Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I tend to think that AGI similar to new born development is built to a large degree primarily on vision. LLMs success is built on top of language which develops after vision has been building generalized associations for months.on top of at least several hundred million of years of evolution to work out the relevant neural network architecture.

For this reason, solving vision may hold primacy over language to achievement of AGI. There is a large uncertainty re the better approach of course.

Thekiwi

Active Member

Agree - I have a hard time figuring out how the fed is supposed to “increase supply” of the factors in high demand. Raising interest rates isn‘t perfect, but it’s the only solution available to central banks the world over.I normally like your arguments but disagree here.

The supply shortage here is really of people as US is a service economy. So many retail oriented businesses have been unable to staff their operations because there is an excess demand and all the stimulus money has left a portion of the population reluctant to work.

Ideally the solution is increased immigration but there is no appetite for it.

Lacking the immigration lever or the fiscal prudence lever, there is undue weight on monetary policy lever. It is minimally effective and is a double edged sword (some evidence that the 100s of billions in additional interest being paid out is actually stimulative)

And unfortunately we can't increase productivity fast enough to get ourselves out of this mess. So interest rates it is

Thekiwi

Active Member

Well it could be worse today for TSLA.

Indeed - a good outperformance today

Monetary policy works primarily on demand, which has historically been how government deals with economic ups and downs. Fiscal policy can and should be used to stimulate supply. The present administration has been focused on stimulating more demand and stifling supply. This does not appear likely to change anytime soon.

Krugerrand

Meow

We can chalk today up to Tesla’s huge options market. Oh, yeah. Kind of like 99% of the trading days. So very shocked.Well it could be worse today for TSLA.

Skryll

Active Member

Such an ironic punishment for xenophobes[...] So many retail oriented businesses have been unable to staff their operations because there is an excess demand and all the stimulus money has left a portion of the population reluctant to work.

Ideally the solution is increased immigration but there is no appetite for it.

Gigapress

Trying to be less wrong

Next-Gen Vehicle Platform to Include Trucks in Classes 4 Through 7?

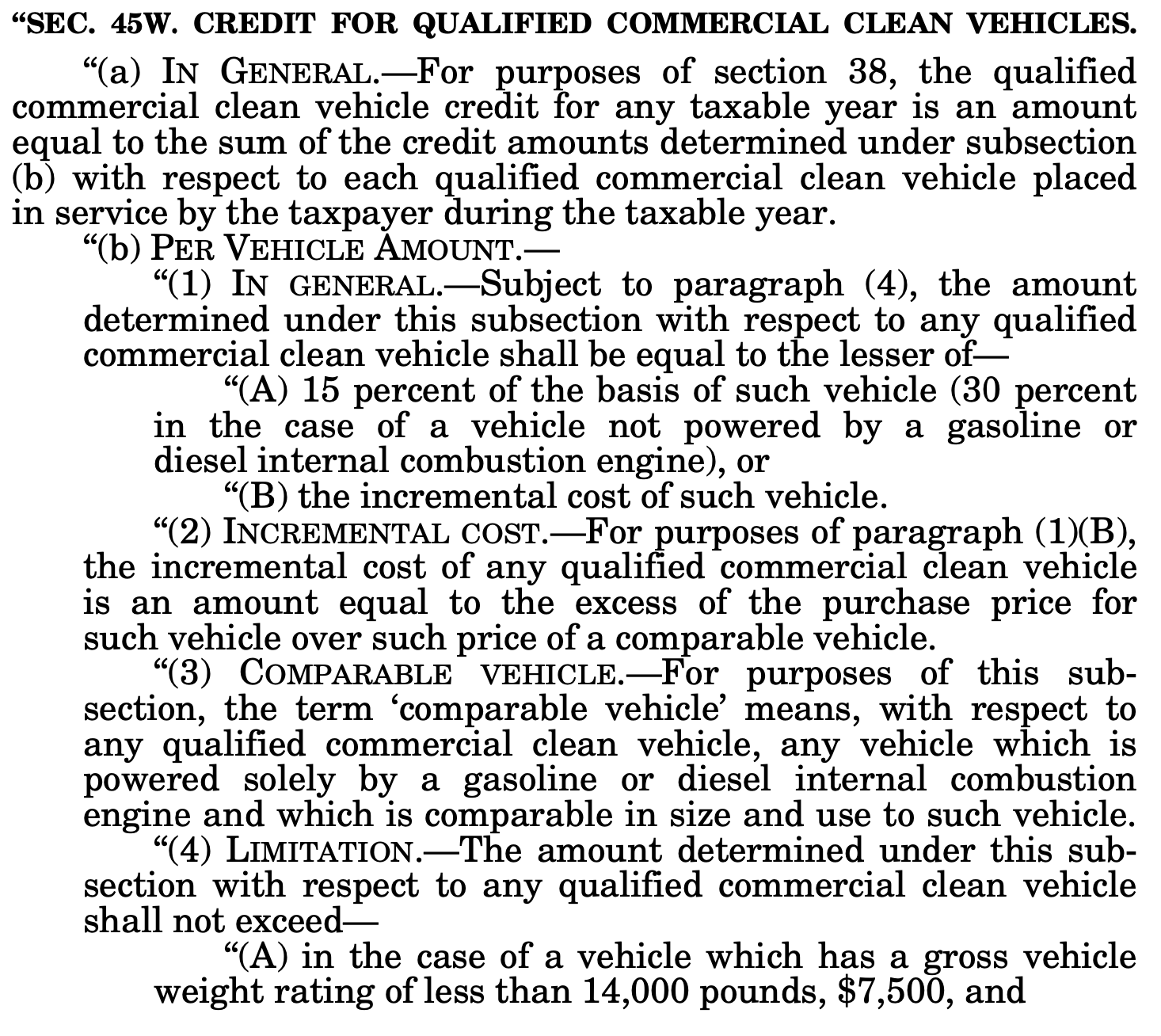

One of Tesla's next-gen vehicles could benefit with a 30% subsidy from the US clean commercial vehicles credit, up to $40k max. Maxing out the credit would imply a 40/0.3 = $133k price.

Most investors are aware that this commercial vehicle subsidy will benefit the Semi, but it also applies all the way down to Class 4 vehicles with a gross vehicle weight rating (GWVR) of at least 14k pounds (per federal classification nomenclature). For smaller trucks (Classes 1 through 3) the clean commercial vehicle credit caps at $7.5k just like the consumer version of the clean vehicle credit.

Disclaimer: I'm not a lawyer.

Disclaimer: I'm not a lawyer.

The Cybertruck will most likely be in Class 2 or 3, but it's reasonable to expect that Tesla will eventually make a larger version of the Cybertruck, just as other truck brands such as Dodge Ram offer a range of sizes based on the same platform. An example of a Class 4 truck is the Ram 4500, depicted below. Tesla has already said a smaller Cybertruck version will probably be made for markets outside North America, and the Master Plan calls for Tesla to "expand to cover the major forms of terrestrial transport".

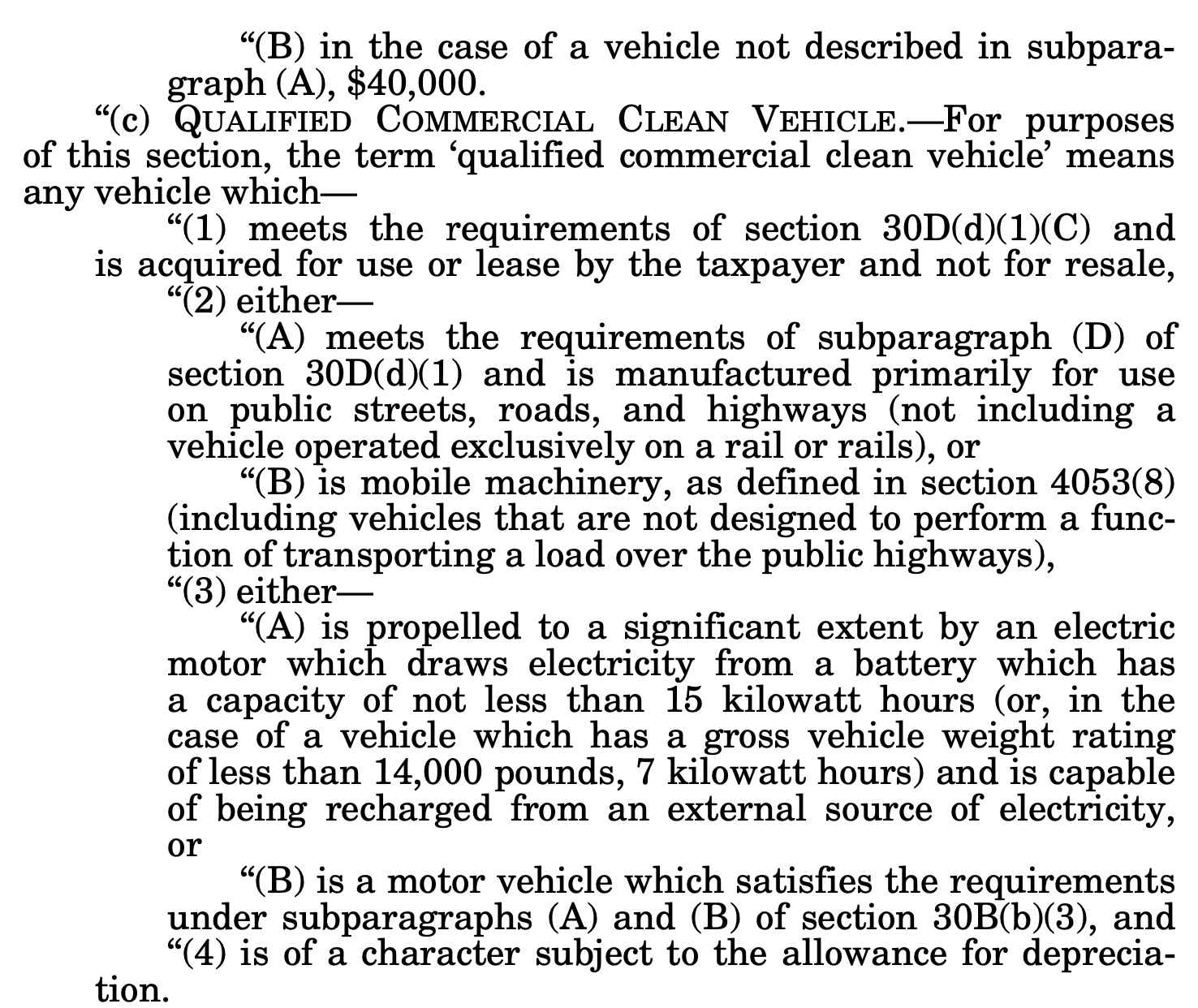

Trucks in classes 4 through 7 are a major form of terrestrial transport, and one with disproportionately large human and environmental impacts from toxic exhaust, brake dust, and noise. Looking at data for the USA, we can see that this mid-market segment is as large as the Class 8 segment that the Semi will serve. I assume it's probably similar elsewhere, but I haven't checked and anyway Tesla's truck division is focused on the American domestic market for the foreseeable future because of the extreme order backlog and the extreme subsidies. The pollution impact from mid-tier 4 through 7 trucks is due to their tendency to be used in more urbanized areas for stuff like Amazon deliveries and local contracting and trades work, which means they frequently start and stop during typical usage and the resulting pollution is released around lots of people.

(link)

Therefore, I expect at least one larger Cybertruck variant suitable for professional use, as well as a box truck like what Rivian will be supplying Amazon.

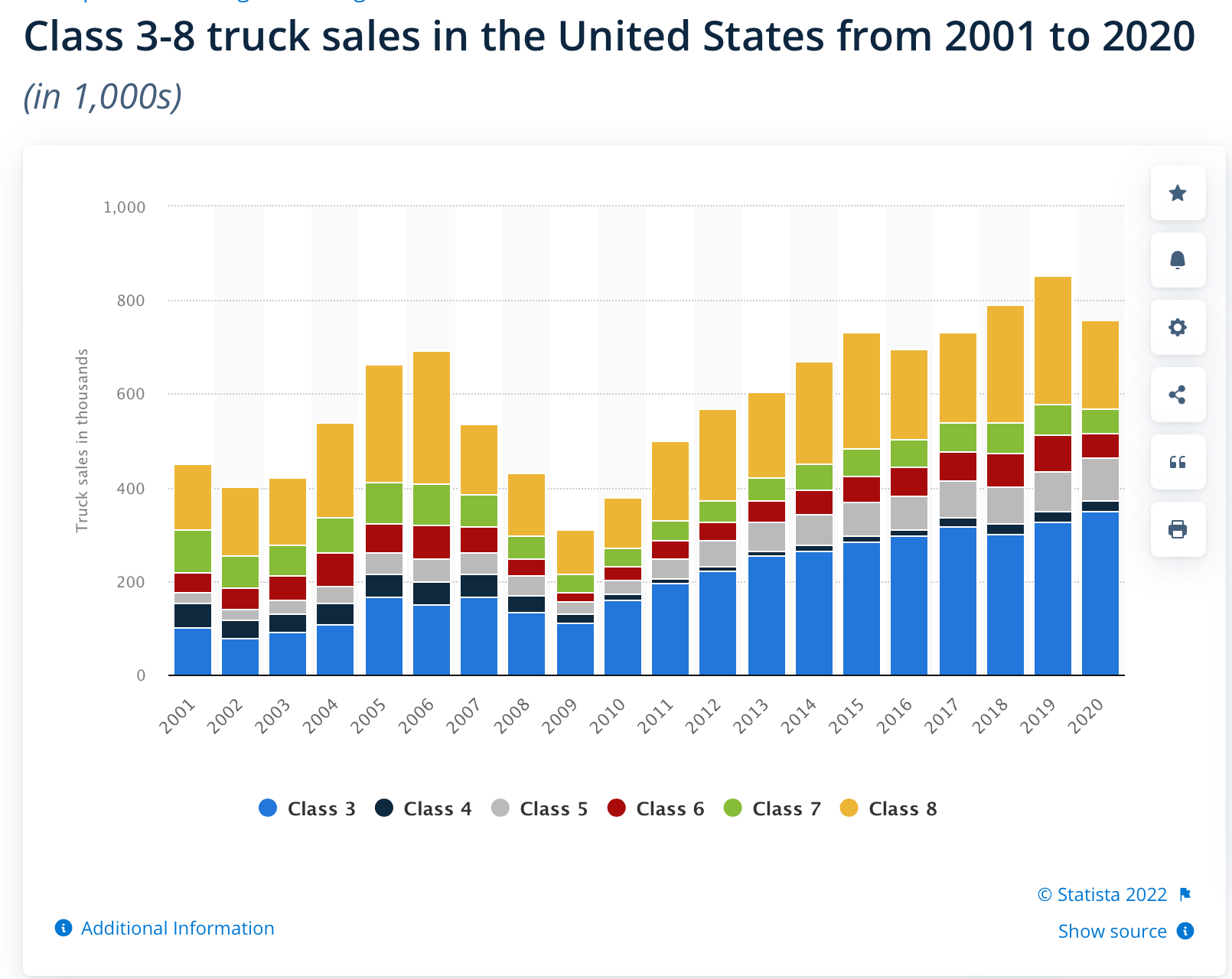

Remember also that one of Tesla's largest competitive advantages is the 4680 nickel batteries. Trucks will be using these batteries, not iron-phosphate cells, in accordance with Tesla's three-pronged cathode strategy presented at Battery Day. If all of the Battery Day tech roadmap happens, then Tesla will have a major advantage in cost, performance, scalability, efficiency and longevity for these high energy density cells. My understanding is that getting these cells right is much more difficult than LFP cells.

Having a battery advantage matters even more for the truck segment because the larger vehicle size and heavy work requirements dictate designs in which the battery pack comprises a bigger portion of the overall weight and cost than for vehicles like a Model Y. Additionally, in contrast to retail vehicle buyers, professional truck buyers look more at factors like total ownership cost and longevity, so it matters more than Tesla will win on these objective metrics. The hardcore smackdown of electric trucks embarrassing diesel trucks is much stronger for more urbanized usage because range is less of a concern and because every start-stop cycle for a diesel truck inevitably sends money up in smoke, and the slow acceleration makes for worse average speed. The advantage of regenerative braking and efficient acceleration is a huge deal for urban trucks.

In summary, Tesla has a large opportunity to dominate the mid-tier work vehicle segment, which currently has annual volume of ~200k trucks in the US alone, and Tesla can benefit from up to 30% subsidies for sales in the US until the end of 2032.

One of Tesla's next-gen vehicles could benefit with a 30% subsidy from the US clean commercial vehicles credit, up to $40k max. Maxing out the credit would imply a 40/0.3 = $133k price.

Most investors are aware that this commercial vehicle subsidy will benefit the Semi, but it also applies all the way down to Class 4 vehicles with a gross vehicle weight rating (GWVR) of at least 14k pounds (per federal classification nomenclature). For smaller trucks (Classes 1 through 3) the clean commercial vehicle credit caps at $7.5k just like the consumer version of the clean vehicle credit.

The Cybertruck will most likely be in Class 2 or 3, but it's reasonable to expect that Tesla will eventually make a larger version of the Cybertruck, just as other truck brands such as Dodge Ram offer a range of sizes based on the same platform. An example of a Class 4 truck is the Ram 4500, depicted below. Tesla has already said a smaller Cybertruck version will probably be made for markets outside North America, and the Master Plan calls for Tesla to "expand to cover the major forms of terrestrial transport".

Trucks in classes 4 through 7 are a major form of terrestrial transport, and one with disproportionately large human and environmental impacts from toxic exhaust, brake dust, and noise. Looking at data for the USA, we can see that this mid-market segment is as large as the Class 8 segment that the Semi will serve. I assume it's probably similar elsewhere, but I haven't checked and anyway Tesla's truck division is focused on the American domestic market for the foreseeable future because of the extreme order backlog and the extreme subsidies. The pollution impact from mid-tier 4 through 7 trucks is due to their tendency to be used in more urbanized areas for stuff like Amazon deliveries and local contracting and trades work, which means they frequently start and stop during typical usage and the resulting pollution is released around lots of people.

(link)

Therefore, I expect at least one larger Cybertruck variant suitable for professional use, as well as a box truck like what Rivian will be supplying Amazon.

Remember also that one of Tesla's largest competitive advantages is the 4680 nickel batteries. Trucks will be using these batteries, not iron-phosphate cells, in accordance with Tesla's three-pronged cathode strategy presented at Battery Day. If all of the Battery Day tech roadmap happens, then Tesla will have a major advantage in cost, performance, scalability, efficiency and longevity for these high energy density cells. My understanding is that getting these cells right is much more difficult than LFP cells.

Having a battery advantage matters even more for the truck segment because the larger vehicle size and heavy work requirements dictate designs in which the battery pack comprises a bigger portion of the overall weight and cost than for vehicles like a Model Y. Additionally, in contrast to retail vehicle buyers, professional truck buyers look more at factors like total ownership cost and longevity, so it matters more than Tesla will win on these objective metrics. The hardcore smackdown of electric trucks embarrassing diesel trucks is much stronger for more urbanized usage because range is less of a concern and because every start-stop cycle for a diesel truck inevitably sends money up in smoke, and the slow acceleration makes for worse average speed. The advantage of regenerative braking and efficient acceleration is a huge deal for urban trucks.

In summary, Tesla has a large opportunity to dominate the mid-tier work vehicle segment, which currently has annual volume of ~200k trucks in the US alone, and Tesla can benefit from up to 30% subsidies for sales in the US until the end of 2032.

I believe taking out the froth from the speculatory economy is perhaps necessary to get people back to work. All the crypto and stock traders are now poor, no more free money in which stonks only goes up. We are not hearing a lot of news about job shortages anymore vs a year ago.Agree - I have a hard time figuring out how the fed is supposed to “increase supply” of the factors in high demand. Raising interest rates isn‘t perfect, but it’s the only solution available to central banks the world over.

As for feds can do to increase supply? Supply is increased with low interest rates. High interest rates kill demand and supply. Factories couldn't afford to expand as borrowing cost goes up. quantitative tightening with low interest rate can tackle supply without destroying demand.

I feel hiking rates is fine, however doing monthly in rapid successions break a few things. Contagion from SVB fallout spread today. All of these stocks are down 15%+.

TLDR on SVB collapsed: due to bond value tanking as fed aggressively hiked rates. A good portion of depositor's money were in bonds getting the old 1.6% return from last year, the principle of that money's value dropped significantly which cause SVB to offer shares as a way to make up the difference.

TLDR on SVB collapsed: due to bond value tanking as fed aggressively hiked rates. A good portion of depositor's money were in bonds getting the old 1.6% return from last year, the principle of that money's value dropped significantly which cause SVB to offer shares as a way to make up the difference.

Last edited:

gabeincal

Active Member

I mean I have no idea about economics but I’ve been hearing this thing that people are reluctant to work due to the fiscal stimulus checks…I normally like your arguments but disagree here.

The supply shortage here is really of people as US is a service economy. So many retail oriented businesses have been unable to staff their operations because there is an excess demand and all the stimulus money has left a portion of the population reluctant to work.

Ideally the solution is increased immigration but there is no appetite for it.

Lacking the immigration lever or the fiscal prudence lever, there is undue weight on monetary policy lever. It is minimally effective and is a double edged sword (some evidence that the 100s of billions in additional interest being paid out is actually stimulative)

And unfortunately we can't increase productivity fast enough to get ourselves out of this mess. So interest rates it is

Didn’t the majority of people get only around $5k altogether in the past couple years?! How does that keep anyone afloat for years…?

Drumheller

Active Member

It doesn't.I mean I have no idea about economics but I’ve been hearing this thing that people are reluctant to work due to the fiscal stimulus checks…

Didn’t the majority of people get only around $5k altogether in the past couple years?! How does that keep anyone afloat for years…?

Many people are out of touch with how bad the economy is for the working class. Wages have not kept up with productivity gains since the 1970s in the USA, and have not kept up with inflation in recent years.

Many people are working multiple jobs and still debt is increasing. In housing, the USA is now the most expensive to buy a house relative to income that it has ever been since record keeping started tracking that metric. Several other metrics show the situation is worse than 2008.

For the poorer people, if they're living on govt assistance and can only find jobs that won't pay enough to cover the bills after govt assistance goes away (which it does, including healthcare in many states once you pass a low income threshold), then why bother?

OMG. That was really quick. Startups will be failing left and right after this. It isn’t uncommon for them to put their entire capital raises into an account until they can get their treasury figured out and buy things like US Treasuries. FDIC insurance only covers something like $500K from what I remember. What a disaster.

I feel like the stimulus check was not the cause, but the inflation of assets due to speculation in NFTs, crypto, and the market that caused many to quit their jobs or reluctant to return to work. Buying BTC was free money, and then you cash out to buy NFTs, then use that money to buy TSLA. Get some GME as it squeeze and weekly options to yolo your allowance money. Wallstreet Bet subreddit I think gained...what 10 million new followers at the time?I mean I have no idea about economics but I’ve been hearing this thing that people are reluctant to work due to the fiscal stimulus checks…

Didn’t the majority of people get only around $5k altogether in the past couple years?! How does that keep anyone afloat for years…?

Mod: Yes, please do that. We are volunteers, busy with lives and other things, and between the time you posted the fake video and one of us noticed, it had already generated replies and confusion. In other words, you want instant gratification from others for things that you should have done yourself. It is a standing rule to not post off-site stuff without accompanying detail, and as RSF said, a smiley is not sufficient.Mods could have simply added a comment to that post stating it is fake. Anyway no big deal in deleting that post either.

In future I will mark any such post with a rider, "this is humor and fake"

And now you seem to be going out of your way to annoy us. Not necessarily a smart move.

--ggr

Between SIPC (250k cash, 500k total) and whatever assets can be recovered, I think most of their customers will get most or all of their money back. The real question is, when? I hope you are OK.No but (Today I Learned) apparently my startup had 3/4 of their money in it!

Exciting times I live in.

My startup was in the middle of negotiating a line of credit with SVB. I really feel for the companies that had drawn down such a loan, because they might be relying on drawing down more (which they won't be able to do), and might have to pay it back quickly (which they also might not be able to do), and there's no SIPC to help them.

Sudre

Active Member

I completely agree with your assessment. How do new companies startup to make competition if they can't get capital?The argument that increasing rate to destroy demand to tame inflation is hilariously bad and I don't even know why they teach this stuff.

Yes, when there's a supply and demand imbalance you either adjust demand or supply. Trying to purposely destroy demand is the most idiotic way to tame inflation as it is purposely destroying wealth. Work to increase supply is the right answer and should always be the right answer. Either you increase supply or leave the economy alone and it'll eventually sort itself out in the world of globalization. Someone will eventually figure out how to take advantage of demand that cannot be met because who doesn't want to make money? However purposely destroying demand in which no one wins besides declaring a win on inflation(because everyone is out of a job and are on the streets eating out of trash cans) is the dumbest win I can think of.

If we have a labor shortage, which is one of the big problems, let those playing the markets do as they please. Stop trying to force them back to work. Congress should get off their butts and let in a lot more legal immigrants to take these jobs Americans do not want. Oh... right but some will not like THOSE people coming in THEIR country. I guess we now see how raising rates ends up being the answer. Less painfully for elected officials.

Actually raising rates is probably not the wrong... just not this much this FAST.

Only 2.7% of their customers has less than 250k in SVB. This is a different beast vs a typical bank. 97.3% are not FDIC insured.Between SIPC (250k cash, 500k total) and whatever assets can be recovered, I think most of their customers will get most or all of their money back. The real question is, when? I hope you are OK.

My startup was in the middle of negotiating a line of credit with SVB. I really feel for the companies that had drawn down such a loan, because they might be relying on drawing down more (which they won't be able to do), and might have to pay it back quickly (which they also might not be able to do), and there's no SIPC to help them.

I wish he was a little more clear about what details were from staff and what was just conjecture.This is pretty informative. More new info from Tesla about the Cybertruck than I think we've heard in years.

I liked the accompanying video which has the same info as the Twitter thread and more commentary and details. It's a half hour but pretty easy to listen to at faster speeds.

Unfortunately for @larmor, it's looking less and less likely that a million reservations will be cancelled.

Also unfortunately, Tesla staff at the event apparently did not disclose whether the in-house accessories team is working on ornamental bull horns. If this is not a standard option, then demand in Texas may suffer as customers will be forced to resort to third-party aftermarket options.

Seems very interesting to me that he suggested Dual Motor was first and Tri Moto (not Quad) might be a while out. That is probably the biggest "Reveal", the rest is mostly bookkeeping, obvious from photos, or from launch day. Good to get confirmation on some of this, but more or less known.

So how reliable is this dual motor launch/ tri motor later leak? This goes about 180 out from everything most people assumed. Makes me wonder if they are still worried about 4680 supply. Not too surprising considering. I know when I suggested they might push out the dual motor first a lot of people pushed back and said it was ridiculous.

Last edited:

I think the pace was a consequence of banking on inflation being transitory and moving too late, but we can only speculate where inflation would be right now if they hadn’t brought in expectations by moving quickly after they did finally start.I completely agree with your assessment. How do new companies startup to make competition if they can't get capital?

If we have a labor shortage, which is one of the big problems, let those playing the markets do as they please. Stop trying to force them back to work. Congress should get off their butts and let in a lot more legal immigrants to take these jobs Americans do not want. Oh... right but some will not like THOSE people coming in THEIR country. I guess we now see how raising rates ends up being the answer. Less painfully for elected officials.

Actually raising rates is probably not the wrong... just not this much this FAST.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M