Krugerrand

Meow

FYI, don’t disagree with you or you posting the tweet. Disagree with the content of the tweet.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

FYI, don’t disagree with you or you posting the tweet. Disagree with the content of the tweet.

I don't have a problem with Gary at all. He gives exposure to how wall street sees it and he is not wrong on why wall street would buy in or sell off. People may have problem with the reasoning because it's short sighted but that's just how Wallstreet goes, a bunch of people who only looks at short term things and extrapolate that for the destiny of the company until something changes. Tesla is always changing, therefore we get these crazy highs and crazy lows.His tweets manage to attack my 5 senses and cause pain that , hitherto never imagined I could experience .

Weird part is , his constant whining is extremely out of proportion to his exposure to TSLA.

Are you sure Elon isn't looking for an out on a stupid deal?Whitehouse contacted not to interfere with Elon's Twitter deal, just in case.

Only takes a few seconds.

I think shares of TSLA are really starting to look attractive, especially since there is a real runway of future potential ahead of it. Due to TSLA's FCF growth, I would get bullish around 40-45x its FCF, and I can't believe I am about to say this, but TSLA could be a buy at these levels for investors who have an elevated tolerance of risk. TSLA has fallen over -48% YTD, and its metrics have only improved.

Meh. It’s his job, his profession, that which he hangs his hat on. Do you not hold people, at least in their advertised professions, to a standard greater than a clock?

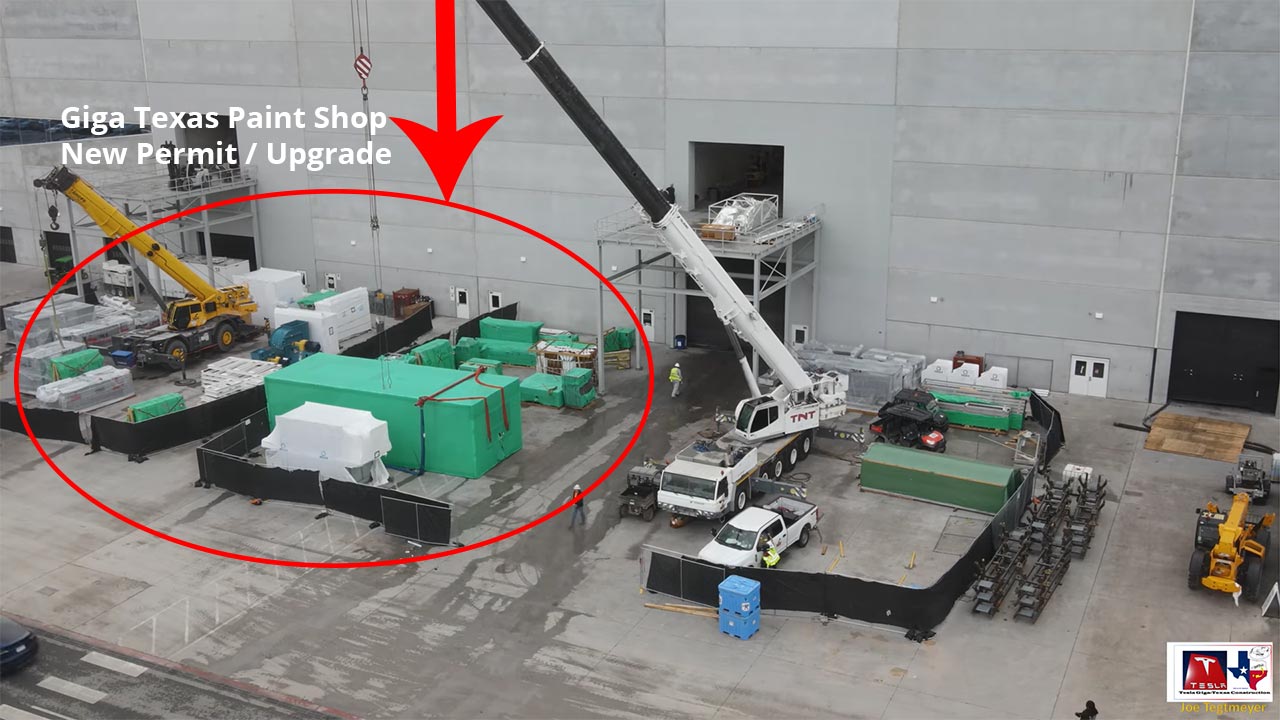

The GeicoTaikisha paint shop as installed in Berlin cannot be retrofitted in any traditional factory because it is designed to be totally integrated in an integrated factory operation, so scheduling and processing are designed to be so deeply integrated that a new factory is needed. Both Berlin and Austin have them. AKAIK we do not know for certain about Shanghai, but the new colors emerging there will prove the point. Fremont is highly unlikely due to the mishmash of facilities there. Obviously, with Tesla anything is possible, however improbable.I remember Elon commenting somewhere long ago that Fremont and Shanghai would eventually get upgraded paint systems so that they could much easier offer the fancy colors possible from Berlin and Austin. I guess to do this for the crowded and messy Fremont factory they would have to shut down for at least a week - or make room for a new paint shop somehow. Can they build more floors on the factory buildings?

And btw I really like this new color. I think I have seen it before but can't quite remember where?

Questioning one’s self is a form of self-awareness.Our CEO may or may not be crazy according to himself.

Did you subtract the purchase cost of Elon's TWTR holdings from free cash?There are a lot of questions being asked at the moment about will Elon sell to fund the last of the Twitter purchase, how much and when. (This directly affects TSLA investors more than just Elon/Twitter speculation).

I've seen the talk and calculations from pundits like Gary Black but some things don't seem to add up. Below is a table Gary posted from a while back when he was still talking about a lower priced deal.

View attachment 866095

A lot of the above calculations seem OK but there appears to be a number of assumptions buried in the table. These include the amount of taxes payable on Elon's sales from this year (the 15.4 figure) and what other equity Elon may have already had on hand. I've been trying to find a better summary of all the equity and costs but haven't found anything decent.

So I thought I'd have a go at pulling some figures together. The table below is my best attempt at summarising all of the sales and costs. I've drawn from Reuters, Forbes, Bloomberg and similar articles on the sales and the Twitter deal to try to make sense of it. Some of this was also insired by @bkp_duke post earlier about people not knowing what Elon's cash balance is.

Here's my table:

View attachment 866109

So after the 10% TSLA sales last year, it appears Elon had around $5B in cash on hand. No-one seems to be considering these funds for the Twitter deal and we don't know for sue what if anything is left over from it (I would suspect much of it). There was some talk at the time of funds to start TITS and also a charitable donation. However from reports at the time it appears Elon made the $5.7B mystery charitable donation with a gift of shares, not cash.

For the recent sales totalling $16.4B, it appears Gary Black assumes Elon has to take out $1B for taxes. But as @bkp_duke has pointed out, if recent high cost exercised shares were sold then there may be no tax payable.

The other wildcard is how many of the $7.1B in committed equity partners is still in the deal. It appears that these are locked in so I would presume they along with the $13B in bank LBO loans are locked in. There has also been talk of other equity partners such as Ken Griffin (Citadel) coming in and we don't know how many of these there are. I've seen the extra $2.5B committed for closing costs being reported but I'm not sure what reconciliation occurs for the actual costs incurred.

I may have some figures or logic wrong so please pull me up on anything that doesn't look right.

So will Elon sell - I dont know! It will be interesting to see how all this plays out. Massive front running shorting sell-off, gamma squeeze rally or something in between?

Very good Point. I'll make an edit to the original post.Did you subtract the purchase cost of Elon's TWTR holdings from free cash?

It seems that Elon is saying that Austin does not have the capability:The GeicoTaikisha paint shop as installed in Berlin cannot be retrofitted in any traditional factory because it is designed to be totally integrated in an integrated factory operation, so scheduling and processing are designed to be so deeply integrated that a new factory is needed. Both Berlin and Austin have them.

Those picky Europeans with their Option desires right from the start.It seems that Elon is saying that Austin does not have the capability:

You lost me at the opening parentheses. Perhaps I’m wrong in defining myself as a *TSLA investor* and I am being affected by Elon/Twitter speculation and I just don’t know it. Guess I’ll find out when I’m done *investing*.There are a lot of questions being asked at the moment about will Elon sell to fund the last of the Twitter purchase, how much and when. (This directly affects TSLA investors more than just Elon/Twitter speculation).

I've seen the talk and calculations from pundits like Gary Black but some things don't seem to add up. Below is a table Gary posted from a while back when he was still talking about a lower priced deal.

View attachment 866095

A lot of the above calculations seem OK but there appears to be a number of assumptions buried in the table. These include the amount of taxes payable on Elon's sales from this year (the 15.4 figure) and what other equity Elon may have already had on hand. I've been trying to find a better summary of all the equity and costs but haven't found anything decent.

So I thought I'd have a go at pulling some figures together. The table below is my best attempt at summarising all of the sales and costs. I've drawn from Reuters, Forbes, Bloomberg and similar articles on the sales and the Twitter deal to try to make sense of it. Some of this was also inspired by @bkp_duke post earlier about people not knowing what Elon's cash balance is.

Here's my table:

View attachment 866109

So after the 10% TSLA sales last year, it appears Elon had around $5B in cash on hand. No-one seems to be considering these funds for the Twitter deal and we don't know for sure what if anything is left over from it (I would suspect much of it). There was some talk at the time of funds to start TITS and also a charitable donation. However from reports at the time it appears Elon made the $5.7B mystery charitable donation with a gift of shares, not cash.

For the recent sales totalling $16.4B, it appears Gary Black assumes Elon has to take out $1B for taxes. But as @bkp_duke has pointed out, if recent high cost exercised shares were sold then there may be no tax payable.

The other wildcard is how many of the $7.1B in committed equity partners is still in the deal. It appears that these are locked in so I would presume they along with the $13B in bank LBO loans are locked in. There has also been talk of other equity partners such as Ken Griffin (Citadel) coming in and we don't know how many of these there are. I've seen the extra $2.5B committed for closing costs being reported but I'm not sure what reconciliation occurs for the actual costs incurred.

I may have some figures or logic wrong so please pull me up on anything that doesn't look right.

So will Elon sell - I dont know! It will be interesting to see how all this plays out. Massive front running shorting sell-off, gamma squeeze rally or something in between?

It seems that Elon is saying that Austin does not have the capability:

Wait a few seconds, he needs his beauty sleep too - oh, nuts. Is that him now?Certainly we don't have the boogieman selling today.

That seems incredibly short sighted on the part of the Austin plant. New colors to the US would be extremely welcome.

www.teslaoracle.com

www.teslaoracle.com

Yeah didn't Pierre Ferragu complimented the Model Y doors from Berlin and was blown away at how "luxurious" it felt? It's an european thing. The Chinese cares more about floods and road suspension durability, the Europeans want luxury options, and Americans want a bull horn attached to their model 3 per Texas intro video.F@#K the jinx.

I see green.

Those picky Europeans with their Option desires right from the start.

Well, Optimii will only come in one color! So deal with it, old world!