This is different then when it was discussed at the last earnings call. While it's possible for an individual to be a shareholder of record, it's rather unusual and the individual must take steps to become one.If I buy some Tesla shares, I'm a shareholder of record just as the funds are.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

gabeincal

Active Member

Are you suggesting keeping the thread from public eyes, or just limiting who can actually post?

Keeping the thread from public eyes.

Edit: A thread only visible to members of TMC (and possibly only paid members) would be a fair compromise in google not picking up content, but anyone able to find the thread if they really looked for it.

Last edited:

Liking Gary Black or not, dude's been nothing short of prophetic during this run. He called the secondary offering and 650-690 peak. Today he called a non-event day before the close. We still have 3.5 hours to go but I'm gonna give him the benefit of the doubt.

JRD1

Member

It looks like you can also do MOC on the TD website but not LOC. Weird.

View attachment 618871

I only use Limit orders so I didn't look at Market at all. Customer service rep said neither could be done on the website or app but could on TOS. Maybe I just asked about limit orders - don't remember.

I placed a high LOC order in TOS and it showed up on the order status screen on the regular website. That was the limit (pun intended) of my testing.

StealthP3D

Well-Known Member

I don't believe I'm a shareholder of record as my broker holds / nominee account. They in turn go through other companies when trading US stocks. The question then becomes, are any of these intermediaries able to naked short. Unlikely for my broker(s) - but possibly for US based/bigger ones.

Yeah, I forgot about that. I still don't think a naked short is prevented from selling to an index fund, they just have to supply the shares eventually. In any case, TSLA is easy and cheap to borrow so regular short-sellers can supply shares to funds (if they have any money left, lol).

nohttps://twitter.com/garyblack00/status/1339975507526504450?s=20

View attachment 618859

Indexers have put in MOC and LOC orders for 130M shares.

Does Gary have a way of actually knowing this? Bloomberg terminal, etc...

lafrisbee

Active Member

Another perspective: IF you weren't in this stock when they were YOU MISSED IT! (the train has left the station, Buy Nikola)Bloomberg - Are you a robot?

Wow, a generally positive article from Dana, although it contains the usual negative slant.

(It’s about stockholders who have become millionaires)

Todd Burch

14-Year Member

Liking Gary Black or not, dude's been nothing short of prophetic during this run. He called the secondary offering and 650-690 peak. Today he called a non-event day before the close. We still have 3.5 hours to go but I'm gonna give him the benefit of the doubt.

About a month ago, wasn't he expecting a run to only $550-600?

maybe he did in the beginning, but for as long as I can remember, he's been sticking to 650-690 for at least 3 weeks.About a month ago, wasn't he expecting a run to only $550-600?

Sudre

Active Member

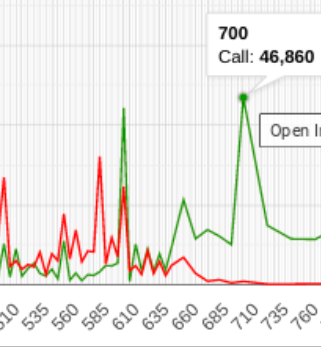

Look at todays open interest chart. Over 4,000,000 share will be traded for those $600 strike Calls. There is no way they push it down that far. They started selling on Monday (altho 20K were already sold previously) but the SP did not dip below $600. Another chunk sold on the 16th. On the 17th they shot over 40K. There was NO major buying to hedge the shares. That means in MY two cents THEY are going to have to eat into their expected profits to cover these.

I doubt we break $700 but I am confident the $650 strike Calls will get paid out, another 2,100,000 shares. These could be rather profitable since the shares could have easily been purchased at or under $650. If we break that $700 I am guessing we eat into THEIR expected profits again.

That leaves the question I have.... WHOs dumping millions of shares today? THEY can't afford to since they will have to pay them out today. Is short interest going to be WAY up today? The front runners are not dumping yet. They are in for the closing cross. Retail simply does not have that many shares to dump. I am all in for the no manipulation thing but if that is true, who has these millions of shares they want to part with at a discount to the closing price? It is not retail, front runners, or option sellers.

I doubt we break $700 but I am confident the $650 strike Calls will get paid out, another 2,100,000 shares. These could be rather profitable since the shares could have easily been purchased at or under $650. If we break that $700 I am guessing we eat into THEIR expected profits again.

That leaves the question I have.... WHOs dumping millions of shares today? THEY can't afford to since they will have to pay them out today. Is short interest going to be WAY up today? The front runners are not dumping yet. They are in for the closing cross. Retail simply does not have that many shares to dump. I am all in for the no manipulation thing but if that is true, who has these millions of shares they want to part with at a discount to the closing price? It is not retail, front runners, or option sellers.

EcoBruin

Member

As good as that sounds, I think it could enter TSLAQ territory where it's an echo chamber of bullish investors despite my evaluation that a majority of folks here are rather level headed investors.Keeping the thread from public eyes.

Yeah he never called infinite squeeze or crazy price actions that would make many call holders filthy rich. So on a prediction level, he is pretty much in the ball park. What are his thoughts for next week?maybe he did in the beginning, but for as long as I can remember, he's been sticking to 650-690 for at least 3 weeks.

Looking at twitter, stock drops down to pre inclusion levels and bounced back a little. Seems like it never reached inclusion levels until a year later. So the support if Tesla drops like a rock is 460 as that acted as the most stubborn resistance prior to inclusion.

He's calling for 10-20% drop, not necessarily all happening next week.Yeah he never called infinite squeeze or crazy price actions that would make many call holders filthy rich. So on a prediction level, he is pretty much in the ball park. What are his thoughts for next week?

Looking at twitter, stock drops down to pre inclusion levels and bounced back a little. Seems like it never reached inclusion levels until a year later. So the support if Tesla drops like a rock is 460 as that acted as the most stubborn resistance prior to inclusion.

mickificki

Member

Our dear prophet Gary is NEVER wrong!About a month ago, wasn't he expecting a run to only $550-600?

Still loading, lol. Yup, it's been a whileYup, no LOC, so opening up Think or Swim then... I figure I have all day, but sooner is better than later for sure!

2daMoon

Mostly Harmless

WTF, both TD Ameritrade and Fidelity had these as options last night. That is VERY odd. I even searched Fidelity's help terms for Limit on Close to make sure I understood it.

On Fidelity, look in the "Time in Force" dropdown.

If we don't see a big run up then will we see a drop towards close as gamblers give up?

That wouldn't change who can join and comment, it would just require that we know who is watching.As good as that sounds, I think it could enter TSLAQ territory where it's an echo chamber of bullish investors despite my evaluation that a majority of folks here are rather level headed investors.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M