Artful Dodger

"Neko no me"

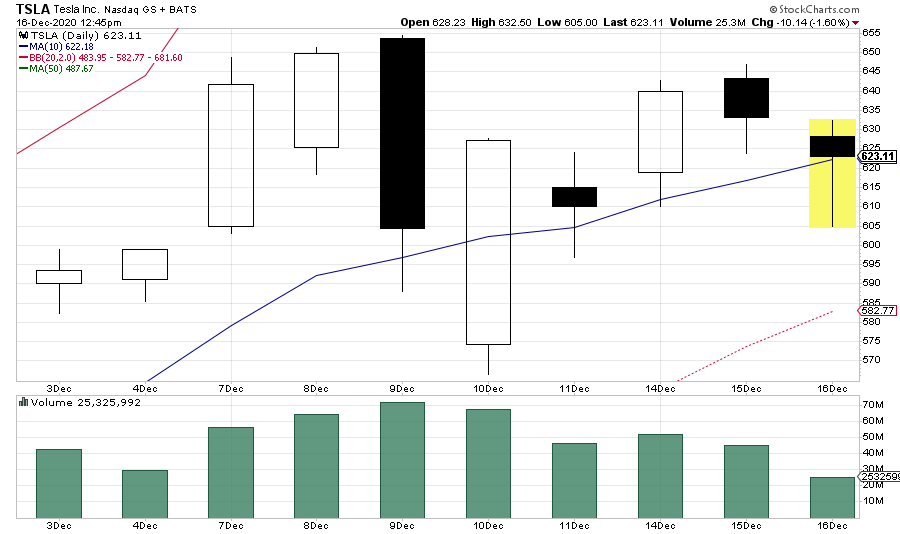

SP at 'half-time' (12:45 ET) is within a buck of the 10-day Moving Average: $622.18 (but there's no manipulation...)

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I was expecting TSLA to be at $650 going into the actual buying. We've spiked at times over the last couple weeks and it's seemed that may have been conservative, now it seems about right that we'll end Friday around there.This S&P inclusion is not going the way many of us expected, but we may get some help from big macro tailwinds if the stimulus package goes though by Friday.

One thing to keep in mind is that we make a lot of assumptions here and neither you, me, or anyone on earth can tell exactly what the total TSLA float looks like. We can't assume that everyone outside of this forum is a perma bull who will not sell at any price. We don't know exactly when SP 500 front running started. It could very well have started in January when it became apparent that TSLA was going to be consistently profitable going forward.Don't get me wrong, I do think there was front running and there will be sell side volume from that. But if you read through my other posts, considering how much of Tesla's available float is held by insiders and investors that won't sell at these share prices, there simply isn't enough float available to come close to front running this thing.

I'm still hoping someone's Momma is right.Have we all forgotten that $623 = $3115 pre split?If anyone told me $TSLA would be over $3k/share in March of this year, i would have probably bet you my next unborn

The funds cannot wait until the Fri close to buy, because they will not know whether these benevolent, infamous front-runners show up with enough sell orders until 5-10 minutes before. For sure it will be a big close, but it will also be a big up day.

You all acting like there are back room deals for funds that are meant to mimic the S&P 500 as if they are competing with each other to eek out .001% more profit than the other S&P 500 funds. THESE S&P 500 FUNDS DO NOT CARE. THEIR BUSINESS ISN'T ABOUT BRAGGING TO THE PUBLIC ABOUT THEIR RETURNS. Their business is about practically no management fees to mirror the S&P 500.

So here's what I can not understand in this theory: they probably could start seriously buying only after Dec 11, correct? And the price since Dec 11 did not go substantially lower than $610, correct? So what's the deal with buying for $610, then skipping $640, $650 and then selling on a pre-arranged trade for let's say $615?

Some of these conviction levels in this post are a bit exaggerated, but on the whole I feel it's accurate. I've seen nothing so far that tells me this buying demand can be absorbed at close Friday. Not even remotely. Does that mean we see some mega-spike to $1200, I highly highly(like 99.5%) doubt it. But that doesn't mean buyers won't be scrambling on Monday after the supply at close Friday is exhausted.

And the biggest thing not being mentioned enough here is these shares ARE NO LONGER ON THE MARKET after being bought by an indexer. That impact alone squeezes us up the week of the 21st so long as literally all the longs don't sell at $675.

I think longs are willing to start selling around $800, and not significantly below something like $950. Personally, I don't think Tesla should be worth anything close to $1T right now, but I know for a fact that it'll be valued at least $1.5T in 3-5 years. Why would I sell for under $700B market cap if I had that level of recession proof certainty?

I guess we'll find out soon enough! I'm gonna keep buying 12/24 $700's if and when they get cheaper.

You all acting like there are back room deals for funds that are meant to mimic the S&P 500 as if they are competing with each other to eek out .001% more profit than the other S&P 500 funds. THESE S&P 500 FUNDS DO NOT CARE. THEIR BUSINESS ISN'T ABOUT BRAGGING TO THE PUBLIC ABOUT THEIR RETURNS. Their business is about practically no management fees to mirror the S&P 500.

I actually expected 700 and looked like we were getting there before the secondary put a brake on momentum.I was expecting TSLA to be at $650 going into the actual buying. We've spiked at times over the last couple weeks and it's seemed that may have been conservative, now it seems about right that we'll end Friday around there.

Were people thinking we'd spike to $850 before the actual buying began?

Let me see if I have this straight.Ah.. yes.

So all the action we see, is just MM milking the option buyers.. I guess you are correct.

How to best profit from this.. I should have sold options instead of buying I guess. :-D

Edit:

Then, we can assume there wont be a SP dip after friday, not until wednesday next week. Any dip should be bought by the index funds, as they can buy and push SP up to fridays close, and get them shares at the correct price.

Agreed...but we all know "The longer a stock bases......" the rest is historyI actually expected 700 and looked like we were getting there before the secondary put a brake on momentum.

I don't blame Tesla. I think it's great. It's just that, as I mentioned before, once a momentum is halted, or worse, reversed, it will be tremendously more difficult to go back to where it would have been.

Agreed. We should probably settle back to maybe $50 above Friday's close regardless.I'm definitely not putting a number on how high the stock could rally through till Wed of next week....but I definitely think any selloff and how much of a sell off would be directly contributed to how high the stock goes. If we're still at upper 600's, even lower 700's by next Mon/Tues, I don't really see any sell off. If it goes into 800's, 900's, etc... the corresponding sell off is going to increase somewhat.

How do you account for an unknown $xB of shares waiting to be unloaded into what could be the last major rally in TSLA for a long while? There are 2 sides to this equation.No matter how you spread your buys , it will not hide $75b to be spent on share purchases

That must effect volume and price

It allows higher volume trades to be done without causing major volatility or having to deal with the intraday shenanigans.Someone that knows (and won't type in acronyms).

Closing Cross.

I have tried very hard to understand it and can't. Financially I don't see how it benefits both sides so why would both sides agree to such a thing.

And therefore I can't even wrap my head around what it does, nor what function it serves.

here's what it sounds like to a dumbazz like me.

For some reason on Friday after hours all the front runners are going to be willing to sell the shares to the index funds at a price that will be determined by the previous price(s) of the stock. The price will be one price for everyone(?). And the selling ends at that "closing cross price" when either all the shares are purchased that the sellers have, or all the shares the buyers need have exchanged hands.

If there were too many stocks bought by the front runners then to bad for them. If there weren't enough shares available for the Index funds then they will have to buy more later.

How does that solve a problem? Why does either side agree beforehand that they will do this? One side is going to get screwed. Or at the very least some traders on one side are going to get their feelings hurt.

What does a closing cross purchase event really solve that would not be solved by regular trading?

They care what they pay if they are unable to obtain an average cost basis that is acceptable in terms of tracking error. They can't buy any significant portion after hours, or it would cause a massive spike and their earlier purchases would be way off. They can buy Monday, but that is unpredictable and again they could end up way off. To do their job they will want it to happen fast and simple. The market will find a zone for that to happen, and then it will be done and resume its usual extreme volatility, and they won't care.Sure they can.

If there's not enough then they can buy in AHs.

Or PM Monday.

Or after open Monday.

But if there IS enough at any step along that path it's likely going to induce less Index error than if they buy days earlier than inclusion.

Because again, they do not care what they pay for the stock

They care that their results mirror the index as closely as possible.

So the further away from inclusion they buy the more likely they are to fail at their one job

Long time lurker here.

After reading a lot here and elsewhere it becomes clear to me that this scenario becomes more and more likely:

1. The inclusion spike is already behind us ($150+ rise since the announcement)

2. Front runners have had enough time during the spike to accumulate shares (eventually partly by exercising call options) and will be happy to sell them at a profit to the index funds.

3. Bench mark funds don’t have to buy Tsla to beat the S&P 500. But if they want to, they can wait for a post inclusion dip.

4. As a result there won't be a further spike

5. Short term call option players (like me) are caught like a deer in the headlights.

I hope I’m wrong but I’m afraid not.