Exactly, Turbotax could easily display that information and the user can enter the appropriate amount. It would then be up to the IRS to validate the amount.Also, it's not a difficult search to find the official gub'ment list.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

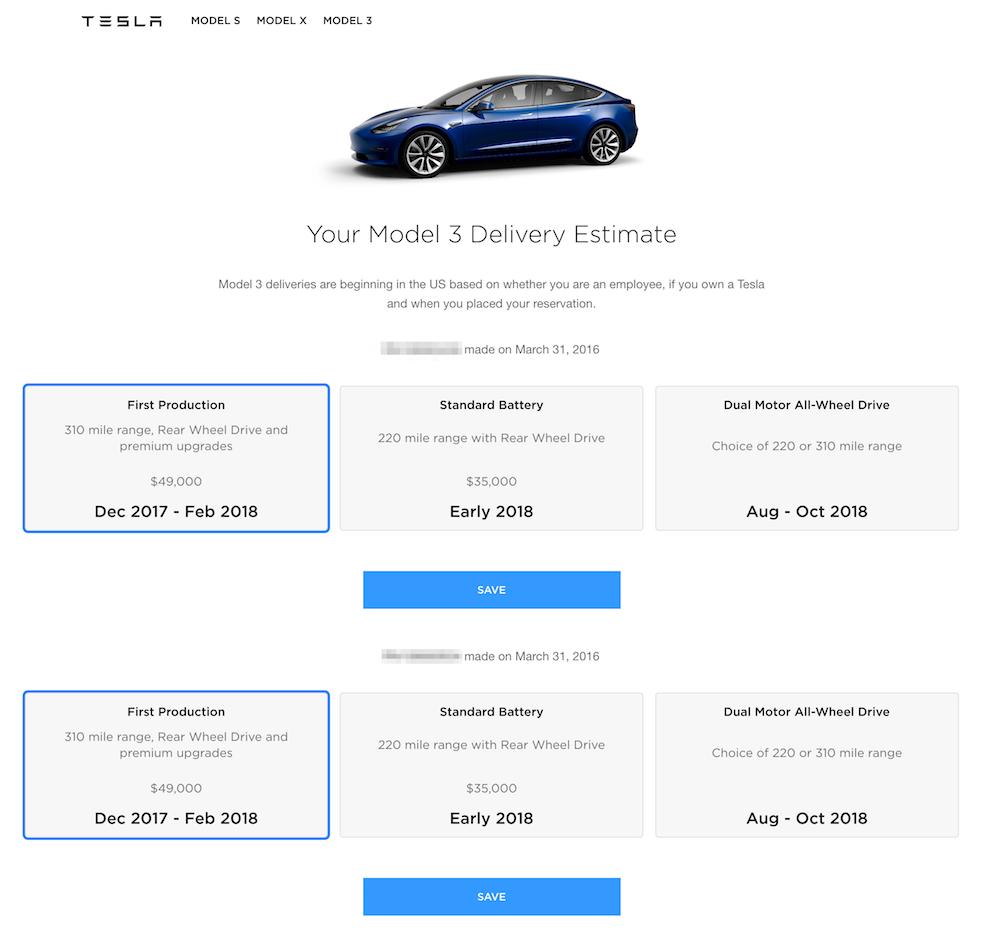

Tesla owner configurations begin

- Thread starter HumanGenome

- Start date

-

- Tags

- Model 3

raptorweb

Member

they reached out to me, once you get a VIN, you should have a DS assigned.

*sigh* I have had a VIN for since last Thursday but have yet to hear from anyone. It would be great to hear from someone so that I can lock in travel plans that are tentatively scheduled to start this Friday or Saturday...

T34ME

Active Member

Here are the TurboTax instructions: Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit - TurboTax Tax Tips & Videos that answers the questions. You must file tax form 8936.Exactly, Turbotax could easily display that information and the user can enter the appropriate amount. It would then be up to the IRS to validate the amount.

Yeah, I filed that in Turbotax earlier this year and claimed my $7500 tax credit. Thanks for the link as it should answer @GarrickS ' question.Here are the TurboTax instructions: Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit - TurboTax Tax Tips & Videos that answers the questions. You must file tax form 8936.

As I thought, it links to the IRS website which then links to this page for Teslas: 30D New Qualified Plug in Electric Drive Motor Vehicles Tesla Motors Inc | Internal Revenue Service

Seems pretty easy to determine the amount one qualifies for.

Last edited:

TurboTax sure should be asking you what brand of EV you bought. Not all EVs qualify for the full credit.

Doesn't the VIN tell all?

Doesn't the VIN tell all?

Yes, if TurboTax is asking for the VIN, that counts as asking for the brand.

g-force

Member

*sigh* I have had a VIN for since last Thursday but have yet to hear from anyone. It would be great to hear from someone so that I can lock in travel plans that are tentatively scheduled to start this Friday or Saturday...

lucky i had one assigned then pulled

told la owners had to take delivery marina del rey so

they had to be reassigned vins. still no reassignment.

any la owners same boat????????????

Last edited:

GasDoc

Member

Lol, but how? I've bought 2 EVs now, and I'm about to buy my 3rd. There's no form they hand you saying whether you qualify or not. TurboTax doesn't ask you which brand of EV you bought. If I'm not watching the news, who is telling me if my car qualifies or not?

Your VIN is required when filling out the tax return and claiming the credit. They can get the manufacturer and other details from that.

Yes I am located in the Santa Clarita area.Out of curiosity, are you in LA? Seems like those who have “jumped the line” are in LA. Congrats on the invite, I’m also a CA owner and placed my order in store a few hours before you, so I’m hoping I’ll get my turn soon.

dstroot

Member

People are going to be moving up in line - I have two "day one" reservations. With the loss of the federal tax credit I have no incentive to buy quickly. So, I will wait a while for the bugs to get worked out and will probably buy only one car, likely a lower spec'ed model. Shame...

daboys2007

Member

and I have no VIN, but have been speaking regularly with my advisor who is in Vegas. Who knows!

Was assigned a VIN (13xx) on 12/7 based on checking my Tesla page as I didn't get an email or anything. Then I got a call yesterday from a DS, who stated he was from Vegas too. He confirmed my VIN # and when I asked him about the delivery timeframe, he indicated that my car is going through QA and we should expect it to be available before the end of the calendar year.

smorgasbord

Active Member

Today is 3 weeks and a day since I configured. I just called my DS (actually Inside Sales Advisor, whom I found out about by proactively calling Tesla last week after getting a VIN at just over the 2 week timeline). No new news since a week ago, just the party line:

- I should expect to take delivery mid to late December; pretty sure I'll have the car this calendar year.

- He doesn't know whether car is still on the line or in QA or what.

- May have a couple days notice before car is ready for delivery.

dhanson865

Well-Known Member

People are going to be moving up in line - I have two "day one" reservations. With the loss of the federal tax credit I have no incentive to buy quickly. So, I will wait a while for the bugs to get worked out and will probably buy only one car, likely a lower spec'ed model. Shame...

Did you lose your job or something? The federal tax credit hasn't gone anywhere assuming you are still eligible to use it (have enough tax liability).

Tax Compromise Keeps Wind and Electric-Car Credits, Source Says

run-the-joules

Turgid Member

Did you lose your job or something? The federal tax credit hasn't gone anywhere assuming you are still eligible to use it (have enough tax liability).

Tax Compromise Keeps Wind and Electric-Car Credits, Source Says

sssshhhhhhh!

raptorweb

Member

Today is 3 weeks and a day since I configured. I just called my DS (actually Inside Sales Advisor, whom I found out about by proactively calling Tesla last week after getting a VIN at just over the 2 week timeline). No new news since a week ago, just the party line:

Very friendly person, said to call back any time with questions. I'll probably call Friday afternoon.

- I should expect to take delivery mid to late December; pretty sure I'll have the car this calendar year.

- He doesn't know whether car is still on the line or in QA or what.

- May have a couple days notice before car is ready for delivery.

Similar story here, I have been unsuccessfully trying to nicely push for info to see when I can leave for vacation. As of yesterday they said they will call me tomorrow(Thursday) to give me and update as they hope to have more info at that point. Still no contact from Vegas or a delivery specialist at this point.

Sparky

Member

Indeed. Technically, my delivery should be no later than the 20th. But I have no VIN and am heading off to Utah in about a week. DS says she can provide no further info until VIN appears.Similar story here, I have been unsuccessfully trying to nicely push for info to see when I can leave for vacation. As of yesterday they said they will call me tomorrow(Thursday) to give me and update as they hope to have more info at that point. Still no contact from Vegas or a delivery specialist at this point.

Reminiscent of my LEAF delivery 7 years ago. Deliveries started in Dec. 2010. Mine was on that first boat, VIN 0256. no news until dealer calls me Jan 5 and says "come and get your car!".

First-world problems. 2018 Model 3 sounds just as good as '17.

And yet, I see myself on the chair-lift when my DS calls and says "Come and get your car!"

Last edited:

Dynastar

Member

And yet, I see myself on the chair-lift when my DS calls and says "Come and get your car!"

FlatSix911

Porsche 918 Hybrid

More good news ... Electric vehicle tax credit is reportedly safe in final US tax bill

Earlier this month, the U.S. Senate passed its version of the Republican tax bill, which didn’t include the proposed language that would have removed the federal tax credit for electric vehicles. Now the bill is being reconciled with the House bill, which reportedly still included the removal of the EV credit, but some Republicans are reportedly leaking that they will side with the Senate bill on the issue, along with keeping the incentive for wind power. View attachment 266517Bloomberg Politics reported the news based on an unnamed Republican reportedly familiar with the process:

“House and Senate negotiators have agreed to spare the electric-vehicle tax credit and wind production tax credit in their compromise package, according to a Republican familiar with process.” No bill has been brought to a vote yet, but it is expected to happen within the next few weeks.

Earlier this month, the U.S. Senate passed its version of the Republican tax bill, which didn’t include the proposed language that would have removed the federal tax credit for electric vehicles. Now the bill is being reconciled with the House bill, which reportedly still included the removal of the EV credit, but some Republicans are reportedly leaking that they will side with the Senate bill on the issue, along with keeping the incentive for wind power. View attachment 266517Bloomberg Politics reported the news based on an unnamed Republican reportedly familiar with the process:

“House and Senate negotiators have agreed to spare the electric-vehicle tax credit and wind production tax credit in their compromise package, according to a Republican familiar with process.” No bill has been brought to a vote yet, but it is expected to happen within the next few weeks.

Similar threads

- Replies

- 4

- Views

- 556

- Replies

- 0

- Views

- 489

- Replies

- 2

- Views

- 904

- Replies

- 4

- Views

- 279