Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

shlokavica22

Member

I picked a helluva week to dip my toe into the waters of selling weekly put options lol. I was so close to escaping unscathed, too, after I'd already learned my lesson.

Cash covered?

It is not going to be Tesla Model 3 safe.

But I trust Smart is going to be much safer than Chinese counterparts.

I'm pointing out that a strong passenger cage is only part of the equation. You say "I trust Daimler Benz."

I trust Tesla more.

Menifeer

Member

Not to worry... Just roll them forward and get a net credit in the process.I picked a helluva week to dip my toe into the waters of selling weekly put options lol. I was so close to escaping unscathed, too, after I'd already learned my lesson.

Just before the major downturn in January with the stock at about $350, I sold the weekly $340 Put for a $2.28 premium. Clearly a mistake in hindsight.

Since then I have rolled it five times and reduced my break-even point to a share price of $325 (expiring March 15). I'll keep this up until I get healthy.

RobStark

Well-Known Member

Nice. Definitely lots of detail into CA sales

Looking at the top selling models in each segment, Tesla still has plenty of opportunity in the compact, and midsize car market.

Also in the pickup category, full size and compact/midsize;

The compact pickup doesn't really exist in the US anymore. I think they all got upsized since around 2008, so I would think there is an opportunity there. It might be something Tesla could look at.

And of course the SUV category is wide open for Tesla, with the compact SUV being the largest.

Thing is compact pickups are not that much cheaper to make than the midsize pickups and Americans expect to pay much less.

RobStark

Well-Known Member

I'm pointing out that a strong passenger cage is only part of the equation. You say "I trust Daimler Benz."

I trust Tesla more.

I trust Tesla more too. But Tesla isn't making a microcar.

I trust Daimler Benz an order of magnitude more than Kandi.

Indeed it's weird, and Consumer Reports was leaking this information:

Tesla Model 3 No Longer Recommended By Consumer Reports

"Consumer Reports reached out to us this week to let us know that it was making some updates based on vehicle reliability data. The Model 3 was one of a handful of cars to be impacted by the updated information."

If InsideEV, a small publication, was informed by CR, so were all the big short sellers...

I believe this explains some of the weird price capping and weird price action @tivoboy and @Papafox observed as well: colluding shorts first quietly capped and grew short positions, then engineered a big drop when the news "broke".

The good news: we now know that the shortz were probably banking on the CR news.

Also note the hilarious argument CR is making:

"Interestingly, even though customers are more satisfied with the Tesla Model 3 than any other car and have pushed its score up to the top of the luxury compact car class, it seems they are still reporting some recurring issues."CRs's solution to a car that makes owners the most happy: do not recommend, because of problems that Tesla says are almost all fixed already.

Because the happiness of future Tesla owners is going to be lower with all these problems they are unlikely to ever experience. Because time travel?

CR's chain of logic: big, major fail, for which reason I cannot possibly recommend their magazine.

When CR appraised Model S, no one complained

schonelucht

Well-Known Member

While we're all staring at our shoes and pulling our bears out, Norway ha registered over 100 today - not all, but mostly M3.

AFAIK, it's the only country where we get such up-to-date stats, right?

the Netherlands too.

Furthermore, as I understand it, not many M3's have gone to Noways yet, most have been for continental Europe.

That's unclear. Looking at the Netherlands data, not many have gone there. They are delivering at maybe 30-40% of the rate of Norway.

jepicken

VIN: 80322

That CR 'unrecommends' the Model 3, based on problems whose "vast majority" Tesla says are already fixed, and which car owners are the most satisfied with despite teething problems of a brand new product, is breathtakingly bad logic by CR that should be called out...

They're just following their own long standing rules. Yes it's a bit silly not to recommend the car with the highest owner satisfaction, but CR's rule is to only recommend vehicles with above average reliability, so they would lose some credibility if they broke their rule and kept the Model 3 as recommended. And they can't just take Tesla's word for it that most of the issues are fixed; they have to wait until that shows up in their survey data, which sadly will probably take 6 months to a year. You could say the rules themselves are illogical I guess.

I hope Tesla responds with a blog post sharing some internal data, something like "according to our internal data, the percentage of cars with issues decreased 50% since mid-2018", and explaining that CR's reliability data is outdated and they expect to regain the "recommended" rating soon. CR's recommendations are based on real data, so the best way for Tesla to counter it is with their own, better, real data.

Meantime it's another buying opportunity... I added a Jan '21 LEAP, still keeping some dry powder in case it drops more though.

Not to worry... Just roll them forward and get a net credit in the process.

Just before the major downturn in January with the stock at about $350, I sold the weekly $340 Put for a $2.28 premium. Clearly a mistake in hindsight.

Since then I have rolled it five times and reduced my break-even point to a share price of $325 (expiring March 15). I'll keep this up until I get healthy.

Indeed -- I rolled out / down to next week.

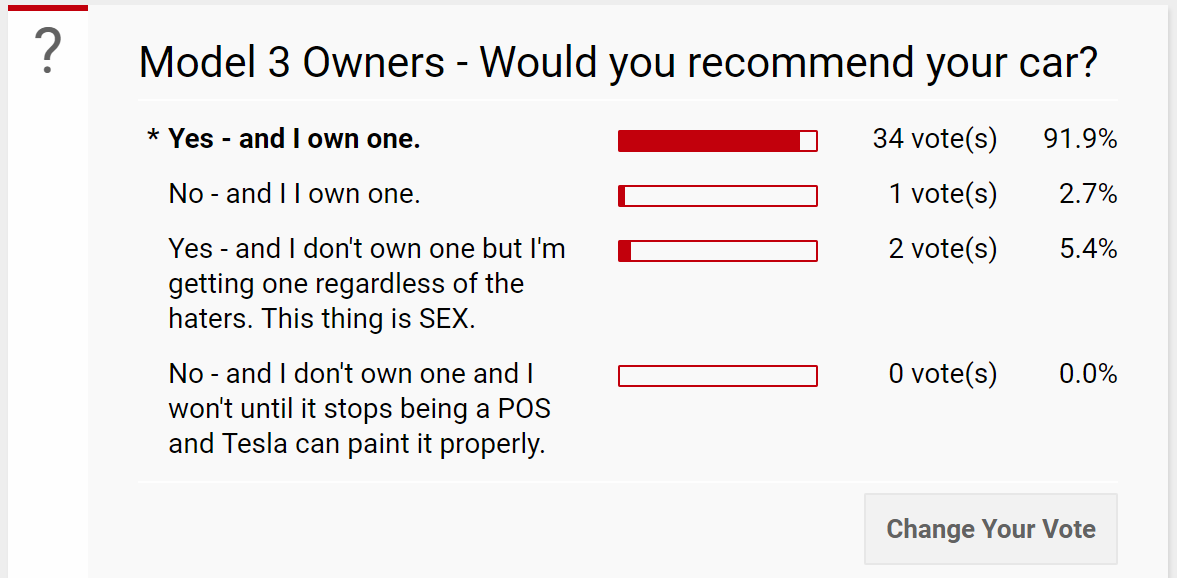

So based on my early polling, Consumer Reports can go eat *sugar* sandwiches.

Model 3 not recommended and also highest owner satisfaction from Consumer Reports

Model 3 not recommended and also highest owner satisfaction from Consumer Reports

StarFoxisDown!

Well-Known Member

Company value about to go under 50 billion...…..for a company that is likely going to post revenue of 8-9 billion in Q2 and 10-11 billion in Q4 and then 12-14 billion in Q1 2020. Sure this makes sense.

Fact Checking

Well-Known Member

When CR appraised Model S, no one complained

Because it was true, while unrecommending the car that owners are the most satisfied with and which is the safest in its class is both bad logic and irresponsible?

HG Wells

Martian Embassy

On a more happy note.

If the model Y unveiling is soon. IE the display of one.

How much advance notice ?

How much advance notice did the model 3 have ?

Is March still in the cards ?

If the model Y unveiling is soon. IE the display of one.

How much advance notice ?

How much advance notice did the model 3 have ?

Is March still in the cards ?

I think that they follow their own established rules. I think that it is not sensible to say that they’re only right when they come to a conclusion that suits you.Because it was true, while unrecommending the car that owners are the most satisfied with and which is the safest in its class is both bad logic and irresponsible?

pnungesser

BarNun

Also the lack of owner authentication is concerning: does this mean that for the price of about 250 CR subscriptions, which is 250x $55 = $13,700, one can knock off 1.5 billion dollars from the market cap of a publicly traded company?

Another question is CR's recommendation priorities: by unrecommending the Model 3 they are basically telling their subscribers to buy less satisfying and less safe cars.

I.e. even if the Model 3 feedback from the July-September 2018 time frame is accurate, CR is recommending subscribers to buy cars in 2019 that can get them killed due to lower safety because of complaints over ... panel gaps and paint flecks?

This new editorial logic of CR is IMHO deeply irresponsible and borderline criminal.

I don't want to be an apologist for CR, but they do it by their numbers. They also anonymously buy the cars in their long-term test fleet. If someone had bought 250 subscriptions so they could downgrade Tesla, why would the buyer satisfaction numbers be so high? But you just gave them the idea of how to bias the next survey.

Just saying.

RobStark

Well-Known Member

BTW, why would any average consumer subscribe to Consumer Reports?

The internet is full of free and excellent info.

Why would anyone subscribe to any magazine?

I think some CR "patrons" view a CR subscription as donating to a charitable good cause. CR doesn't take advertisements.

Fact Checking

Well-Known Member

I think that they follow their own established rules.

No, Consumer Reports actually freshly changed their rules, which resulted in the ranking change.

They also outlined their thinking behind the new rules, which thinking is based on the incredibly bad and irresponsible logic of putting panel gaps and paint flecks ahead of owner satisfaction and owner safety...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M