Option bets continue to increase though this cannot be taken as evidence of the players foreseeing a big jump. This has to be seen in the context of other metrics like IV which has been going down. So clearly demand for new options tapered off a bit perhaps driven by the price action.

Also there was some speculation on twitter that the index fund guys might have entered into contracts with trading desks to transfer stock at x days of VWAP or Friday's close, which means there might be smaller then expected trading on the exchange. But that still leaves open questions on who has the balance sheet to hold these mega positions.

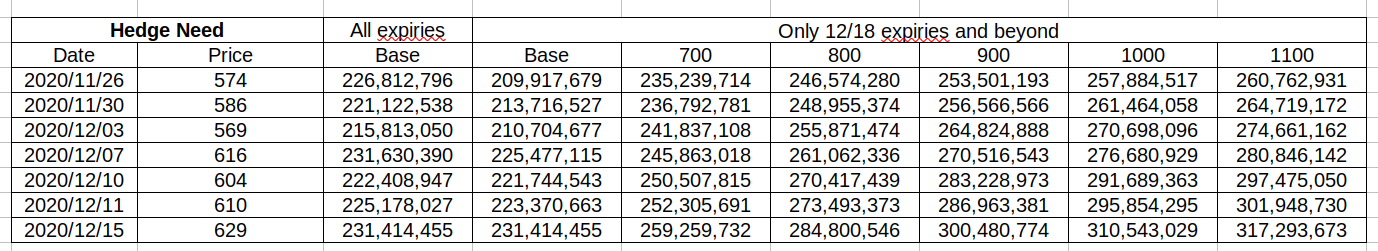

In any case, here is a tweet that takes a contra position on a friday spike. And the usual update on delta exposure.

Also there was some speculation on twitter that the index fund guys might have entered into contracts with trading desks to transfer stock at x days of VWAP or Friday's close, which means there might be smaller then expected trading on the exchange. But that still leaves open questions on who has the balance sheet to hold these mega positions.

In any case, here is a tweet that takes a contra position on a friday spike. And the usual update on delta exposure.