Captkerosene

Member

My pre-post split post: Why is the share price down so much today?Yep I heard the same, the SP will lose bout 2/3rds of it's current price!!!!

/s

Last edited:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

My pre-post split post: Why is the share price down so much today?Yep I heard the same, the SP will lose bout 2/3rds of it's current price!!!!

/s

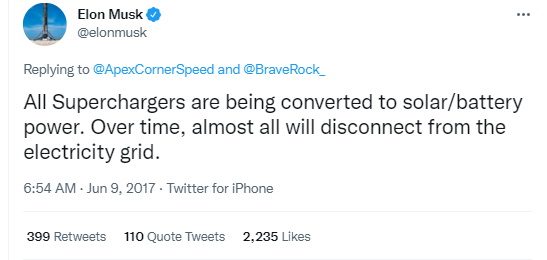

Not if it's also grid connected and selling during peak usage hours/doing arbitrage for a win-win.This claim seems, ultimately, like an inefficient use of battery storage doesn't it?

I’m seeing up just over $15 as I post this.My pre-post split post: Why is the share price down so much today?

How if it's disconnected from the electricity grid?Not if it's also grid connected and selling during peak usage hours/doing arbitrage for a win-win.

There ya go -- next Gigafactory in Scandinavia!Scandinavia basically already has a close to zero carbon hydro/nuke/wind grid.

Disconnecting makes no sense to me. Why wouldn't they put overproduction back into the grid on low demand days at least?How if it's disconnected from the electricity grid?

I have to assume he meant that they wouldn't need to draw power from the grid. Of course not all utilities allow you to sell power to them, and if they do it's often a credit vs cash back.Disconnecting makes no sense to me. Why wouldn't they put overproduction back into the grid on low demand days at least?

I have to assume he meant that they wouldn't need to draw power from the grid. Of course not all utilities allow you to sell power to them, and if they do it's often a credit vs cash back.

Seems risky anyway. What if you get a few cloudy days over a big travel weekend and people can't charge?

Not sure how "most" could. So many SC's have no room for moderate or large solar installations. To SC multiple cars off battery and solar is quite a feat in many areas. Even huge SC locations covered with solar can't keep up with the demand of moderate car traffic. Perhaps this means "solar offset" from other remote locations. Perhaps most is subjective or rural.Disconnecting makes no sense to me. Why wouldn't they put overproduction back into the grid on low demand days at least?

Crazy thought, but is it feasible for Spain to export hydrogen to Germany?France blocks Spanish solar from reaching the continent through it’s borders.

If I was Elon I would be absolutely banning Tesla from installing any domestic solar in Germany until every square meter of the Berlin factory is covered in panels.

That's been known for a while though nothing new.Breaking. CA is mandating zero emission cars by 2035.

Published: Sep 23, 2020

issued an executive order requiring sales of all new passenger vehicles to be zero-emission by 2035 and additional measures to eliminate harmful emissions from the transportation sector.

If Tesla wanted to stick solar panels anywhere, Europe would be the best bet, and UK or Germany the most profitable. Our Energy prices are INSANE right now. It looks like almost everyone's bills are up by at least 400-500% and likely to head towards 800% up on a few years ago.

UK wholesale prices: ( 2 years ago the price was £50/mwh)

View attachment 844513

If you have solar panels and can put them anywhere, you would be crazy to stick them in a country like the US when Germany is about to go toe-to-toe with putin over gas in winter, and electricity is going to be the battleground.

If I was Elon I would be absolutely banning Tesla from installing any domestic solar in Germany until every square meter of the Berlin factory is covered in panels.

All I want for Christmas is the ability to disconnect from all legacy internet and mobile phone providers.