he is more upbeat and we have no such warning.

- Factory capacity plans: I and the market will be disappointed if they are silent on this again. I like Bonnie's theory that they ALMOST talked about it last time so they have had a whole quarter to get the details right. The uncertainty itself is the negative. If they do announce, I will be watching to see if it is not dilutive or if it is dilutive in a smart way. A clear path with partners will be a very bullish factor because it will clear a lot of fog on the path to mass production of the Model E. Without it, the fog remains and that is bad.

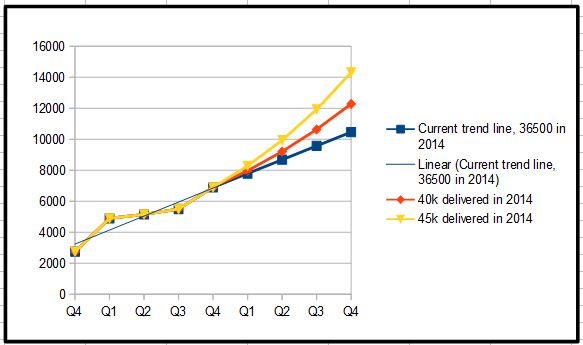

- Supply chain improvement: This one will be my favorite. I will be looking for comments about supply chain constraints easing up, which in the really fun best case scenario could mean they are increasing production in a meaningful way and have a path to more than 35k and they will provide more guidance in the next earnings release or something like that. I like to think they have supply worked out well except for batteries, so output can go up in non linear ways, getting off this trend. Here you see how just a modest acceleration this is:

- ZEV credits: We all forget this one, since TM has guided to ignore it for Q4. So this is all upside. This is an easy way to get surprise into the profits/eps.

- Supercharger update: High install rate and 135kW. Battery swap station (maybe the market will think that is cool)

- Autopilot features plan? That was a heck of a hint. Another headline possibility.

4) Differences from Q3.

Many of us got burned just trusting last time would be ok. In hindsight that was more of a faith move on my part than was warranted. Elon practically told us to take that one off. But, I think there are significant differences between the poorly received 2013 Q3 ER and now. For one, we had just had 2 positive reactions in a row. Honestly I was always a bit puzzled by the positive reaction to the Q2 announcement. It felt like TSLA just had positive momentum so a good report was enough to make it go higher the next day.

For Q3, the momentum was going sharply the other way. We were mid f*re freakout and technically the market was looking for an excuse to push it down. When a good report came out, the fact that it wasn't bristling with extra goodies was enough for the market to push it down, continuing a technical correction. Q3 needed to be so good it broke the back of a strong downward trend.

For Q4 (now) the situation is reversed. The technicals are on an uptrend and the market is looking for a reason to push it up. We just (apparently) survived our first f*re FUD alarm with a shrug, a very bullish sign. Plus, there are good reasons to suspect the Q4 ER will be bristling with goodies, where the Q3 was not. Some of that is priced in, yes, but not all in my humble opinion. I think the market is looking for a reason to push it up to a new ATH, I have a target of 220 for this week and I think it will have support at that level. Sleepy's 280 would be ok too...

I don't think this is irrational exactly, the company is now humming along better than the last ER.

5) Bear case, such as it is:

- "Valuation is just too high. Half of GM!” If you are stuck in valuing it compared to a slow growing old guard company you will just never understand. If you understand/believe in the long term growth story the PE ratio is justified.

Here are some numbers I pulled from Schwab's research tools. Yes, the forward PE is 321. Yes the market cap is 24B. But note the high (and rapidly increasing) gross margins, sky high growth rate, competitive sales per employee and virtually no debt. GM has 22B of debt and Ford 110B.

I am not sure why it is showing Nissan with a 9Trillion dollar market cap... ignore that.

- Execution risk: "A lot of perfection is priced in. Therefore one hiccup and the stock will plummet." That is fairly true and we saw it play out after the f*re debacle. But this switches to a positive now because we all know how that looks now having seen it and seen it recover. This was a lot scarier back in early Oct2013 when the stock had essentially never gone down before. Also, new f*re headlines seem to have little risk now as we saw with the Toronto incident. That hasn't played out yet totally, but the fact that the release itself was harmless is a bullish sign.

- Competition risk: "The other automakers can get in the game and make Tesla killers and halve the potential market for Tesla or undercut them completely with a better product. Everyone would prefer to buy a BMW EV if they could, so Tesla is on thin ice." They won't want to invest to obsolete their core competency so they might be culturally incapable. Also these investments will just cause confusion in their own lineup since they can either make a poor EV that no one will buy and therefore be a waste of money, or they will really pull together and make a car almost as good as a Model S (ignoring the barriers of patents, battery supply, software, charging network, etc) and would be in the position of having a car that was better than their other cars so there is no good way to sell it without admitting that the 99% of their other cars is inferior or trying not to sell the good EV. They see this end so there is little reason to invest. If one accepts that EV platforms are superior, and one sees that most or all of the car makers are in this position, then you now see how the valuation is not worrisome. For Tesla to justify even their current valuation, they essentially have to be on a path to become one of the largest automakers in the world, and indeed largest companies in the world. That seems insane to the casual critic on TV, but in this context you see that in 10 years the other automakers will be going bankrupt one by one and making desperate plans to reinvent themselves as EV companies, far too late to be a serious threat. THEY will be the small upstarts trying to gain market share, not Tesla. Furthermore, EM has said multiple times he is not afraid of competition, since a vibrant market place would be a rising tide lifting all boats. Other serious entrants would rapidly accelerate acceptance in the marketplace and Tesla would benefit for being the first mover. Telsa could also benefit from becoming the licensor of Supercharging capacity for competitors or even drive train patents. There are more paths for TM to become the largest automaker in the world, than there are paths to settling in Porsche territory, as critics like to place them. Also there are no good pure EV's yet. The BMW i3 is being advertised on the Olympics and is lackluster by all accounts

6) Investment setup:

I have a fair amount of shares, 15 Jan '16 leaps that I have as a "core" position. I got these in Dec when it was testing lows and I wasn't sure of the timeframe of the inevitable recovery. Since then I have gotten many Feb 22 DITM calls and a few 190's. I have some more cash on the sideline that I will look to deploy on a dip.

With all of this going on, I haven't been more sure of an upside after earnings since the Q1 '13 report that we all love so much. I am seriously questioning why I am not putting the couch cushion change into Feb 22 200's. I am calling for a target of 220 post earnings which is only 8% from Tuesdays close.

The big risk of course is that all or much of this is priced in already, and the report will just trigger a sell-the-news drop commonly seen with other momentum stocks. This is my biggest fear for this week, but I do not think it will happen for these reasons:

[*=1]While it is true that the stock is up sharply in the last few weeks, I see that as a recovery from the f*re overreaction, not growth.

[*=1]Technically the market is in an upswing and wants to push it higher. The 195 previous ATH is now support and have confirmed upward momentum to ATH's. One could argue that even without an earnings release this week the stock is poised for a breakout on technical terms alone. Contrast this with Q3 when the stock was in a confirmed downtrend, and the report would have to be so good it reversed that trend. Q3 was merely "good". Workmanlike. Solid. Good job. But, nothing fancy and the market sold it off due to continuing softness and risk in the unfolding f*re story.

[*=1]We on TMC have proven again and again that just because we TMC nerds know stuff that doesn't mean the market does. With the long list of things I expect to be positive bullet points in the announcement, along with loads of potential great news bullets, I think the announcement will be immediately perceived as positive and that will be the narrative.

[*=1]Lots of shorts have been attracted to the ATH. It went down from 195, why not 203? If you think that the half-of-GM market share is silly then it is a very attractive short, but they will be weak shorts indeed.

[*=1]If Tesla pops, a lot of sideline people may capitulate, buy in at $220 and hate it, figuring that it simply won't be cheaper in the future and it is time to bandwagon a bit. There is a big risk of weak longs who will head for the exit at $220+, but they will be matched by shorts heading for the exit and other technical traders looking to take advantage of a technical rise. If that plays out prices above $220 are not crazy talk.

Headlines from the future, internet writers feel free to use:

TSLA up 8% on China reservation strength

TSLA surges to new ATH on higher guidance

TSLA higher after announcing battery factory deal